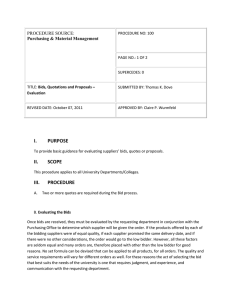

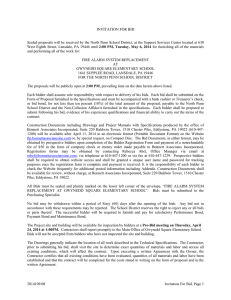

Project Modifications and Bidding in Highway Procurement

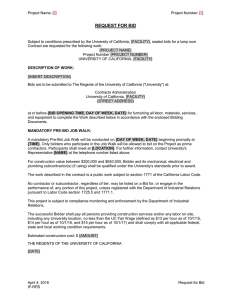

advertisement