Electric Motors, Generators and Transformers in Mexico: ISIC 311

advertisement

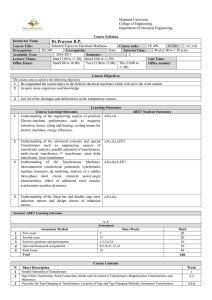

ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 Euromonitor International May 2013 ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 LIST OF CONTENTS AND TABLES Headlines ..................................................................................................................................... 1 Market Trends .............................................................................................................................. 1 Production Trends ........................................................................................................................ 2 Competitive Environment ............................................................................................................. 2 Prospects ..................................................................................................................................... 3 Industry Overview ......................................................................................................................... 3 Table 1 Table 2 Chart 1 Chart 2 Key Industry Indicators 2007–2012 .............................................................. 3 Key Industry Indicators: Annual Growth 2008–2012 .................................... 3 Production vs Nominal GDP 1997–2018 ...................................................... 4 Producer Volume Index vs Producer Price Index 1997–2012 ...................... 4 Industry Sectors ........................................................................................................................... 5 Table 3 Table 4 Table 5 Chart 3 Production by Sector: Value 2007–2012 ...................................................... 5 Production by Sector: Annual Growth 2008–2012 ....................................... 5 Production by Sector: Share of Total 2007–2012 ......................................... 5 Industry Sectors’ Growth Indices 1997–2018 ............................................... 5 Firmographics............................................................................................................................... 6 Table 6 Table 7 Table 8 Table 9 Table 10 Table 11 Table 12 Number of Companies by Employment Size 2007–2012 ............................. 6 Number of Companies by Employment Size: Annual Growth 2008– 2012 ............................................................................................................. 6 Number of Companies by Employment Size: Share of Total 2007– 2012 ............................................................................................................. 6 Production by Employment Size 2007–2012................................................ 7 Production by Employment Size: Annual Growth 2008–2012 ...................... 7 Production by Employment Size: Share of Total 2007–2012 ....................... 7 Industry Leaders: Company Production Shares in 2010 .............................. 7 Import and Export ......................................................................................................................... 8 Table 13 Table 14 Table 15 Chart 4 Import and Export 2007–2012 ...................................................................... 8 Export Destinations 2007–2012 ................................................................... 8 Importing Countries 2007–2012 ................................................................... 8 Import vs Export Growth 1997-2012............................................................. 9 Market and Buyers ....................................................................................................................... 9 Table 16 Table 17 Key Market Indicators 2007–2012 ................................................................ 9 Key Market Indicators: Annual Growth 2008–2012 ...................................... 9 Suppliers .................................................................................................................................... 10 Table 18 Table 19 Table 20 Supply Structure 2007–2012 ...................................................................... 10 Supply Structure: Annual Growth 2008–2012 ............................................ 10 Supply Structure:Share of Total 2007–2012 .............................................. 