ESES CSD Adaptation to Target2-Securities

advertisement

•

•

•

•

•

•

•

Euroclear

Bank

Euroclear

Belgium

Euroclear

Nederland

Euroclear

France

Euroclear

UK & Ireland

Euroclear

Sweden

Euroclear

Finland

White paper

Adaptation of ESES CSD

services to Target2-Securities

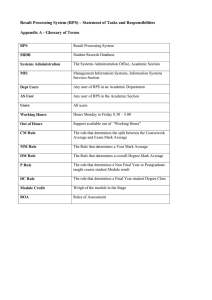

1. Introduction ................................................................. 4

1.1 Objective of the White paper .......................................................................................................... 5

1.2 Project governance with ESES users ............................................................................................. 6

2. Executive summary..................................................... 7

2.1. Connectivity .................................................................................................................................. 7

2.2. Account structure .......................................................................................................................... 8

2.3. Matching and settlement ............................................................................................................... 8

2.4. Asset servicing .............................................................................................................................. 8

2.5. Issuer services .............................................................................................................................. 8

3. Connectivity ................................................................ 9

3.1. Connectivity options ...................................................................................................................... 9

3.1.1. ESES Connectivity offer – ICPs ..................................................................................... 11

3.1.2. ESES connectivity offer – DCPs .................................................................................... 13

3.2. Subscriptions and users management ........................................................................................ 14

4. Reference data ......................................................... 16

4.1. Account structure ........................................................................................................................ 16

4.2. Parties and securities accounts ................................................................................................... 20

4.3. Securities data ............................................................................................................................ 21

4.4. Dedicated cash accounts ............................................................................................................ 21

5. Settlement ................................................................. 23

5.1. Lean T2S settlement ................................................................................................................... 23

5.1.1. Validation and matching ................................................................................................. 23

5.1.1.1. Access to T2S matching system ................................................................................. 23

5.1.1.2. Type of instructions .................................................................................................... 24

5.1.1.3. Validation ................................................................................................................... 25

5.1.1.4. Matching rules ............................................................................................................ 26

5.1.1.5 Reporting ..................................................................................................................... 28

5.1.2. Settlement and operational day ...................................................................................... 29

5.1.2.1. T2S Operational day................................................................................................... 30

5.1.2.2. Settlement reporting ................................................................................................... 32

5.1.3. Settlement instruction management ............................................................................... 33

5.1.3.1. Hold and release mechanism ..................................................................................... 33

5.1.3.2. Partialling ................................................................................................................... 34

5.1.3.3. Transaction linking ..................................................................................................... 35

5.1.3.4. Prioritisation................................................................................................................ 35

5.1.3.5. Others ........................................................................................................................ 36

5.1.4. Liquidity management .................................................................................................... 37

5.1.4.1. Liquidity transfers ....................................................................................................... 37

5.1.4.2. Limit management ...................................................................................................... 40

5.1.4.3. End of day cash management .................................................................................... 41

5.1.4.4. Cash blocking and reservation ................................................................................... 41

5.1.4.5. Liquidity monitoring..................................................................................................... 41

5.1.4.6. Auto-collateralisation .................................................................................................. 42

5.1.5. Cross-CSD settlement ................................................................................................... 47

5.1.6 Settlement with CSDs outside T2S ................................................................................. 49

5.2. Pre-settlement processes ........................................................................................................... 50

5.2.1. MTFs and CCPs transactions ........................................................................................ 51

5.2.2. Trade confirmation – SBI ............................................................................................... 52

5.2.3. Funds order routing ........................................................................................................ 53

5.3. Issuance and primary market settlement ..................................................................................... 54

5.3.1. Standard securities ........................................................................................................ 55

5.3.2. French money market instruments ................................................................................. 55

5.3.3. Funds issuance .............................................................................................................. 56

5.3.4. Warrants & certificates issuance (Plug & Clear service) ................................................. 57

5.4. Settlement of registered securities .............................................................................................. 58

5.4.1. French registered securities (BRN) ................................................................................ 58

5.4.2. Belgian registered shares .............................................................................................. 59

5.5. Other settlement related processes ............................................................................................ 61

5.5.1. Physical securities ......................................................................................................... 61

5.5.2. ISIN conversion (‘transfert valeurs’) ............................................................................... 61

5.5.3. Stripping and reconstitution of government debt ............................................................ 62

5.5.4. Dedicated ESES offer for free of payment without matching .......................................... 62

5.5.5. Bilateral repos ................................................................................................................ 63

5.5.6. Automatic balance transfers ........................................................................................... 63

6. ESES Central Bank Money triparty service ............... 64

6.1 General description of the service ................................................................................................ 64

6.2 How will the service interact with T2S? ........................................................................................ 66

7. Corporate actions and issuer services ...................... 68

7.1. Corporate actions ........................................................................................................................ 68

7.1.1. Corporate actions on stocks ........................................................................................... 68

7.1.1.1. Notification and entitlement advices ........................................................................... 68

7.1.1.2. Corporate action processing ....................................................................................... 69

7.1.1.3. Corporate action reporting .......................................................................................... 73

7.1.2. Corporate action on flows .............................................................................................. 74

7.1.2.1. Generic principles ....................................................................................................... 74

7.1.2.2. Market claims and transformations ............................................................................. 74

7.1.2.3. Buyer protection ......................................................................................................... 78

7.2. Issuer services ............................................................................................................................ 78

7.2.1. Overview of issuer services on the T2S platform ........................................................... 78

7.2.2. Titres au Porteur Identifiable (TPI) ................................................................................. 80

8. ESES Investor CSD offer .......................................... 81

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 2

9. Client readiness, migration and testing ..................... 83

9.1. Migration ..................................................................................................................................... 84

9.2. Testing ........................................................................................................................................ 84

Annex 1 - Overview of main ESES services and changes in relation to the T2S project .................... 87

Annex 2 - Overview of the future state of ESES settlement messages – Matching and Repo............ 92

Annex 3 - Overview of the future state of ESES settlement messages – Settlement ......................... 94

Annex 4 - Overview of the future state of ESES settlement messages – Payments........................... 96

Annex 5 - ESES – T2S messages life cycle ....................................................................................... 98

Annex 6 - Detailed CSDs and NCBs migration planning .................................................................. 100

Annex 7 - Future state of ESES documentation ............................................................................... 103

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 3

1. Introduction

We are pleased to provide you with version 3.1 of the White paper, Adaptation of ESES CSD services

to Target2-Securities. Since the last version, the Euroclear CSDs located in the Euro-zone have all

signed the T2S Framework Agreement with the Eurosystem, hereby confirming their commitment to

join the new platform.

This version focuses entirely on the adaptation of ESES CSDs (Euroclear Belgium, Euroclear France

and Euroclear Nederland). The ESES CSDs intend to migrate their settlement services to T2S in

March 2016.

