milwaukee school of engineering

advertisement

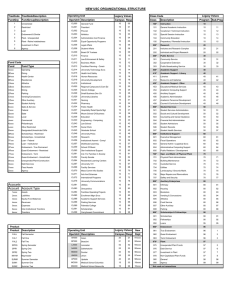

MILWAUKEE SCHOOL OF ENGINEERING Milwaukee, Wisconsin FINANCIAL STATEMENTS Including Independent Auditors' Report June 30.2011 and 2010 MILWAUKEE SCHOOL OF ENGINEERING TABLE OF CONTENTS Independent Auditors' Report Financial Statements Statements of Financial Position Statements of Activities Statements of Cash Flows Notes to the Financial Statements + BAKER TILLY Baker TillyVirchow Kraurc. LLP 115 S 84rh Sr.Src400 Milwaukee. WI 53214-1475 re1414777 5500 fax414777 5555 bakcrrilly.com INDEPENDENT AUDITORS' REPORT Board of Regents Milwaukee School of Engineering Milwaukee. Wisconsin We have audited the accompanying statements of financial position of Milwaukee School of Engineering (the "University"), as of June 30, 2011 and 2010, and the related statements of activities and cash flows for the years then ended. These financial statements are the responsibility of the University's Board of Regents and management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America and the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the University's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion. In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the University as of June 30,2011 and 2010, and the changes in its net assets and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America. Milwaukee, Wisconsin October 21,201 1 Page 1 B* ; ;b;y;8diM[ i INTERNATIONAL An AGrmarive A~rionEyualOppcct~niry Employer MILWAUKEE SCHOOL OF ENGINEERING STATEMENTS OF FINANCIAL POSITION June 30,2011 and 2010 ASSETS 2011 2010 ASSETS Cash and cash equivalents Receivables Accounts receivable, net Contributions receivable, net Loans to students, net Inventories, at cost Prepaid expenses and other assets Investments Cash surrender value of life insurance Land, buildings and equipment, net TOTAL ASSETS LIABILITIES AND NET ASSETS LIABILITIES Accounts payable and accrued liabilities Deferred revenues Liabilities under split interest agreements U.S. Government grants refundable Long-term debt Accumulated post-retirement benefit obligation Asset retirement obligation Total Liabilities NET ASSETS Unrestricted Temporarily restricted Permanently restricted Total Net Assets TOTAL LIABILITIES AND NET ASSETS See accompanying notes to financial statements. Page 2 MILWAUKEE SCHOOL OF ENGINEERING STATEMENT OF ACTIVITIES Year Ended June 30,201 1 Unrestricted Temporarily Restricted 2011 Permanently Restricted Total Total 2010 OPERATING REVENUES Student tuition and fees, gross Less: Discounts and Allowances Funded Unfunded Net Tuition and Fees Auxiliary enterprises Contribution revenue Government grants and contracts Applied Technology Center Endowment payout Interest earned on unrestricted loan funds Other investment income Other income Net assets released from restrictions Total Operating Revenues OPERATING EXPENSES Instructional Student services Institutional support Academic support Auxiliary enterprises Research and amlied technoloav -. Total operating Expenses Operating Revenues in Excess (Deficit) of Operating Expenses NONOPERATING ITEMS Net realizedlunrealizedgains on investments Unrealized oost-retirement benefit aains Changes in'value of split interest agreements Total Nonoperating items CHANGE IN NET ASSETS 6.176.220 (5.382.835) 2,207,645 75.586 4,398,264 126,804 920.189 6,605.909 75.586 ~,~ . 687.394 700,136 2,283.231 695.886 5.094.150 (8.492) (8.492) 7.368.889 3.297.760 367.704 .. , 146.791 3.812.255 8,459.451 (288,685) 118.312 8,289,078 4,512,391 NET ASSETS - Beginning of Year - NET ASSETS END OF YEAR $ 94.757.141 $ 20.785.91 1 8 32,551,264 $ 63.490.841 $139,805,258 See accompanying notes to financial statements. Page 3 MILWAUKEE SCHOOL OF ENGINEERING STATEMENT OF ACTIVITIES Year Ended June 30,2010 2010 Temporarily Permanently Restricted Restricted Unrestricted OPERATING REVENUES Student tuition and fees, gross Less: Discounts and Allowances Funded Unfunded Net Tuition and Fees $ 69,384,020 $ - $ Total - (7,126.318) (26.334.272) 35,923,430 $ 69.384.020 (7,126,318) (26.334.272) 35.923.430 Auxiliary enterprises Contribution revenue Government grants and contracts Applied Technology Center Endowment payout Interest earned on unrestricted loan funds Other investment income Other income Net assets released from restrictions Total Operating Revenues OPERATING EXPENSES Instructional Student Services Institutional support Academic support Auxiliary enterprises Research and applied technology Total Operating Expenses 5.012.718 - 62.200.196 Operating Revenues in Excess (Deficit) of Operating Expenses NONOPERATING ITEMS Net realizedlunrealizedgains on investments Unrealized post-retirement benefit gains Changes in value of split interest agreements Total Nonoperating items (511.159) 39,816 1,017,041 2.280.719 1.171.479 NET ASSETS - Beginning of Year $ 28.988.511 8,977.134 10.787.810 2.608.063 5,825.960 5.012.71@ 62.200.196 700.138 3.297.760 367,704 CHANGE IN NET ASSETS NET ASSETS -END OF YEAR - 28,988,517 8.977.1 34 10,787.810 2,608,063 5.825.960 367.704 1.384.745 228,214 2.508.933 (81.423) (81.423) 146,791 3.812.255 873,586 2,548.749 1,090.056 4,512,391 85,424.104 18.525.847 31.342.916 135.292.867 32.432.972 $ 139.805.258 86.297.690 $ 21.074.596 $ See accompanying notes to financial statements. Page 4 MILWAUKEE SCHOOL OF ENGINEERING STATEMENTS OF CASH FLOWS Years Ended June 30,201 1 and 2010 CASH FLOWS FROM OPERATING ACTIVITIES Change in Net Assets Adjustments to reconcile change in net assets to net cash flows from operating activities Depreciation and amortization Contributions restricted for long-term investment Gifts-in-kind - equipment Actuarial (gain) loss on split interest agreements Accretion of asset retirement obligations Unrealized gain on investments Realized gain on investments Changes in assets and liabilities Accounts receivable Contributions receivable Inventories Prepaid expenses and other assets Cash surrender value of life insurance Accounts payable and aCCNed liabilities Deferred revenues Accumulated postretirement benefit obligation Nel Cash Flows from Operating Activities CASH FLOWS FROM INVESTING ACTIVITIES Proceeds from sale of investments Purchase of investments Purchase of land, buildings, and equipment Loans issued to students Repayments received on loans to students Net Cash Flows from Investing Activities CASH FLOWS FROM FINANCING ACTIVITIES Proceeds from contributions restricted for long-term purposes Payments to annuitants Payments made on long-term debt Net Cash Flows from Financing Activities Net Change In Cash and Cash Equivalents 3.226.804 (163.658) (1,775,000) 1.288.146 2.595.172 (117,369) (1,720,000) 757.803 (3,557,737) (1,201,086) 9.354.887 10.555.973 CASH AND CASH EQUIVALENTS - Beginning of Year CASH AND CASH EQUIVALENTS -END OF Y W R Supplemental disclosure of cash flow information: Cash paid during the year for interest ~urchesesof land, bildings, and equipment in accounts payable and accrued liabilities Acquisition of building through settlement of note and accrued interest $ 5.797.150 $ 9.354.887 $ $ 127,193 $ $ 14.283 3,399.699 - See accompanying notes to financial statements. Page 5 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30,2011 and 2010 - NOTE 1 Organization Milwaukee School of Engineering (the "University") is a nonprofit, nonstock, nondenominational, private