10 Labour Costs .............................................................................................................................. 11 Table 21 Chart 5 Chart 6 Key Statistics 2007–2012 ........................................................................... 11 Number of Employees vs Average Salary 1997–2012 ............................... 11 Output per Employee vs Average Salary 1997–2012................................. 11 Industry Attractiveness Index ..................................................................................................... 12 Table 22 Chart 7 Attractiveness Index Composition .............................................................. 12 Attractiveness Index of Electric Motors, Generators and Transformers Among Other Mexico Industries ................................................................. 12 © Euromonitor International Passport I ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 Chart 8 Binary Diagram of Attractiveness Index ..................................................... 12 Attractiveness Index: Explanation .............................................................................................. 13 Future Outlook............................................................................................................................ 15 Table 23 Forecasts 2013–2018................................................................................. 15 Definitions................................................................................................................................... 15 Electric Motors, Generators and Transformers ....................................................................... 15 © Euromonitor International Passport II ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 HEADLINES Mexican market for electric motors, generators and transformers outperforms overall Mexican economy and nearly doubles in value over review period of 2006-2012 Business demand represents 78% of market value in 2012 Imports constitute 26% of Mexican market in 2012, down from 35% in 2006, representing greater competitiveness of local producers Turnover of local producers increases 91% from beginning of review period to Mx$122.5 billion in 2012 Total number of companies increases 35% over 2006-2012, dominated by micro-size establishments Industry turnover projected to surge at 9% annual rate over forecast period to reach Mx$207 billion in 2018 MARKET TRENDS Over 2006-2012 Mexican demand for electric motors, generators and transformers increased by an average annual rate of 12% to reach a value in excess of Mx$126 billion by the end of the review period. Intermediate business spending in the market amounted to 78% of its value in 2012. At the same time, purchases of market products as investment goods contributed an additional 21% of total market sales. In value terms purchases for investment purposes soared by 130% over the review period, albeit seeing a 2% decline in 2009. Electric motors are widely used for key compression, ventilation, pumping and conveyance activities. According to World Bank, driven by surging energy-intensive manufacturing activities and increasing population, Mexican electricity production increased from 249 billion kWh in 2006 to 271 billion kWh in 2011, resulting in additional demand for power generation apparatus. Demand for power generation equipment was generally shaped by natural gas-, coal- and oilfired power plants, which dominate the Mexican electricity production industry, accounting for 50%, 12% and 18% of energy produced in 2011, respectively. Mexico operated two nuclear reactors at the Laguna Verde site in Veracruz, responsible for 4% of electricity production. In February 2007 the Federal Electricity Commission signed contracts with Spain’s Iberdrola Engineering and Alstom to install new turbines and generators in the Laguna Verde plant at a cost of US$605 million. After the main modifications, both reactors’ operating life was extended to 40 years, and operating power upgraded by 20% from approximately 1,300 MWe at the beginning of review period to 1,600 MWe in 2011. Since 2006 the value of imported production sold on the market increased by 113%; however imports’ share decreased by nine percentage points to 26% of total market value in 2012. The top three import partners were the