This document represents the latest status of ESES adaptation plan, prior to the publication of the

contractual documentation. This version is based on the latest version of the T2S documentation

published by the Eurosystem.

·

User Requirements Document (URD)

·

General Functional Specifications (GFS)

·

User Detailed Functional Specifications (UDFS)

This version includes changes and additional information essentially in the following areas:

·

mapping of ESES account structure with T2S

·

ESES T2S account naming conventions

·

connectivity options and services

·

project governance with ESES users

·

changes on auto-collateralisation in ESES

·

cross-border settlement outside T2S

·

allegement periods

·

processing of French and Belgian registered securities (BRN and BRS)

·

our documentation

During the past months, we have been communicating on the ESES-T2S project, through dedicated

presentations, documents and brochures. We have introduced dedicated governance for this project;

with the creation of ad hoc users groups (please refer to section 1.2). We have also started a

dedicated training program and will progressively adapt ESES contractual documentation. We intend

to publish the main documents impacted by T2S as from the beginning of 2014. Please refer to

section 9 for more details.

Note

This White paper is also relevant for participants in the Irish market who want to access the T2S

platform. As the Euroclear UK & Ireland platform (which settles the Irish market transactions) will not

join T2S, the Irish market has requested that Irish securities are made eligible on T2S via ESES

Investor CSD offer described in section 8.

The information herein is not contractual and is subject to changes as a result of our analysis, market

requirements or changes in ESES or T2S platform function. In particular, the implementation of some

functions depends on the acceptance of ongoing T2S change requests.

Definitive features will be published before the launch of T2S, via new Detailed Service Descriptions,

Data Dictionaries or updates to existing documentation.

If you have any questions, please contact your Account Manager.

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 4

1.1 Objective of the White paper

The main objective of this White paper is to give a view of the impact of connecting to the T2S

platform for users of the ESES platform. It serves the following purposes:

·

present the impact of reshaping the ESES platform as a result of connecting to the T2S

platform

·

allow market participants to make their own decisions as to how they will connect to the

T2S platform

·

help participants prepare for the changes required to operate on the T2S environment

We will give ESES participants the choice to connect directly to the T2S platform for settlement

services, or to maintain their current ESES connectivity configurations:

·

Participants who choose to connect directly to the T2S platform will be considered Directly

Connected Participants, and will be referred to throughout this White paper as ‘DCPs’

·

Participants that choose to maintain their current ESES connectivity configurations will be

considered Indirectly Connected Participants, and will be referred to throughout this White

paper as ‘ICPs’

For all services described in this White paper, we provide a view of the impact for both DCPs and

ICPs, with the necessary detail to guide their decisions as to which connectivity route to choose.

With regard to the way we will adapt our service offerings in relation to the T2S platform, we have

attempted to find the right balance, in consideration of the following principles:

·

ensure the continuity of services (i.e. avoid service regression to the greatest possible

extent)

·

minimise the impact of connecting to the T2S platform on the Euroclear service offerings,

thereby minimising adaptation costs for participants

·

take advantage of the T2S functionalities, to maximise the benefit of connecting to the T2S

platform

·

take advantage of the T2S project as a means of harmonising rules, in accordance with

international standards and market practices

·

based on the above principles, minimise the additional cost of T2S for ESES and its

participants

These principles may occasionally be in conflict with each other. When this happens, we favour the

optimal use of the T2S platform, and the resulting innovation, over continuity. This approach

maximises the longer-term benefits of the T2S platform for participants and enables easier adaptation

of the ESES platform to future T2S changes. It will, however, result in necessary changes for

participants. Such changes have been highlighted in this White paper, where applicable.

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 5

1.2 Project governance with ESES users

We have implemented dedicated project governance with ESES users through the creation of three

ad hoc instances:

T2S National Coordination Committee

The T2S National Coordination Committee has been set up in each ESES market and gathers cash

and securities professionals to cover the ESES/T2S project both from the cash and the securities

perspectives. The Committee is composed of the current members of the local Euroclear Market

Advisory Committee and by several cash professionals (including the Chairman of the local T2 NUG

and a National Central Bank (NCB) representative). Its main mission is to:

·

ensure efficient coordination of T2S migration among cash and securities businesses

·

follow-up readiness of local market infrastructures and intermediaries

·

coordinate the testing calendars between NCBs and CSDs participants

This group started working in May 2013.

ESES – T2S Users Group

This ESES – T2S Users Group gathers product/business experts from the three ESES markets

(including NCBs and the CCP), to address all service issues and evolutions in relation to adapting

ESES platform to T2S.

Another aim of this Group is to leverage and promote high market proximity with the ESES market in

relation to the project. Its main mission is to oversee the detailed adaptation of ESES services to T2S

(e.g. T2S harmonisation, account structure, connectivity).

The Group is based on the existing ESES Users Forum and started working in May 2013.

ESES – T2S Implementation Committee

This ESES – T2S Implementation Committee gathers T2S project managers from clients in the three

ESES markets. It will monitor client readiness and prepare the testing and migration process. This

group will play a key role in the roll-out of the project and in preparing the best conditions for a

successful migration.

The Group will start working in 2014.

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 6

2. Executive summary

The three ESES CSDs signed the T2S Framework Agreement in June 2012 and plan to migrate their

settlements services to T2S in March 2016.

In relation to the T2S platform, the ESES CSDs will outsource matching and settlement services to

T2S, but will continue to directly offer all custody and other services to their clients. We will provide

ESES participants with the full benefits of the T2S platform, including:

·

harmonised matching and settlement rules and life cycles with all T2S counterparties

·

single settlement window

·

extended settlement and liquidity management services

·

single pool of liquidity and collateral

·

ability for clients to replace the multiple connections to European CSDs with a single

connection via ESES (thanks to ESES acting as investor CSD)

In this context, we will provide a single access point from the ESES platform to all T2S eligible

securities. This involves:

·

the activation of Delivery Versus Payment (DVP) links with the other T2S connected CSDs

thanks to the cross-CSD settlement feature of T2S

·

the provision of extended asset servicing on all securities

ESES participants will be able to consolidate all assets holding and their activity relating to the

securities of CSDs joining the T2S project, on the ESES platform.

We will continue to offer the other ESES services, such as triparty collateral management, custody

and issuer services and trade management. We intend to take advantage of the T2S platform in order

to expand the scope of these services, as required by ESES participants.

The connection to the T2S platform will, however, impact ESES participants. The extent of the impact

is addressed throughout this White paper. The impact will vary according to the current setup of each

participant and their connectivity. For details on the T2S impact on each ESES service offering, see

Annex 1.

2.1. Connectivity

·

Each ESES participant will be given the choice of connecting directly to the T2S platform

for settlement services only, or continuing to use the ESES platform as a single entry point

for settlement, custody and other services.

·

Settlement will be accessible from the ESES platform via EuroclearConnect for STP, for

ISO 15022-compliant and ISO 20022-compliant messages, or via the EuroclearConnect for

screens and from the T2S platform via ISO 20022-compliant messages or the T2S screen.

