SAN DIEGO STATE UNIVERSITY College of Health and Human Services

advertisement

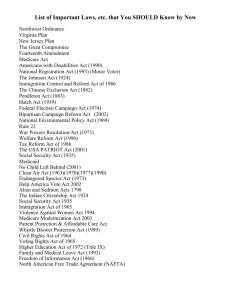

SAN DIEGO STATE UNIVERSITY College of Health and Human Services Graduate School of Public Health Division of Health Management and Policy PH 742B: Health Insurance and Financing Systems Fall 2011 3 Units Day: Time: Location: Schedule No.: E-mail: Office Location: Monday 1600-1840 COM-206 22339 akoch@mail.sdsu.edu HT-154 Instructor: Alma L. Koch, Ph.D. Office Hours: By appointment. Available evenings & weekends, and regular hours. Office Phone: (619) 594-5698 Home Phone: (619) 286-5229 COURSE DESCRIPTION U.S. healthcare financial systems at the macro-level. Overview of the 2010 Patient Protection and Affordable Care Act (aka Health Reform). Principles of public programs and private health insurance, types of reimbursement for healthcare organizations and providers, issues of cost containment, effects of uninsurance and underinsurance, and financial practices of other advanced nations. COURSE COMPETENCIES & LEARNING OBJECTIVES: The Division of Health Management & Policy is accredited by the Commission on Accreditation Healthcare Management Education (CAHME). Refer to the GSPH website and Blackboard HR140 for more details and a full listing of our CAHME program competencies. Following are the competencies that PH 742B fulfills. Competency A1: Discuss heath care organization and its relationship to access, quality cost resource allocation, accountability, and the health of patients and the community. Competency A2: Describe trends in health care expenditures, causes, and consequences on health and healthcare management. Competency A4: Identify revenue sources and reimbursement methods in the U.S. healthcare system, including historical origins and current policy. Competency A5: Compare and contrast various healthcare delivery models, including verious forms of managed care and fee-for service. Competency A6: Relate health disparities, lack of insurance, and changes due to health care reform to the challenges posed by delivering health care services to diverse populations. Competency A7: Describe the roles of legislation, and governmental , regulatory, professional, and/or accreditation agencies, including current legislative issues, in the U.S. healthcare system. 1 Competency C5: Describe the market characteristics of provider organizations from an economic perspective. Competency C9: Describe formulas and strategies used by healthcare organizations and the government for cost containment and revenue enhancement especially for Medicare and Medicaid. Competency C11: Compare alternatives for health care transformation and reform in the U.S. with other countries and individual state initiatives. Competency E4: Apply medical and business ethics to aid in decision making and analysis of health care problems and issues - expecially access, quality, and the cost of care. COURSE GOALS AND LEARNING OBJECTIVES [CAHME Competencies in brackets] By the end of this course, the student will be able to: 1. Describe the 2010 Patient Protection and Affordable Care Act (i.e., the health reform act) and its probable financial effects, both short term and long term, on critical aspects of health care in the U.S. [A1, A3, A6, A11, C5, C11, E4] 2. Discuss major topics in financing national health systems, comparing the American system to other approaches used internationally to finance health services. [A11, C11] 3. Critique traditional strategies for financing a health care system. [A2, A4, A5, A6, A7, E4] 4. Compare, contrast, and analyze reimbursement principles and procedures for financing health services, including: a. General health insurance concepts, [A1, A4, A6] b. Differentiation among types of health insurance—voluntary (i.e., private), social, and welfare, [A1, A2, A6] c. Tax policy, party politics, and their relationships to health financing, [A7] d. Precepts of Medicare and Medicaid, including major laws and regulations, [A4, A7, C5, C9] e. Reimbursement modalities and monetary incentives embedded in health insurance strategies, and their ethical consequences, [A6, C4, E4] f. Monetary incentives embedded in health insurance strategies, [ A4, C9] g. Pay for performance, [ A4, A7, C9] h. Financial organization of managed care, in its various manifestations, [A5] i. The idea of establishing global budgeting for health services. [A2, A3] 5. To distinguish among various public and private methods for financing health services by setting and provider type, both inpatient and ambulatory, [A2, A3, A4, A5] 7. To apply the principles of insurance in choosing a health insurance plan, as part of a written assignment. [B2, E4] 2 8. To intelligently discuss major health care financing issues of the day including, but not limited to health reform, cost containment strategies, humanitarian considerations, and evolving reimbursement schemes, such as the Medicare prescription drug benefit and IPPS “pay for performance” measures, and Accountable Care Organizations. [A1, E4] Prerequisites: PH 742A or the equivalent READINGS: Stephen J. Williams and Paul R. Torrens, Introduction to Health Services, 7th Edition. Chapters 4 and 5. Note