US, China and Germany, with their value shares of total imports standing at 52%, 18% and 9%, respectively in 2012. Imports from China were gaining © Euromonitor International Passport 1 ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 momentum, increasing their share by seven percentage points over 2006-2012; this was indicative of increasing competition from Asian production in the Mexican market. PRODUCTION TRENDS The turnover of local producers grew at a slightly slower pace than the overall market, seeing a 91% increase over 2006-2012. The largest category of the industry under review was the manufacture of electric motors and generators, comprising 57% of total turnover in 2012. Miscellaneous industrial electrical apparatus generated a further 29% of total income, while power distribution transformers accounted for the remaining 14% of turnover. As electric motors use around 45% of global electricity, local producers are under more strict efficiency standards, imposed by the government. New Mexican Minimum Energy Performance Standards (MEPS) came into action in 2010, replacing those adopted in 2002. According to regulations that adjust energy performance standards to manufactured goods, the minimum efficiency level was set to IE2. All motors must be provided with a specific rating plate according to the standard. Furthermore, production must be tested and approved by accredited laboratories annually. Implementation of the new standard restricted sales of manufactured goods, that are less energy efficient than the minimum criteria, and forced the electric motors, generators and transformers industry to innovate. Over the period under review domestic producers were unable to strengthen their positions in foreign markets, as the Mexican electric motors, generators and transformers industry’s export share declined by seven percentage points from 2006 to 38% of total output in 2012. Trade flows were directed mainly towards the US and Canada, which captured 82% and 8% of the value of Mexican exports respectively in 2012. The industry’s cost structure changed slightly over the review period. Supplier expenses, accounting for the major 93% share of total industry costs in 2012, doubled in value and increased in importance by five percentage points from 2006. This was mainly due to significant increases in the prices of principal materials, such as precious and non-ferrous metals, basic iron and steel. Compared with business-related expenditures, labour costs changed to a lesser extent, growing by only 13% over the period under review. As remuneration costs were increasing faster than the number of people employed, the average annual wage rate went up from Mx$140,380 in 2006 to Mx$157,406 in 2012. A sharp upward shift of 90% in total industry costs was matched by a 56% increase in producer prices and growth in volume demand. Consequently, over the review period the Mexican electric motors, generators and transformers industry experienced stable profit margins of around 6% of turnover. COMPETITIVE ENVIRONMENT Over the review period the number of companies active in the electric motors, generators and transformers industry increased by 35% to almost 1,300 enterprises in 2012. The reviewed industry is highly concentrated, as micro-sized companies employing fewer than 10 people accounted for 82% of the total number of establishments, but the major share (85%) of turnover was generated by the largest companies, employing more than 250 people. One of the largest players in the field is Xignux SA de CV, a Mexico-based company which operates in such categories as cables, transformers, infrastructure and foods. The company has 25 production facilities and 20,000 employees. Exports account for 58% of the company’s revenue. © Euromonitor International Passport 2 ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 Passport Mitsubishi Electric de Mexico SA de CV, owned by Mitsubishi Electric Corp, is a Mexicobased company which manufactures various machinery and equipment including: control systems, transformers, motors, elevators, electronic controllers, and industry automation solutions such as robots, software, chips, etc. The company has one manufacturing facility and 500 employees in Mexico. Some notable manufacturers include Industrias Iem SA de CV, IGSA SA de CV, and Cummins Generator Technologies Mexico S de RL de CV, among