·

ESES proprietary settlement messages will be discontinued. Proprietary messages will be

kept for specific services such as SBI, TCN, BRN, TPI and FTT.

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 7

2.2. Account structure

The current ESES account structure will be maintained and mapped with T2S account structure

components. Directly connected participants will have to adapt to T2S structure. Indirectly connected

participants will have the option to continue to dialogue with the ESES CSDs using the current ESES

account structure.

2.3. Matching and settlement

·

The T2S platform is expected to offer the same services as the ESES CSDs and will

provide some new functions.

·

·

Cross-CSD DVP settlement will be offered by the ESES platform.

The French repo service will be discontinued. We have proposed an alternative to users of

the service.

·

ESES pre-settlement services will be maintained (e.g. SBI, funds order routing). Related

settlement will be routed through the T2S platform. Equally, the ESES Central Bank Money

Triparty Collateral Management will be linked for settlement on the T2S platform.

2.4. Asset servicing

·

Corporate actions, whether on stocks or on flow, will continue to be processed on the ESES

platform.

·

Settlement of corporate action related movements will be processed on the T2S platform,

upon ESES CSDs instructions.

·

The classical ‘coupon’ payment procedure will be removed.

·

Significant harmonisation and standardisation of market practices are expected to take

place in Belgium, France and the Netherlands before and while connecting to the T2S

platform.

2.5. Issuer services

Registration services (French BRN service, Belgian BRS service) will continue to be processed in the

relevant ESES CSDs as they are today. The ESES platform will interact with the T2S platform to

manage the settlement instructions related to registered securities.

Other issuer services such as TPI (identifiable bearer securities) or the ESES Broadridge service (for

shareholder meeting management) should not be impacted by T2S.

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 8

3. Connectivity

In a T2S environment, the ESES CSDs will introduce changes in the connectivity set up and new

options to ESES participants.

·

For pure settlement services, ESES participants will have the choice of connecting directly

to the T2S platform (DCP) or maintaining their current ESES connectivity configurations

(ICP).

·

ESES proprietary settlement messages will be discontinued. Settlement will be accessible

from the ESES platform via ISO 15022 compliant and or ISO 20022-compliant messages.

·

ESES participants opting for DCP will communicate with the T2S platform exclusively via

ISO 20022-compliant messages.

We will take the opportunity of joining the T2S project to decommission all ESES proprietary

settlement messages and adopt ISO standards for settlement messaging. This decision was made,

based on the following considerations:

·

full compliance for the ESES CSDs with the initiatives to remove Giovannini Barrier 1

·

cost reduction for ESES participants, as they will be able to harmonise ESES messaging

with other channels for which ISO-compliant messages are already used

·

maintaining proprietary messages would imply adaptation costs for participants, as such

messages need significant revamping to become compliant with function on the T2S

platform (e.g. hold/release, cross-CSD and the use SWIFT BICs)

Some non -settlement messages, however, will remain available in proprietary format only, either

because they have no ISO equivalent (e.g. BRN and TPI) or because there is no business case to

move such messages towards ISO compliance (e.g. SBI). For an overview of the status of ESES

settlement messages foreseen at the launch of the T2S platform, see Annexes 2, 3, 4 and 5 at the

end of this White paper.

3.1. Connectivity options

Difference between ICPs and DCPs

All ESES participants will maintain their business, legal and operational relationships exclusively with

their ESES CSDs whether they connect directly or indirectly to the T2S platform.

ICPs clients do not connect directly to T2S but send their messages exclusively via the ESES

platform and receive related reporting from the ESES platform only. The ESES CSDs will be

responsible for managing the connection with T2S on their behalf. We will shield ICPs as much as

possible from the connectivity impact inherent to the T2S project.

DCPs are defined as parties that are capable to send and to receive messages directly to the T2S

platform. According to their needs or to operate non settlement services, DCPs send also instructions

to the ESES platform. They receive reporting from the T2S platform or from the ESES CSDs,

depending on their subscriptions. In section 3.2, you can find a list of criteria that can be used to

configure the connectivity set up (this can include, for example, the securities account number and

ISO transaction code).

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 9

DCPs will need to maintain a direct connection with their ESES CSDs, to access all services other

than settlement services. Equally, even for settlement, DCP connectivity is neither exclusive nor

definitive: the same party can decide to use both DCP and ICP channels, depending on the type of

operation or its internal business lines.

Figure 1: ICP and DCP connectivity

Note: ESES participants wishing to become DCP were required to confirm their intention, in a nonbinding manner, to the CSD Steering Group (CSG) before 15 October 2013. Final confirmation is

required one year before the start of community testing (scheduled for mid-September 2014 for the

ESES markets (wave 2) but to be confirmed) Expressions of interest received after 15 October 2013

will only be considered for the next migration cycle, i.e. after the 4th wave in 2017.

Figure 2: Service access – ICPs and DCPs

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 10

ESES direct connectivity

EuroClearConnect for STP

Proprietar

y

Settlement

Payment

Custody

messages

SBI trade

confirmation

Money Market

Instruments

(TCN)

Registered

securities

TPI

Funds order

routing

Triparty

collateral

management

EuroclearConnect

for Screens

ISO 15022

ISO 20222

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

Direct

connectivity

T2S

T2S

platform

scree

n

ISO

20022

•

•

•

•

•

•1

•2

Table 1: Overview of connectivity means that will be offered for main ESES services

3.1.1. ESES Connectivity offer – ICPs

ICPs will interact with the T2S platform only via the ESES platform. ICPs will therefore have a single

entry point for all their activity, whether taking place on T2S or with ESES, for both settlement and

other services, including value-added services.

ICPs can communicate via:

·

EuroclearConnect3 for STP using ISO 15022- or ISO 20022-compliant messages for

settlement and ISO 15022-compliant messages for corporate actions. Some services will

continue to use existing proprietary format

·

EuroclearConnect for Screens

EuroclearConnect for STP

We intend to give ICPs access to almost all ISO 20022-compliant messages available on the T2S

platform, from the current EuroclearConnect for STP platform. Current ESES ISO 15022-compliant

messages will be maintained. However, their format will be adapted, to take into account the new

features of T2S. In addition, some new ISO 15022-compliant messages will be introduced, to ensure

full coverage of T2S functionality. For an overview on the impact of settlement messages, see

Annexes 2, 3, 4 and 5.

1

Dedicated browser

Dedicated browser

3

EuroclearConnect is the brand name for ESES connectivity means.

2

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 11

To limit the adaptation costs for all ICPs, whether using ISO 15022 or ISO 20022-compliant

messages, we will:

·

offer the option of keeping some elements of the current ESES party and account structure

·

maintain the concept of routing code which is currently available in ESES settlement

(such as the participant code, sub account, account nature, collateral indicator (ICPG))

proprietary messages; this facility will be implemented for ISO15022 and ISO20022

messages

Alternatively, ICPs (particularly those who intend to be DCPs as well), can use ISO 20022-compliant

messages in full T2S format.

