Document 18007628

advertisement

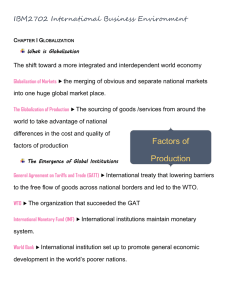

The conventional economics view… ◦ “Every individual seeks the most advantageous employment for his capital…. ◦ “Study of his own advantage necessarily leads him to prefer that employment most advantageous to society” - Adam Smith, 1776 Models from economics generally assume that if everyone pursues self-interest, things will work out for good ◦ May assume adherence to some straightforward ethical principles Free Trade occurs when a government does not attempt to influence, through tariffs, quotas, or other means, ◦ what citizens can buy from other countries or ◦ produce and sell to other countries The Benefits of Trade allow countries to be richer by specializing in products they can produce most efficiently The history of government involvement in trade presents mixed evidence ◦ There are lots of problems with trade There may be some ways that some governments can make things better by intervening (that is, by not practicing free trade) ◦ But government intervening in free trade is definitely dangerous Restrictions on trade have kept some countries very poor contributed to huge depressions Till the 16th century, philosophers didn’t theorize much about trade Then mercantilists sought what we now call ‘development,’ teaching that a nation’s wealth depends on accumulated “treasure” ◦ Gold and silver are the currency of trade Mercantilists argued their countries should run a trade surplus ◦ Maximize export through subsidies ◦ Minimize imports through tariffs and quotas Flaw: “zero-sum game” ◦ Mercantilists neglected to see the benefits of trade Adam Smith argued (Wealth of Nations, 1776): Capability of one country to produce more of a product with the same amount of input can vary ◦ A country should produce only goods where it is most efficient, and trade for those goods where it is not efficient Trade between countries can, therefore, benefit both sides ◦ Example: Portugal/wine vs. England/wool ◦ Ghana/cocoa vs. South Korea/rice As people specialize and seek higher incomes, they may learn to do their specialties better Suppose one country is more efficient than another in everything? There are still global gains to be made if a country specializes in products it produces relatively more efficiently than other products David Ricardo (Principles of Political Economy, 1817): ◦ A country should import products for which it is relatively inefficient even if the country is more efficient in the product’s production than country from which it is buying Trade is a positive-sum game Theory of Comparative Advantage Countries have comparative advantage in goods for which the opportunity cost of production is relatively low ◦ That is, those that can be produced by giving up relatively little in production of other goods This means your country has comparative advantage in the product or service where the ratio Resources required in your country . Resources required in the other country is low Ghana has absolute advantage in both cocoa and rice, but its comparative advantage is in cocoa. Cocoa Korea has comparative advantage in rice . 20 tons 15 tons 5 tons Ghana Korea 10 tons 3.75 tons Let Korea specialize in rice – Ghana expands cocoa production to replace all Korean cocoa production lost Then Ghana can replace all Korean cocoa production and the countries have more of both goods. 15 tons Rice The country less efficient in everything will be poor … But it would be even poorer if it did not trade This argument leaves money out of the discussion entirely ◦ It’s designed to show there can be benefits from trade even for poor countries This is a very simple case, but the basic conclusions are generally valid and are used in setting international policy ◦ We’re assuming no transportation costs ◦ We’re simplifying by not talking about currencies ◦ We’re assuming constant returns to scale ◦ We’re assuming resources can move freely from production of one good to another ◦ We’re not thinking about effects on income distribution In a money economy under free trade, the country that is less efficient will have low wages It will be able to sell the products where it has comparative advantage without any special tariff or subsidy protection ◦ But it may need to work on infrastructure, institutions, and education for trade China, India both sell cheap manufactured goods China sells more because it has better transportation infrastructure and government that supports manufactured exports Immobile resources: ◦ Resources do not always move easily from one economic activity to another So some rice farms will persist in Ghana no matter what (Rice farmers will be losers as cheap rice