institution of higher education whose mission is to provide a balanced education in technical and nontechnical areas for men and women in the disciplines of engineering, engineering technology, management systems, business, nursing, and technical communication. The University is accredited by the North Central Association of Colleges and Schools and offers bachelor's degree, master's degree, and certificate programs. The University is governed by a 52 member board of regents comprised of leaders from business, industry, and other professions. - NOTE 2 Summary of Significant Accounting Policies Basis of Presentation The financial statements are prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America. Under current authoritative guidance, net assets, revenues, gains and losses are classified based on the existence or absence of donor-imposed restrictions. Accordingly, net assets of the University and changes therein are classified and reported as follows: - Unrestricted Net assets that are not subject to donor imposed stipulations. - Temporarily restricted Net assets subject to donor imposed stipulations that will be met either by actions of the University andlor passage of time. Permanently restricted- Net assets subject to donor imposed stipulations that they be maintained permanently by the University. Revenues are reported as increases in unrestricted net assets, unless use of the related assets is limited by donor imposed restrictions. Expenses are reported as decreases in unrestricted net assets. Gains and losses on investmenk are reported as increases or decreases in unrestricted net assets unless their use is restricted by explicit donor stipulations or by law. Expirations of temporary restrictions recognized on net assets (i.e. the donor stipulated purpose has been fulfilled andlor the stipulated time period has elapsed) are reported as reclassifications from temporarily restricted net assets to unrestricted net assets With respect to temporarily restricted net assets, the University follows these accounting policies: Reporting as Temporarily Restricted Revenues - Contributions received with donor-imposed restrictions that are met in the same year as received are reported as revenues of the temporarily restricted net asset class, and a reclassification to unrestricted net assets is made to reflect the expiration of such restrict~ons. Investment income that is earned from permanently restricted net assets or restricted by the donor is recorded as temporarily restricted income. Page 6 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30,2011 and 2010 - NOTE 2 Summary of Significant Accounting Policies (continued) Basis of Presentation (continued) Release of Restrictions on Net Assets for Acquisition of Land, Buildings and Equipment - Contributions of land, buildings and equipment are reported as revenues of the unrestricted net asset class absent specific donor restrictions. Contributions of cash or other assets to be used to acquire land, buildings and equipment are reported as revenues of the temporarily restricted net asset class; the restrictions are considered to be released at the time such long-lived assets are placed in service. Cash and Cash Equivalents For financial statement purposes, the University considers all highly liquid investments, except for those held for long-term investment, to be cash equivalents. The University is required to maintain funds relating to the Perkins loan program in a separate account. At June 30, 2011 and 2010, the University had $158,856 and $107,747, respectively, of cash for the Perkins loan program. Interest bearing accounts at a bank are insured by the Federal Deposit Insurance Corporation up to $250,000. The University has not experienced any losses in such accounts and believes it is not exposed to any significant credit risk on cash Receivables Accounts receivable are carried at the unpaid balance of the original amount billed to students and loans to students are carried at the amount of unpaid principal. Both receivables are shown less an estimate made for doubtful accounts based on a review of all outstanding amounts. Management determines the allowance for doubtful accounts by identifying troubled accounts and using historical experience applied to an aging of accounts. Accounts receivable and loans to students are written-off when deemed uncollectible. Recoveries of accounts receivable and loans to students previously written-off are recorded when received. Receivables are generally unsecured. After a student is no longer enrolled in an institution of higher education and after a grace period, interest is charged on Perkins and institutional student loans receivable and is recognized as it is charged. Perkins student loans receivable are considered to be past due if a. payment is not made within 30 days of the payment due date, at which time, late fees are charged and recognized. The Perkins Loan Program receivables may be assigned to the U.S. Department of Education. Students may be granted a deferment, forbearance, or cancellation of their student loans receivable based on eligibility requirements defined by the U.S. Department of Education. Page 7 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30.2011 and 2010 - NOTE 2 Summary of Significant Accounting Policies (continued) Contributions Contributions are recognized as revenues in the period received or unconditionally pledged. Contributions received are recorded as unrestricted, temporarily restricted, or permanently restricted revenue depending on whether the donor imposes any restriction. Conditional promises to give are not recognized as revenues until the conditions on which they depend are substantially met. Contributions of assets other than cash, including technologies, patents, or software, are recorded at their estimated fair value at the date of gift, except that contributions of works of art, historical treasures, and similar assets held as part of collections are not recognized or capitalized. Contributions to be received after one year are discounted. Amortization of the discount is recorded as additional contribution revenue. Allowance, if any, is made for doubtful contributions receivable based upon management'sjudgment and analysis of the creditworthiness of the donors, past collection experience, and other relevant factors. Contributions determined not to be collectible are recorded as bad debt expense. Inventories lnventories consist of bookstore inventory and are valued at the lower of cost or market. Government Grants and Contracts Revenue from governments, private grants, and contract agreements is recognized as it is earned through expenditures in accordance with the related agreement. Any advance funding received is recorded as deferred revenue in the statements of financial position. Bond Underwriting Costs The costs related to the issuance of bonds are amortized using the pro rated balance effective interest method over the lives of the three Series 1999 bonds and the straight line method over the life of the Series 20038 bonds. These are included in prepaid expenses and other assets on the statements of financial position. lnvesfments lnvestments are stated at fair value, primarily based on quoted market prices or quoted net asset values. except for life insurance policies. Life insurance policies are