With regard to the STP channel, we will continue to offer an access through current network

providers:

·

SWIFT (FIN, TDA, Interact or File Act)

·

BT (BT/Radianz MQ, BT/Radianz FT)

EuroclearConnect for Screens

EuroclearConnect for Screens will be modified to offer clients with an access to their T2S activity in

real time. This will include the following functions:

·

matching and settlement instruction input, maintenance instructions4 and associated

reporting

·

security balance monitoring

·

liquidity messages and purchasing power monitoring

The access to EuroclearConnect for Screens can be subscribed by any client regardless of the

connectivity used for STP messages (i.e. a client which is directly connected for its STP messages

can have access to the EuroclearConnect for Screens to monitor its activity in T2S). This can be done

as the ESES CSDs will receive real time copies of applicable inbound and status messages.

New functionality offered on the T2S platform, such as management of priorities, linking or cross-CSD

instructions will also be accessible from EuroclearConnect for Screens. Consultation tools will be

upgraded to cover the larger scope of T2S securities and counterparties.

Other ESES CSDs services, such as corporate actions input and reporting or TCN issuance, will

continue as well to be offered from EuroclearConnect for Screens.

We will continue to offer an access through:

·

Public internet

·

SWIFT

·

BT/Radianz

Management of copies and duplicates

We will maintain the extensive functionalities already offered by EuroclearConnect that allow clients to

have copies of their messages sent to third parties. In addition, ICPs will have the option to select the

format of the copy (ISO 15022/ISO 20022) regardless of the original message.

Just like today, the ESES CSDs may send duplicate messages if the receiver of a message wants it

to be sent again.

4

Maintenance refers to modification or cancellation instructions.

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 12

3.1.2. ESES connectivity offer – DCPs

DCPs can communicate with the T2S platform via:

·

T2S STP channel: this connectivity solution will provide access to the majority of T2S

functionality, including the use of ISO 20022-compliant messaging:

◦ sending settlement instructions to the T2S platform and receiving reports

◦ querying the T2S platform

◦ liquidity management and cash account monitoring

·

T2S screen: will provide an access to the complete T2S functionality, including all those

offered in STP mode

Requirements for direct connectivity

·

Contracts: DCPs must have a contractual relationship with the CSD. There will be no

contractual relationship between DCPs and T2S/Eurosystem. DCPs must also select and

have a contract with a Network Provider for its connection to the T2S platform.

·

Becoming a DCP: ESES participants wishing to become DCP have confirmed their

intention before 15 October 2013. This allows the Eurosystem and the ESES CSDs to

prepare their respective testing plans.

·

Certification and testing: DCPs must obtain ECB certification to ensure that they are

technically able to send messages to T2S without harming the platform. This certification is

received once and is valid for all CSDs. In addition, DCPs will have to follow the standard

certification and testing process defined by each CSD in which they want to act as a DCP.

See section 9.2 regarding testing.

·

ISO 20022: DCPs must comply with ISO 20022-compliant message formats for STP

connectivity.

·

DCP compliance: the activity flowing through direct connectivity must be DCP-compliant

(i.e. when the end-to-end process does not require direct interaction between the DCP and

the CSD). DCPs will still need access to the CSDs system for non-settlement purposes.

·

Network solutions: DCPs have to decide between the two Network Providers for Value

Added Network (VAN) for the connectivity solution:

◦ SWIFT

◦ SIA / Colt

For settlement services, the ESES CSDs will remain the single point of contact for operational

support, issues and incident management. On a day- to-day basis, there will not be interaction

between DCPs and the T2S operator, except in case of technical connectivity problems: a business

continuity procedure will be in place through which the DCP may contact the T2S Operator.

Management of copies and duplicates

The T2S platform can, upon subscription, send copies of messages.

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 13

This feature can be used by DCPs to have copies of their sent or received messages to third parties

of their choice.

In addition, in order to process some services or to implement some controls, the ESES CSDs will

receive copies of messages sent by DCPs to T2S or status messages sent by T2S to DCPs. The

scope of relevant messages is under definition.

Upon request from the DCP client or from the ESES CSD, T2S can send duplicates of messages

already sent.

3.2. Subscriptions and users management

The ESES CSDs will be in charge of creating the necessary authorisations, privileges and

subscriptions for both ICPs and DCPs to connect to the T2S platform, for settlement activities. NCBs

will have the same responsibility for liquidity management aspects.

Two different profiles can be established in T2S:

·

Read-only direct access to T2S – for reporting and querying

·

Full access – for sending instructions, reporting and querying

T2S will offer flexibility in terms of access and reporting options. Subscriptions for reporting can be

based on different value criteria (i.e. set of data to be present in the message and conditions to be

fulfilled for the message to be sent by T2S). The possible criteria are the following:

·

Message type

·

Instruction type

·

Instruction status

·

Party (as account owner or receiving/delivering party or CSD, etc. depending on message

type)

·

Securities account

·

Cash account

·

ISIN

·

Currency of instruction

·

Already Matched flag

·

ISO transaction code

The ESES CSDs will:

·

define a default profile and reporting options that replicate current standard ESES setups

for both ICPs and DCPs

·

offer the flexibility to subscribe to customised profiles and reporting options, under specific

conditions that will be defined in the relevant ESES Detailed Service Descriptions

It is important to note that the ECB has set up some limitations in the use of this flexibility: the

maximum number of different sets of combined criteria that can be configured cannot exceed 1500

per CSD.

Just like today, the ESES CSDs will allow clients to grant access for instructing their settlement

instructions by other parties, by means of a Power of Attorney to, for example, Central Counterparties

(CCPs).

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 14

ICP service offering

The members that will opt for indirect connectivity will have their accesses and user profiles set up on

the ESES platform, as today, by their ESES CSDs. Therefore, the user and profile management on

T2S is transparent for them. However, they can be granted access to the T2S screen, in addition to

EuroclearConnect access.

Routing code

The routing code allows the ESES participants to specify by default or explicitly in the settlement

instruction the address where the reporting for this instruction must be sent. This facility is available

today in ESES proprietary settlement messages.

This service will be maintained and improved within T2S and will be implemented in all the ISO15022

and ISO20022 messages sent by ICPs. A default value will be set up and used when the settlement

instruction does not include any routing code. Unlike today, where the choice of routing code is

available only for SLAB matching instructions, this facility will be offered for any kind of instruction

sent by the participant.

For certain settlement messages generated by the CSD only (such as market claims, corporate

actions) or by T2S platform only (such as auto-collateralisation), the ICPs will have the possibility to

specify a dedicated routing code. Based on the original ISO transaction code, the ESES CSD will

route the settlement reporting to the appropriate address defined by the client.

