Footloose Capital and Productive Public Services Pasquale Commendatore

advertisement

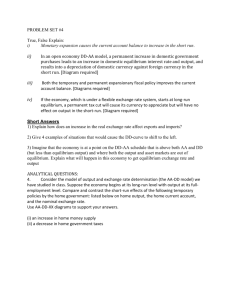

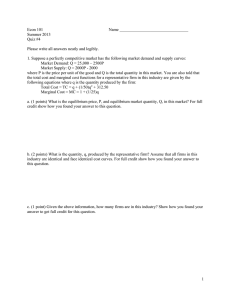

Footloose Capital and Productive Public Services Pasquale Commendatore Ingrid Kubin Carmelo Petraglia Forthcoming in: “Geography, Structural Change and Economic Development: Theory and Empirics”, Salvadori N., Commendatore P. and Tamberi M. (Eds), Edward Elgar Publishing 2 Outline Motivation and Aim Basic Framework Short-run equilibrium Capital movements and long-run equilibrium The impact of public services on industrial location Conclusions 3 Motivation and Aim European Cohesion Policy is inconsistent since it sometimes seems to target agglomerations of industrial activities in core regions, but more often stimulates their relocation in the periphery (Brakman et al. 2005). Such a criticism provides a motivation to analyse policy issues in New Economic Geography (NEG) models, which mainly focus on the determinants of the spatial location of the manufacturing industry 4 Motivation and Aim We aim to study the impact of such policies on the spatial distribution of economic activities within a NEG model What are the agglomeration and dispersion effects induced by policy measures aimed to make backward regions more attractive to foreign firms? Does the result depend on the financing scheme of such policies? In Commendatore et al (forthcoming Èconomie Internationale) focus on long-run equilibrium location In this paper: focus also on the dynamic process 5 Basic Framework 2 trading regions (r = 1,2) 2 sectors in each region: • Agriculture (A): perfect competition • Manufacturing (M): monopolistic competition (“i” varieties of a composite good) 2 factors of production: • K is inter-regionally mobile (K owners are immobile) • L is inter-regionally immobile (intra-regionally mobile) A central government provides public services which enhance labour productivity in M 6 Agriculture Constant return to scale sector 1 unit of labour = 1 unit of output 7 Manufacturing sector 1 unit of capital & βr units of labour = 1 unit of output Decreasing average costs: TCr ( xi ) F wM r xi n=K number of (firms=) varieties in regions 1 & 2: n1,t t n t K n2,t (1 t )n (1 t )K 8 Transport costs Agricultural good traded costless across regions Transport costs for manufacturers in “iceberg” form: • 1 unit shipped, 1/T arrives, where T≥1 Trade Freeness Prohibitive tc T 0 1 No tc 1 9 Government 1 unit of agricultural good = 1 unit of H Hrβr f (H ) r r ; f ’ <0, f ’’>0 H financed taxing residents’ income Balanced budget constraint: TB = H TB s H TB (1 s )H 1 F 2 F sF = share of public expenditures financed by residents in region 1 10 Consumption and Expenditure Utility function (household j; j = 1 .. L) 1 A M where 1 11 N 11 CM xi ; σ>1 U C C i Total expenditure in manufactured goods: M w L w L H A A M M 11 Regional Expenditure Regional expenditures in manufactured goods: Given: sK = share of capital owned by capitalists living in region 1 sL = share of workers located in region 1 M s w L w L s TB 1 L A A M M K 1 M 2 (1 sL )wA LA wM LM (1 sK ) TB2 M1 sE M region 1’s relative market size 12 Short-run equilibrium regional allocation of private capital (λ) is given Perfect mobility of workers between sectors: wA wM w Agriculture: pA w 1 Manufacturing sector: pr r 1 pr depends on the allocation of H 13 Short-run equilibrium The higher H1 (given H2), the cheaper manufactured goods in region 1: p1 p p2 ph where 2 f ( H 2 ) and h h 0 H 1 f ( H1 ) 1 14 Short-run equilibrium Demand = supply in region 1 and region 2: 1 sE 1 M sE q1,t d1,t t 1 t z t 1 t z p K q2,t d 2,t 1 M sE 1 sE 1 z 1 z t t t t pz 1 K zh 1 and z 0 H1 15 Short-run equilibrium Short-run equilibrium profits in regions 1 and 2: 1 sE 1 M sE 1,t t 1 t z t 1 t z K 2,t z M sE 1 sE t 1 t z t 1 t z K 16 Capital movements and long-run equilibrium The incentive to move capital is based on relative profitability: R t 1,t 2,t 17 Capital movements and long-run equilibrium if 0 t 1 Z t F t if 1 if F t 0 0 F t 1 F t 1 where R t 1 F t t t 1 t t R t 1 t 18 Capital movements and long-run equilibrium In the long-run, profits across regions equalize Interior fixed point 0 <λ*<1: 1 (1 )(1 ) 1 (1 z )( z ) z sE 2 (1 z )( z ) 2 (1 )(1 ) z * Boundary (CP) fixed points 0 and 1 19 z 1 z 0.98 1 sE 2 20 The impact of public services on industrial location * ( z 2 1)(1 2 ) z 12 sE 1 sE z 2 2 H1 (1 z ) (z ) H1 (1 z )( z ) H1 >0 <0 ? “Productivity effect” Positive sign: ↑ H1 region 1 is more attractive because of the lower labour input requirement relative to region 2 “Demand effect” the sign depends on how H1 impacts on the relative market size of region 1 (sE = M1/M) 21 The impact of public services on industrial location The impact on H1 on sE depends on the distribution of the tax burden across the two Regions: sF = sL the demand effect = 0 sF > sL the demand effect is negative sF < sL the demand effect is positive 22 The impact of public services on industrial location sL = 0.5 ; sK = 0.25 ; σ = 4 ; μ = 0.5 ; Ф = 0.2 ; sE < 0.5 region 1's share of capital λ* 1 sF 0.5 sF = sL sF > sL sF 0.55 0.5 sF 1 0 0 sF = 1 0.5 provision of public services in region 1 H1 1 23 0.3 0.23 1 sE 2 24 Conclusions The overall effect of an increase in productive public services on industrial location has been decomposed into two effect: • Firms attracted by lower input requirements (productivity effect), while higher taxation tend to shrink the local market, leading firms to relocate elsewhere (demand effect) • The demand effect is nil only if tax payers of the richer region contribute on the basis of their capacity 25 Conclusions Further results • dynamics of capital movements (stability of industrial location equilibria under alternative degrees of economic integration) • policy analysis extended to a dynamic context 26