reported at the cash surrender value of the policies and approximate fair value. Closely held stock is valued at independent appraised values in the absence of readily ascertainable market values. lnvestment transactions are recorded as of the trade date. Realized gains and losses on the sale of investments are calculated on the basis of specific identification of the securities sold. lnvestment management fees are classified as a reduction in investment income for financial reporting purposes. Page 8 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30,2011 and 2010 - NOTE 2 Summary of Significant Accounting Policies (continued) Land, Buildings, and Equipment Land, buildings, and equipment are stated at cost as of the date of acquisition or at fair value at the date of donation, if received as a contribution, less accumulated depreciation. Depreciation of buildings and equipment is provided on the straight line basis over the estimated useful lives of the related assets as follows: Assets Buildings ~qui~ment Furniture, fixtures and other Computer and technical equipment Year 40 45 - The University capitalizes collections at cost when purchased but does not record any collections that are contributed. Collections that were purchased include paintings that are on display. The University does not depreciate collections. Impairment of Long-lived Assets Long-lived assets (including land, buildings, and equipment) are evaluated for impairment whenever events or changes in business circumstances indicate that the carrying amount of an asset may not be fully recoverable. An impairment loss would be recognized when the estimated future cash flows from the use of the asset are less than the carrying amount of that asset. To date, there have been no such losses Deferred Revenues Student deposits and advance payments for tuition related to the summer term, or any other future term. are deferred and reported as unrestricted revenue in the year in which the term is completed. Split Interest Agreements with Donors The University's split interest agreements with donors consist primarily of irrevocable charitable remainder trusts and ~ooledincome funds for which the University has received documents indicating it is either the remainderbeneficiary or both the trustee and remainder beneficiary. Page 9 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30,201 1 and 2010 - - - NOTE 2 - Summaty of Significant Accounting Policies (continued) Split lnterest Agreements with Donors (continued) Assets held in trusts for which the University serves as trustee are included in investments. In addition, the present value of the estimated future payments to be made to the donors or other beneficiaries is reported as liabilities under split interest agreements. Such liabilities are adjusted during the term of the trusts for changes in the value of the assets, accretion of the discount, and other changes in the estimates of future benefits. The University has no assets being held in trust for which it does not serve as trustee. Contribution revenue is recognized at the date the split interest agreement is established for the present value of the expected remainder interest. Any subsequent changes in value of the split interest agreement are recognized as a nonoperating change in net assets. The University did not recelve any annuity gifts during the years ended June 30, 2011 and 2010. Adiscount rate of 2.8% and 5.0% was used to project the liability as of June 30, 2011 and 2010. respectively. Investment assets held by the University under deferred gift agreements totaled $4,239,756 and $3,706,550 at June 30, 2011 and 2010, respectively, and are included in investments on the statements of financial position. U.S. Government Grants Refundable Funds provided by the United States Government under the Federal Perkins Student Loan program are loaned to qualified students. Receipts of principal and interest payments are utilized to finance future loans to students. These funds are ultimately refundable to the government and are included as liabilit~esin the statements of financial position. Conditional Asset Retirement Obligations Current authoritative guidance clarifies the term "conditional" in regards to accounting for asset retirement obligations. This interpretation refers to a legal obligation to be performed upon an asset retirement activity even if the timing andlor settlement are conditional on a future event that may or may not be within the control of an institution. Accordingly, the University records a liability for the conditional asset retirement obligation at its estimated fair value because it owns several buildings that contain encapsulated asbestos material and other contaminants. The liability for asset retirement obligation was $291,993 and $280.763 as of June 30, 201 1 and 2010, respectively. Fair Value of Financial Instruments - The University records financial instruments at cost, with the exception of investments (see Note 2 Fair Value Measurements) in marketable equity and debt securities which are reflected in the financial statements at fair value. Cash and cash equivalents, receivables, and accounts payable and accrued liabilities are reflected in the financial statements at cost which approximates fair value because of the short-term maturity of these instruments. The cash surrender value of life insurance is the the amount reported by the insurance company and approximates fair value. The fair value of investments is based upon values provided by custodians or quoted market values. In certain cases where such values are not available, the University records the investment based on the most recent appraisal and reviews for potential impairment based on annual distributions by the company. The carrying value approximates fair value for these investments. Page 10 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30.201 1 and 2010 - NOTE 2 Summary of Significant Accounting Policies (continued) Fair Value of Financial Instruments (continued) Liabilities under split interest agreements are calculated at the end of each fiscal year and the carrying amount approximates fair value. The carrying amount of long-term debt approximates fair value because these financial instruments bear interest at rates which approximate current market rates for notes with similar maturities and credit quality. lnvestments in securities traded on national or international securities exchanges are carried at fair value based on values provided by external investment managers or quoted market values. lnvestments in limited partnerships, hedge funds, private equity funds, real estate funds, venture capital funds, commodity funds, offshore fund vehicles, funds of funds and similar nonmarketable equity interests consist primarily of investments that are not readily marketable. lnvestments in these categories, which are managed externally, are valued utilizing the most current information provided by the general partner or investment manager. These valuations generally reflect discounts for illiquidity and consider variables such as financial performance of investments, recent sales prices of investments and other pertinent information. Where applicable, independent appraisers are utilized to assist in the valuation. These values are determined under the direction of, and subject to approval by, management