that this is the 2007 edition. The first few weeks of the course will cover these chapters in depth. For those who no longer have this edition of book, a draft copy of the updated chapters will be made available on Blackboard. Journal articles and other readings will be copied from various sources. Readings are uploaded on Blackboard. Because of U.S. Health Reform, updates to the readings are expected. Details will be forthcoming in class and on Blackboard. Copies of Classroom-Use Materials The slides used in lectures will be distributed at regular intervals in PDF files via Blackboard. GRADING: Two examinations - a midterm and a final - will be administered. One written assignment dealing with health insurance selection will be required. The grading will be calculated as follows: Midterm Examination Final Examination Assignment Total 35% 35% 30% 100% HEALTH INSURANCE SELECTION ASSIGNMENT Due: Monday, November 28, 2011 Choose an individual health insurance policy. Here is the scenario. You are working in San Diego for a small employer in health care, with only 24 employees to insure. Your organization is making enough money and everyone wants health insurance, including the owner. The organization is besieged by lousy deals from "iffy" insurance brokers. In a fit of kindness, your employer announces the following plan. This is based on sales/marketing available on the internet directly from Blue Cross or Kaiser. Every employee may purchase an individual comprehensive insurance policy from either Blue Cross or Kaiser. The employee may insure his/her spouse, legal domestic partners, and children (or the employee only). The company will pay 50% of the monthly premium up to $300 a month, whichever is lower. For example, if you choose a plan with a $350 premium per month, the company will pay $175 and you will pay $175. If you choose a plan that is $625 per month, the company will pay $300, and you pay $325. 3 You are insuring for general health only, including prescription drugs. No dental, no vision. You may choose any individual plan that you want, even catastrophic (if it makes sense financially). You may choose any individual plan from Kaiser or Blue Cross. Here are the web addresses to use: http://www.kaiserpermanente.org/ http://www.bluecrossca.com/ You will not use any brokers unless instructed to by the Blue Cross or Kaiser websites. Write an assessment of your selection, evaluating the following factors: Size and composition of your family as of 01/01/09. Or you may invent a “fantasy family” or project your presumed family composition a few years into the future. Just make it clear that you have done so. However, if you create an outlandish example, and say that you are making $300,000 in your first job, and can afford anything, think again. Anticipated health/medical needs and risk factors. Financial factors including (1) the premium price of the plan per month and per year (2) anticipated copayments and deductibles, (3) and the net cost to you (i.e., the total cost minus the employer contribution). You must display the differences among costs for three plans selected. Tables are nice, especially if they are well organized. The location of providers, including hospitals and physicians. Please be sure to select a plan for your expected area of residence in San Diego County. (Kaiser may not cover every zip code.) The features of the plan, including benefits, copayments, and any other factors that are important to you. The reputation of the health plan, including timeliness of referrals, reimbursements to you (if applicable). Features of unselected plans that turn you off (for example, benefits that you'd just as soon not pay for). Written Assignment: Discuss your general criteria for selection. Then choose three plans for further research and comparison. Briefly discuss your reasons for choosing these three plans in the first place. Then select one plan, giving detailed reasons why you chose this plan over the others. You can choose any plan available in your area. The 3 plans that you choose to compare may affect your grade. For example, you can choose one HMO and compare the various premium options. But if you take this route, the assignment may not be challenging (that is, worthy of a high grade), especially if the decision is a no-brainer. Extending the example, it would not be much of a challenge for a 25 year old, healthy, single woman to choose a the cheapest Kaiser 4 plan and take her chances on staying healthy—not mounting up out-of-pocket payments). So try comparing HMO plans offered by both companies, or compare the HMO to the PPO or the MSA. You are not allowed to take any gambles that you can’t cover with money. If you choose a lowpremium PPO plan with a high deductible and high copayments, you must have access to the money to cover the deductible and activate the policy. In other words, you must convince me that this is a sound choice that you can cover financially. Medicare Savings Accounts (MSAs fall in this category.) Suggested length: 5 double-spaced pages. Needlessly long papers will be downgraded. *Any real life health factors or “fantasy family” details that you wish to include will be kept in strict confidence. With that said, don’t disclose any deep, dark secrets that should remain confidential—secrets that you should discuss only with your physician or attorney, for examples. GRADING SCALE FOR COURSE Total Points Assigned Grade 94-100 A 90-94 A- 87-89 B+ 84-86 B 80-83 B- 77-79 C+ 74-76 C 70-73 C- F <70 Course Syllabus Subject to Change Every effort will be made to follow the syllabus content and schedule; however, if circumstances dictate there may be modifications necessary during the semester. If such is the case, the professor will notify students via Blackboard. 