Second Order Approximation Methods for DSGE Models

advertisement

Second Order Approximation Methods for

DSGE Models

The University of York

Dr. Nicola Branzoli

11-12 June 2009

Contents

1 Introduction

2

2 Starting Examples

2.1 A Simple Economic Example . . . . . . . . . . . . . . . . . . . .

2.2 A Simple Numerical Example . . . . . . . . . . . . . . . . . . . .

3

3

4

3 Algebraic and Economic Preliminary De…nitions

3.1 Algebraic Tools . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.2 Economic Tools . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5

6

4 First Order Approximation

7

5 Higher Order Approximations

5.1 A General Approach . . . . . . . . . . . . . . . . . . . . . . . . .

5.2 Using …rst order methods to solve up to the second order . . . .

5.3 A Simple RBC application . . . . . . . . . . . . . . . . . . . . . .

9

9

11

13

6 Normative Analysis

15

6.1 Policies not a¤ecting the steady state . . . . . . . . . . . . . . . . 15

6.1.1 An RBC application . . . . . . . . . . . . . . . . . . . . . 15

6.2 Policies a¤ecting the steady state . . . . . . . . . . . . . . . . . . 16

6.2.1 An RBC application . . . . . . . . . . . . . . . . . . . . . 16

6.3 Exercises policy not a¤ecting the steady state: an RBC model

with Money and Optimal Policy . . . . . . . . . . . . . . . . . . 18

6.4 Exercise with Money policy a¤ecting the steady state: optimal

level of in‡ation in an RBC model with Money . . . . . . . . . . 20

1

1

Introduction

Numerical Methods and Systems of Partial Di¤erential Equations

A model is a system of partial di¤erential equations describing the evolution of (economic) variables over time (dynamic approach)

Di¤erent models are judged by their implications (variances, covariances,

impulse responses etc.)

"Good" models (models whose implications match empirical facts under

study) are used for normative analysis

Economic Research

Identify interesting empirical facts

#

Write down and solve (derive …rst order conditions) the model that describe

these empirical facts

#

Solve the system of di¤erential equations (global solutions or local solutions

like Taylor expansion)

#

Study the implications of the model (variances and variance decomposition,

impulse response functions)

#

Perform Normative Analysis

Today’s Lecture

We will study numerical methods to implement the last three steps and

(some) theory behind these methods

Our road map for today is:

1. Present two simple examples to get basic ideas

2. Algebraic and economic preliminary de…nitions

3. First Order Taylor Approximation (recap of the generalized Schur decomposition)

4. Higher Order Taylor Approximations (the Schmitt-Grohé-Uribe and Lombardo Sutherland approaches)

5. RBC application

6. Normative Analysis

2

2

Starting Examples

2.1

A Simple Economic Example

A simple economic example: A Phillips Curve and the Quantity Theory of

Money

Suppose that in‡ation and aggregate demand can be described:

=

=

t

4mt

Et t+1 + 4yt "Phillips Curve"

t + 4yt Agg. Demand Function (quantity Theory of Money)

This is a system of two equations in three variables (describing dynamic

behavior rather than "static" values)

4mt is a policy variable.

IF this model were true, what are the implications?

A simple economic example: solve the system

This system implies:

t

=

t

=

t

=

4yt

Et

1+

t+1

+ [4mt

Et

1+

= 4mt

1

X

1+

"

Et

i=0

Et+1

t]

)

t+2

+

i

1+

t

=

1+

1+

#

Et

4mt+1

t+1

+

+

1+

1+

4mt )

4mt ::: )

4mt+i

t

A simple economic example: implication of the model

1. Constant Money Supply: 4mt+i = m 8i

"

#

1

i

X

Et

4mt+i =

t =

1 + i=0

1+

1+

4yt

= 4mt

t

=

1

1+

1

X

i=0

"

i

1+

#

m =

m

2. AR(1) Money Supply 4mt+1 = 4mt + "t+1

( Et "t+1 = 0; unpredictable, from the private sector, component of monetary policy):

"

#

1

i

X

Et

4mt =

m

t =

1 + i=0

1+

1+

4mt+1

=

4mt + "t+1 )

t+1

=

t

+

1+

"t+1

What you "feed in" as a description of the policy is also the description

of the evolution of in‡ation. Match evidence?!