and the Investment Committee of the Board of Regents. The preparation of financial statements requires management to make estimates and assumptions about the effects of matters that are inherently uncertain. The accounting policies considered potentially significant in this respect are the valuation of the limited partnerships, hedge funds, private equity funds. real estate funds, venture capital funds, commodity funds, offshore fund vehicles, funds of funds and similar nonmarketable equity interests. Values for these instruments are often estimated using techniques such as discounted cash flow analysis and comparisons to similar instruments. Estimates developed using these methods are subjective and require judgment regarding significant matters such as the amount and timing of future cash flows and the selection of discount rates that appropriately reflect market and credit risks. Estimates, by their nature, are based on judgment and available information. Changes in assumptions could have a significant affect on the fair value of the instruments. Actual results could differ from these estimates and could have a material impact on the financial statements. Page 11 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30,2011 and 2010 NOTE 2 - Summary of Significant Accountlng Policies (continued) Fair Value of Financial Instruments (continued) The estimated carlying and fair values of the University's significant financial instruments are as follows: 2011 2010 Carwina Estimated Fair Carrying Estimated Fair vaiueValue valueValue Financial assets: Investments Financial liabilities Debt $ 17.145.000 $ 17.151.837 8 18.920.000 $ 18.917.405 Fair Value Measurements Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. In determining fair value, the University uses various valuation methods including the market, income and cost approaches. The assumptions used in the application of these various methods are developed from the perspective of market participants pricing the asset or liability. Inputs used in the valuation methods can be either readily observable, market corroborated, or generally unobservable inputs. Based on the observability of the inputs used in the valuation methods, the University is required to provide the following information according to the fair value hierarchy. The fair value hierarchy ranks the quality and reliability of the information used to determine fair values. Assets and liabilities measured, reported andlor disclosed at fair value will be classified and disclosed in one of the following three categories: Level 1 -Quoted market prices in active markets for identical assets or liabilities. Level 2 - Observable market based inputs or unobservable inputs that are corroborated by market data. Level 3 Unobservable inputs that are not corroborated by market data. - Page 12 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30.201 1 and 2010 - NOTE 2 Summary of Significant Accounting Policies (continued) Fair Value Measurements (continued) The table below presents the balances of assets measured at fair value on a recurring basis by level within the hierarchy. June 30,201 1 Level 1 Level 2 Total Investments: Cash held in money market $ funds Short-term U.S. Government securities mutual funds Bond mutual funds U.S. Government securities Corporate bonds Mortgage backed securities Stock mutual funds Common stock in a closelv held company Total Investments $ 2,734.865 $ - $ 2,198.536 2,208,708 11,113,373 10,400,275 2,360,345 41,151.076 40,246,320 1.015.800 73.182.978 $ 40,246.320 % Total 2,734,865 Level 3 - $ 2,198,536 1,908,503 11,113,373 10,400.275 2,360,345 300,205 904,756 30.715.897 $ June 30,2010 Level 1 Level 2 1,015.800 2.220.761 Level 3 Investments: Cash held in money market funds Short-term U.S. Government securities mutual funds Bond mutual funds U.S. Government securities Corporate bonds Mortgage backed securities Stock mutual funds Common stock in a closely held company Total lnvestments Page 13 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30,201 1 and 2010 NOTE 2 - Summary of Significant Accounting Policies (continued) Fair Value Measurements(continued) The University estimates fair value based on the following: Level 1 -investments in stock mutual funds are actively and publicly traded on U.S. stock exchanges. Level 2 - investments in cash held in money market funds, short-term U.S. Government securities mutual funds. U.S. Government securities, bond mutual funds, corporate bonds and mortgage backed securities are not publicly traded on U.S. exchanges and the fair value is based upon quoted prices for similar, but not identical, assets in active markets, and other inputs that are observable for the asset, either directly or indirectly, for substantially the full term of the financial instrument. This also includes quoted prices for identical or similar assets in markets that are not active, inputs other than quoted prices that are observable for the asset, or inputs that are derived principally from or corroborated by observable market data. - Level 3 investments in an off shore stock mutual fund and a fixed income mutual fund are based on the net asset value of the fund as provided by the investment manager in the Bahamas. The valuation date was June 30 and there are no withdrawal restrictions or unfunded commitments related to these investments. The common stock in a closely held company is not publicly traded, the valuation of which is determined by a market appraisal and subsequently reviewed for potential impairment based on annual distributions by the company. The investments in stock mutual funds are calculated based on a net asset value at June 30. There are eiaht total stock mutual funds. They are all actively traded and listed on U.S. exchanges. The funds in;estments include large caps, mid-caps, international, growth and high yield stocks: There are no unfunded commitments or withdrawal restrictions related to any of the funds. The Level 3 activity is as follows: Balance at June 30,2009 Net investment loss presented in net realizedlunrealized gains on investments on the statements of activities Balance at June 30.2010 Net investment gain (loss) presented in net realizedlunrealized gains on investments on the statements of activities Balance at June 30,2011 Common stock in a Bond mutual Stock mutual closelv held companv fund fund $ 1,768,000 $ 1,667,184 $ 434,123 1,768.000 (752.200) 3 1.015.800 $ 1891.701) 775.483 129.273 904.756 $ (148.831) 285,292 14.913 300.205 Page 14 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30,201 1 and 2010 -- - NOTE 2 Summary of Significant Accounting Policies (continued) FunctionalAllocation of Expenses The costs of providing the various programs and other activities have been summarized on a functional basis in the statements of activities. Accordingly, certain expenses have been allocated among the programs and supporting services benefited. Income Taxes The University has received a determination letter from the Internal Revenue Service indicating that it is a tax-exempt organization as provided for in Section 501(c)3 of the Internal Revenue Code and is exempt from federal and state income taxes, except for taxes pertaining to unrelated business income. No provision has been made for income taxes in the accompanying financial statements because the University does not have