others. PROSPECTS Over the forecast period of 2013-2018 the turnover of local producers is expected to rise by 69%. The positive outlook for energy generation and other manufacturing industries will maintain a stable development in demand for electric motors, generators and transformers. However, the increasing importance of Chinese production in the international arena might result in corrections to the forecast long-term growth rates. To meet the country’s energy policy requirements, which aim to increase carbon-free power generation to 35% of capacity by 2024 and lessen reliance on natural gas resources, the Mexican Government actively supports further development of nuclear plants. In 2010 Mexico Federal Electricity Commission (CFE) proposed four scenarios for new power generation capacity, including major investments in nuclear and wind power. However, recent discoveries of trillions of cubic feet of gas, as well as the disaster in Fukushima Dai-Ichi plant, delayed plans to build as many as 10 new nuclear reactors by 2028. Until renewable energy becomes less costly, Mexico’s Energy Ministry prepares to shift the country’s long-term strategic plans to a greater dependence on natural gas-fired thermoelectric power plants, and seeks private investment of around US$10 billion to expand its pipeline network. INDUSTRY OVERVIEW Table 1 Key Industry Indicators 2007–2012 Production (Turnover)(MX$ million) Value Added (MX$ million) Profit (MX$ million) Profit Margin (%) Producer Volume Index(1997=100) Producer Price Index(1997=100) Number of Enterprises Number of Employees Output per Employee(MX$ '000) Average Salary (MX$ '000) Source: Table 2 2007 2008 2009 2010 2011 2012 73,653 72,943 72,101 90,564 100,006 122,485 11,952 3,890 5.3 135 11,872 3,997 5.5 121 11,499 3,877 5.4 111 12,999 4,923 5.4 133 13,583 5,546 5.5 143 15,379 6,861 5.6 165 233 258 278 291 299 318 1,037 52,887 1,393 1,037 53,235 1,370 1,064 53,437 1,349 1,178 55,054 1,645 1,241 52,898 1,891 1,293 52,657 2,326 150 145 140 144 148 157 Euromonitor International from official statistics, trade associations, trade press, company research. Key Industry Indicators: Annual Growth 2008–2012 © Euromonitor International 3 ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 Production (Turnover) (%) Value Added (%) Profit (%) Profit Margin(Percentage points) Producer Volume Index(1997=100, %) Producer Price Index(1997=100, %) Number of Enterprises (%) Number of Employees (%) Output per Employee (%) Average Salary (%) Source: Chart 1 Source: Chart 2 Source: Passport 2008 2009 2010 2011 2012 -1.0 -0.7 2.8 0.2 -1.2 -3.1 -3.0 -0.1 25.6 13.0 27.0 0.1 10.4 4.5 12.7 0.1 22.5 13.2 23.7 0.1 -10.6 -8.2 19.7 7.7 15.1 10.8 7.6 4.9 2.5 6.4 0.0 0.7 -1.6 -3.5 2.6 0.4 -1.5 -3.3 10.7 3.0 21.9 2.7 5.3 -3.9 14.9 3.4 4.2 -0.5 23.0 6.0 Euromonitor International from official statistics, trade associations, trade press, company research. Production vs Nominal GDP 1997–2018 Euromonitor International from official statistics, trade associations, trade press, company research. Producer Volume Index vs Producer Price Index 1997–2012 Euromonitor International from official statistics, trade associations, trade press, company research. © Euromonitor International 4 ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 Passport INDUSTRY SECTORS Table 3 Production by Sector: Value 2007–2012 MX$ million Electric Motors andGenerators Power and DistributionTransformers Miscellaneous IndustrialElectrical Apparatus Total Source: Table 4 2007 2008 2009 2010 2011 2012 42,457 38,973 36,373 48,321 54,089 69,505 10,778 11,754 12,319 13,185 14,182 17,271 20,418 22,216 23,409 29,058 31,735 35,709 73,653 72,943 72,101 90,564 100,006 122,485 Euromonitor International from official statistics, trade associations, trade press, company research. Production by Sector: Annual Growth 2008–2012 % Electric Motors andGenerators Power and DistributionTransformers Miscellaneous IndustrialElectrical Apparatus Total Source: Table 5 2008 2009 2010 2011 2012 -8.2 -6.7 32.8 11.9 28.5 9.1 4.8 7.0 7.6 21.8 8.8 5.4 24.1 9.2 12.5 -1.0 -1.2 25.6 10.4 22.5 Euromonitor International from official statistics, trade associations, trade press, company research. Production by Sector: Share of Total 2007–2012 % 2007 2008 2009 2010 2011 2012 Electric Motors andGenerators Power and DistributionTransformers Miscellaneous IndustrialElectrical Apparatus