3

1+

m

2.2

A Simple Numerical Example

A simple numerical example: a monetary model with two period stickiness

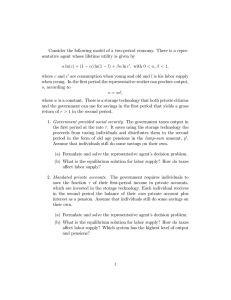

Consider the following system of equations (this model comes from the overlapping contract model à la Taylor 1979 1980):

Optimal Price Equation

:

xt =

1

xt

2

1

1

+ Et

2

1 xt+1

::: +

The price Level

:

Agg. Demand

Policy Rule

:

:

E t 1 y t + Et

2

2

1

1

pt = xt + xt 1

2

2

y t = mt pt

4mt = g4pt + "t

+ :::

1 yt+1

A simple numerical example: the solution

Note that the policy implies:

mt = gpt

gpt

1

+ mt

Substitute into the Agg Demand to get Et

plicit assumption of rational expectations):

Et

1 yt

=

(1

g) Et

1 pt

1

+ "t

1 yt

gpt

and Et

1

+ mt

1 yt+1 (note

the im-

1

Substituting in the Optimal Price Equation:

(mt

1

gpt

1)

=

h

=

(1

h)

2

(1

xt

1

(1 + h) Et

1 xt

+

(1

h)

2

Et

1 xt+1

g)

2

The Key Question of solving dynamic equations: for what law of motion this

equation is always true (whatever is the value of mt 1 , pt 1 and xt 1 )? Solving

a system of dynamic equations "boils down" to answer this question

A simple numerical example: the solution I

"Guess and Verify" Method

Note that we can (wisely) guess that the solution has the form:

xt = dxt

1

+ b (mt

1

gpt

1)

where d and b are coe¢ cients to be determined. Substituting this equation

we obtain:

(1 h) 2

d xt 1 + (d + 1) b (mt 1 gpt 1 ) + :::

2

(1 h)

::: (1 + h) [dxt 1 + b (mt 1 gpt 1 )] +

xt 1 =

(mt 1 gpt 1 )

2

A simple numerical example: the solution II

4

"Guess and Verify" Method

For this equation to be true:

(1

h)

2

d2

(1

(1 + h) d +

h) (d + 1) b

2

(1

h)

2

(1 + h) b

=

0

=

Which gives us the solution:

p

h

1

p

d=

1+ h

; d=

1 d

1+g

This method is clearly unfeasible and/or ine¢ cient in general! However the

methods we see/saw in this course rely on the same ideas: solving backward or

forward some equations (…rst example) to …nd a low of motion for endogenous

variable (second example).

3

Algebraic and Economic Preliminary De…nitions

3.1

Algebraic Tools

Algebraic De…nitions

De…nition 1 Matrix Pencil: let A0 ; A1 ; :::; Al be nxn complex matrices s.t.

Al 6= [0] than the matrix valued function:

P( )=

l

X

i

Ai

i=0

is called a matrix pencil, written as (A0 ; A1 ; :::; Al ) :

When l=1 we have a linear matrix pencil.

De…nition 2 A linear matrix pencil is said to be regular: if 9 s.t. det (A0 ; A1 ) 6=

0

Corollary 3 The eigenvalues of P ( ) are the set of

0

s s.t. det (A0 ; A1 ) = 0

Algebraic De…nitions

De…nition 4 Unitary Matrix: A square complex matrix Q is said to be unitary

if it satis…es:

QQ = In

where Q is its conjugate transpose (take the transpose and than the complex

conjugate of each element).

When l=1 we have a linear matrix pencil.

