Welcome to Benedictine University Financial Aid 101: Funding a College Education

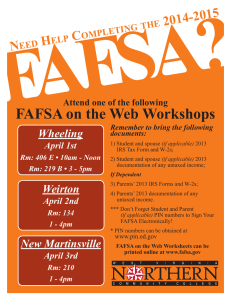

advertisement

Welcome to Benedictine University Financial Aid 101: Funding a College Education 2015-2016 Award Year 1 What is Financial Aid? Funds provided to students and families to help pay for a postsecondary education. Financial aid is the bridge between the family’s ability to pay for that education and the costs associated with obtaining it. 2 The role of Financial Aid The primary responsibility to fund a student’s postsecondary education lies with the student and his/her parents. Families are evaluated based on their present financial condition. 3 Types of Financial Aid Gift assistance: Scholarships and Grants Self-help: Direct and Private Loans and Employment/Federal Work-Study Financial Aid may be awarded based on Merit, Need or Entitlement. 4 Sources of Financial Aid Institutional – Colleges and Universities Federal Government – US Dept. of ED. State Government – ISAC Private: companies, labor unions, religious organizations, fraternities or sororities, community organizations, civic groups, etc. 5 Institutional Aid Scholarships can be awarded to the student based on Merit (GPA, ACT score, etc) Some may have GPA requirements Some may have enrollment requirements BenU funds are applicable towards Fall & Spring Contact your admissions counselor with questions about eligibility 6 Federal and State Aid-Grants Federal Pell Grant – Award can be up to $5,775* per academic year *on a 0 EFC. Higher EFC will result in less Pell funds. Federal SEOG (Supplemental Educational Opportunity Grant) – Award ranges from $500 to $4,000 per academic year – Student must be Pell eligible 7 Federal and State Aid-Grants (cont.) ISAC MAP Grant (Illinois Monetary Award Program) – Full award amount $4,720* – Based on 15 credit hour enrollment – File your FAFSA early for priority awarding *Estimated 8 Federal Loans Loans Offered for the student: – Direct Subsidized Stafford Loan – Direct Unsubsidized Stafford Loan – Perkins Loan Loans Offered for the parent: – Direct Parent PLUS Loan 9 Direct Loan information Direct Loans are low-interest loans for students and parents to help pay for the cost of a student's education after high school. The lender is the U.S. Department of Education rather than a bank or other financial institution. Students borrow directly from the federal government and have a single contact for everything related to the repayment of their loans. Student can choose from several repayment plans and you can switch repayment plans if your needs change. Learn more at Direct Loans on the Web at: www.Direct.ed.gov 10 Federal Loans (cont.) Subsidized Stafford Loan – Maximum award amount $3,500 – Award based on NEED – Fixed interest rate of 4.66%* – 6 month grace period before repayment – No interest accumulates during enrollment * 10-year Treasury note yield + 2.05% (Capped at 8.5%) 11 Federal Loans (cont.) Unsubsidized Stafford Loan – Maximum for dependent students $5,500 – Fixed interest rate at 4.66%* – 6 month grace period before repayment – Interest will accumulate * 10-year Treasury note yield + 2.05% (Capped at 8.5%) 12 Federal Loans (cont.) Perkins Loan – Amounts can vary – Fixed interest rate of 5% – 9 month grace period 13 Federal Loans (cont.) Parent PLUS Loan – Amount ranges $1,000 up to COA – Fixed interest rate of 7.21%* – Parents can request to have the loan deferred until the student has graduated. – Credit checks information – not score * 10-year Treasury note yield + 4.6% (Capped at 7.9%) 14 Federal Work Study Federal Work Study – Need based financial aid – Not applied directly to tuition – Earned financial aid Students can work in a variety of jobs to earn FWS funds. 15 Determining Aid How much money will I receive? 16 Determining the COA Your COA is the amount it will cost you to go to school. Most colleges calculate your COA to show your total cost for the school year (for instance, for the fall semester plus the spring semester). Tuition and Fees + Room and Board + Books and Supplies + Transportation + Misc. Expenses ------------------------------------------= Total Cost of Attendance (COA) 17 What is the EFC? The Expected Family Contribution (EFC) is a number on a scale from 0 to 999,999. The EFC is not the amount of money that your family must provide. Think of the EFC as an index schools use to determine how much financial aid you may receive if you attend their school. 18 Financial Need Financial need differs from school to school and is determined using the COA at those institutions. 19 Financial Need Financial need is used to help determine the student’s eligibility for “need based” aid. Need based aid includes: Federal & State grants, Direct Subsidized Stafford Loans, Perkins Loans, and Federal Work Study 20 How the COA works COA $10,000 Financial NEED EFC 2500 EFC 2500 21 INTERMISSION The presentation will resume in 10 minutes Coming up…. The Financial Aid Application Process 22 Financial Aid Application Process 23 FAFSA Overview 24 What is the FAFSA? The FAFSA (the Free Application for Federal Student Aid) is the first step in the financial aid process. You use it to apply for federal student aid, such as grants, loans and work-study. In addition, most states and schools use information from the FAFSA to award students non-federal aid. The FAFSA is used to calculate the Expected Family Contribution (EFC). 