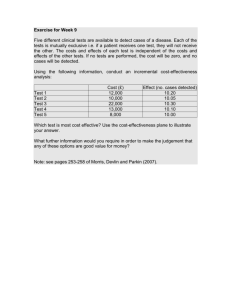

Energy Efficiency Cost-Effectiveness Screening

advertisement