DCP service offering

Each ESES CSD will define a standard user profile on the T2S platform for DCP access to both the

T2S network and T2S screen, and create a DCP administrator profile for each DCP. The

administrator profile will grant a number of access rights to users, and will give them the ability to

amend and update certain features. The access rights will be limited, to ensure that DCPs cannot

perform operations on the T2S platform that are not covered by the contractual and service

arrangements between us and the DCP.

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 15

4. Reference data

This section describes how core reference data will be managed by the ESES CSDs in relation to the

T2S project and in comparison with the way it is managed today.

We will only address data needed for the correct processing of settlement instructions (i.e. account

structure, securities, parties and cash accounts). Other data, such as that required to process

corporate actions, are not impacted.

4.1. Account structure

The ESES system and the T2S platform have different account structures. Both allow participants to

segregate their holdings in several sub-positions (ESES sub accounts or T2S accounts / restricted

balances). However, there are some specific components in the ESES account structure (e.g.

account natures and collateral indicators) that have no identical equivalent on the T2S platform. The

T2S account structure includes a layer for the CSD (which is implicit in the ESES CSDs).

ESES

T2S

CSD (SWIFT BIC)

Institution code

Party (SWIFT BIC)

Sub-account Account Nature (NDC)

Account

Collateral indicator (ICPG)

Earmarked balance

Table 2: ESES and T2S account structures

We intend to maintain the same account structure as today, in order to continue to offer the same

level of safety and flexibility to account holders and meet the business and legal requirements that

are behind the current account structure. In particular, the ESES multi-jurisdictional model will be

maintained. Therefore, each ESES security will continue to be assigned a single CSD of reference.

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 16

The following table summarises how we will map current ESES account structures to the T2S

platform:

ESES

account

structure

component

Description

Size

T2S

equivalent

How will it be mapped to the T2S

account structure

Size

Institution

code

The identifier of

the Party

11N

SWIFT BIC

11 of CSD +

SWIFT BIC

11 of the

party

the SWIFT BIC 11 of the party, in

combination with

the SWIFT BIC 11 of the CSD

11AN

+

11AN

The same SWIFT BIC 11 of the party can

be used across all CSDs.

Type of

Sub-account

+

Sub account

Segregated

account opened

by the party

2AN

+

23AN

Account

Each ESES sub-account will be mapped

with one segregated T2S account per CSD

35AN

Account

Nature

(NDC)

Feature that

specifies the legal

nature of the

holding or the

usage of the

securities

3N

Account

This concept does not exist in T2S. Each

account nature (including default ‘Ordinary

securities’) will be mapped with a specific

T2S account per CSD. We will attach to the

account a specific Market Specific Attribute

(MSA) in T2S data base to reflect the

relevant account nature. The specific

checks made by ESES in relation to the

account nature will be replicated through

the use of Market Specific Restriction Type

(MSRT) section 5.1.1.3. paragraph

Additional controls set by the ESES CSD

part of

the

above

size

35AN

ICPG

Collateral indicator

1N

Earmarked

balance

The participant will manage the autocollateralisation usage as a sub-position of

its account (earmarked balance):

- AWAS for non-collateralised

holdings (ICPG 0)

4AN

- EXXX for holdings eligible for autocollateralisation (ICPG 3)

Table 3: Mapping ESES to T2S account structure

The main impact of moving from the ESES account structure to the T2S account structure can be

summarised as follows:

·

For ICPs, we will offer the option of managing the account structure using the legacy

structure. We will convert this data when communicating with T2S, so as to shield clients

from any impact.

·

For DCPs, or for ICPs opting for T2S account structure, the following impact is expected:

◦ ESES single operational account will be translated into up to three T2S accounts. In the

ESES account structure, account details can be identical across the three ESES CSDs. In

the T2S account structure, only the SWIFT BIC 11 of the party can be used across CSDs,

whereas account numbers must be specific per CSD. Multiple T2S accounts will replace

ESES specific account structure components (sub-accounts, account nature and

potentially ICPG). These account numbers will be specific per CSD

T2S accounts naming convention

The CSDs joining T2S have agreed on a common high-level structure for naming the T2S securities

account. On the ground of this high-level structure, each CSD has defined a detailed structure for the

community of its clients.

High level structure

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 17

·

4 first digits = the BIC4 of the CSD

·

subsequent 31 digits: free text / 31 characters to be defined by the CSD with its clients

Figure 3: Structure of securities account in T2S

Following consultation with the ESES markets, via the ESES T2S User Group, we have defined the

following structure for the ESES CSDs:

Type

The BIC4 of the ESES CSDs

The ESES party BIC 11

The Account Nature (NDC)

The sub-account type

The sub-account number

Total

Length

4AN

11AN

3N

2AN

15AN (max)

35AN

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 18

The following example illustrates the mapping of an ESES account structure to the T2S account

structure, for a participant that accesses the three ESES CSDs through a single operational securities

account.

ESES account structure

Institution

code

Subaccount

5555

L1 0

5555

Account

nature

000

Ordinary

securities

L1 0

000

Ordinary

securities

Mapping to T2S account structure

ICPG

0

6

3

CSD SWIFT

BIC5

SWIFT BIC

Account

Earmarking

restriction type

ESESBEBBXXX

ABCDEFGHXXX

CIKBABCDE

FGHXXX000

L10

Deliverable

(AWAS)

ESESFRPPT2X

ABCDEFGHXXX

SICVABCDE

FGHXXX000

L10

Deliverable

(AWAS)

ESESNL2AXXX

ABCDEFGHXXX

NECIABCDE

FGHXXX000

L10

Deliverable

(AWAS)

ESESBEBBXXX

ABCDEFGHXXX

CIKBABCDE

FGHXXX000

L10

Autocollateralisation

(EXXX)

ESESFRPPT2X

ABCDEFGHXXX

SICVABCDE

FGHXXX000

L10

Autocollateralisation

(EXXX)

ESESNL2AXXX

ABCDEFGHXXX

NECIABCDE

FGHXXX000

L10

Autocollateralisation

(EXXX)

5555

L1 0

001

Administered

registered

securities7

0

ESESFRPPT2X

ABCDEFGHXXX

SICVABCDE

FGHXXX001

L10

Deliverable

(AWAS)

5555

L1 0

0

ESESBEBBXXX

ABCDEFGHXXX

CIKBABCDE

FGHXXX104

L10

Deliverable

(AWAS)

5555

L1 0

104

Specific

NOMS for

Belgian

registered

securities8

106

Securities

exchange

account

0

ESESNL2AXXX

ABCDEFGHXXX

NECIABCDE

FGHXXX106

L10

Deliverable

(AWAS)

5555

LM 235

0

ESESBEBBXXX

ABCDEFGHXXX

CIKBABCDE

FGHXXX000

LM235

Deliverable

(AWAS)

ESESFRPPT2X

ABCDEFGHXXX

SICVABCDE

FGHXXX000

LM235

Deliverable

(AWAS)

ESESNL2AXXX

ABCDEFGHXXX

NECIABCDE

FGHXXX000

LM235

Deliverable

(AWAS)

000

Ordinary

shares

Table 4: Example of mapping ESES to T2S account structure

We intend to reduce the number of Account Natures (currently almost 100) on or before the launch of

T2S, in line with the proposals made by a dedicated marketplace working group in France in 2012.

