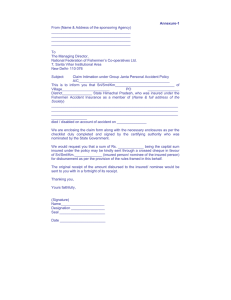

Group Salary Continuance Insurance Policy

advertisement