ACCTG 202: Managerial Accounting Fund Fall 2012

advertisement

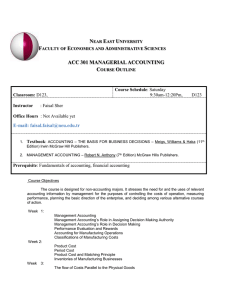

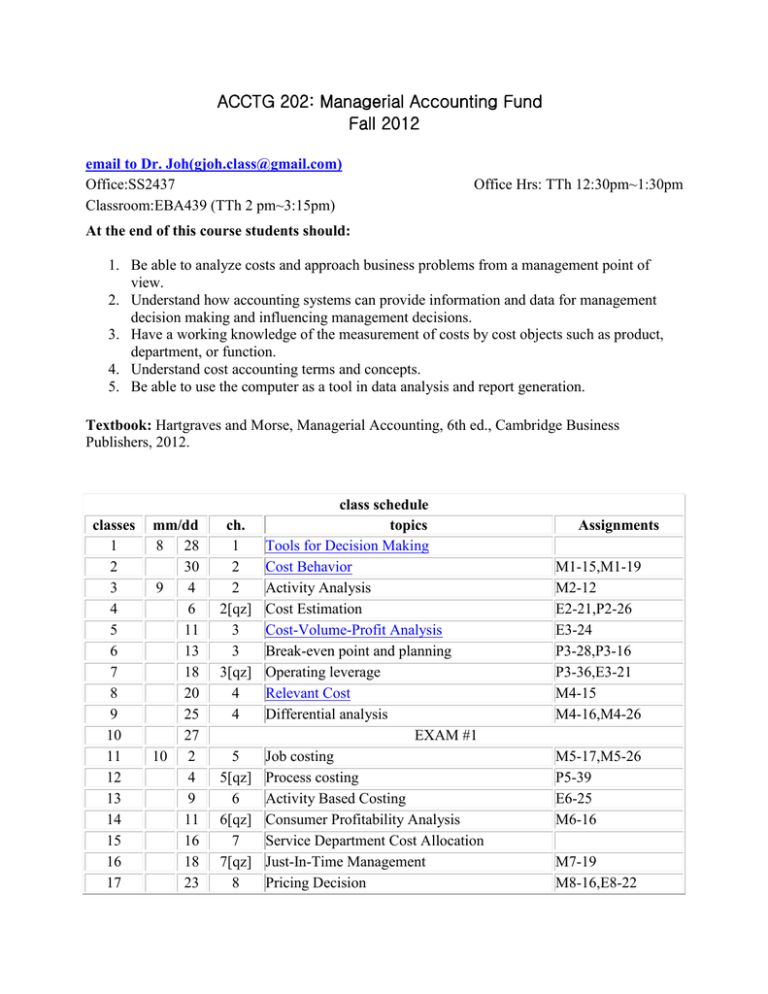

ACCTG 202: Managerial Accounting Fund Fall 2012 email to Dr. Joh(gjoh.class@gmail.com) Office:SS2437 Classroom:EBA439 (TTh 2 pm~3:15pm) Office Hrs: TTh 12:30pm~1:30pm At the end of this course students should: 1. Be able to analyze costs and approach business problems from a management point of view. 2. Understand how accounting systems can provide information and data for management decision making and influencing management decisions. 3. Have a working knowledge of the measurement of costs by cost objects such as product, department, or function. 4. Understand cost accounting terms and concepts. 5. Be able to use the computer as a tool in data analysis and report generation. Textbook: Hartgraves and Morse, Managerial Accounting, 6th ed., Cambridge Business Publishers, 2012. classes 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 mm/dd 8 28 30 9 4 6 11 13 18 20 25 27 10 2 4 9 11 16 18 23 ch. 1 2 2 2[qz] 3 3 3[qz] 4 4 5 5[qz] 6 6[qz] 7 7[qz] 8 class schedule topics Tools for Decision Making Cost Behavior Activity Analysis Cost Estimation Cost-Volume-Profit Analysis Break-even point and planning Operating leverage Relevant Cost Differential analysis EXAM #1 Job costing Process costing Activity Based Costing Consumer Profitability Analysis Service Department Cost Allocation Just-In-Time Management Pricing Decision Assignments M1-15,M1-19 M2-12 E2-21,P2-26 E3-24 P3-28,P3-16 P3-36,E3-21 M4-15 M4-16,M4-26 M5-17,M5-26 P5-39 E6-25 M6-16 M7-19 M8-16,E8-22 18 19 20 21 22 23 24 25 26 27 28 29 30 11 11 12 25 30 1 6 8 13 15 20 27 29 4 6 13 8 Target Costing E8-24 Exam #2 9 9[qz] 10 10[qz] 11 11 11[qz] 12 12 12 Budgeting Flexible Budgeting Standard Costing Performance Reporting Segment reporting Transfer Pricing Balanced Scorecards Capital Budgeting Models Time-Value Capital Budgeting Non Time-Value Capital Budgeting Final Exam (1pm~3pm) M9-17,E9-25 M9-18 E10-26,M10-18 E10-29,E10-28 M11-17 E11-24 M12-16 E12-11 [qz]: chapter review quiz. Course Policies: The pre-requisite for the course is Accounting 201 or its equivalent, with a minimum grade of C. No make-up examination will be permitted except for reasons of illness where the instructor is notified in advance of the scheduled exam and the student supplies a letter from a physician explaining the nature of the illness. I retain the right to retain any class related materials prepared by students. Each significant contribution during class discussion is rewarded by a bonus point card. A few examples of "significant contribution" are "to ask appropriate questions helping the class understand the content," "to show a better and creative approach to cases or problems." Each bonus card is worth one multiple choice question in the next exam. You may not sell or buy the card or use the bonus card to raise your score above 100%. Assignments are due by the beginning of each class: for example, M2-12 must be turned in between 1:50pm through 2:00 pm September 4th. No late submission or early submission will be accepted. Each submission must be hand-written (NOT typed) unless it requires otherwise. You only get a credit for doing