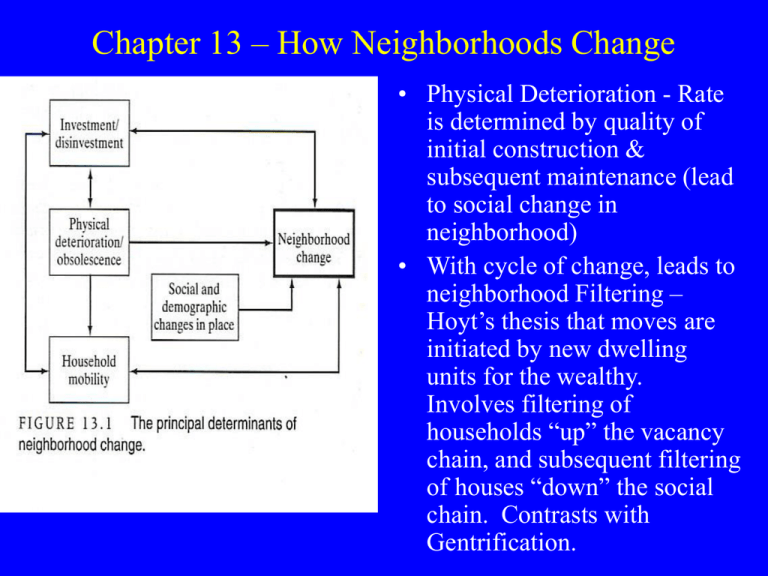

Chapter 13 – How Neighborhoods Change

advertisement

Chapter 13 – How Neighborhoods Change • Physical Deterioration - Rate is determined by quality of initial construction & subsequent maintenance (lead to social change in neighborhood) • With cycle of change, leads to neighborhood Filtering – Hoyt’s thesis that moves are initiated by new dwelling units for the wealthy. Involves filtering of households “up” the vacancy chain, and subsequent filtering of houses “down” the social chain. Contrasts with Gentrification. Neighborhood Life Cycles 1. Suburbanization 2. In-filling 3. Downgrading 4. Thinning Out 5. Renewal or Rehabilitation and Gentrification Urbanization and the Housing Tenure Transformation in the US • Home ownership in US is one of biggest influences on the social and cultural evolution of American urban life. • After WWII, homeownership became the dominant form of tenure in the US (Thanks to the GI bill) – Homeownership rose from 20% in 1920s to 44% in 1940 to 60% in 1960 and 66% in 1980 and 68% in 2000 Why? 1. Increasing affluence of common people, plus innovations allowed for economies of scale in building activities (cookie cutter homes versus custom built) 2. Recognition of homeownership – social status, part of American Dream of individual property rights; achieving residential segregation, which led to social and political strategies; allowed financial benefits through equity gains. Encouraged social mobility on housing “ladder”; able to fulfill familistic lifestyles 3. Economic and Political Significance-Downpayment to bank allowed pools of capital for banks to lend for other uses (industrial projects, other mortgages, etc). Also consumer consumption of furniture, lawn care, and so on -Homeownership led to a regulatory economic mechanism (key element in Keynesian Economic management). Interest rates on mortgages used an a lever to boost or slow the economy Benefits of US Homeownership Continued • Homeownership promoted social and political stability – Idea that the more people have a “stake” in private property market the less likely they are to threaten economic and political stability. Helps eliminate the “alienated tenant” psychology. “Locked into a mortgage!” • Savings and Loans Institutions evolved to perpetuate this cycle. S&L Institutes gained special privileges in terms of corporate tax laws & taxation. • Could deduct the interest on mortgage from income and also exemption of equity gains from capital gains laws 4. Sharp decline in the profitability of Rental Units – Enforcement of rigorous building standards and housing codes eliminated cheap rental units; slow rise of income of tenants; rent control legislation during WWII; continued deterioration of rental stock (Victorian housing); taxation policies did not encourage maintenance of rental properties; decrease in demand for rental properties Jane Jacobs – Urban Wisdom • In Jane’s eyes, how should we begin to learn about cities? • Why is messiness and disorganization important to a city? • What do you think are the most important 20points of this documentary? • What is your home’s walkability score? Go to (http://www.walkscore.com) to find out! Housing Markets • Since 1980s and early 1990s general decline in home ownership • Legacy of stagflation beginning in 1970s (prices rose, but incomes were stagnant). • Housing prices rose faster than rate of economic inflation due to increased material costs and finance costs. By 1983 homeowners had to use 20 % more of their income towards their mortgages. • Led to a housing affordability crisis. • Some people tried to take advantage of the rise in home values by becoming ‘house poor’. “Getting into the Game” Housing Markets • By early 1980s, homeownership rose to 36% of median income. • 1980-1986 – Overall proportion of U.S. households buying homes decreased – 1st time since Great Depression. • New rental units rose from 196,000 in ’80 to 365,200 in ’85. – Beginning signs of moving back to CBD, change in family status, and DINKS. • By 1990s, homeownership & housing starts rebounded. Ratio of housing prices to income increased, but ratio of mortgage payment to income decreased, due to lower interest. • Housing affordability improved, but (Beginning of “Housing Serfs”) • Rise in homeownership in lowest 20% of income bracket, but gap between Americans of European ancestry and all other Americans narrowed slightly • Subprime mortgages in low income neighborhoods rose from 6.8% to 13.4%. • Housing affordability among renters also improved in 1990s. • However, by 2001, poorest 20% of renters (9.9 million) outnumbers lower cost rentals by 2 million. • Builders are choosing to build market rent units or have paid off federally subsidized mortgages. • Continued demolition of existing public housing from Urban Renewal era without one-for-one replacement. Housing Market Gatekeepers • In Chapter 11, we talked about “City Makers”. After structures have been built, we have “exchange professionals” who facilitate residential mobility: • Realtors, mortgage financiers, insurance agents, appraisers, landlords and so on. • Called “Social Gatekeepers” • Why? • Real estate Agents – income based on commission – want high priced, high turn-over property. Practice “Steering” • Mortgage Finance ManagersChief alliance is to investors, not to borrowers. Look for low risk, stable return. Usually rent to other married middle class men. • “Redline” areas of the urban that have minority groups, female headed households, and people with unconventional lifestyles. Housing Market Gatekeepers • Redlining become a selffulfilling prophecy of neighborhood decline • Series of laws enacted in the late 1960s, 1970s and 1980s to eradicate redlining, but still exists. • Insurance Agents – A potential homebuyer must obtain property insurance before a lender will ensure a mortgage. • Harder to obtain in central city than suburbs – older wood homes, wiring, theft and so on. • Leads to higher insurance rates for inner city homes. Gentrification • Gentrification – a physical, economic, social and cultural phenomenon that involves the invasion of the middle class (or higher) into central city neighborhoods that were once working class. Process replaces or displaces many of the original inhabitants. • Involves rehabilitation of a highly devolved housing stock. Upgrading meets the standards and lifestyles of new owners. Houses in the area go through significant price appreciation. • Renters to Owners • Found in World Cities and Regional Nodal Centers