An industry perspective on carbon emission pricing Rick Hyndman

advertisement

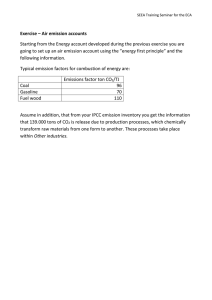

An industry perspective on carbon emission pricing Carbon Pricing and Environmental Federalism Conference Queen’s University, October 17-18, 2008 Rick Hyndman Senior Policy Advisor, CAPP Canada’s GHG 2020 & 2050 Emission Objectives 2006 BEFORE 2020 Target AFTER 2050 Target Complex Issue, Confusing Labels Free Access to allocation Offsets 100% Cdn Federal cap & trade Warner Lieberman “Cap & Trade” Access to Offsets Yes US SO2 Alberta Cap &Trade P set directly No 0 “Carbon Tax” BC Carbon tax 2008 100% of target RGGI Phase 1 of WCI Confusing labels: carbon tax label is dead Carbon Tax Born 2008 Died 2008 RIP Complex issue: Emission pricing design IS rocket science Artistic depiction of String Theory’s Multiple Dimensions Image:Calabi-Yau.png, Wikipedia And yet …… At its heart, emission pricing is very simple Emission pricing is taxation Currency of the tax is either $ or an emission permit The $/tonne price is set INDIRECTLY, if the tax is levied in Govt- issued emission permits Environment Canada The $/tonne price is set DIRECTLY, if the tax is levied in Canadian $ CANADA Une/One Tonne CO2e GHG Policy Compliance Certificate 1 The P v. Q issue is: Do we set the policy price of CO2: Directly Orderly, simple, clear and predictable way $/tonne Time or Indirectly Volatile, complex, costly and unpredictable way Setting the price indirectly via a permits market is separate from emission trading Alberta cap & trade system has: a directly set (default) price of CO2 AND Emission trading among covered facilities and ability to use offsets for compliance Allocation Facility targets: emissions taxed if above target, credits if below target Free distribution of permits Recycling of revenue Design First, Bundle Later Break design into single policy elements Emission pricing element: using price system to drive decentralized decisions Income and wealth effects based on the incidence of pricing 4 categories of emissions with different patterns of incidence of emission pricing 1. Upstream oil and gas production emissions (and other industries with resource rent) Prices are set internationally independent of Canadian costs Carbon costs on production emissions not covered by border adjustments are ultimately borne by resource owner through reduced resource rent 2. Trade-exposed industry with significant life-cycle emissions Requires border adjustment to allow incidence to flow to consumers 3. Electricity Costs passed through to consumers, incidence varies regionally with energy supply patterns 4. Other, end use consumption emissions Roughly common patterns of consumption across regions, though heating energy is a question ALLOCATION is about INCIDENCE Competitiveness is an incidence question Border adjustments can shift incidence to end users 125 $/unit 100 75 50 25 0 -25 High Seas Import Price net of carbon cost Carbon cost Domestic Export Border adjustment Without Border Adjustments, need to address incidence via allocation Intensity targets for emission intensive, trade-exposed sectors Might be possible in some sectors to accomplish via international performance benchmarks For other emission sources, recycling should address differences in regional and sectoral incidence Key differences: Electricity generation Resource industries Recycling methods: Federal income tax reductions Replacement of GST Per capita grants Won’t do it Mixed federal – provincial policy Provincial Electricity Resource industries Energy intensive industry unless covered by border adjustments Federal Transportation Broad energy use THE KEY POLICY & EMISSION PRICING ISSUE $/tonne CO2 2020 Emissions Objective Uncertain emission cost curve = Choice of emissions & costs $100 Where the govt says it wants to be $15 What the public currently supports Emissions mT CO2e 576 721 2006 Actual 800 2020 BAU