Total 57.6 53.4 50.4 53.4 54.1 56.7 14.6 16.1 17.1 14.6 14.2 14.1 27.7 30.5 32.5 32.1 31.7 29.2 100 100 100 100 100 100 Source: Chart 3 Euromonitor International from official statistics, trade associations, trade press, company research. Industry Sectors’ Growth Indices 1997–2018 © Euromonitor International 5 ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 Source: Passport Euromonitor International from official statistics, trade associations, trade press, company research. FIRMOGRAPHICS Table 6 Number of Companies by Employment Size 2007–2012 Number of companies 2007 2008 2009 2010 2011 2012 micro (1-9 employees) extra small(10-19 employees) small (20-49 employees) medium (50-249 employees) large (250+ employees) Total 842 68.0 847 63.0 874 68.0 970 68.0 1,020 73.0 1,065 74.0 42.0 51.0 34.0 1,037 42.0 51.0 34.0 1,037 42.0 46.0 34.0 1,064 47.0 56.0 37.0 1,178 47.0 60.0 41.0 1,241 48.0 63.0 43.0 1,293 Source: Table 7 Euromonitor International from official statistics, trade associations, trade press, company research. Number of Companies by Employment Size: Annual Growth 2008–2012 % micro (1-9 employees) extra small(10-19 employees) small (20-49 employees) medium (50-249 employees) large (250+ employees) Total Source: Table 8 2008 2009 2010 2011 2012 0.6 -7.4 3.2 7.9 11.0 0.0 5.2 7.4 4.4 1.4 0.0 0.0 0.0 0.0 0.0 -9.8 0.0 2.6 11.9 21.7 8.8 10.7 0.0 7.1 10.8 5.3 2.1 5.0 4.9 4.2 Euromonitor International from official statistics, trade associations, trade press, company research. Number of Companies by Employment Size: Share of Total 2007–2012 % 2007 2008 2009 2010 2011 2012 micro (1-9 employees) extra small(10-19 81.2 6.6 81.7 6.1 82.1 6.4 82.3 5.8 82.2 5.9 82.4 5.7 © Euromonitor International 6 ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 employees) small (20-49 employees) medium (50-249 employees) large (250+ employees) Total Source: 4.1 4.9 3.3 100 4.1 4.9 3.3 100 Passport 3.9 4.3 3.2 100 4.0 4.8 3.1 100 3.8 4.8 3.3 100 3.7 4.9 3.3 100 Euromonitor International from official statistics, trade associations, trade press, company research. Table 9 Production by Employment Size 2007–2012 MX$ million 2007 2008 2009 2010 2011 2012 micro (1-9 employees) extra small(10-19 employees) small (20-49 employees) medium (50-249 employees) large (250+ employees) Total 1,637 746 1,656 707 1,678 707 2,106 849 2,272 911 2,790 1,086 1,385 7,796 62,090 73,653 1,353 7,794 61,432 72,943 1,324 7,466 60,926 72,101 1,661 9,688 76,259 90,564 1,748 10,456 84,619 100,006 2,100 12,810 103,698 122,485 Source: Table 10 Euromonitor International from official statistics, trade associations, trade press, company research. Production by Employment Size: Annual Growth 2008–2012 % micro (1-9 employees) extra small(10-19 employees) small (20-49 employees) medium (50-249 employees) large (250+ employees) Total Source: Table 11 2010 2011 2012 1.2 -5.2 1.3 0.0 25.5 20.2 7.9 7.2 22.8 19.3 -2.3 0.0 -1.1 -1.0 -2.1 -4.2 -0.8 -1.2 25.4 29.8 25.2 25.6 5.2 7.9 11.0 10.4 20.1 22.5 22.5 22.5 Production by Employment Size: Share of Total 2007–2012 micro (1-9 employees) extra small(10-19 employees) small (20-49 employees) medium (50-249 employees) large (250+ employees) Total Table 12 2009 Euromonitor International from official statistics, trade associations, trade press, company research. % Source: 2008 2007 2008 2009 2010 2011 2012 2.2 1.0 2.3 1.0 2.3 1.0 2.3 0.9 2.3 0.9 2.3 0.9 1.9 10.6 84.3 100 1.9 10.7 84.2 100 1.8 10.4 84.5 100 1.8 10.7 84.2 100 1.7 10.5 84.6 100 1.7 10.5 84.7 100 Euromonitor International from official statistics, trade associations, trade press, company research. Industry Leaders: Company Production Shares in 2010 Production share (%, 2010) Xignux SA De CV Cummins Generator Technologies Mexico S de RL de CV © Euromonitor International 12.7 2.5 7 ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 Passport Industrias Iem SA de CV IGSA SA de CV Mitsubishi Electric de México SA de CV Other Source: 1.8 1.4 1.3 80.2 Euromonitor International from official statistics, trade associations, trade press, company research. IMPORT AND EXPORT Table 13 Import and Export 2007–2012 Trade Balance(MX$ million) Trade Balance (%) Imports CIF (MX$ million) Imports CIF (%) Imported Products inTotal Market (%) Exports FOB (MX$ million) Exports FOB (%) Exported Products inTotal Products Output (%) Source: Note: 2007 2008 2009 2010 2011 2012 15,628 13,914 