Impact of ESES account structure for T2S counterparties of ESES clients

5

The BIC4 and CSDs BICs shown in this example are illustrative; actual BICs and BIC4 will be confirmed in

relevant DSDs.

6

Auto-collateralisation is currently only available in Euroclear France. Following the local NCBs’ decision, it

should also be extended to Euroclear Nederland at the time of the launch of T2S.

7

This account nature is specific to the relevant ESES CSD. It should remain with T2S.

8

Idem

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 19

In most cases, the account structure of ESES participants on the T2S platform should have little or no

impact on counterparties, independently if they are ICP or DCP, meaning that except for mandatory

matching criteria (CSD + SWIFT BIC of the participant), ESES counterparties (in the ESES CSDs or

in other CSDs) will not need to know all of the details of the accounts opened by the ESES

participant.

The two following elements, however, could influence counterparties:

·

the T2S account number is an optional matching criterion (matching is needed if the two

counterparties have specifically input the account). The aim is to reduce the instances of

cross-matching. If the market practice evolves towards the T2S account number becoming

a matching criterion, there is a risk of increased complexity for ESES counterparties, as

they will need to know all market specific accounts opened by ESES participants

·

as a consequence of the ESES multi-jurisdictional model, each ESES security will continue

to be eligible on the T2S platform only in a single CSD of reference. As the CSD is a

matching criterion on the T2S platform, the ESES counterparties on the T2S platform will

have to identify and populate the ESES CSD of reference linked to the security

For further detail on the matching process and matching criteria, see section 5.1.1. ‘Validation and

matching’.

4.2. Parties and securities accounts

The ESES CSDs will be in charge of creating parties and securities accounts in the T2S database, for

all ESES participants, regardless of whether they are directly or indirectly connected.

Parties are identified on the T2S platform by means of a SWIFT BIC 11, in combination with the

SWIFT BIC 11 of the CSD(s) of which they are a member. Consequently, ESES participants will need

to use a SWIFT BIC 11 to be set up correctly on the T2S platform. Some members may need to use

several SWIFT BICs. At the level of the ESES CSDs, the party will be linked to the institution code.

In order to have business continuity and to benefit from the same granularity as in the ESES CSDs

today, we recommend ESES participants to set up one BIC11 for each current ESES party account.

Securities accounts on the T2S platform are linked to a single party. A party can have several

securities accounts linked to it. Securities account numbers are defined by the CSD, at the opening

request according to standard rules defined in section 4.1. When opening a securities account the

ESES CSD will specify which types of balances are allowed:

·

only credit or zero balances or

·

credit, debit and zero balances

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 20

The ESES CSDs can allocate some additional specific parameters, called Market Specific Attributes

(MSAs) to parties and accounts. We will use this additional data to perform some validation checks on

the T2S platform, for example to check some management rules linked to the profile of the party or

the account.

If allocated to parties, MSAs will subsequently be applicable to the party and all underlying accounts.

An example of such additional data is the account nature linked to the securities account (e.g. bearer

and registered).

4.3. Securities data

CSDs will be in charge of the creation of securities in the T2S database. For each security eligible in

T2S, there is a single CSD which takes the role of SME (System Maintaining Entity). The SME is in

charge of creating and maintaining the data for this security for the whole T2S community.

·

For a security issued in T2S, the SME will be the issuer CSD.

·

In the case of a foreign security issued outside T2S, there will be one or several CSDs in

T2S, the technical issuer CSDs that accept this security via a direct or a relayed link with

the issuer CSD outside T2S. In such a case, the SME will be the technical issuer CSD (or

one of them only, if there are many9).

Data required by the T2S platform is limited to a number of basic elements that are common to all

CSDs. In addition, CSDs can add new elements in the form of MSAs ('Market Specific Attributes), to

be able to perform additional validations for country or service specific items, on T2S rather than on

their legacy systems.

We intend to use this feature to perform all validations on the T2S platform, to facilitate cross-CSD

settlement and direct connectivity. Examples of such additional data include legal form or the

category of securities.

In the context of ESES adaptation to T2S, we will be prepared to accept a maximum number of

securities as issuer CSD, investor CSD or technical issuer to cover the largest scope of T2S eligible

securities and to offer the required asset servicing. Nevertheless, there could be some exceptions. In

particular, we will not accept securities in face amount (FMT) with a Deviating Settlement Unit (DSU):

i.e. securities which settlement amount defined in T2S securities database is not a multiple of the

nominal.

4.4. Dedicated cash accounts

As far as payments are concerned, ESES participants will choose one of the following statuses:

·

payment bank, corresponding to the ESES status of settlement bank. As in ESES today, a

payment bank can:

◦ use its own RTGS account for a T2S-eligible currency or

◦ use the RTGS account of another payment bank (an agent), while having full control of

cash on the T2S platform.

·

payment bank client, corresponding to the ESES status of settlement bank client, which

fully outsources cash management to a payment bank

Please note that unlike in the current ESES situation, the auto-collateralisation mechanism will only

be available for payment banks linked to their own RTGS account. This would be a change to the

9

The detailed criteria to select the SME for non-T2S securities will be defined jointly by the CSDs before

the launch.

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 21

current auto-collateralisation mechanism which is open to all payment banks, including to those which

operate DCAs not linked to their own RTGS account10.

Cash balances in central bank money will be held by payment banks on the T2S platform within

Dedicated Cash Accounts (DCAs). These accounts will include both the liquidity generated from the

auto-collateralisation process and the cash resulting from settlement, corporate actions or liquidity

transfers.

In T2S, a securities account is always linked to a T2S DCA via a Credit Memorandum Balance

(CMB). A CMB is a tool T2S uses to track the provision of credit from a central bank to a payment

bank (for central bank collateralisation) and from a payment bank to their clients.

A payment bank may authorise one or more of its clients to use its own DCA for the settlement of

their instructions. Each DCA is linked to one CMB related to the payment bank holding the DCA and,

possibly, to one CMB for each client authorised to use the payment bank's DCA for settlement of the

cash leg of its settlement instructions.

NCBs will be in charge of creating DCAs for payment banks in the T2S database. Unlike ESES,

where the DCA is linked to the party level (institution code), DCAs will be linked in T2S to the

securities account level. Each DCA will be allocated a specific number on the T2S platform.