5

Corollary 5 Q = Q

1

, i.e. (roughly speaking Q is made of independent lines)

Corollary 6 If Q is real, it is said to be orthogonal (made of orthonormal

vectors)

Algebraic De…nitions

De…nition 7 Generalized Schur Decomposition (GSD): let P ( ) = (A; B) be

a regular pencil matrix. Then 9 unitary matrices Q and Z such that:

QAZ

QBZ

= S is upper triangular

= T is upper triangular

tii

: sii 6= 0

(A; B) =

sii

Corollary 8 A GSD always exists (given regularity)

Corollary 9 If tii = sii = 0 than 9 a linear combination of lines (rows) in each

matrix that gives 0 at the same line (row).

Algebraic Operators

De…nition 10 Let X be a general nxm matrix. Than vec(X) is a mnx1 vector

obtained stacking all the columns of X one under each other.

Corollary 11 Let A; B; C matrices such that the product ABC exists, then

vec (ABC) = (C 0 A) vec (B)

De…nition 12 Let X be a general square nxn matrix. Than vech(X) is a

n(n+1)

x1 vector obtained stacking by columns the lower-triangular part of X.

2

Corollary 13 For any symmetric square matrix X there exist a unique matrix

L such that vec (X) = Lvech (X)

1

Furthermore Lh vec (X) = vech (X) where L+ = (L0 L) L0 and L+ L = I

3.2

Economic Tools

Economic De…nition

De…nition 14 Martingale Di¤ erence Process: A process "t is said to be a martingale di¤ erence process if Et ("t ) = 0 8t

De…nition 15 Backward-looking (state) variables: a variable yt is said to be a

backward-looking (state) variable if:

yt+1

Et [yt+1 ] is martingale di¤ erence process;

y0 is given

6

Economic Tools: obtaining a VAR(1) representation

We are interested in studying a system of expectational di¤erence equation

of the form:

A Et [xt+1 ] = Bxt +

t

nxn

nxmmx1

nx1

where xt is a vector of correlated endogenous variables and t is a set of

exogenous variables.

Most, if not all, models can be written into this form. We now brie‡y discuss

how to accomplish this task.

More than one lag

If the model has more than one lag:

Et [xt+1 ] = Bxt + Cxt

1

introduce an auxiliary variable to write:

Et [xt+1 ] = Bxt + C x

~t

x

~t+1 = xt

to obtain an equivalent VAR(1) system.

More than one expectation

If the model has more than one lag:

Et [xt+1 ] = Bxt + CEt

1

[xt ]

introduce an auxiliary variable to write:

Et [xt+1 ] = Bxt + C x

~t

xt+1 = x

~ t + "t

where E ("t ) = 0 to accommodate the hypotesis of rational expectation.

This two cases are enough to handle probably the 99% of macro models

nowadays used...

4

First Order Approximation

Solving a System of Partial Di¤erential Equations up to the …rst order: The

Generalized Schur Decomposition

The Problem

With a small loss of generality we are interested in studying a system like:

A Et [xt+1 ] = Bxt +

nxn

nx1

zt

nxmmx1

It’s not uncommon that the matrix A is not invertible, so that pre-multiplying

by A 1 and apply the Jordan decomposition is unfeasible

The Generalized Schur Decomposition: a quick review

Transformation of Variables

7

Re-order the variables in the system, states must come …rst:

x1t

x2t

xt

label all non-states variables controls.

Consider the following transformation of variables:

st

= ZH

ut

| {z }

x1t

x2t

yt

where Z H is the conjugate transpose of the Z matrix in the GSD.

The Generalized Schur Decomposition: a quick review

Transformation of Variables

Note that:

AEt [xt+1 ]

=

)

)

)

Bxt + t ) Q 1 SZ 1 Et [xt+1 ] = Q 1 T Z

Q 1 SZ H Et [xt+1 ] = Q 1 T Z H xt + zt

Q 1 SEt [yt+1 ] = Q 1 T yt + zt

SEt [yt+1 ] = T yt + Q zt

1

xt + zt

Partitioned as:

S11

0

S21

S22

st+1

ut+1

Et

=

T11

0

T21

T22

st

ut

+

Q1

Q2

zt

This system is clearly equivalent to the original one.