a significant amount of unrelated business income. The University addresses the determination of whether tax benefits claimed on a tax return should be recorded in the financial statements. Under current accounting guidance, the University may recognize the tax benefit from an uncertain tax position only if there is substantial authority that the tax position will be sustained on examination by taxing authorities, based on the technical merit of the position. Examples of tax positions include the tax-exempt status of the University and various positions related to the potential sources of unrelated business taxable income. There were no significant unrecognized tax expense identified or recorded as liabilities during fiscal year 2011. Open tax years subject to examination by the U.S. and state taxing authorities are for the years 2008 to 2010, which statutes expire in 201 1 to 2014, respectively. Operations Operating results in the statements of activities reflect all transactions increasing or decreasing net assets except those items of a long-term nature, that is, those associated with: realized and unrealized gains on investments, unrealized post-employment benefit gains, and changes in value of split interest agreements. Use of Esfimates The preparation of the financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues, expenses, gains, and losses during the reporting period. Actual results could differ from those estimates. Page 15 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30,2011 and 2010 NOTE 3 -Applied Technology Center The University's Applied Technology Center ("ATC") conducts strategic research for business, industry. and government. The ATC is involved in the transfer of new technologies to real business practices through its Fluid Power Institute, Rapid Prototyping Consortium, and Center for Biomolecular Modeling. More than 100 projects are processed annually for companies in conjunction with the University's various academic programs, utilizing faculty and student expertise, as well as its laboratories and equipment. Membership fees for the Rapid Prototyping Consortium are recognized as unrestricted revenue over the membership term and cover, in part, related expenditures for research provided to its members. NOTE 4 -Accounts Receivable Accounts receivable comprise the following at June 30: Tuition and fees Other Total Less: allowance for doubtful accounts Total accounts receivable $ 4,348,904 5 3,416.864 NOTE 5 -Contributions Receivable Contributions receivable consist primarily of donor pledges for facility construction and the annual fund raising campaign. Contributions receivable that are expected to be collected within one year are recorded at net realizable value. Contributions that are expected to be collected in future years are recorded at the present value of their estimated future cash flows. The discounts on those amounts are computed using rates applicable to the years in which the contributions are received. Amortization of the discount is included in contribution revenue. The discount rate was 0.48% for both 2011 and 2010. All contributions are expected to be collected in fiscal year 2012. Net contributions receivable are summarized as follows: Total contributions receivable Less: unamortized discount Net contributions receivable Page 16 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30,2011 and 2010 - - NOTE 6 Loans to Students The University issues uncollateralized loans to students based on financial need. Student loans are funded through Federal government loan programs and institutional funding. Allowances for uncollectible accounts are established based on previous collections experience and current economic factors which, in management's judgment could influence the ability to repay according to the loan terms. At June 30, 2011 and 2010, student loans represented 2.0% of total assets. At June 30, student loans consisted of the following: 201 1 The University's Institutional Loans Federal perkins Loans Program Total Less: allowance for uncollectible loans Net loans to students $ 2,477,683 $ 2010 2,982,786 Funds advanced by the Federal government under the Perkins Loan Program of $1,647.800 at both June 30. 2011 and 2010 are ultimately refundable to the government and are included as a liability in the statements of financial position. At June 30, 201 1 and 2010, the following amounts were past due under the student loan programs: 1-60 days past due June 30, 201 1 2010 $ $ 825 $ 1,075 $ 60-90 days past due 1,447 $ 979 $ 90+ days past due 820,120 $ 732.642 $ Total past due 822,392 734,696 - NOTE 7 Investments Investments are segregated for investment management purposes as follows: Endowment Investment Funds Debt R e s e ~ eFunds Other lnvestments Total Page 17 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30.2011 and 2010 - ~ -~ - NOTE 7 Investments and Note Receivable (continued) The University's return on investments as reported in the financial statements under the total return concept for the years ended June 30,2011 and 2010 is summarized as follows: Year Ended June 30,2011 Interest and dividends Unrealized gains Realized gains Total return on investments Endowment payout lnvestment return in excess of endowment payout 736,206 $ 2,275,109 8.122 3,019,437 $ Permanently Restricted 372.399 $ 5,488,510 131.752 5,992,661 g 3.019.437 Unrestricted $ Endowment payout Endowment payout in excess of total return on investments $ Total - - 4.398.264 $ $ Temporarily Restricted Permanently Restricted - $ 7.417.701 Total $ 1,123,813 4,273,908 9 6 . 2 0 6 5,493.927 - 11.547.467) 2.280.719 (1,594,397) $ 648,700 $ 475,113 $ 1,021,027 3,252.881 (3.986) 100.192 1,665,741 3,828.186 1.665.741 $ $ 1,108,605 7,763,619 139.874 9,012,098 (1.594.397) Year Ended June 30,2010 Interest and dividends Unrealized gains Realized gains (losses) Total return on investments Temporarily Restricted Unrestricted 11,547.467) $ 3.946.460 The University's investment strategy incorporates a diversified asset allocation approach and maintains, within defined limits, exposure to the world equity, fixed-income, commodities, real estate and private equity markets. This strategy provides the University with a long-term asset mix that is most likely to meet the University's long-term return goals with the appropriate level of risk. The alternative investments were purchased to diversify the University's portfolio, to provide predictability in overall earnings and to provide market neutral holdings. The University's management, the Investment Committee of the Board of Regents and the University's external investment consultants review reports provided by the general partners and hedge fund managers, and the University's external investment consultants attend meetings of the various general partners and hedge fund managers in order to evaluate the risk associated with these investments. In addition, the University monitors its portfolio mix to ensure that it is in accordance with Board policy. Investments are exposed to potential risks including interest rate risk, credit risk and overall market volatility. Accordingly, it is reasonably possible that changes in the value of investments will occur in the near term and such changes could be material in amount. Page 18 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30.201 1 and 2010 -- - NOTE 8 