payment frequency calculations

advertisement

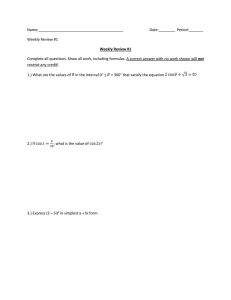

Housing support How to 2 Helpsheet 2 - payment frequency calculations This will hopefully provide useful information when trying to budget as it explains how to change amounts paid to match different payment periods, E.g. weekly, monthly etc. There is a separate information sheet available just on budgeting (Housing Support helpsheet 1) which provides tips when creating and maintaining a budget. There is also a separate financial statement/budgeting sheet (Housing Support helpsheet 3) available that provides a step by step work sheet to calculate your income/outgoings. These are available online, from the person that gave you this sheet, or Housing Support. How can this help me? There are many advice websites that have on line budgeting tools that automatically calculate amounts and payment frequencies. If you are using an on-line budgeting tool this help sheet should not be necessary. If you do not have access to the internet or prefer to do the calculations yourself then this may be helpful. This calculation sheet shows how to change the amounts from one payment frequency to another, i.e., changing weekly payments to a monthly amount. There are many different types of payment frequency but this help sheet includes the most common ones. There are calculation tables to show how to convert payments to weekly, fortnightly (2 weekly), four weekly and monthly. You will notice that with the exception of the daily payment conversions, that all the other calculated figures in each table are the same. There are also notes at the back of the sheet to explain how to input items that cost less than £1, that MONTHLY and FOUR WEEKLY payments are NOT the same, and how to get an annual (once a year) figure. Page 1 What is frequency? Frequency - this term is used to indicate how often a payment is made, for example weekly, fortnightly (2 weekly), monthly, annual – there are other payment frequencies but these are most common. It is important that when working out your budget the same payment frequency is used for each item or your budget will be wrong. For example, if your rent is weekly at £50 and your income is fortnightly at £200: Correct way 1: £50 weekly rent x 2 weeks = £100 fortnightly rent (50 x 2 = 100) £200 fortnightly income - £100 fortnightly rent = £100 left over to spend per fortnight (200 - 100 = 100) Correct way 2: £200 fortnightly income ÷ 2 weeks = £100 weekly income (200 ÷ 2 = 100) £100 weekly income - £50 weekly rent = £50 left over to spend per week (100 – 50 = 50) Wrong way: £200 fortnightly income - £50 weekly rent = £150 left over to spend either weekly or fortnightly??? (200 – 50 = 150) Because the payment frequencies did not match before the calculations it has shown that there is WAY more money left to spend than there actually is. This will mean that the budget figures will be inaccurate and there may not be enough money to cover payments. Housing Support contact If you would like any extra information or would like to ask anything about the help sheet please contact us: T: 01384 814123 E: HousingSupport.Dachs@dudley.gov.uk W: http://www.dudley.gov.uk/resident/housing/housing-options/housing-support/ Converting income received, or payments out, to same payment frequency (how often the payment is made) Converting payments to weekly Symbol ÷ means divide the figure. Weekly payments are often shown as pw or p/w or wkly Payments to Convert Calculations Example Daily to weekly Daily payment x 7 days Daily paper is 75p (see notes A) 0.75 x 7 = £5.25 p/w Fortnightly (2 weekly) to weekly Fortnightly payment ÷ 2 weeks Fortnightly rent or benefit is £100 100 ÷ 2 = £50 p/w Four weekly to weekly Four weekly payment ÷ 4 weeks Four weekly rent or benefit payment is £200 200 ÷ 4 = £50 p/w Calendar monthly to weekly Step 1. Monthly payment x 12 months = total Step 2. Total ÷ 52 weeks Calendar monthly rent or benefit is £216.67 Step 1. 216.67 x 12 = 2600.04 Step 2. 2600.04 ÷ 52 = £50 p/w Annual (once a year - see below notes C) to weekly Annual payment due is £2600 2600 ÷ 52 = £50 p/w Page 2 Amount ÷ 52 weeks Converting payments to fortnightly (2 weekly) Symbol ÷ means divide the figure Fortnightly payments are often shown as f/n, fn or 2wkly Payments to Convert Calculations Example Daily to fortnightly Daily payment x 14 days Daily paper is 75p (see notes A) 0.75 x 14 = £10.50 f/n Weekly to fortnightly Weekly payment x 2 weeks Fortnightly rent or benefit is £100 50 x 2 = £100 f/n Four weekly to fortnightly Four weekly payment ÷ 2 weeks Four weekly rent or benefit payment is £200 200 ÷ 2 = £100 f/n Monthly to fortnightly Step 1. Monthly payment x 12 months = total Step 2. Total ÷ 26 weeks Calendar monthly rent or benefit is £216.67 Step 1. 