The Generalized Schur Decomposition: a quick review

Solving for controls

All controls are solved forward:

S22 Et [ut+1 ] = T22 ut + Q2 zt

The solution is:

ut =

T22

1

X

T221 S22

k

Q2 Et [zt+k ]

k=0

that can be easily solved depending on the structure of the endogenous

processes.

The Generalized Schur Decomposition: a quick review

Solving for states

Solved for controls, we can treat present controls and their expectations as

given and solve backward for states:

S22 Et [ut+1 ] = T22 ut + Q2 zt

8

The solution is:

ut =

T22

1

X

T221 S22

k

Q2 Et

t+k

k=0

that can be easily solved depending on the structure of the endogenous

processes.

5

Higher Order Approximations

5.1

A General Approach

Higher order approximations: why we need them?

First order approximation techniques are useful when studying impulse response functions (dynamic response to exogenous shocks)

However they have been proved to be ill suited to develop welfare analysis: second order terms (related to the variances of endogenous variables) are

generally important for the equilibrium welfare functions (Kim et Kim (JIE

2005), see Woodford (2002) for a discussion of the su¢ ciency of the …rst order

approximation for welfare analysis)

A general approach to approximation methods.

For simplicity let me change the notation: x are states in period t, x0 states

in period t+1, y are controls, y 0 controls at period t+1.

Clearly we can write the system characterizing the model as:

Et [f (y 0 ; y; x0 ; x)] = 0

(1)

nx1

higher order approximations are based on this simple representation

A general approach to approximation methods

De…ne implicitly:

y

x0

= g (x; )

= h (x; ) + ' "t

(2)

(3)

where is a variance (scalar) parameter.

Than an n-th order Taylor approximation of these functions around the nonstochastic steady-state are:

2

3

i

1

n

i

X

1 4 @ gx x ; 0

@

g

(x;

0)

i

i5

(x x) +

y = g (x; ) = g (x; 0) +

ix

ix

i!

@

@

i=1

x0

= h (x; ) + ' "t = h (x; 0) +

n

X

1 @ i hx (x; 0)

(x

i!

@ix

i=1

9

i

x) +

@ i h (x; 0)

@ix

i

Objective: …nd higher order approximations of g and h around x, y and

= 0;

Observations:

By de…nition

y = g (x; 0)

x = h (x; 0)

and:

Et [f (y 0 ; y; x0 ; x)] =

0 for ANY value of y 0 ; y; x0 ; x and

nx1

SO

@f

i

@ x@ j y@ s

=

0 for 8i; j; s; t; x; y

A direct Taylor approximation: state variables

Substitute eqs.(2)-(3) in (1):

Et f (g (h (x; ) + ' "t ; ) ; g (x; ) ; h (x; ) + ' "t ; x) = 0

(4)

nx1

and take the total derivative w.r.t. x :

@f

@x

=

0)

@f

@g

@h

@f

@g

+

+ :::

@y 0 j(x;0) @x0 j(x;0) @x j(x;0) @y j(x;0) @x j(x;0)

ny xnx

nxny

+

nx xnx

nxny

ny xnx

@f

@h

@f

+

= 0

0

@x j(x;0) @x j(x;0) @x j(x;0) nxnx

nxnx

nx xnx

nxnx

System of nxnx equations in nxnx variables.

A direct Taylor approximation: stochastic parameter

Take the total derivative w.r.t.

@f

@

=

:

0)

@f

@g

@h

@f

@g

+

+ :::

@y 0 j(x;0) @x0 j(x;0) @ j(x;0) @y 0 j(x;0) @ j(x;0)

+

@f

@g

@f

@h

+ 0

=0

@y j(x;0) @ j(x;0) @x j(x;0) @ j(x;0)

@g

@h

@ j(x;0) and @ j(x;0)

and @@g j(x;0) = [0]

this is a linear homogenous equation in

solution exist it must be

@h

@ j(x;0)

= [0]

10

so if a unique

the same method shows that

@h

@ @x1t j(x;0)

= [0] and

@g

@ @x1t j(x;0)

= [0]

A direct Second Order Taylor approximation: state variables

[0]