10,931 15,670 15,818 20,342 49.5 58,633 4.5 29.8 -11.0 61,523 4.9 32.0 -21.4 64,158 4.3 34.9 43.4 78,748 22.7 26.0 0.9 92,721 17.7 29.6 28.6 119,286 28.6 25.9 74,261 11.6 43.6 75,437 1.6 44.4 75,088 -0.5 44.5 94,418 25.7 37.6 108,540 15.0 40.2 139,628 28.6 37.6 Euromonitor International from official statistics, trade associations, trade press, company research. Imports CIF (Costs, Insurance and Freight) is imports value with freight, insurance and other costs incurred during transportation of goods from the port of origin. Exports FOB (Free on Board) is exports value including freight cost up to the port of origin but excluding all other costs. Table 14 Export Destinations 2007–2012 % share of exports 2007 2008 2009 2010 2011 2012 USA Canada United Kingdom Brazil Australia Other Total 88.3 3.8 1.4 0.6 0.8 5.2 100 88.0 3.3 1.4 0.6 0.8 5.9 100 85.3 6.6 1.2 0.4 0.7 5.9 100 85.0 7.5 1.1 0.9 0.9 4.8 100 83.4 8.5 1.0 0.8 0.9 5.4 100 81.7 8.1 1.1 0.8 0.8 7.5 100 Source: Euromonitor International from official statistics, trade associations, trade press, company research. Table 15 Importing Countries 2007–2012 % share of imports 2007 2008 2009 2010 2011 2012 USA China Germany Japan Brazil Other Total 54.2 14.0 8.0 4.3 3.1 16.4 100 50.3 13.6 11.8 5.3 3.3 15.7 100 47.0 16.8 12.0 3.7 3.8 16.8 100 51.2 16.0 9.3 4.3 3.9 15.5 100 49.4 16.4 8.9 4.1 3.9 17.3 100 52.0 17.8 8.9 4.3 4.2 12.8 100 © Euromonitor International 8 ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 Source: Chart 4 Source: Passport Euromonitor International from official statistics, trade associations, trade press, company research. Import vs Export Growth 1997-2012 Euromonitor International from official statistics, trade associations, trade press, company research. MARKET AND BUYERS Table 16 Key Market Indicators 2007–2012 Market Size (MX$ million) Imported Products inTotal Market (%) Share of LocallyProduced Products (%) Trade Margins(MX$ million) Trade Margins(% of Market Size) B2B Sales (MX$ million) Households Expenditureon Electric Motors,Generators andTransformers(MX$ million) GFCF (MX$ million) Change in Stock(MX$ million) Source: Table 17 2007 2008 2009 2010 2011 2012 70,821 29.8 71,587 32.0 74,446 34.9 92,946 26.0 103,233 29.6 126,033 25.9 70.2 68.0 65.1 74.0 70.4 74.1 9,197 9,459 9,482 13,172 14,259 18,428 13.0 13.2 12.7 14.2 13.8 14.6 56,806 38.9 56,516 40.0 59,761 34.5 74,458 41.1 82,244 44.6 98,812 55.5 13,589 386 14,702 329 14,460 191 18,260 188 20,422 523 26,997 169 Euromonitor International from official statistics, trade associations, trade press, company research. Key Market Indicators: Annual Growth 2008–2012 Market Size (%) Imported Products © Euromonitor International 2008 2009 2010 2011 2012 1.1 2.2 4.0 2.9 24.8 -8.9 11.1 3.6 22.1 -3.6 9 ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 inTotal Market(Percentage points) Share of LocallyProduced Products(Percentage points) Trade Margins (%) Trade Margins(Percentage points) B2B Sales (%) Households Expenditureon Electric Motors,Generators andTransformers (%) GFCF (%) Change in Stock (%) Source: Passport -2.2 -2.9 8.9 -3.6 3.6 2.9 0.2 0.2 -0.5 38.9 1.4 8.3 -0.4 29.2 0.8 -0.5 2.8 5.7 -13.8 24.6 19.3 10.5 8.5 20.1 24.5 8.2 -14.7 -1.6 -42.0 26.3 -1.7 11.8 178 32.2 -67.7 Euromonitor International from official statistics, trade associations, trade press, company research. SUPPLIERS Table 18 Supply Structure 2007–2012 MX$ million B2B Purchases Labour Costs Taxes Less Subsidies Costs Source: Table 19 2007 2008 2009 2010 2011 2012 61,701 7,927 135 69,763 61,071 7,698 177 68,946 60,603 7,471 150 68,224 77,565 7,902 175 85,641 86,424 7,852 185 94,460 107,106 8,289 229 115,623 Euromonitor International from official statistics, trade associations, trade press, company research. Supply Structure: Annual Growth 2008–2012 % 2008 2009 2010 2011 2012 B2B Purchases Labour Costs Taxes Less Subsidies Costs -1.0 -2.9 31.0 -1.2 -0.8 -2.9 -15.0 -1.0 28.0 5.8 16.0 25.5 11.4 -0.6 5.9 10.3 23.9 5.6 23.9 22.4 Source: Table 20 Euromonitor International from official statistics, trade associations, trade press, company research. Supply Structure:Share of Total 2007–2012 % 2007 2008 2009 2010 2011 2012 B2B Purchases Labour Costs Taxes Less Subsidies Costs 88.4 11.4 0.2 100 88.6 11.2 0.3 100 88.8 11.0 0.2 100 90.6 9.2 0.2 100 91.5 8.3 0.2 100 92.6 7.2 0.2 100 Source: Euromonitor International from official