5 COURSE CALENDAR Week 1 2 3 4 5 6 7 8 Date 08/29 09/05 09/12 09/19 09/26 10/03 10/10 10/17 9 10 11 12 13 14 10/24 10/31 11/07 11/14 11/21 11/28 15 12/05 16 12/12 Topic Introduction to Health Insurance LABOR DAY: No Class Actuarial Principles of Health Insurance Health Spending and Cost Containment Social Health Insurance Private Health Insurance Health Reform Act of 2010, Financing health reform MIDTERM EXAMINATION; Film #1: Who Pays for Mom and Dad? Long-Term Care Financing Principles Medicare Financing Principles Medicare Pay for Performance, HMO Reimbursement Medicaid Benefits and Financing Principles Medicare Physician Reimbursement Financing Health Reform Health Insurance Selection Assignment Due. MD Reimbursements Systems Worldwide Single Payer Systems with Global Budgeting, International Financing Systems FINAL EXAMINATION 1600-1800 Required Readings by Week and Topic (Subject to Revision) Wk 1 2 3 Topic Introduction to Health Insurance: risk, moral hazard, selection bias. Introduction to the Patient Protection and Affordable Care Act Health Reform Act of 2010 LABOR DAY Readings CAHME Competency ”Financing Health Services,” Williams A2 and Torrens, Introduction to Health C5 Services, 7th Edition, 2007, Chapter 4. C11 E4 No Class Actuarial Principles of Health Chapter 4 continued. Insurance; Social Health Insurance: revenues, premiums, ratings, equity, individual vs. group risk assessment. 6 A1 A4 C5 4 5 6 Health Spending and Cost Containment: national health expenditures, revenue contributors, provider expenditures, major dollar trends in health insurance. Public vs. private sector trends vs. overarching social goals. Basic methods of reimbursement. Micah Hartman, et al. Heath Spending Growth at a Historic Low in 2008. Health Affairs, January 2010. Social Health Insurance: Principles of Taxation, Social Security principles, Medicare Reimbursement Principles and Benefits Private Health Insurance: Taxonomies, revenue distribution, uninsurance and underinsurance trends and causes Chapter 4 continued 7 Patient Protection and Affordable Care Act Health Reform Act of 2010: Sequencing of funding and insurance changes. Accountable Care Organizations. 8 Midterm Exam; 9 10 A1 A2 E4 Henry J. Aaron, “Should Public Policy Seek to Control the Growth of Health Care Spending?” Health Affairs, January 2003, W3 28-36. Medicare and You, 2010. A1 A5 A7 C9 ”Health Insurance,” Williams and A1 Torrens, Introduction to Health A2 Services, Chapter 5. A4 A6 E4 A1 Compilation of the Act (974 pages for A2 reference) C11 E4 Issue briefs from Kaiser Family Foundation Film, "Who Pays for Mom and Dad? Long-Term Care Financing Principles and their ethical and social consequences. Medicare Reimbursement Chapter 4, pp. 97-101 Principles: Medicare Inpatient Prospective Payment System (IPPS),various provider payment schemes and formulas. Relationship to Federal health reform reimbursement and other state models. Medicare HMO payment, Medicare P4P article TBD. Pay for Performance Randall S. Brown, et al. Do Health Maintenance Organizations Work for Medicare? Health Care Financing Review, 15(1):7-23. Fall 1993. 7 A1 A7 E4 C9 C11 A5 A7 C5 11 Medicaid Financing and Benefits; Relation to Health Reform Chapter 4 Readings from CMS A5 A7 C9 C11 12 Medicare Physician Reimbursement: Resource Based Relative Values. Hsiao, William C., et al., “Results and Impacts of the Resource-Based Relative Value Scale.” Medical Care, 30(11):NS61-NS79. November 1992. A1 A6 C9 E4 Levy, Jesse M. et al., “Understanding the Medicare Fee Schedule and its Impact on Physicians Under the Final Rule.” Medical Care, 30(11):NS80NS94. November 1992. 13 Organizing Health Reform: Accountable Care Organizations. Kaiser Family Foundation: Assorted Issue Briefs A1 C5 C11 14 MD Reimbursement Systems and their relationship to the continuum of managed care. Chapter 5, Section on Managed Care & HMOs Reinhardt, Uwe E., “The Compensation of Physicians: Approaches Used in Foreign Countries.” Quality Review Bulletin, pp.366-377. December 1985. A1 A4 A5 A7 15 Single Payer System with Global Budgeting: Germany Reinhardt, Uwe E., “West Germany’s Health Care and Health Insurance System: Combining Universal Access with Cost Control” A Call for Action: Final Report of the U.S. Bipartisan Commission on U.S. Health Care. Washington, D.C., U.S. Government Printing Office, September 1990. pp. 316. Reinhardt, Uwe E., “Global Budgeting in German Health Care: Insights for Americans.” Domestic Affairs, pp. 159-194. Winter 1993/94. C11 E4 8 COURSE POLICIES Missing class. A student who is unable to attend a lecture should get impeccable notes