= fy0 y0 gx hx + fy0 y gx + fy0 x0 hx + fy0 x gx hx + fy0 gxx hx hx + fy0 gx hxx + ::: =

(fyy0 gx hx + fyy gx + fyx0 hx + fyx ) gx + fy gxx + (fx0 y0 gx hx + fx0 y gx + fx0 x0 hx + fx0 x ) hx + fx0 hxx

fxy0 gx hx + fxy gx + fxx0 hx + fxx

General Results

Theorem 16 Consider the model whose equations can be written as (1), then:

@h

@ j(x;0)

= [0]

@g

@ j(x;0)

= [0]

@h

@ @x j(x;0)

= [0]

@g

@ @x j(x;0)

= [0]

Corollary 17 The low of motion of the linearized system is independent

of the volatility of the shocks

A second order approximation to the policy function of a stochastic model

di¤ er from the non-stochastic version only by a constant parameter of the

control vector.

5.2

Using …rst order methods to solve up to the second

order

Finding second order solutions using …rst order methods

A second-order approximation of model can be written as:

A1 Et [xt+1 ]

nxn

nx1

= A2 xt + A3 zt +

nxnnx1

nxmmx1

A4

nx

t

n(n+1) n(n+1)

x1

2

2

+

A5

nx

where:

t

= vech (~

xt x

~0t )

where:

x

~t

3

zt

4 x1t 5

x2t

2

Finding second order solutions using …rst order methods

11

Et [

t+1 ]

n(n+1) n(n+1)

x1

2

2

Suppose we have applied the Schur decomposition to solve the …rst order

approximation obtaining the state-space form:

1

f xt+1

2

f xt

= F1 zt + F2f x1t

= P1f x1t + P2f xt

and we can compactly write the solution as:

2

3

zt

zt

4 f x1t 5 =

1

f xt

2

f xt

zt 1

1

f xt 1

zt

=

1

f xt

| {z }

+ "t

st

where f x1t is the …rst order approximation of the states, and are appropriate matrices constructed using F1 ; F2 ; P1 ; P2 and I

Finding second order solutions using …rst order methods

Since we are already dealing with an approximation, we can substitute x1t

with its …rst order approximation.

Note that:

!

0

z

z

t

t

0

xt x

~0t ) = Lvec

t = vech (~

x1t

x1t

!

0

zt

zt

= L(

) vec

x1t

x1t

!

0

z

z

t

t

= L(

) Lh vech

1

1

f xt

f xt

= RVt

Finding second order solutions using …rst order methods

Second:

Vt

0

1 + "t ]

st 1 s0t 1 0 + st 1 0 "0t + "t s0t 1 0 + "t 0 "0t

st 1 s0t 1 0 + Lvec ( st 1 "0t 0 ) + Lvec "t s0t 1 0

) Lh vech st 1 s0t 1 + L (

) Lh vech ("t "0t ) +

) Lh vech (st 1 "0t ) + L (

) Lh vech "t s0t 1

= vech (st s0t ) = vech [ st

= vech

= Lvec

= L(

1

+ "t ] [ st

+ Lvec ( "t "0t 0 )

+L (

= ~ Vt 1 + ~ ~"t + ~ ~t

where ~ = L (

vech (X)

) Lh + L (

) Lh P and P is such that P vech (X 0 ) =

12

Therefore the second order elements of the system are themselves an independent system.

Finding second order solutions using …rst order methods

Hence we have now an augmented system:

A1 Et [xt+1 ] = A2 xt + A3 zt + G t + H

Vt = ~ Vt 1 + ~ ~"t + ~ ~t

zt = N z t 1 + " t

where G = A4 R + A5 R ~ H = A5 R ~ and = Et ~"t :

We can than solve backward for Vt and than treating it and H

variables in the main representation.

