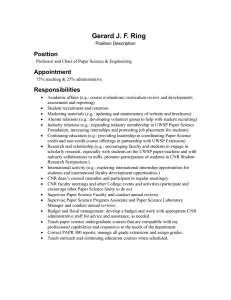

the importance of the standstill obligation in merger proceedings

advertisement

Merger control Electrabel/CNR: the importance of the standstill obligation in merger proceedings Bruno Alomar, Sophie Moonen, Gorka Navea and Philippe Redondo (1) On 26 March 2008, Electrabel SA (“Electrabel”), a Belgian electricity company which is part of the French group, Suez (now GDF Suez), notified to the Commission a concentration consisting in the acquisition of de facto sole control over Compagnie Nationale du Rhône (“CNR”), the second largest electricity operator in France. 1 On 29 April 2008, the Commission cleared this concentration, as it did not raise any competition concerns. In this decision, the Commission left open the exact date on which Electrabel had acquired control over CNR, as that element had no impact on the competitive assessment in the case. One year later, in a decision of 10 June 2009 concluding proceedings initiated under Article 14 of the Merger Regulation (2), the Commission found that Electrabel had actually acquired de facto sole control over CNR as from 23 December 2003 and it imposed a fine of EUR 20 million on Electrabel. The Merger Regulation has created a system for the preventive control of mergers. Under the EU merger control system, a concentration with a Community dimension must be notified to the Commission before its implementation. (3) In addition, such a concentration cannot be implemented both before and after notification until it has been declared compatible with the common market (4). This latter provision is also referred to as the ‘suspension obligation’ or ‘standstill obligation’. The decision of 10 June 2009 finds that Electrabel had breached the standstill obligation, which was (1) The content of this article does not necessarily reflect the official position of the European Commission. Responsibility for the information and views expressed lies entirely with the authors. (2) In 2003, the old Merger Regulation (Council Regulation (EEC) No 4064/89) was still in force. It was repealed by the current Merger Regulation (Council Regulation (EC) No 139/2004) from 1 May 2004. The old Merger Regulation was in force at the time Electrabel acquired control of Compagnie Nationale du Rhône on 23 December 2003. Accordingly, the Commission’s infringement proceedings were conducted under the old Merger Regulation. (3) The obligation to notify a concentration with a Community dimension prior to its implementation is provided by Article 4 (1) of both the old and the new Merger Regulations. (4) The standstill obligation is contained in Article 7 (1) of both the old and the new Merger Regulations. 58 not time-barred at the time when the decision was adopted. (5) Ten years after the first infringement proceedings in the Samsung/AST and A.P. Møller cases, the Commission’s decision of 10 June 2009 strongly re-affirms that the standstill obligation is a fundamental rule and that the Commission will not tolerate its breach. The case is also an interesting – albeit fairly classical – application of the prospective analysis which the Commission undertakes in order to assess whether an undertaking acquires de facto control over another undertaking. The fundamental rule of the standstill obligation The standstill obligation is laid down in Article 7(1) of the Merger Regulation (6) which provides that a merger with a Community dimension may not be implemented until it has been declared compatible with the common market by a Commission decision or, in the absence of a decision, by expiry of the legal deadline. The standstill obligation also applies to public bids, since although the acquisition of shares is allowed, the acquirer is required to notify the concentration without delay and must not exercise the voting rights attached to the acquired securities before the Commission’s decision approving the concentration. (7) Derogations from this obligation are possible, but a derogation can only be granted by the Commission upon reasoned application of the party acquiring control. (8) In practice, the Commission grants such derogation only in exceptional circumstances, and it (5) See Regulation (EEC) No 2988/74 of the Council of 26 November 1974 concerning limitation periods in proceedings and the enforcement of sanctions under the rules of the European Economic Community relating to transport and competition. (6) Article 7 (1) of both Merger Regulations. (7 ) Article 7 (2) of both Merger Regulations. (8) Article 7 (3) of both Merger Regulations. Number 3 — 2009 Competition Policy Newsletter The standstill obligation, along with the obligation of prior notification which it complements, is one of the cornerstones of the EU merger control system, in that it enables the Commission to carry out an ex ante control of all concentrations with a Community dimension. Its existence also prevents a concentration that is already implemented and that gives rise to competition concerns from possibly damaging competition. Furthermore, if the parties to the concentration were allowed to implement a potentially problematic transaction prior to a Commission decision approving the concentration, this could make it more difficult to design effective remedies to the possible competition