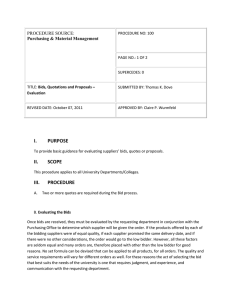

Project Modifications and Bidding in Highway Procurement

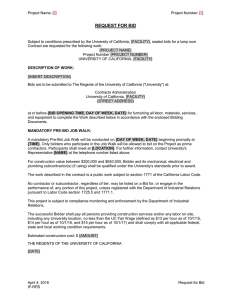

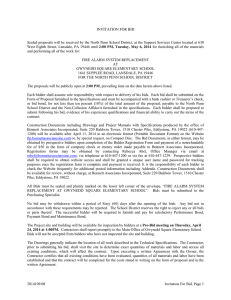

advertisement