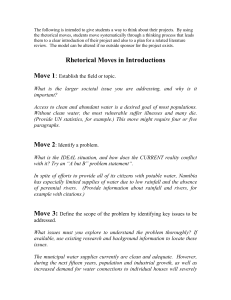

Makana Municipality Council Powers & Functions

advertisement