5.3

as exogenous

A Simple RBC application

Finding second order solutions: A Simple RBC application

We now consider a simple application. The Ramsey model is:

max E0

1

X

C1

t

t=0

s:t:Kt+1

It + Ct

log At+1

1

= (1

) Kt + It

= At Kt

=

log At + "t+1

we assume "t N (0; 1) and, for simplicity, = 1 and = 0:

Finding second order solutions: A Simple RBC application

FOC’s imply:

Ct

Kt+1

log At+1

=

Et Ct+1 At+1 Kt+11

= At Kt

Ct

= "t+1

which implies:

log Ct = log ( )

Et [log Ct+1 ] + Et [log At+1 ] + (

log (Kt+1 + Ct ) = log [At Kt ]

log At+1 = "t+1

1) Et [log Kt+1 ]

So:

Et f x2t+1 ; x2t ; x1t+1 ; x1t

Et

log Ct + log (

nx1

=

0

13

)

Et [log Ct+1 ] + Et [log At+1 ] + (

log (Kt+1 + Ct ) log [At Kt ]

1) Et [log Kt+1 ]

x1t = Kt ; x2t = Ct and zt = at

Finding second order solutions: taking the …rst order approximation

Recall that in this case we have one state and one control.

For the SGU Method:

fy0 gh + fy g + fx0 h + fx

0

gh +

(

g+

Css

Kss +Css

1)

Kss

Kss +Css

h+

0

=

[0]

=

[0]

Note that we are looking for the roots of this system of equations (see example at the beginning of the class).

For the GSD:

Et c^t+1 + (

1) k^t+1

Kss

k^t+1

Kss + Css

=

=

c^t

Css

c^t + k^t + a

^t

Kss + Css

In Matrix notation:

(

1)

Kss

Kss +Css

0

k^t+1

Et c^t+1

k^t

c^t

0

+

Css

Kss +Css

+

0

1

a

^t = [0]

Finding second order solutions: the second order approximation for SGU

Method

For the second order we have:

[0]

= fy0 y0 gx hx + fy0 y gx + fy0 x0 hx + fy0 x gx hx + fy0 gxx hx hx + fy0 gx hxx + ::: =

(fyy0 gx hx + fyy gx + fyx0 hx + fyx ) gx + fy gxx + (fx0 y0 gx hx + fx0 y gx + fx0 x0 hx + fx0 x ) hx + fx0 hxx

fxy0 gx hx + fxy gx + fxx0 hx + fxx

which is a system of two equations in two unknowns.

Finding second order solutions: the second order approximation for the Lombardo Sutherland Method

For the second order we have:

2

1

^t+1 + Et c^t+1 + (

1) k^t+1

1) k^t+1 + Et a

2

2

Css

1

Css

1 2

c^t + k^t + a

^t

c^2t +

k^2 + a

^ + k^t a

^t

Kss + Css

2 Kss + Css

2 t

2 t

Et c^t+1 + (

In matrix notation:

A1

k^t+1

Et c^t+1

= A2

k^t

c^t

+ A3 a

^t + A4

14

t

+ A5 Et [

t+1 ]

2

=

=

c^t +

2

c^2t

Kss

1

Kss

k^t+1 +

k^2

Kss + Css

2 Kss + Css t+1

where:

A1

(1

=

A5

=

"

)

Kss

Kss +Css

1

2

0

(

0

1)

0

; A2 =

0

1)2

2

Kss

1

2 Kss +Css

Css

Kss +Css

(

(

0

1)

0

; A3 =

2

2

0

0

1

; A4 =

#

"

0

1

2

trough which we can construct the auxiliary system.

6

Normative Analysis

Normative Analysis

We distinguish between two cases:

policies NOT a¤ecting the steady state, stochastic environment

policies a¤ecting the steady state, non stochastic environment

The two cases can be combined in a conceptually easy (tough not always

easy to implement) way.

6.1

6.1.1

Policies not a¤ecting the steady state

An RBC application

Policies not a¤ecting the steady state

The standard Ramsey model augmented with consumption taxes is:

"1

#

X c1

t t

max E0

ct ;kt+1 ;it

1

t=0

s:t:kt+1

(1 + t ) ct + ii

yt

at+1

= (1

) kt + it

= at kt

= at kt

=

at + "t

Consider an exogenous set of policies:

^t =

k Et

[^

yt+1 ]

where the hat denote deviations from equilibrium level.