from another student or a tape of the lecture. Readings may support or refute material given in lectures, and without lecture notes, you won’t know what is what. If you miss a class, it is your responsibility to contact the instructor, to obtain lecture notes, handouts, other materials or instructions from the course Blackboard site or a classmate. Missing an Examination. Examinations will never be given in advance of the scheduled date and time of the exam. In extenuating circumstances, makeup examinations will be administered as soon as possible. In the case of final examinations, a student missing the exam may be given an “Incomplete” grade until the exam is made up. Religious holidays The University Policy File includes the following statement on absence for Religious Observances: “By the end of the second week of classes, students should notify the instructors of affected courses of planned absences for religious observances.” Testing. Once a test begins, students are not to leave the classroom until he or she has completed the examination. Needs should be attended to prior to the examination. The Final Examination will not be comprehensive per se, but the student is expected to know basic material in the first part of the course in order to understand and answer questions on the final exam. Extenuating circumstances. If severe difficulties (e.g., illness, injury, death of a family member) prevent you from completing an assignment on time, please contact the instructor to discuss alternative arrangements. Computers. Every student must have access to the internet and a computer in order to obtain communications from the professor, download reading material and conduct document searches of on-line publications. Safety. Students are encouraged to consult with SDSU public safety regarding parking and other safety issues. Late at night, students are encouraged to walk to their destinations in groups of two or more. Academic misconduct by a student shall include, but not be limited to: disrupting classes; giving or receiving unauthorized aid on examinations, reports or other assignments; knowingly misrepresenting the source of any academic work; falsifying research results; plagiarizing another’s work; violating regulations or ethical codes for the treatment of human subjects; or otherwise acting dishonestly. If an instance of academic misconduct is suspected, the student will be informed of the infraction and the penalty to be imposed. If appropriate, the matter will be referred to the Director of the GSPH and Assistant Dean of the College of Health and Human Services for mediation. Potential sanctions include a warning, an admonition, censure, reduction of grade (including a grade of F for the course), disciplinary probation, suspension, or expulsion. Statement on Nondiscrimination Policy San Diego State University complies with the requirements of Title VI and Title VII of the Civil Rights Act of 1964, as well as other applicable federal and state laws prohibiting discrimination. 9 No person shall, on the basis of race, color, or national origin be excluded from participation in, be denied the benefits of, or be otherwise subjected to discrimination in any program of the California State University SDSU does not discriminate on the basis of disability in admission or access to, or treatment or employment in, its programs and activities. Students should direct inquiries concerning San Diego State University’s compliance with all relevant disability laws to the Director of Student Disability Services (SDS), Calpulli Center, Room 3101, San Diego State University, San Diego, CA 92128 or call 619-594-6473 (TDD: 619-594-2929). SDSU does not discriminate on the basis of sex, gender, or sexual orientation in the educational programs or activities it conducts. More detail on SDSU’s Nondiscrimination Policy can be found in the SDSU General Catalog, University Policies. Student Conduct and Grievances SDSU is committed to maintaining a safe and healthy living and learning environment for students, faculty and staff. Sections 41301, Standards for Student Conduct, and Sections 4130241304 of the University Policies regarding student conduct should be reviewed. If a student believes that a professor’s treatment is grossly unfair or that a professor’s behavior is clearly unprofessional, the student may bring the complaint to the proper university authorities and official reviewing bodies. See University policies on Student Grievances. Statement on Plagiarism and Academic Dishonesty Academic dishonesty includes cheating, plagiarism or other forms of academic dishonesty that are intended to gain unfair academic advantage. See section 41301 of the University policies. Plagiarism is an important element of this policy. Plagiarism is defined as ‘formal work publicly misrepresented as original; it is any activity wherein one person knowingly, directly and for lucre, status, recognition, or any public gain resorts to the published or unpublished work of another in order to represent it as one’s own’. Any work, in whole or in part, taken from the Internet or other computer-based source without referencing the source is considered plagiarism. 10