Annual Report 2015-16

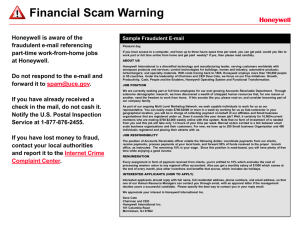

advertisement