concerns at a later stage. This is why, under the terms of the Merger Regulation, the Commission can impose a significant fine (up to 10% of the turnover of the undertakings concerned) in the event of an infringement of the standstill obligation. (10) It is the first time that the Commission has imposed a significant fine for a breach of the standstill obligation since the EU merger control system entered into force in 1990. Although the Commission imposed fines for such an infringement twice in the past – in the Samsung/AST case in 1998 and in the A.P. Møller case in 1999 – these two precedents were the first such cases, and the amount of the fines was comparatively much lower (EUR 28,000 (11) and EUR 174,000 (12)). In imposing a significant fine, the Commission sent out a clear message to the effect that violating the standstill obligation is, by its very nature, a serious infringement which undermines the effectiveness of Community provisions on the control of concentrations. (13) Thus, in its decision the Commission emphasizes that the principle that a concentration implemented without authorisation does not give rise to competition concerns (as was the case for the concentration (9) Article 7(3) of the Merger Regulation requires that, when examining a request for derogation, the Commission takes into account inter alia the threat to competition posed by the concentration. Over the period 1990-2008, 101 derogations were granted and they concerned about 2.4% of the notified concentrations. It can be noticed that the trend of derogations granted has decreased from 2005: over the period 2005-2008, the derogations concerned 1.2% of the notified concentrations on average, while the average ratio was 3.2% for the period 1990-2004 (source: statistics published on the website of DG Comp). (10) Article 14 (2) (b) of both Merger Regulations. (11) Case IV / M.920 - Samsung / AST, Commission decision of 16 February 1998. (12) Case IV / M.969 – A.P. Møller, Commission decision of 10 February 1999. (13) See paragraph 188 of the Commission decision of 10 June 2009. Number 3 — 2009 Electrabel/CNR) cannot detract from the seriousness of the infringement. The presence of damage to competition would actually make the infringement even more serious. (14) The seriousness of an infringement of the standstill obligation is, of course, only the starting point when setting the fine. Indeed, in fixing the amount of the fine the Commission will take into account the possible additional factors of the gravity and also the duration of the infringement. Likewise, the Commission will also assess whether there are any mitigating and aggravating circumstances. Thus, in the Electrabel/CNR case, the Commission found other factors of gravity, namely that Electrabel is a large company with substantial legal resources, the acquisition of de facto control was foreseeable under a well-established decision-making practice of the Commission and there already existed precedents of fines for implementation before clearance. Also, the duration of the infringement was of at least three years and a half. Finally, in this case, the Commission did not find any aggravating circumstances and took into account the fact that Electrabel had disclosed the situation of sole control voluntarily and had answered the Commission’s questions. Prospective method for detecting de facto control As a consequence of the rule of the standstill obligation at the heart of a preventive merger control system, the acquirer of control cannot decide to detect its de facto control once the transaction has been implemented. In other words, the acquirer has a duty to assess the likelihood that it may acquire de facto control through a proposed transaction before the transaction takes place by using a prospective method. In the case at issue, it is worth mentioning that the Commission’s approach regarding the acquisition of de facto control has been fully in line with its past practice, as set out in various Commission communications. The background to the decision is that, on 23 December 2003, when Electrabel acquired from EDF a number of shares in CNR, it increased its shareholding from 17.86% of the shares and 16.88% of the voting rights to 49.95% of the shares and 47.92% of the voting rights of the CNR respectively. The second main shareholder was Caisse des Dépôts et Consignations (CDC), a French public institution, which held 29.43% of the shares and 29.80% of the voting rights. The remaining shareholding was (and still is) very dispersed, since about 20% of the (14) See paragraphs 192 to 194 of the Commission decision of 10 June 2009. 