Taxes on consumption are set as a (linear) function function of expected

level of production.

Policies not a¤ecting the steady state

15

0

0

2

2

0 0

0 0

2

2

Css

1

2 Kss +Css

#

FOC’s imply the following system of 3 equations in 3 variables:

ct

kt+1

^t

)

Et ct+1 at+1 kt+11 + (1

(1

) kt + at kt

(1 + t ) ct

yt+1 ]

k Et [^

=

=

=

Plus:

ct

ii

= (1 +

= at kt

t)

t

(1 +

t ) ct

Policies not a¤ecting the steady state

This is the basic RBC model with an additional variable and an additional

equation.

Type of questions we can address:

What is the optimal taxation policy in this class?

What is the optimal taxation within linear policies? i.e. would it be better

to respond to past or current level of production?

What are the implication of the policy that maximizes private welfare?

Tomorrow we will discuss how to code and solve this problem.

6.2

6.2.1

Policies a¤ecting the steady state

An RBC application

Policies a¤ecting the steady state: the problem

Consider the following problem:

"

1

X

c1t

t

max

ct ;kt+1 ;it ; t

1

t=0

s:t:kt+1

ct + it

xt

log at+1

= (1

= at kt x1t

=

t kt

=

log at

#

t ) kt

+ it

That is the government can impose wealth taxes to provide services that

enter in the production function.

In this problem the level of taxes a¤ects the steady state.

Policies a¤ecting the steady state: analytical solution

16

Write the lagragian:

8

2

1

(1

< c1

X

t

t

L=

+ t4

:1

1x2

t=0

1

+ at kt1 ( t )

1

( t)

ct

log at+1 = log at

t ) kt

at kt1

ct

kt+1

it

FOC’s imply:

ct

=

1

t

=

kt

=

1

t

n

1

t+1

h

(1

) at+1 (kt+1 )

(

1

t+1 )

+1

(1

) at kt1 ( t )

+ the constraints

t+1

39

=

5

;

io

Policies a¤ecting the steady state: analytical solution

In steady state the FOC’s imply:

c

1

=

k

=

1

=

1

(1

(1

)

(1

c =

1

)k

(

1

)

( )

)k + k

1

1

( )

which implies:

1 = (1

)

1

(1

(1

)

)

which implies:

=

(1

) [1

[ ]

(1

)]

Policies a¤ecting the steady state: numerical solution

This problem is simple, so we can use it to test a numerical approach.

Consider the problem written in matrix notation:

L=

1

X

t

Ot +

t=0

t Lt

1xnc nc x1

we have two sets of …rst order conditions, those w.r.t. endogenous variables

and those w.r.t. the lagrange multipliers.

The latter are the constraints, that we can use to solve for the steady state,

given a value of the policy variable.

Policies a¤ecting the steady state

First order conditions w.r.t endogenous variables imply:

@Ot

+

@xt

t

@Lt

= [0]

@xt

17

Note that this is a system of n variables in nc unknowns (the lagrange multipliers) and therefore can not be solved exactly.

t

Furthermore @L

@xt is not a square matrix and therefore can not be inverted.

However we can, given a value of the policy parameter that determine the

value of endogenous variables, solve this system by OLS (i.e. the values of the

lagrange multipliers that minimize the sum of squared residuals).

Than we can check if this is a solution.

Tomorrow we will see how to implement this.

6.3

Exercises policy not a¤ecting the steady state: an

RBC model with Money and Optimal Policy

1

X

max

ct ;kt+1 ;it ;mt ;bt

c1t

t

+ (1

1

t=0

s:t:kt+1

Bt

Mt

ct + it +

+

Pt

Pt

log at+1

=

(1

) kt + it

= at kt + (1 + Rt )

=

1

1

) m1t

Bt 1

Mt 1

+

Pt

Pt

log at

which implies:

ct + kt+1 + bt + mt = at kt + (1

) kt + (1 + Rt )

bt

1

+

mt

t

Lagrangian and First Order Conditions are:

