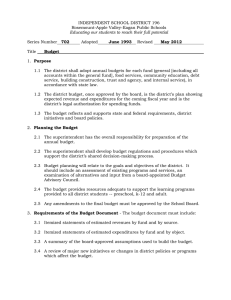

Alignment (Clear Line of Sight) Project Cm 7567

advertisement