comes from Korea) Diminishing returns: ◦ Diminishing returns to specialization suggests that after some point, the more units of a good the country produces, the greater the additional resources required to produce an additional item They believed that if people were left to trade on their own, they would naturally trade the goods in which their countries had comparative advantage ◦ “Every individual seeks the most advantageous employment for his capital…. ◦ “Study of his own advantage necessarily leads him to prefer that employment most advantageous to society” - Adam Smith, 1776 They didn’t advocate that government ensure that the right kind of trade take place They believed that if governments put no barriers in place, businesspeople would make the right kind of trades because it would be in their economic interest. When Intervention May Help Infant industry ◦ Oldest argument for protection - Alexander Hamilton, 1792 ◦ Hamilton said that US textile & machinery industries were ‘infants’ They needed protection to give them time to learn to be competitive If given time, they would learn to compete ◦ WTO rules allow countries to protect infant industries Infant industry protection is only good if it helps the industry become efficient Japanese automakers – were protected with ‘infant industry’ tariffs for 20+ years, became world leaders Brazil automakers – world’s 10th largest auto industry – wilted when protection eliminated In industries with high fixed costs: ◦ Specialization increases output, ◦ The ability to achieve economies of scale increases through exporting ◦ Learning effects are high. These cost savings come from “learning by doing” In many industries, world demand will support few competitors Successful firms may emerge because of “First-mover advantage” ◦ Economies of scale may preclude new entrants ◦ Role of the government becomes significant Some argue that it generates a need for government intervention and strategic trade policy When Intervention May Help Strategic trade policy ◦ Government should use subsidies to protect promising firms in newly emerging industries with substantial scale economies ◦ Governments may benefit if they support domestic firms to overcome barriers to entry created by existing foreign firms Airbus in Europe Didn’t work for U.S. in flat panel displays For economists, the key point is the power of free trade Free trade is more efficient almost all the time Free trade (open economies): ◦ Free trade might increase a country’s stock of resources (as labor and capital arrives from abroad) ◦ Increase the efficiency of resource utilization inside each country as well as between them Paradox: US exported labor-intensive goods when it had lots of capital The U.S. seems to be good at inventing new products The important factors may be highly specialized ◦ Software design engineers Or the U.S. may have a unique constellation of factors that produces new products Production of the new products tends to be labor intensive at first ◦ The U.S. imports older, heavy industrial products Development of the World Trading System Intellectual arguments for free trade ◦ Adam Smith and David Ricardo 1776-1820s Free trade emerged gradually as government policy in Britain, the leading nation in the 19th century ◦ Repeal of the Corn Laws (1846) allowed free trade in food ◦ Leading European nations maintained free trade through late 19th Century to WW I Development of the World Trading System Great Depression ◦ US stock market collapse (1929) Partial recovery ◦ Congress adopted the Smoot-Hawley tariff (1930) Almost every industry had its “made to order tariff” Foreign response was to impose own barriers Everyone’s exports tumbled ◦ Depression continued almost till World War II Development of the World Trading System No one wanted to repeat the mistakes of the 1930s General Agreement on Tariffs and Trade (GATT) - multilateral agreement established in 1948 under US leadership ◦ Big conference at Bretton Woods, NH, during WW II ◦ Objective was to liberalize trade by eliminating tariffs, subsidies, and import quotas ◦ 19 original members grew to 120 Development of the World Trading System GATT used ‘rounds of talks’ to gradually reduce trade barriers ◦ Mutual tariff reductions negotiated ◦ Dispute resolution only if complaints were received Uruguay Round GATT 1986-93 The World Trade Organization The WTO was created (1995) during the Uruguay Round of GATT to police and enforce GATT rules Most comprehensive trade agreement in history Formation of WTO had an impact on ◦ Agriculture subsidies (stumbling block: US/EU) ◦ Applying GATT rules to services and intellectual property ◦ Strengthening of monitoring and enforcement