A Stock Broker`s Implied Liability to Its Customer for Violation of a

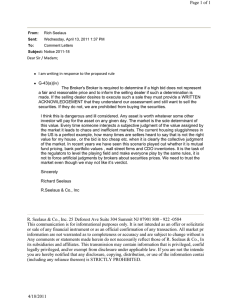

advertisement