statistics, trade associations, trade press, company research. © Euromonitor International 10 ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 Passport LABOUR COSTS Table 21 Key Statistics 2007–2012 Labour Costs(MX$ million) Number of Employees Output per Employee(MX$ '000) Average Salary (MX$ '000) Source: Chart 5 Source: Chart 6 Source: 2007 2008 2009 2010 2011 2012 7,927 52,887 1,393 7,698 53,235 1,370 7,471 53,437 1,349 7,902 55,054 1,645 7,852 52,898 1,891 8,289 52,657 2,326 150 145 140 144 148 157 Euromonitor International from official statistics, trade associations, trade press, company research. Number of Employees vs Average Salary 1997–2012 Euromonitor International from official statistics, trade associations, trade press, company research. Output per Employee vs Average Salary 1997–2012 Euromonitor International from official statistics, trade associations, trade press, company research. © Euromonitor International 11 ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 Passport INDUSTRY ATTRACTIVENESS INDEX Table 22 Attractiveness Index Composition Weight (%) Attractiveness in Stable Economic Environment - Industry Growth - Demand Stability - Profitability - Bargaining Power over Suppliers - Bargaining Power over Buyers - Entry Barriers - Foreign Competition - Foreign Opportunities Attractiveness in Turbulent Economic Environment - Industry Growth - Industry's Cyclicality - Industry's Dependence on Households - Durability of the Products/services - Resistance to Drop in GDP - Dependence on Other Industries - Influence on Other Industries Overall Attractiveness Index Source: Chart 7 Source: Chart 8 Rating 21 10 5 10 5 5 5 5 5 88 14 4 66 45 17 4 96 22 5 5 5 5 12.5 12.5 5 94 17 14 21 97 16 5 43 Euromonitor International from official statistics, trade associations, trade press, company research. Attractiveness Index of Electric Motors, Generators and Transformers Among Other Mexico Industries Euromonitor International from official statistics, trade associations, trade press, company research. Binary Diagram of Attractiveness Index © Euromonitor International 12 ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 Source: Euromonitor International from official statistics, trade associations, trade press, company research. ATTRACTIVENESS INDEX: EXPLANATION The Industry Attractiveness Index has two parts, evaluating: the industry’s performance in a stable economic environment; the industry’s performance in a turbulent economic environment and the industry’s resistance to economic downturn. The first part of the index represents the industry’s performance in a stable economic environment in the period of 2004–2007. It covers several criteria of the industry’s performance: Industry’s growth: the compound annual growth rate of the industry’s production (turnover). Demand stability: coefficient of variation of year-on-year growth indexes of demand. Coefficient of variation is a ratio between the standard deviation and sample mean. It complements the measure of average growth rates by giving the growth stability characteristic. Industry’s profitability: average Profit share of production (turnover) over five years of stable economic environment. Bargaining power over suppliers: the measure is calculated as the industry’s average percentage share in its three major suppliers’ sales. It shows the industry’s potential power to negotiate the prices and other supply conditions of its major intermediate purchases. © Euromonitor International Passport 13 ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 Bargaining power over buyers: the measure is calculated as the industry’s average percentage share in its three major buyers’ costs. It evaluates the potential power of the industry to negotiate the price of its production and set other sales conditions. Barriers of entry: a share of large companies in the total number of companies within the industry. The share of big companies is a proxy for entry barriers and concentration measure within the industry. Foreign competition: average annual import share in market size, average of five years. It shows how strong local companies are in comparison with foreign competitors. Global opportunities: export share of industry’s production (turnover), the average of five years. It shows the external industry’s possibilities to supply the foreign markets and implicitly demonstrates the