Instructor: Katie Jaques Phone: 619-420-1958, cell 619-787-2116 SYLLABUS

advertisement

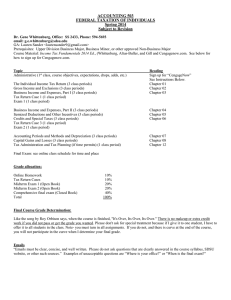

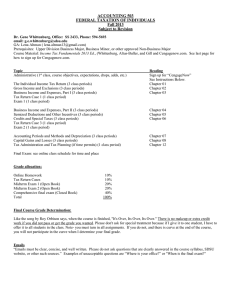

SYLLABUS ACCTG 656 - CALIFORNIA & MULTISTATE TAXATION FALL 2013 Instructor: Katie Jaques Office: SSE 2415, no regular hours, available by appointment Phone: 619-420-1958, cell 619-787-2116 Email: katiej_1958@yahoo.com Text: CCH California Tax Handbook, 2013 Edition; instructor-prepared outlines Course Outline See attached Reading Assignments See attached. Items marked "KMJ" are articles and outlines provided by the instructor and will be available on Blackboard. Be sure to check Blackboard at least two times a week for new material. Please download and print a hard copy of each week's instructorprovided material to bring to class. PowerPoint files will also be available for most topics. Be aware that the California Tax Handbook is not designed to be a text; it is a reference book. Other reference material is available through the Internet and RIA Checkpoint. Evaluation Examinations Two midterms, one final exam, all take-home, due as indicated on attached Course Outline True-false, multiple choice, some short answer essays, one research memo per midterm Each exam worth approximately 100 points -- some more, some less. True-false questions are worth 2 points each; multiple choice questions 3 points; research memos 21 points each. Problem-type questions Some questions will require research Exams are not cumulative, i.e., each test covers the topics studied in that part of the course. However, concepts learned in the early weeks are used throughout the course and will be reflected accordingly in the exams. Research memos will be graded in accordance with SDSU written communication rubric (available on Blackboard), except that we will use the Blue Book (see http://www.law.cornell.edu/citation/index.htm) rather than APA or MLA style for legal citations. 1 Homework Case analyses, problems, 2 or 3 comprehensive problems Hand in for checkoff, go over in class Points (equivalent to exam points) for substantial effort -- not for "right" answer Homework problems are worth 2 to 6 points each, depending on complexity Homework will be available on Blackboard. Letter grades will be calculated with and without homework points, and if the grades are different, the higher grade will be awarded. Doing the homework should help you do well on the exams, but not doing it will not directly impact your letter grade. MSA Program Goals MSA students will graduate with: Communication Skills Group/Interpersonal Skills Ethics Research Skills Global/International Skills Accounting 656 contributes to these goals through its student learning outcomes. At the end of this course, students should be able to: 1. Identify and distinguish among major types of state and local taxes 2. Identify the subject and the measure of a state tax, and distinguish between the taxpayer and the party that bears the economic burden of the tax 3. Distinguish between tax authorities and tax information 4. Analyze and distinguish among statutory, administrative, and judicial state and local tax authorities 5. Identify and locate sources of state and local tax information 6. Use RIA Checkpoint to research state and local tax questions 7. Explain the federal and state constitutional and statutory limitations on state taxation, and be familiar with some major judicial and statutory authorities 8. Explain the constitutional basis and the practical application of the unitary business principle, including the basic mechanics of combined reporting 9. Explain the provisions of the Uniform Division of Income for Tax Purposes Act with respect to the apportionment factors and the distinction between business and nonbusiness income, and distinguish particular state statutes from UDITPA 10. Explain how California tax laws are administered, including the protest and appeal process 11. Explain the relationship between the federal income tax law and state laws 12. Describe major differences between federal income tax law and California law for corporations, individuals, and flowthrough entities 13. Prepare a fairly complex non-apportioning California corporate franchise tax return 2 14. Prepare a simple California combined report 15. Explain the concepts of residence and source of income for individuals 16. Prepare a fairly complex California part-year resident individual income tax return 17. Explain the distinction between sales tax and use tax 18. Explain the major provisions of the California sales and use tax law ACADEMIC HONESTY The SDSU Standards for Student Conduct (http://www.sa.sdsu.edu/srr/conduct1.html) states that unacceptable student behavior includes “cheating, plagiarism, or other forms of academic dishonesty that are intended to gain unfair academic advantage.” Unprofessional conduct adversely impacts your fellow students, the accounting faculty, the Charles W. Lamden School of Accountancy, SDSU, and the accounting profession. The Charles W. Lamden School of Accountancy takes academic honesty very seriously and vigorously enforces university policy related to any such infractions. Any student suspected of academic dishonesty will be reported to the SDSU Center for Student Rights and Responsibilities; if found responsible, the student will receive no credit for any affected item. With respect to homework assignments in this course, collaboration with fellow students or colleagues is not only allowed but encouraged. In real life, that is an important part of a tax practitioner's work. Examinations are a different matter. All course materials and research facilities that are available to you may be used in completing exams; however, you are expected to do all of the work on your own without consulting with fellow students, instructors, colleagues, or any other individuals. I expect that no student will either give or receive assistance to or from any other person in completing examinations. Any student suspected of dishonesty will be reported to the SDSU Center for Student Rights and Responsibilities, and will receive no credit for any affected item. 3