Land, Buildings, and Equipment Land, buildings, and equipment comprise the following assets at June 30: Land Buildings Equipment Furniture, fixtures and other Art collection Construction in progress Less: accumulated depreciation Net land, buildings, and equipment Depreciation expense was $3,913,184 and $4,092,082 for the y e a s ending June 30, 201 1and 2010, respectively. - NOTE 9 Long-term Debt The long-term debt of the University as of June 30 is comprised of the following: Description Redevelopment Authority of the City of Milwaukee Revenue Refunding Bonds, Series 1999A Redevelopment Authority of the City of Milwaukee Revenue Refunding Bonds, Series 19998 Wisconsin Health and Educational Facilities Authority Revenue Bonds. Series 19996 Redevelopment Authority of the City of Milwaukee Revenue Refunding Bonds. Series 20038 Interest Rate Due Date 4.10% to 4.70% Annual maturities on October 1 of each year through 2017 in amounts ranging from $615.000 to $915,000 4.40% to 5.0% Annual maturities on October 1 of each year through 2017 in amounts ranging from $465.000 to $720.000 4.55% to 5.13% Annual maturities on October 1 of each year through 2017 in amounts ranging from $120.000 to $185.000 3.8% to 5.35% Annual maturities on July 1 of each year beginning in 2010 through 2023 in amounts from $465.000 to $470,MH] 2011 $ 5,595,000 2010 $ 6.260.000 4,345,000 4,855,000 1.135.000 1,270.000 6.070.000 6.535.000 Total Debt Page 19 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30.2011 and 2010 NOTE 9 - Long-term Debt (continued) In 1999, $7,845,000 and $8,895.000 Redevelopment Authority of the City of Milwaukee ("RACM") Revenue Refunding Bonds (Series 1999A and 19998 Bonds, respectively) and $2,315.000 Wisconsin Health and Education Facilities Authority Revenue Bonds (Series 1999C Bonds) were issued on behalf of the University to refinance previously issued bonds, fund a Debt Service Reserve Fund, pay a portion of the issuance costs and to finance various equipment purchases and capital improvements to its facilities. The Series 1999 Bonds are collateralized by a pledge of a Mortgage Note on all of the University's land and buildings, with the exception of the Kern Center building and property, in an aggregate principal amount equal to the aggregate principal amount of the Bonds. The Bond indentures for Series 1999A. 19998 and 1999C Bonds established Debt Service Reserve Funds, amounting to $1,908,503 and $1,908,487 as of June 30, 201 1 and 2010, respectively, which are included in investments on the statements of financial position. In July 2003, $8,000.000 RACM Variable Rate Demand Redevelopment Revenue Bonds (Series 2003A) and $7,000,000 RACM Redevelopment Revenue Bonds (Series 20038) were issued on behalf of the University. Both issues were for the purpose of partially financing a $31,000,000 building project, consisting of a 215.000 square foot recreation and education center named the Kern Center, to be owned and operated by the University. In May 2009, the Series 2003A outstanding amount of $7,250.000 was paid from unrestricted funds and the bonds were called. The remaining RACM bond obligations are provided for by indenture under terms of a loan agreement and promissory note from the University. All principal and interest payments are collateralized by a letter of credit from a bank which expires July 15, 2012, with renewable provisions if approved by the bank. A Credit Agreement to provide reimbursement for amounts owed to the bank under the letter of credit is collateralized with a mortgage and an assignment of leases and rents on the Kern Center property and operation. In the event that the Bond Remarketing Agent is unable to remarket the Bonds, the Bonds will become a demand note under the irrevocable letter of credit. The Credit Agreement requires the University to maintain a Minimum Liquidity Ratio in excess of 1.0 and requires the University to own and maintain a Minimum Liquid Asset Balance of $8,000,000. Both the 1999 and 2003 Agreements have covenants that require the University to maintain certain annual operating results and balance sheet liquidity ratios. The University has reported its compliance with these covenants to the respective Trustees. Future maturities of long term debt at June 30. 2011 are as follows: Amount Years ending June 30: 2012 2013 2014 2015 2016 Subsequent to 2016 Interest expense was approximately $828,000 and $915,000 for the years ended June 30,2011 and 2010. respectively. Page 20 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30,2011 and 2010 - NOTE 10 Unemployment Compensation Deposit As of June 30, 2011 and 2010, the University had a letter of credit of $642,835 that is designated for the reimbursement of unemployment benefits paid by the State of Wisconsin to former University employees. - NOTE 11 Employee Benefit Plans All eligible full time personnel may elect to participate in a defined contribution, multi-employer, individual annuity plan for retirement benefits. The University has neither administrative responsibilities nor any financial liabilities under this plan except for an annual matching contribution equal to the amount contributed by the participants, which may not exceed 6% of the annual wages of the participants. In addition, voluntary contributions by participants may be made, subject to IRS limitations. All benefits under this plan are provided solely through individually owned, fully funded annuity contracts. For 201 1 and 2010, the University's matching contributions to this plan were $1,226,060 and $1,171,675, respectively. The University provides certain postretirement benefits other than pensions, primarily health care, for retired employees that have attained specified years of service. The University accrues the estimated cost of retiree benefit payments during the years the employee provides services. The measurement date for the plan is June 30. The status of the postretirement benefit liability for this plan as of June 30, is as follows: 2011 Retirees $ Active employees currently eligible to retire Other active employees Accumulated postretirement benefit obligation Fair value of plan assets Unfunded status Current and unamortized actuarial losses Accrued postretirement benefit obligation recognized in the statements of financial position $ 2010 286,674 $ 1,071.035 1.370.577 2,728,286 357,413 922,373 1.253.737 2,533,523 2,728.286 2,533,523 (2.728.286) $ (2.533.523) The following is a reconciliation of the benefit obligation and the value of plan assets at June 30: 2011 Change in projected benefit obligation Benefit obligation at beginning of year Interest cost Sewice cost Actuarial gain Benefits paid Benefit obligation at end of year $ 9 2,533,523 $ 117,546 185.541 (75,588) (32.736) 2,728,286 $ 2010 2,610,652 130,533 198,467 (367,704) (38.425) 2.533.523 The plan participants made no contributions to the plan assets during 2011 and 2010. The plan has no assets at June 30,201 1 and 2010. Page 21 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30,2011 and 2010 - NOTE 11 Employee Benefit Plans (continued) Net periodic post retirement benefit expense for 2011 comprised the following: Service cost Interest cost Amortization of unrecognized net gains . Net gain Net periodic postretirement cost $ $ 185,541 117,546 (192.749) . . (367.704) (257.368) The University contributed $32,736 to the postretirement plan in fiscal 2011. The University expects to contribute $31,674 to its postretirement plan in fiscal 2012. These payments have been estimated based on the same assumptions used to measure the University's benefit obligation. Benefit payments, which reflect expected future sewice, as appropriate, are expected to be paid as follows: 2012 2013 2014 2015 2016 2017-2021 Total The estimated service cost, interest cost and net gain for fiscal year 2012, are as follows: $ Service cost Interest cost Net gain Amortization of unrecognized net gains Net periodic postretirement benefit cost $ 207.133 126,133 (75,588) (192.749) 64.929 A 4% rate of increase in the per capita costs of covered health care benefits was assumed at June 30. 