8

1

1

<

[ c1t +(1 )m1t ] 1

X

+

t

1

h

max

mt 1

bt 1

: +

ct ;kt+1 ;mt ;bt

) kt + (1 + Rt ) t + t

t=0

t at kt + (1

c1t

t

1

1

) m1t

+ (1

=

(1

at+1 kt+11 + (1

t+1

t

1

) ct

1

t

=

ct

kt+1

bt

mt

i

9

=

;

t

)

1 + Rt+1

=

t+1

t+1

c1t

+ (1

1

1

) m1t

1

(1

) (1

) mt

=

t+1

t

t+1

Couple of notes:

This is a system of 7 variables ct ; mt ; kt ; bt ; t ; at ; Rt in 4 equations, the

government budget constraint, the exogenous low of motion and the policy rule:

c1t

+ (1

) m1t

1

1

1

ct

=

c1t+1 + (1

18

) m1t+1

1

1

1

ct+1

at+1 kt+11 + (1

)

c1t

+ (1

c1t

+ (1

1

1

) m1t

1

1

1

) m1t

1

ct

c1t+1 + (1

=

(1

) (1

1

1

) m1t+1

) mt

c1t

=

1

ct+1

1 + Rt+1

t

) m1t

+ (1

c1t+1 + (1

1

1

) m1t+1

t+1

ct + kt+1 + bt + mt = at kt + (1

) kt + (1 + Rt )

bt

1

+

t

log at+1 = log at

B t B t 1 + Mt Mt

Pt bt + Pt mt Pt 1 mt

mt

t b t + t mt

= Rt 1 B t

= (1 + Rt

= (1 + Rt

1

1

1

1

1 ) Pt 1 bt 1

1 ) bt 1

Steady state: a = 1 than

1

k=

(1

(1

R=

1

=

ct

) mt

"

m =

|

b

=

b

=

1

1

)

1

ct+1

(1

{z

)

#

AA

t+1

1

c

}

m

1+R

1

1

|

1+R

{z

BB

19

(1

)

c

}

mt

1

t

1

1

1

(1

1

(1

) ct +

) ct+1

c + BBc + AAc = kt

1 + AA 1

1

1+R

+ 1

k + (1 + R)

BB c = kt

c+

AA

c

k

k

c =

BB

1+A 1

1

k

+ 1

1+R

B

Than we are ready to solve the model.

6.4

Exercise with Money policy a¤ecting the steady state:

optimal level of in‡ation in an RBC model with Money

Consider the same model with money, but with instantaneous utility function:

log ct + mt exp (

mt )

Lagrangian and First Order Conditions are:

(

1

X

log ct + mt exp ( mt ) +

h

t

max

+ t at kt + (1

) kt + (1 + Rt ) bt t1 + mt t 1 ct

ct ;kt+1 ;mt ;bt

t=0

1

=

ct

t

=

at+1 kt+11 + (1

t+1

t

t

)

1 + Rt+1

=

t+1

t+1

(1

mt ) exp (

mt ) =

1

+

ct

The last four equation constitute our model.

In steady state:

1

(1

)

k=

c (1

m) exp (

20

t+1

1

1

R=

1

m) = 1

1

ct+1

kt+1

bt

mt

i

)

b

=

b

=

b

=

b

=

1

1+R

1

m

m

1

m

1

|

{z

BB

}

(

1)

m

(1

)

| {z }

BB

k

k + (1 + R)

b

+

m

= c+b+m

k

k

= c+ 1

k

k

= c+ 1

k

k

= c+ 1

k

k

= c+

k

k

= c

k

k

= c

(

(1 + R)

1

1

b+ 1

(

(1

(

(1

1

b+ 1

1

m

m

1)

m+ 1

)

1)

1

m+ 1

)

1)

1

m+ 1

m

1

1

m

m

Since steady state consumption is independent of money, we need to set an

in‡ation rate to maximize utility derived by money holdings. Than maximization of mt exp ( mt ) w.r.t mt implies m = 1 ;which is true if = :

We are ready to solve the model and check the numerical solution.

21