PA 450: Fiscal and Budgetary Policy - Spring 2015

advertisement

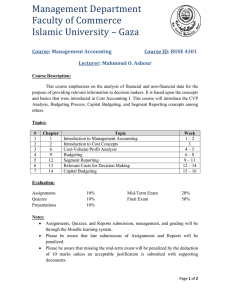

PA 450: Fiscal and Budgetary Policy - Spring 2015 Instructor: Douglas Newland, CPA. Where and When: South Calexico Campus Room A-003; W 07:25 – 10:05 p.m. Course Description and Purpose Policies of fiscal administration and budgeting; political implications of the governmental budget process; revenue, debt and treasury management; the functions of accounting and financial reporting. Course Learning Objectives This course explores the complexity of the fundamental principles of public budgeting in four general ways from examples in all three levels of government (Federal, state and local): 1. A survey of literature that defines the structural foundation of revenue generation including income, sales and property taxes, user charges, grants-in-aid and other income as well as strategies and best practices in the allocation, management and financial control of budgeting. 2. An examination of the budgetary process identifying the roles of each of the major actors/institutions (the agency, the executive, the legislature and special interest groups) in budget preparation, including budgetary reform.. 3. Analyze the politics of the budgetary process which makes budgeting in the public sector unique 4. The course will also deal with the skills and techniques associated with public budgeting, and capital budgeting and evaluation techniques. The team project required is in capital budgeting or special project budgeting. Texts There is one required text as well as articles that will be made available on Blackboard Mikesell, John, Fiscal Administration: Analysis and Applications for the Public Sector 9th edition, Boston, Wadsworth Publishing, 2013 Please note this book can be rented. Course Requirements Participation Student preparation and participation is required. Students are expected to be prepared for every class. This expectation includes reading the material assigned for that week before the scheduled class. The instructor reserves the right to change or supplement the reading assignments or schedule as the situation dictates. Journal Participants are required to keep a journal. Each week beginning with the second week, you will be required to journal. The journal will include your observations of related news accounts or observations related to the theories being studied and identified for that week on the syllabus. Spelling, grammar and writing skills will be graded. 1 The instructor reserves the right to change or supplement the reading assignments or schedule as the situation dictates. TestThere is a final open book test. I expect you to interpret the information from your notes and text, not copy or repeat the lecture. All answers should be unique and I should become familiar with your thoughts. It is recommended that you attempt at least one or two of the problems at the end of each chapter in preparation for the test in addition to homework. Homework- There are four (4) homework assignments. Each is due the date specified in the syllabus. The instructor reserves the right to change or supplement the reading assignments or schedule as the situation dictates. ProjectPresentations are during the last two class periods. Each group of students selects an approved topic. Describe the process to get the object of your project to completion. Include as many aspects of fiscal administration and budgeting that apply. The instructor reserves the right to change or supplement the reading assignments or schedule as the situation dictates. Grade Components: Final Exam Homework In class quiz Journal Attendance Project Participation 20% 20% 5% 15% 5% 30% 5% 100% Grading: 94-100 A 90-93 A- 87-89 B+ 83-86 B 80-82 B- 77-79 C+ 73-76 C 70-72 C- 67-69 D+ 63-66 D 60-63 D- 0-62 F Plagiarism and Cheating You must cite (use APA style) the author and the source of any quotes or any paraphrase of someone else’s work in your paper. Those who do not cite quoted work may receive a fail on the paper and a warning or referral for possible suspension, probation or expulsion. 2 Accommodations Students who need accommodations of their disabilities should contact me privately to discuss specific accommodations for which they have received authorization. If you have a disability please contact me after you have contacted the Student Disability Services at 760.768.5509. Course Outline and Reading Schedule Jan 21: Introduction to Fiscal and Budgetary Policy Syllabus review Some comments and discussion on the current state of affairs. Get to know each other Jan 28: Logic of the Budget Process and Social Decisions Read Mikesell Chapters 1 & 2 Journal Topic: “Dillon’s Rule” Feb 4: Budget Structure and Institutions Read Mikesell Chapters 3 Homework: Chapter 2 problems 2 & 5 page 85-86 Journal Topic: “Entitlements” Feb 11: Budgeting Methods and Practices Read Mikesell Chapter 4 & 5 Journal Topic: “Budget Enforcement Act” Journal Due Feb 18: Budget Classifications, Systems and Reforms Read Mikesell Chapter 6 Homework: Chapter 4 problems 1 & 3 page 173-174 Journal Topic: “Zero Based Budget and SALY (same as last year)” Feb 25: Capital Budgeting Read Mikesell Chapter 7 Journal Topic: “Pay-As-You-Go” & “Bidding” Mar 4: Revenue - Taxation: State and Income Taxes Read Mikesell Chapter 8 & 9 Homework: Chapter 7 problems 3,4,6 & 8 page 338-340 3 Journal Topic: Tax Equity and Compliance Journal Due Mar 11: Tax Structures: Sales Tax Read Mikesell Chapter 10 Journal Topic: Effective tax rates & Excise Tax Mar 18: Taxation – Property Taxes Read Mikesell Chapter 11 Journal Topic: Tax Year & Tax Lien Journal Due Mar 25: Revenue – User fees, Charges & Public Monopolies Read Mikesell Chapter 12 Journal Topic: Fiscal Monopoly Mar 3– Apr 3: Spring Break Apr 9- No Class – Meet on Budget Projects Apr 15: Revenue Forecasting, Estimates and Expenditures Read Mikesell Chapter 13 Journal Topic: Revenue Forecasts and Expenditures Homework Chapter 12 problem 1 & 5, Chapter 13 problem 6 Apr 22: Debt Administration and Intergovernmental Fiscal Relations Read Mikesell Chapter 14 &15 Journal Due Apr 29: Project Presentations May 7: Project Presentations/Final The instructor reserves the right to change or supplement the assignments or schedule as the situation dictates. 4