Each party can open several DCAs for each securities account, in which case, a default DCA is

defined per currency. Settlement is operated in the default DCA unless a specific DCA is mentioned

in the settlement instruction. We will offer ESES participants the option to designate a specific DCA

for the use of corporate actions (income payments). CSDs will be in charge of creating links between

securities accounts and DCAs in the T2S database.

Figure 4: Link between securities and cash accounts

Each DCA will be linked to a RTGS account with an NCB in the relevant RTGS payment system (e.g.

TARGET2). For auto-collateralisation purposes, each DCA can only be linked with a single NCB

receiving account. The same DCA can be used for the settlement of transactions in various securities

accounts and in various CSDs.

10

Please note that there is an ongoing change request which may modify the conditions to access the autocollateralisation for payment banks.

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 22

5. Settlement

This section covers all settlement and settlement-related services, as they will be offered by the

ESES CSDs on the T2S platform. ESES matching and settlement services will be fully outsourced to

the T2S platform. These services will be the ones that are the most impacted by the T2S project. In

most cases, new T2S features will replace current ESES functions.

In this section, we will:

·

provide an overview on how matching and settlement services will be impacted by the T2S

project.

·

describe how liquidity management and cross-CSD settlement will be operated by the T2S

platform

·

highlight the impact of the T2S project on issuance, primary market operations and on presettlement services

For each service, we will highlight how it is impacted by the T2S project, point out the differences with

current ESES processing, and indicate whether or not we anticipate any service level differences for

DCPs and ICPs.

5.1. Lean T2S settlement

5.1.1. Validation and matching

To efficiently reshape the ESES platform, matching will be fully outsourced to the T2S platform. To

that extent, the current ESES SLAB matching system will be discontinued and replaced by the T2S

matching system.

The T2S matching system follows similar workflows to those of the ESES SLAB matching system.

·

Two counterparties send buy and sell instructions

·

Allegement messages are sent to the counterparty for unmatched transactions

·

The system compares the two instructions according to standard matching criteria

·

Matched transactions are candidates for settlement

As a result of the discontinuation of the SLAB matching system, and in line with discussions held with

the market, the ‘Pension Livree’ repo mechanism will no longer be available to ESES clients. For

more details, see section 5.5.5. – ‘Bilateral repos’.

5.1.1.1. Access to T2S matching system

ESES ICPs will either send matching instructions from EuroclearConnect for Screens, or by sending

ISO 15022- or ISO 20022-compliant messages to the ESES platform. ESES matching proprietary

messages will be discontinued.

DCPs will communicate with the T2S matching system via ISO 20022-compliant messages or the

relevant T2S screens.

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 23

Matching will be available to both ICPs and DCPs, in any of the following configurations.

Figure 5: Possible matching configurations

5.1.1.2. Type of instructions

The T2S matching system will accommodate the following types of instructions. As a new feature for

ESES participants, ‘Delivery with payment’ instructions and ‘cash only’ instructions can be input by all

participants, whereas today they can only be input for CCPs or for some corporate actions.

Instruction

Definition

Free of payment (FOP)/Deliver free of payment

(DFP)/Receive free of payment (RFP)

Delivery/Receipt of securities without payment being made

Deliver Versus Payment (DVP)/Receive

Versus Payment (RVP)

Exchange of securities against cash

Payment free of delivery (PFOD) or ‘cash only’

Exchange of cash without the delivery of securities

Deliver With Payment (DWP)/Receive With

Payment (RWP)

Delivery/Receipt of cash and securities from one party to

another

Table 5: Transaction types in T2S

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 24

5.1.1.3. Validation

Technical validation

At the receipt of a settlement instruction and before the business validation, T2S processes a

technical check which includes:

·

sender authentication and decryption

·

duplicate check validation (no active instruction from the same instructing party with the

same T2S Actor’ instruction reference)

·

privilege check validation (the T2S system user has the relevant privileges to send the

corresponding instruction)

Business validation

The T2S business validation processes will ensure that all incoming instructions are valid at the time

they are received by the T2S platform. These checks will be either:

·

the basic controls that are common to all CSDs participating to T2S

·

the additional controls that will be set up specifically by the ESES CSDs (e.g. related to

account natures, registration or issuance)

To the extent that it is possible, the ESES CSDs will outsource the basic and the additional settlement

validations to the T2S platform, even for transactions received from ICP clients. As a result, rejections

will be reported to ICPs, using T2S reason codes.

T2S will validate transactions vis-à-vis reference data on the intended settlement date only, whereas

ESES validates on the trade date and intended settlement date.

Additional controls set by the ESES CSDs

In the context of ESES adaptation to T2S, we intend to implement in T2S a number of controls or

processes which are currently performed by ESES system, through the creation of dedicated rules.

These controls or processes are needed for:

·

regulatory reasons (e.g. because of the legal features of the security or of the party),

·

security and integrity reasons (to ensure that various components of a settlement

instruction are consistent among themselves)

·

service reasons: to apply some processes which are needed to offer CSDs services which

are not in the scope of T2S lean settlement

T2S rule-based model provides CSDs with tools that allow them to decentralise these controls, for

example:

·

Market Specific Restrictions Types (MSRT)

·

Market Specific Attributes (MSA)

·

CSD validation hold

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 25

In particular, the ESES CSDs will set up a number of MSAs to complement T2S data base with

specific ESES attributes needed to perform these additional controls. These MSAs will relate to 3

components:

·

securities

·

parties

·

securities accounts

The number of rules and market specific attributes that each CSD is authorised to create is limited:

·

the number of Market-Specific Attributes (MSAs) to be used is limited to 10 per CSD

·

the number of rules (restriction types) for system configuration is limited to 5000 per CSD

Revalidation process

A revalidation process is triggered on all recycled instructions at the start of day or when there is a

change in the static data, in order to check that these instructions are still valid. If a pending

instruction does not pass the revalidation, T2S cancels the instruction and informs the participant.

However, T2S does not apply the revalidation process when there is a change in business rules set

by the CSD (Market specific restrictions) unless a new CSD rule is created. In such case, manual

cancellation should be processed.

5.1.1.4. Matching rules

This section compares the main matching rules on the T2S platform and the ESES platform.

Mandatory matching

Unlike on the ESES platform, free of payment without matching (‘dumps’) will no longer be authorised

on the T2S platform. The following are exceptions to this rule:

·

transfers between the accounts of the same party

·

already matched instructions sent by a party that has the required authorisation of the

accounts (e.g. CSD or CCP) of both counterparties. This will be limited to intra-CSD

transactions. In all cases, matching will be required for cross-CSD transactions

We will implement a solution for FOP without matching dedicated to ICPs, see section 5.5.4.

Matching criteria

Matching rules that will apply are those defined by the T2S platform, regardless of the configuration of

the party (i.e. matching criteria will be the same for both DCPs and ICPs). The matching criteria are

compliant with the European Central Securities Depositories Association (ECSDA) and the European

Securities Forum (ESF) matching standards.

