surety bonding 101

advertisement

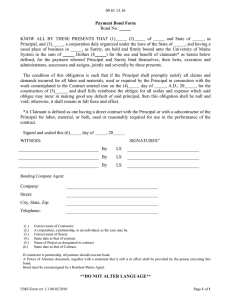

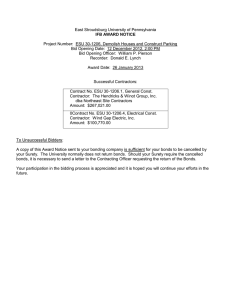

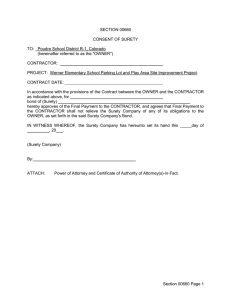

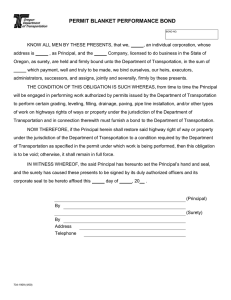

5 6 Surety bonds are used for public works contracts to transfer risk and fulfill statutory requirements. Since 1893, the federal government has required contractors to obtain bonds for federal public works projects to assure performance of the contract and payment to certain laborers and materials suppliers. The federal law mandating surety bonds is the Miller Act of 1935. Most states and local jurisdictions have similar legislation, commonly referred to as “Little Miller Acts,” which vary greatly from jurisdiction to jurisdiction. Note: Research local regulations to determine if there are any specifics related to surety requirements that the audience should be aware of. For example, in Missouri the requirement is actually for a payment bond, not a performance bond. However, in addition to the bond requirement, there is a statute that makes employees and/or officers of a public body awarding the contract who fail to comply with the bonding statute, personally liable in the event there is a loss that would have been covered by a payment bond. 7 8 9 While the terms principal and contractor will be used interchangeably throughout this presentation, contractor is not necessarily limited to the construction industry, rather, a contract can include any party entering into a contract to supply materials or services . 10 Surety bonding shares some characteristics of bank credit, in that the surety company’s financial resources back the contractor’s commitment to complete the contract. This backing enables the contractor to enter into a contract with an Obligee. Like traditional insurance, surety is a risk transfer mechanism and is licensed and regulated by state insurance departments. Unlike traditional insurance, however, surety bonds are three-party agreements among the Obligee, principal, and surety. The premium is a fee for service and is not based upon expected loss. 11 There are several types of surety bonds used on public works contracts, including: Bid bonds assure that the bid has been submitted in good faith, the contractor intends to enter into the contract at the price bid, and will provide the required performance and payment bonds. Performance bonds assure quality construction by assuring the fulfillment of a contract in accordance with the terms and conditions. Generally, performance bonds include a one year maintenance period to cover corrections of defects from faulty materials or workmanship for at least 1 year. For longer periods, a separate maintenance bond may be obtained. Payment bonds protect taxpayers from unpaid bills on public projects and assure payment to certain subcontractors, suppliers, and laborers if the contractor defaults on the project or fails to pay them. Supply bonds guarantee the performance of a contract to furnish supplies or materials. 12 The Bid Bond provides financial assurance that the bid has been submitted in good faith and that the contractor intends to enter in to the contract at the price bid and provide the required performance and payment bonds. 13 14 15 16 17 The charge for a surety bond is referred to as the bond premium. Generally, there is no charge for the bid bond. The performance bond premium is typically ½% to 2.5% of the contract amount. And, there is typically no charge for the payment bond when purchased in conjunction with the performance bond. The surety bond premium is a fee for the surety’s underwriting services. In theory, sound underwriting should result in no loss to the surety. 18 Contractors are not guaranteed a surety bond, but rather must qualify for them. That process is called prequalification or underwriting. 19 The surety company will only bond those principals who can demonstrate that they have the capital, capacity, and character to perform the specific contract. Prequalification is done to determine if the principal can handle the scope of work in the contract, to verify a company’s financial strength, and to determine if the principal can meet current and future obligations. 20 The surety underwriter goes beyond the simple acquisition of financial reports to determine the capital available for the applicant to perform. The underwriter analyzes financial trends and tracks gross profits on open and closed projects to determine the validity of the financial reports. The surety also is interested in what a principal does to keep his or her capital, and scrutinizes investment strategies, cost control mechanisms, and continuity plan. 21 The surety looks at the principal’s: •Business plan, with growth and profit objectives, how jobs are obtained, job size and scope, bidding practices, and geographic areas in which work is performed. •Organizational structure of key employees and their qualifications. •Systems to schedule and control work flow. •Continuity plan that details what happens in the event of the loss of a key employee. The surety will carefully analyze the principal’s past, current, and future work program, especially when the contractor is performing a construction contract. The surety will analyze: •Past performance and experience with a look at types of projects completed over the past 5 years with size, completion date, and final gross profit. •Current work load of both bonded and non-bonded projects. 22 A surety company also evaluates the principal’s character (as an individual and of the company) by checking references with subcontractors, suppliers, and bankers. Sureties may investigate pay records and legal filings, for example, in order to assess the principal’s general business reputation. 23 24 25 26 27 28 Commercial surety protects against failure to fulfill a contract or obligation, such as: •Court bonds secure the faithful performance of fiduciaries’ duties and compliance with court orders. Types of court bonds used in judicial proceedings include injunction, appeal, Mechanic’s lien, attachment, and replevin action (which means: an act or writ to recover goods by somebody who claims to own them and who promises to have the claim later tested in court). •Public officials bonds guarantee the faithful performance of public officials, such as treasurers, sheriffs, judges, and notaries. •Bonds that protect the federal government for a number of different obligations, such as Medicare and Medicaid bonds, customs bonds, and alcoholic beverage bonds. •Miscellaneous bonds include things like lost securities, leases, payment of utility bills, employer contributions to Union fringe benefits, and workers compensations for self-insurers. 29 • License and permit bonds may be required by state or local jurisdictions before a license or permit can be granted to a business. There bonds cover everything from contractors licenses, motor vehicle dealers, securities dealers, to cigarette tax, sales tax, or liquor bonds. 30 31 32