Solutions to selected exercise Exercise 1 Given the model y = Xβ + u

advertisement

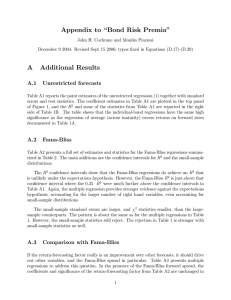

Solutions to selected exercise Exercise 1 Given the model consider the estimator y = Xβ + u ¢ ¡ ∼ iid 0 2 β = Ly −1 L = (X0 X) X0 + C • obtain the condition on C that guarantees unbiasedness of β (β | X) = (LXβ) the required condition LX= I is satisfied when CX = 0 • assuming that the conditions derived in (a) are satisfied compare the variance of β and β It easily shown that the variance of β is larger than the variance β In fact −1 (β | X) = 2 LL0 = 2 (X0 X) + 2 CC0 Exercise 2 Consider the model = + + ∼ (0 1) construct a test for the null = 0 = 0 assuming t=1,2 with (1 = 0 1 = 1) (2 = −1 2 = 0) compute the test for the null. Use the result: ³ ´ ³ ´0 b −β b − β X0 X β β 1 1 | X ∼ 2 (2) Exercise 3 You have available outputs of two regressions: a traditional CAPM for a given portfolio and a CAPM augmented with the Fama-Franch SMB factor for the same portfolio: (a) Derive the coefficient(s) of the OLS regression of _ on _ ˆ 0788 + 1067 ∗ = 1016 (b) Is it true that an F-test for the restriction C(3)=0 can be obtained by squaring the t-statistic on C(3) in the augmented regression? Can you derive an alternative form for the test using the Sum of Squared residuals from the two regressions? YES. y0 M2 y−y0 My − y0 My ∼ ( − ), (c) Do the above results lead to a rejection of the CAPM ? YEs becasue the two factor model statistically dominates the one-factore model (d) what is the semi-partial R2 of _ ? How would you interpret it ? 2 = 2 (1 − 2 ) = 076 − 052 ( − ) 2 Exercise 4 In the following table you have the results of two ARMA regressions run in EVIEWS. The first is obtained by issuing the command smpl 1980:1 2012:12 equation ar1.ls ger_stock_ret_2y c ar(1) ma(1) while the second one is obtained by running the command smpl 1980:1 2012:12 equation ar1.ls ger_stock_ret_2y c ger_stock_ret_2y(-1) ma(1) • Explain the differences in the outputs from the two different regressions. The two regressions are identical. in one regression the constant is rescaled to be the unconditional mean • Defining y = _ _ _2Indicate — ( | −1 ) = 006 + 096−1 + 010−1 ( | −1 ) = 007ˆ2 — ( | −2 ) = 006 + 006 ∗ 096 + 096ˆ2−2 + 096 ∗ 010−2 ( | −2 ) = 007ˆ2 (1 + 001) i h 2 1 +1 ) 2 — ( ) = 016 ( ) = 1 + (1− 2 1 • derive a test of the hypothesis that the constant in the first regression is equal to the mean of the dependent variable and discuss the statistical evidence that you obtain from the test . The null is obviously not rejected 3