59 MERGER CONTROL ensures that the derogation will not impair the effectiveness of the EU merger control system. (9) Merger control shares and the voting rights were shared between around 200 public local entities. In addition, CNR’s Board of Directors comprised two representatives of Electrabel out of three, thereby giving Electrabel a majority on the Board. This was facilitated by a shareholder agreement signed by CDC and Electrabel in July 2003, which provided that, inter alia, CDC and Electrabel would vote together when appointing the representatives at the Supervisory Board and at the Board of Directors of CNR. At the time, Electrabel was also the sole industrial shareholder of CNR and, as such, had taken over the central role previously held by EDF in the operational management of CNR’s power plants and in the marketing of the electricity produced by CNR. (15) Electrabel did not acquire de jure sole control over CNR since, inter alia, it did not acquire a majority of the voting rights of CNR. Furthermore, such a possibility was prohibited by a French law – and this was still the case when Electrabel notified its acquisition of control over CNR in early 2008. (16) A minority shareholder can nevertheless acquire sole control on a de facto basis. Indeed, the Commission considers that this is especially the case when the acquirer is highly likely to achieve a majority at the shareholders’ meetings, taking into account the attendance of shareholders at the shareholders’ meetings in previous years. (17) In accordance with the Commission’s decision-making practice, the shareholders’ meetings have to be analysed over a period of at least the past three years. (15) Since 1948, CNR was bound by contract to EDF as regards the management of CNR’s hydroelectric plants. Moreover, EDF held one sixth of CNR’s capital and had a representative on its board of directors. In the context of the acquisition in 2001 of joint control over EnBW together with OEW (Commission Decision of 7 February 2001 in case COMP/M. 1853 – EDF/EnBW ) EDF undertook to ensure that CNR would be enabled to be an entirely independent electricity producer. To this end, EDF undertook, inter alia, not to exercise its voting rights at general meetings except through an independent proxy, to refrain from having a representative on the board of directors, and to purchase, until April 2006, upon request of CNR, part of its production as necessary to allow CNR gradual entry on the market. EDF also undertook to provide technical services to CNR for a transitory period, excluding functions related to the optimisation and the production of CNR. (16) Article 21 of Law No 2001-1168 of 11 December 2001 (the “Murcef law”) provides that more than 50% of CNR’s capital and voting rights must be owned by public entities. Thus, a private operator cannot hold more than 50% of CNR’s capital and voting rights. (17 ) See paragraph 14 of the 1998 notice on the concept of concentration under Council Regulation (EEC) No 4064/89 on the control of concentrations between undertakings. See also paragraph 59 of the Commission Consolidated Jurisdictional Notice under Council Regulation (EC) No 139/2004 on the control of concentrations between undertakings, adopted on 10 July 2007. 60 In the course of the procedure, Electrabel claimed that, on 23 December 2003, it could not have detected the existence of de facto exclusive control over CNR. According to Electrabel, it was not until June 2007, when it was in a position to examine the situation prevailing at the shareholders’ meetings of the CNR over the previous three years during which it had achieved a constant majority of voting rights, that it asked itself whether it had acquired de facto control over CNR. In its decision of 10 June 2009, the Commission rejected Electrabel’s method since “it would necessarily mean that a company could exercise de facto control (without notification or approval) over another company for three years before notifying the Commission of the operation, on the basis that it would not be absolutely sure that it was exercising control until the three years were up.” (18) Accordingly, if Electrabel had used a prospective method from December 2003, it would have easily detected that, on the basis of the attendance rates at the shareholders’ meetings of CNR of the preceding years and the fact that the remaining shares of CNR were widely dispersed, Electrabel - with 47.92% of the voting rights - was assured of a stable majority at the shareholders’ meeting of CNR as from December 2003. In addition, the Commission noted that, already from December 2003, Electrabel had had the majority on CNR’s Board of Directors, had been the sole industrial shareholder of CNR and, as such, had assumed the central role previously held by EDF in CNR. All these elements constituted a body of evidence showing that Electrabel’s de facto control over CNR had been easily foreseeable in December 2003. Conclusion By its decision of 10 June 2009, the Commission has shown – like its counterparts in other jurisdictions where such infringement proceedings are routinely pursued by national competition authorities – its commitment to enforce the obligations of prior notification and standstill obligations, which are at the heart of the EU’s preventive merger control system. The decision to sanction the infringement committed by Electrabel is also entirely in line with the Commission’s strict policy when granting derogations from the suspension obligation. At the same time, the Commission’s decision is a relatively conventional application of its long-standing practice as codified in communications of 1998 and 2007 on the acquisition of de facto sole control, and should come as no surprise to market participants. The significant fine imposed on Electrabel was carefully weighed to take into account all the circumstances of the case. (18) See paragraph 56 of the Commission Decision. Number 3 — 2009