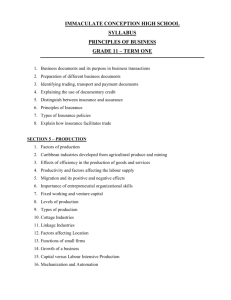

Land as a Distinctive Factor of Production

advertisement