201 1 and June 30, 2010. A discount rate of 5% was used to determine the accumulated postretirement benefit obligation for 201 1 and 2010. A decrease of one percentage point in the discount rate causes an increase of approximately 9% in the liability. The University has a deferred compensation agreement with its President that provides for the deferral of $75,500 of compensation for each year of service until retirement. The deferred compensation agreement allows the President to have the University pay for various insurance policies and the amount paid by the University reduces the amount of deferred compensation to be paid to the President. The amount of deferred compensation is to be paid in two equal annual installments afler the President retires. The amount of deferred compensation owed to the President at June 30, 2011 and 2010 is approximately $1,330,000 and $1,290,000, respectively, and the amounts are included in accounts payable and accrued liabilities on the statements of financial position. Deferred compensation expense for the years ending June 30, 2011 and 2010 was approximately $40.000. Page 22 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30.201 1 and 2010 NOTE 11 -Employee Benefit Plans (continued) In addition to the deferred compensation agreement, the University has an agreement with the President that allows for the University to advance the President amounts to be used for personal insurance and the advances are to be repaid upon retirement. The advanced amounts to the President at June 30,2011 and 2010 were approximately $1,330,000 and $1,290,000, respectively, and are recorded in prepaid expenses and other assets on the statements of financial position. The President has assigned a life insurance policy to the University to secure the payment of the loan. - NOTE 12 Self-funded Employee Medical Plan The University has medical, dental and vision benefits coverage by participating in the Wisconsin Association of Independent Colleges and Universities Benefit Consortium ("WBC"). As a charter member. along with 8 other universities in the association ("WAICU"), the University has agreed to remain a member until December 31. 2013. The WBC is a separate entity formed as a Voluntary Employee Beneficiary Association ("VEBA") under federal tax code IRC 501 (c)(9) and is incorporated under Chapter 181 of the Wisconsin statutes. The members included in the WBC, by sharing the cost of medical claims and administrattve costs, operate as an Associated Health Plan ("AHP). The WBC has adopted a multiemployer health plan approved by its Board of Directors and meets the requirements of the Employee Retirement Security Act of 1974 ("ERISA"). The University is entitled to a position on the WBC's Board of Directors along with one member each from the other eight charter members. As a member, the University pays fees to the WBC for coverage under the WBC's Health Plan in amounts determined by the various plan coverage options chosen by the participating employees. The University pays approximately two thirds of the total membership fees as determined by the WBC and the employees contribute the remainder. Under the WBC Health Plan employees who work at least 1,000 hours per year are eligible. Employees are eligible for retiree benefits if they are a participant for a one year period prior to retirement, and are at least 55 years of age with 15 years of continuous service with the University, or are over 55 years of age and the sum of the age and years of full-time service equals at least 70. A surviving spouse who is a planeligible dependant can remain in the Health Plan until remarriage or age 65. Fees paid to the WBC exceeded claims paid by $1,509,411 and $1,312.003 at June 30,2011 and 2010, respectively, and is included in prepaid expenses and other assets on the statements of financial position. - NOTE 13 Lease Commitments The University is committed under operating leases for various equipment, automobiles and laptop computers. Page 23 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30,2011 and 2010 - NOTE 13 Lease Commitments (continued) Future minimum lease payments for the years ended June 30 are as follows: 2012 2013 2014 2015 Total Lease payments charged to expense were $2,003,973 and $2,106,650 for the years ended June 30, 2011 and 2010. respectively. The University provides its full-time students with a mandatory technology plan for which it charges a fee. The plan includes a laptop computer which the University leases for two-year terms. Upon reaching junior status, each full-time student receives the current model replacement which he or she is entitled to own upon graduation. As of June 30, 201 1 the University had 2,370 laptop computers on lease under the plan. At the expiration of each two-year lease, the University has an option to purchase the computers or return them. On an annual basis, prior to the start of each school year, the University enters into new lease agreements to obtain the required computers to accommodate incoming freshman, new transfer students, and students enrolled in their junior year. The University acquires capital equipment at times through lease/purchase agreements. The gross amount of these assets under capital leases is $154,250, which is included in fixed assets. Amortization of the capital lease is included in depreciation expense. The future minimum lease obligations and the net present value of these minimum lease payments included in accounts payable and accrued liabilities on the statements of financial position at June 30, 2011, are as follows: Year ending June 30.2012 Less: Interest Present value of minimum lease payments $ 9 Amount 42,951 (1.074) 41.877 - NOTE 14 Net Assets Unrestricted net assets consist of the following as of June 30: Unrestricted, undesignated Page 24 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30,2011 and 2010 - NOTE 14 Net Assets (continued) Donor restrictions on temporarily restricted net assets consist of the following at June 30: Split interest annuity agreements Donor imposed restrictions: Art collection and related buildings Capital expenses Scholarships Instructional programs and other operating purposes $ 676,500 $ 1,193,837 5 4,810,503 2,713,305 903,010 11,682,593 20.785.911 9 8,853,934 4,918,571 1,016.467 5,091.787 21.074.596 Permanently restricted net assets consist of the following at June 30: Scholarships Instructional Programs Operational NOTE 15 - Endowment The University's endowment consists of approximately 150 individual funds established for a variety of purposes. Its endowment includes only donor-restricted funds. As required