competitiveness of the industry’s products/services abroad. The second part of the index reflects the industry’s vulnerability in economic downturn. It is calculated during recessionary years (2008–2011) and based on several criteria: Industry’s growth: the compound annual growth rate of production (turnover). Dependence on capital purchases: ratio of non-investment (B2B) purchases of industry’s products/services to investment purchases of industry’s products/services. Usually, goods and services that are treated as capital by companies are pro-cyclical, their reaction to changes in economic conditions is more sensitive in comparison with B2B purchases. Dependence on household consumption: the average ratio of household consumption expenditure to business purchases of the product is used to evaluate the sensitivity of the specific production category. Usually B2B goods and services experience amplified fluctuations in their demand compared to final consumption spending categories, which exhibit lower levels of volatility and are less sensitive to economic downturn. Durability of the industry’s product: time between the purchase and the complete wearing out of a product/service. The longer the time the more durable the good is. Demand for durable or semi-durable goods usually has greater sensitivity to economic slowdowns as time of service can be prolonged for these goods. Industry’s resistance to changes in a country’s GDP: measured as the elasticity coefficient of how sensitively the industry reacts to changes in a country’s GDP. Industry’s dependency on other industries (forward linkage): the variable, measured as the horizontal sum of all coefficients of Leontief’s matrix inverse. It measures the cumulative output decrease in the sector, if the final demand for the production of all sectors were to decrease by one unit. In a period of economic downturn, it is a measure representing the power of other industries to affect the industry of interest. Industry’s ability to affect other industries in the economy (backward linkage): measured as the vertical sum of the coefficients of Leontief’s matrix inverse. It shows how much influence the industry has on other industries and how strong these links are. It measures the extent to which a unit change in the demand for the product causes production increases in all the industries of the economy. Being one of the key industries in the economy gives additional strength and resistance to economic shocks. Each measure of the industry’s performance is compared across all industries in the country and is then attributed to a corresponding percentile judged on its performance (scale from 1 to 100). The better the value of criteria the higher percentile the industry reaches. The percentiles are then weighted by their relative importance and the final score is calculated as the weighted average. © Euromonitor International Passport 14 ELECTRIC MOTORS, GENERATORS AND TRANSFORMERS IN MEXICO: ISIC 311 Passport FUTURE OUTLOOK Table 23 Forecasts 2013–2018 Turnover by category (MX$ million) Electric Motors andGenerators Power and DistributionTransformers Miscellaneous IndustrialElectrical Apparatus Total Source: 2013 2014 2015 2016 2017 2018 78,483 85,833 93,663 101,744 110,758 119,507 18,745 20,565 22,706 24,879 27,198 29,558 39,501 42,862 46,525 50,225 54,265 58,163 136,729 149,261 162,894 176,848 192,221 207,227 Euromonitor International from official statistics, trade associations, trade press, company research. DEFINITIONS Electric Motors, Generators and Transformers Electric motors, generators and transformers is an aggregation of Electric motors and generators, Power and distribution transformers and Miscellaneous industrial electrical apparatus. Electric Motors and Generators This category includes manufacture of DC motors and generators, universal AC/DC motors, AC motors and generators (alternators), generating sets with compression-ignition internal combustion piston engines, generating sets with spark-ignition engines, other generating sets, electric rotary converters. Power and Distribution Transformers This category includes manufacture of liquid dielectric transformers and other transformers. Miscellaneous Industrial Electrical Apparatus This category includes manufacture of ballasts for discharge lamps or tubes, static converters, other inductors. © Euromonitor International 15