the homework in good faith. Any homework with a score below 5 (out of 10 possible points) is considered not done in good faith. Each assignment is graded mainly based on the effort that you put, not by the correct answers. No two submissions should look similar. If you are not available during the class to answer how you did the assignment, your submission is assumed done not in good faith either. On finishing each chapter, there may be a review quiz. Out of the eight scheduled quizzes, the worst two scores will be dropped. The class average for this course has typically been in the 2.2 - 2.7 range. You may assess your performance based on the traditional grade cutoffs of 93%=A, 90% = A-, 87%=B+, 83% = B, 80%=B-, 77%=C+, 73% = C, 70%=C-, 60% = D, and below 60% = F. I may curve the final grades if necessary, based on the class average and the academic standards for the course. Incompletes will be given only in the RAREST of circumstances and according to university policy. There will be no opportunity to raise your course grade by doing "extra credit" work during or after the end of the semester-that would violate University policy. Course Assessment: Assignments Exam 1 Weights 20% Exam 2 30% Final Exam 30% In-class Quizzes (Best 6 out of 8) 10% Homework (22) 10% Total 100% Office Hours I encourage each of you to take advantage of my regularly scheduled office hours to discuss problems and to seek assistance when needed throughout the semester. I would like to talk to each of you at least once. If you cannot make it to my regularly-scheduled office hours, feel free to schedule an individual appointment with me. It is my job to help you learn and succeed in this class, and I will help whenever possible. In an effort to make the class successful for all students, please provide me feedback on how the course is going and how you feel you are doing in the course. I can make this class more successful if I hear from you about what you do and do not understand. I welcome your feedback during office hours and via e-mail. Grading questions or appeals DO NOT WAIT UNTIL THE END OF THE SEMESTER TO TAKE ACTION ON GRADING ISSUES. BY THAT TIME IT WILL BE TOO LATE! If you feel there exists a grading error on any of the above grade components, or if you feel you need to bring to my attention other facts or circumstances that might affect the grade for that item, you will have one week from the date the grade is posted on Blackboard or the graded item is redistributed back to the class (whichever is earlier) to take such action and have the matter resolved. If for whatever reason you are not in class on the day the graded item is available for pickup, the one-week period will still begin on that day. Dishonesty Policy: Cheating on any exam or class assignments will result in a zero for that activity. A definition of "cheating" is found in the SDSU Student Policies Manual, Section 01:10:01 on cheating, plagiarism and facilitating academic dishonesty. Executive Order 969 mandates that faculty report all incidents of academic dishonesty to the Center for Student Rights and Responsibilities. http://csrr.sdsu.edu. Fulfillment of assigned projects must represent the original work of each student. Plagiarism is not appropriate.