by Generally Accepted Accounting Principles ("GAAP"), net assets associated with endowment funds are classified and reported based on the existence of donor-imposed restrictions. The University is subject to the Uniform Prudent Management of Institutional Funds Act ("UPMIFA"). The University's governing Board of Regents has interpreted UPMIFA in the State of Wisconsin as requiring the preservation of the historical value of the original gift as of the gift date of the donor-restricted endowment funds absent explicit donor stipulations to the contrary. As a result of this interpretation, the University classifies as permanently restricted net assets (a) the original value of the gifts donated to the permanent endowment. (b) the original value of subsequent gifts to the permanent endowment, and (c) accumulations to the permanent endowment made in accordance with the direction of the applicable donor gift instrument at the time the accumulation is added to the fund. Page 25 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30,201 1 and 2010 NOTE I 5 -Endowment (continued) The remaining portion of the donor-restricted endowment fund that is not classified as permanently restricted net assets is classified as temporarily restricted net assets until those amounts are released for expenditure by the University in a manner consistent with the standards required by the donor. The University considers the following factors in making a determination to appropriate or accumulated donorrestricted endowment funds: . The duration and preservation of the fund The purposes of the University and the donor-restricted endowment fund General economic conditions The possible effect of inflation and deflation The expected total return from income and the appreciation of the investments Other resources of the University The investment policies of the University The University includes in its endowment gifts received from donors of cash and cash equivalents and investments. The University's endowment excludes pledges receivable and split interest agreements. Endowment net asset composition by type of fund consists of the following at June 30: June 30. 201 1 Donor-restricted endowment funds June 30. 2010 Donor-restricted endowment funds Unrestricted Temporarily Restricted - $ 10.135.575 Unrestricted Temporarily Restricted Permanently Restricted - $ 5.831.494 $ 31,666.557 9 $ Permanently Restricted Total $ 31.793.361 $ 41.928.936 Total $ 37,498,051 Changes in endowment net assets for the year ended June 30,2011 and 2010 are as follows: Endowment Net Assets June 30,2010 Contributions Investment gain Appropriated for expenditure Endowment Net Assets June 30,2011 Unrestricted Temporarily Restricted Permanently Restricted Total - $ 5,831,494 $ 31,666,557 $ 37,498,051 $ 126,804 - $ - 126.804 5,858,313 5,858,313 (1.554.232) (1.554.232) $ 10.135.575 $31.793.361 $ 41.928.936 Page 26 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30,2011 and 2010 - NOTE 15 Endowment (continued) Unrestricted Endowment Net Assets June 30.2009 Contributions Investment gain Appropriated for expenditure Endowment Net Assets June 30.2010 $ - $ Temporarily Restricted Permanently Restricted $ 3,227,353 $30,495.078 - 1,171,479 3,828,186 (1.224.045) $ 5.831.494 $31.666.557 Total 33,722,431 1,171,479 3,828,186 (1.224.045) $ 37.498.051 $ The University has adopted investment and spending policies for the endowment assets that attempt to provide a predictable stream of funding to the programs supported by its endowment while seeking to maintain the purchasing power of the endowment assets. Endowment assets include those assets of donor-restricted funds that the University must hold in perpetuity. Under this policy, as approved by the Board of Regents, the endowment assets are invested in a manner that is intended to produce results, while assuming a moderate level of investment risk. The University expects its endowment funds, over time, to provide an average annual rate of at least 5% annually. Actual returns in any given year may vary from this amount. To satisfy its long-term rate of return objectives, the University relies on a total return strategy in which investment returns are achieved through both capital appreciation, both realized and unrealized, and current yields from interest and dividends. The University targets a diversified asset allocation that places a greater emphasis on equity based investments to achieve its long term return objectives. The University has a policy of appropriating for distribution each year 5% of its endowment fund's average book (donated) value over the prior two fiscal years. In establishing this policy, the University considered the long term expected return on its endowment. Accordingly, over the long term, the University expects the current spending policy to allow its endowment to remain at least intact at donated value at the date of the gift. This is consistent with the University's objective to maintain the purchasing power of the endowment assets held in perpetuity as well as to provide additional real growth through new gifts. Page 27 MILWAUKEE SCHOOL OF ENGINEERING NOTES TO FINANCIAL STATEMENTS June 30.201 1 and 2010 - NOTE 16 Government Grants and Contracts Sources of government grant and contract revenues are not segregated in the financial statements. The primary sources for the years ended June 30,201 1 and 2010 are as follows: Unrestricted government contracts: TRIO Droarams ~esearch'andother Unrestricted government grants: Federal PELL Grant Federal Supplemental Education Opportunity Grant Federal Work Study Wisconsin Tuition Grant Other Wisconsin Programs Total government grants and contracts $ 2,565,752 209,127 314,618 1,917,994 173.683 5.181.174 8.074.408 $ 2,415,945 207,747 322,624 1,870,143 133.277 4.949.736 7.332.474 - NOTE 17 Fundraising and Advertising Expenses Fundraising expenses of $830,695 and $816,102 are included in institutional support for the years ended June 30, 2011 and 2010, respectively. Advertising expenses approximated $808,000 and $523,000 for the years ended June 30, 201 1 and 2010, respectively. Advertising costs are expensed when incurred. - NOTE 18 Contingencies The University is currently planning a major building project in 2012, consisting of a 780 car parking garage, a competition grade athletic field for soccer and lacrosse located on top of the structure, and a small community park. Total cost of the project is estimated at $30,000,000. The project has received preliminary from local governmental units but is also subject to a vacant land purchase involving . approvals .. Milwaukee County and a local bank. It is expected that purchase negotiations and final government approvals will be completed by early 2012 with construction commencing in spring of 2012. The project is td be financed with ddnor contributibns of approximately $20,000,000 and the balance from issuing additional RACM bonds throuah the Citv of Milwaukee, who has provided initial approval. Related legal and other professional fees todate of approximately$275,000 have been recorded as construction in progress in land, buildings, and equipment and have been funded by payments received from donors. ~ ~~ . NOTE 19 -Subsequent Events The University has evaluated subsequent events through October 21, 2011 which is the date that the financial statements were issued. Page 28