216.67 x 12 = 2600.04 Step 2. 2600.04 ÷ 26 = £100 f/n Annual (once a year see below notes C) to fortnightly Amount ÷ 26 weeks Annual payment due is £2600 2600.04 ÷ 26 = £100 f/n Converting payments to monthly Symbol ÷ means divide the figure Monthly payments are often shown as pm, p/m or pcm Payments to Convert Calculations Example Daily to calendar monthly Step 1. Amount x 365 days = total Step 2. Total ÷ 12 months = amount payable Daily paper is 75p Step 1. 0.75 x 365 = 273.75 Step 2. 273.75 ÷ 12 = £22.81 p/m Weekly to calendar monthly - (see below notes B) Step 1. Weekly payment x 52 weeks = total Step 2. Total ÷ 12 months = amount payable Weekly rent or benefit is £50 Step 1. 50 x 52 = £2600 Step 2. 2600 ÷ 12 = £216.67 p/m Fortnightly (2 weekly) to calendar monthly Step 1. Fortnightly payment x 26 weeks = total Step 2. Total ÷ 12 months = amount payable Four Weekly to calendar monthly - (see below notes B) Step 1. Four weekly payment x 13 pyts = total Step 2.Total ÷ 12 months = amount payable Fortnightly rent or benefit is £100 Step 1. 100 x 26 = £2600 Step 2. 2600 ÷ 12 = £216.67 p/m Step 2. 2600 ÷ 12 = £216.67 p/m Four weekly rent or benefit is £200 Step 1. 200 x 13 = £2600 Step 2. 2600 ÷ 12 = £216.67 p/m Annual (once a year - see below notes C) to monthly Amount ÷ 12 months Page 3 Annual rent or benefits is £2600 2600 ÷ 12 = £216.67 p/m Notes Note A - inputting items that cost less than £1.00 Anything costing £1.00 or more should be input in a calculator as you see it: eg. £1.75 will be 1.75 Anything that costs less than £1.00 needs a decimal point before the number, this can be input as an ‘0.’ Or ‘.’ eg. 75p will be ‘0.75’ or ‘.75’ This is only required if you are calculating your budget by hand with a calculator. On-line budgeting sheets should have their own individual instructions. Note B – monthly and four weekly payments are NOT the same Please note that four weekly payments and calendar monthly payments are NOT the same. Four weekly payments - paid every FOUR WEEKS on the same DAY of week. If something is paid four weekly there are 13 payments due in one year. Calendar monthly payments – paid every calendar month on the same DATE or DAY OF MONTH. For example the money could be due on 15th of each month so the day will be different each month but date remains constant. OR the payment may be due on a certain day of the month such as last Thursday of each month, this will mean either 4 or 5 weeks between each payment depending on the month, but the payment will always be on the Thursday. If something is paid monthly there are 12 payments due in one year. If a weekly figure is needed to be monthly DO NOT multiply by 4. This will make the amount incorrect – see below example: If you calculate by 4 weeks: £50 x 4 weeks = £200 If you calculate monthly: £50 x 52 weeks = £2600 then £2600 ÷ 12 months = £216.67 There is a £16.67 difference by not doing the calculation correctly. Your payment will be short £16.67 each month. Calendar monthly payments can be abbreviated to pm, p/m or pcm Note C – getting an annual (once a year or total for the year) figure Some annual figures are easy to find out, for example car tax can be found on line, or on your renewal letter. Some annual figures need to be calculated. For example, birthday presents. To get an annual figure just add up all the amounts for each occasion. 15 birthday presents are bought each year. 10 presents £10 each 10 presents x £10 = £100 4 presents are £15 each 4 presents x £15 = £60 1 present is £20 1 present x £20 = £20 £100 + £60 + £20 = £180 annual figure (ie, the amount spent on birthday presents each year) This annual figure can then be converted to weekly, fortnightly, four weekly or monthly payments so an amount can be saved regularly towards the cost instead of having to find a lump sum payment. An annual payment can be referred to as - per annum .......................................................................................................................................................................... If you would like to request an interpreter, translated large print or audio version in other languages, please contact the equality and diversity unit on 01384 813400. For alternative formats in English contact 01384 814123. Page 4