DEPARTMENT OF ECONOMICS MAY 4, 2012 SAN JOSE STATE UNIVERSITY

advertisement

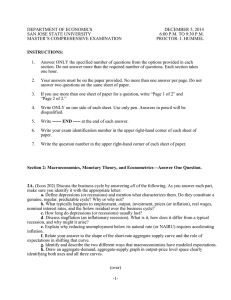

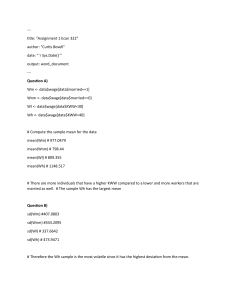

DEPARTMENT OF ECONOMICS SAN JOSE STATE UNIVERSITY MASTER’S COMPREHENSIVE EXAMINATION MAY 4, 2012 6:00 P.M. TO 9:30 P.M. PROCTOR: J. HUMMEL INSTRUCTIONS: 1. Answer ONLY the specified number of questions from the options provided in each section. Do not answer more than the required number of questions. Each section takes one hour. 2. Your answers must be on the paper provided. No more than one answer per page. Do not answer two questions on the same sheet of paper. 3. If you use more than one sheet of paper for a question, write “Page 1 of 2” and “Page 2 of 2.” 4. Write ONLY on one side of each sheet. Use only pen. Answers in pencil will be disqualified. 5. Write ------ END ----- at the end of each answer. 6. Write your exam identification number in the upper right-hand corner of each sheet of paper. 7. Write the question number in the upper right-hand corner of each sheet of paper. Section 2: Macroeconomics, Monetary Theory, and Econometrics—Answer One Question. 2A. (Econ 202) Answer either a or b but not both: a. Discuss the business cycle. Is it really a regular cycle? What typically happens to employment, output, prices, real wages, and the Solow residual over the cycle? Make sure you define depressions (or recessions) and mention what characterizes them. How long do depressions (or recessions) usually last? Then discuss stagflation (an inflationary recession). What is it, how does it differ from a typical recession, and why might it arise? Why does reducing unemployment below its natural rate (or NAIRU) require accelerating inflation? Be sure to relate your answer to the shape of the short-rate aggregate supply curve and the role of expectations in shifting that curve. b. Discuss and graph the Solow growth model. What are its underlying assumptions and its conclusions? How consistent with empirical reality is the model, and how would Austrian capital theory critique it? Then briefly explain endogenous growth theories. What variable do they make endogenous and how do they relate to the Solow model? (over) -1- DEPARTMENT OF ECONOMICS SAN JOSE STATE UNIVERSITY MASTER’S COMPREHENSIVE EXAMINATION MAY 4, 2012 6:00 P.M. TO 9:30 P.M. PROCTOR: J. HUMMEL 2B. (Econ 235) Analyze the impact of changes in the money stock on interest rates. Does the Federal Reserve actually set interest rates? Explain in detail why the effects in the short term differ from those in the long term, and what are the implications for a monetary policy that targets interest rates? Give a formula for the Taylor Rule and describe how it deals with these implications? You may use diagrams if you wish. 2C. (Econ 203) Consider the following results from a sample semi-log wage regression: -----------------------------------------------------------------------------ln(hourly wage) Coef. -------------+---------------------------------------------------------------yrs of education 0.10 educ * female 0.02 yrs of experience 0.01 female = 1 -0.50 white = 1 0.08 married = 1 0.08 married * white = 1 0.05 union = 1 0.16 lives in west region = 1 0.001 lives in metro area = 1 0.13 constant 0.45 -----------------------------------------------------------------------------a. What are the necessary assumptions for the error term to estimate the coefficients using ordinary least squares? b. Provide an interpretation of education coefficient and the education * female interaction term based on the semi-log form. Do the same for the married and married*white coefficient. c. Describe the base group in interpreting the dummy variables. Provide the wage differentials for the four groups of married and white. d. Estimate the log wage for a recent college graduate (educ = 16) with no work experience who is a non-white married female living in a metropolitan area in the west and does not belong to a union. e. Demonstrate and explain one way to test the hypothesis that the return from education is the same for males and females. f. Draw a graph using residuals that would suggest heteroskedasticity with respect to the union variable. State and explain the steps of a test for determining heteroskedasticity. -2-