Most of the matching criteria are similar to those currently used in the ESES SLAB sub-system. As

such, no major impact is foreseen from a client perspective.

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 26

Matching criteria

Current ESES

With T2S

Delivering Party

•

•

Receiving Party

•

•

CSD of the Delivering Party

N/A

•

CSD of the Receiving Party

N/A

•

ISIN

•

•

Trade date

•

•

Intended settlement date

•

•

Settlement quantity

•11

•

Currency

•

•12

Settlement amount

•

•13

Credit/Debit

N/A

•14

Payment type

N/A

•

15

•

Mandatory matching fields

Securities movement type

•

Instruction type

•

Reversing-entry indicator16

•

Additional matching fields (mandatory matching as soon as one party has input the field)

Opt-out ISO transaction condition indicator17

•

CUM/EX indicator18

•

Optional matching fields (mandatory matching only if the two parties have input the field- matching against blank

allowed)

Common trade reference

•

Client of delivering CSD participant

• (client reference)

•

Client of receiving CSD participant

• (client reference)

•

Securities account of the delivering party

•

Securities account of the receiving party

•

Table 6: ESES/T2S matching criteria gap analysis

Matching tolerance

A matching tolerance is the maximum difference authorised between the cash amounts input by the

seller and the buyer in settlement instructions. This principle currently exists on the ESES platform,

and will apply on the T2S platform, with slightly different conditions.

Matching tolerance

Current ESES

With T2S

EUR 2

EUR 2 (if settlement amount is less

11

Two separate matching criteria on the ESES platform (i.e. ‘expression of the quantity’ and ‘quantity of

securities traded’) will be covered in a unique matching criterion on the T2S platform.

12

Only a matching criterion for DVP and DWP instructions.

13

Idem

14

Idem

15

The current ESES matching criterion is ‘purchase/sale codes’, used in RGV proprietary format

messaging only.

16

The ‘reversing entry indicator’ informs the counterpart that the settlement instruction is the reversal of a

former settlement instruction.

17

Opt-out: counterparties in the underlying transaction may choose to ‘opt-out’ of the transaction

management process if they want to indicate that no market claims and transformations at all should apply

on a given transaction

18

Cum/ex: counterparties in the underlying transaction may choose to include the ex/cum indicator only if

they want to deviate from the standard market claim procedure, as described in the CAJWG standards.

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 27

EUR 25 (for repo instructions ‘Pension

Livrée’)

than or equal to EUR 100.000)

EUR 25 (if settlement amount is

greater than EUR 100.000)

Table 7: Matching tolerance in EUR

Additional matching period

The additional matching period defines the period following the intended settlement date of an

unmatched transaction, during which it still has a chance to match and settle. After that period, the

unmatched instructions are automatically cancelled.

Additional matching period

Current ESES

With T2S

Per instruction type (0, 5 or 10 days)

20 days after ISD or the last status

change

Table 8a: Additional matching period

Allegement

Similar to today in the ESES CSDs:

·

T2S sends an allegement to the counterparty of an unmatched transaction to alert them

that a matching instruction is required on their side

·

the allegement message is cancelled or removed when it is no longer needed for the

counterparty

For more details, see section 5.1.1.5.

Cancellation

Similar to today in ESES:

·

unmatched transactions can be cancelled unilaterally

·

cancellation of matched transactions must be bilaterally requested

Note: the senders of instructions that are already submitted as ‘already matched’ can cancel the

instructions themselves.

5.1.1.5 Reporting

Upon the receipt of instruction, relevant reporting will be sent to the relevant parties, whether ICPs or

DCPs. This will include:

·

an ‘Accepted’ or ‘Rejected’ Securities Settlement Transaction Status Advice

·

a ‘Matched’ Securities Settlement Transaction Status Advice, in real time

·

an allegement message to be sent to the counterparty if the instruction is not matched

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 28

The allegement message will be sent:

Timing

I > SD-1

I = SD-1

Current ESES

2h

20 min

until SD noon

I = SD

1 min after noon

T2S

1h until SD 13:00

(1-hour delay period from the

first unsuccessful matching

attempt)

Real time after 13:00

(from 5-hour delay period

measured backwards from

18:00 (the FOP cut-off time))

I = Date of issuance of matching instruction

SD = Intended settlement date

Table 8b: Allegement periods

Instead of subscribing to individual allegement messages, the participant can subscribe to receive the

Statement of Settlement Allegements report. This report includes details of all transactions that its

counterparties have alleged against it on a settlement day. The report can be generated at a specific

time or upon the occurrence of specific event(s).

Cancellation/removal of allegements

As it is today on the ESES platform, based on the messages subscription, an allegement message

can be removed or cancelled after it has been sent to the counterparty of an unmatched transaction.

·

If an unmatched instruction is cancelled, the counterparty receives an advice that the

allegement is cancelled.

·

In case the counterparty sends its corresponding instruction and if both instructions match,

the counterparty receives an advice that the allegement is removed.

5.1.2. Settlement and operational day

T2S provides free of payment and DVP book-entry settlement services that follow most of the ESES

principles:

·

Central Bank Money settlement

·

integrated model by which securities accounts and cash positions in central bank money

are held within the same settlement platform

·

auto-collateralisation mechanism

·

overnight batch settlement and daytime real-time settlement

·

real-time exchanges with TARGET2

T2S settlement is built as a multi-currency platform open to the Eurozone NCBs and to any other

NCB that has signed a currency participation agreement with T2S. Nevertheless at the launch of the

platform, only euro currency will be eligible.

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 29

5.1.2.1. T2S Operational day

This section describes the main features of T2S operational day and T2S settlement reporting.

In the framework of T2S, the ESES operational day will be amended to cope with the new timing,

deadlines and milestones that will be triggered on the T2S platform. The T2S accounting day will be

considered the Master day. As a result, the timings related to matching and settlement activity will be

aligned with T2S timings, while other timings, related either to added value settlement services or

custody services offered by ESES, might be modified to fit within this new framework.

Operational day generic framework

Note: all times mentioned are in Central European Time (CET).

The main characteristics and sequences used within the T2S operational day take place in the

following order:

1.

2.

3.

Operational day value S will start on the T2S platform around 18:45 on S-1

Start-of-day processing

Night-time settlement period:

- first night time starts around 19:30

- last night time starts around 21:45

4.

Maintenance window from 03:00 to 05:00

5.

Real-time settlement period:

- starts before 03:00 or at 05:00 depending on T2S reception of notification status

- real time settlement closure at 16:00

6.

End-of-day processing at 18:00

The following figure provides a high level overview of the main exchanges between the ESES

platform and the T2S platform.

Figure 6: Interaction between ESES and T2S platforms

During each window and period, some specific flows and exchange of information will be performed.

These timings are indicative.

White paper – Adaptation of ESES CSD services to Target2-Securities – Version 3.1 I December 2013 I 30

Main impact

Due to the changes that will arise from the new timings set by the T2S platform and the various