25 www.fafsa.gov 26 New applicants complete 2015-16 27 The importance of filing early Many schools will award on a first complete, first awarded basis. Some State and Federal aid programs have limited funding. Illinois State deadline: To be determined The FAFSA can be completed with estimated information and updated later. 28 Helps and Hints box… The Help and Hints box displays additional information on your currently selected question. Unsure of how to answer? Look at the box to the right during the application! 29 When filling out the FAFSA… Be sure to use the Previous and Next buttons on the application itself. Do not use your browser’s back button! Any time during the process you can save the application and log back in to finish. Benedictine University Code: 001767 30 Financial Aid Application Process Step 1: Students and Parents apply for PIN at www.pin.ed.gov The PIN Application Process consists of 3 steps: 1: Enter Personal Information Name, SSN, address, email, etc. 2: Submit Your PIN Application 1 to 3 days processing time 3: Receive Your PIN It will be sent to your provided e-mail. Never share your PIN with anyone! 31 www.pin.ed.gov 32 FSA ID – April 2015 FSA ID – replacement for PIN Used to log into FAFSA, Studentloans.gov, NSLDS, and other Federal aid sites. Process will be live April 2015 PIN will still work for 2015-16 Aid Year 33 Financial Aid Application Process Step 2: Complete 2015-2016 FAFSA online at: www.fafsa.gov Select 2015-2016 FAFSA Begin entering the student’s information… Things you will need: • Student & Parent 2014 Taxes &W2’s • Assets and bank information • About 20 minutes • Estimated data can be used 34 FAFSA Sections Student Demographics School Selection Dependency Status Parent Demographics Financial Information Sign & Submit Confirmation 35 Student and School Student Demographics – Name, DOB, and SSN – Males 18-25 must register for the Selective Service to receive FSA funds School Selection – Up to 10 schools can be entered – Schools can be removed and others added 36 Dependency status and Parent information Dependency Status – Determines if you need to enter parental info – Under 23 and Independent? Additional info may need to be submitted to confirm your status. Parent Demographics – Parent information – Primary support – Number in the Home and College: Separate from taxes – Unable to provide info? You can still submit. 37 IRS Information Retrieval You can download your filed 2014 Tax information directly from the IRS after February 1st 2015. Enter your PIN and Link To IRS 38 IRS Information Retrieval Once transferred, questions with tax information will be marked with “Transferred from the IRS” It’s important that you do not adjust the transferred data. 39 Important reminders Financial Information – SNAP SHOT as of today If you used the IRS tool, many fields will already be completed. Paperwork to have on hand – 2014 tax information – W-2’s – Bank statements – Investment information 40 Information on Assets and Investments Assets that should be included: – Mutual Funds, CD’s, Stocks, Bonds, 529 Savings plans, Trust funds, money market funds, etc… – Net worth of real-estate and rental property, second or summer homes. Assets that should NOT be included: – Family’s principal home / farm – Value of Life insurance plans – Retirement plans, pension funds, annuities, etc… Business value: Value minus debt Remember to be realistic and only list present value. 41 Submitting your FAFSA Sign & Submit – Sign with a PIN (instant processing) – Sign on paper (7-10 days) – Submit with no signature (longer process) Confirmation – Once you receive a confirmation number, the application is submitted. – Processing time is 1-3 days 42 Submission - Confirmation Page You can retain a copy of this page for your records. This page is proof of your submitted FAFSA application. DRN: Data release number. 43 After you are done… 44 After you are done… A few days after you complete your FAFSA, you will get your Student Aid Report (SAR). The SAR summarizes the information you submitted on the FAFSA. You can access the SAR on FAFSA.gov, updating the FAFSA if needed. 45 After you are done… The school will cross reference admission records with FAFSA applications to determine a student’s aid eligibility. 46 What to expect next… Verification - Should the student be selected for verification, additional documents will be requested by the Office of Financial Aid. Typically this could include: – – – – IRS Tax Return Transcripts - www.irs.gov/transcript W-2’s for the student and parent if applicable. A signed verification worksheet. Other documents may be requested by the Office of Financial Aid on an individual basis. Students will receive a letter letting them know what they will need to submit. Submit the documents as soon as you can! 47 Award Notification: The Award Letter If the student is accepting all awards as offered, keep award letter for your records. If the student is declining or adjusting awards, sign and return award letter reflecting adjustments. Students must indicate any outside awards and scholarships on the award letter. 48 www.StudentLoans.gov 49 How to Apply - Student Step 1: Federal Loan Entrance Counseling – Read the content and answer the questions – Read the Borrower's Rights and Responsibilities Step 2: Federal Loan Master Promissory Note (MPN) – You will be required to enter: • Your personal information • Two references for the loan • Federal PIN to sign the MPN – Keep going until you receive a confirmation The Office of Financial Aid will access your completed MPN and counseling and set up dates for the transmission of loan funds. 50 How to Apply - Parent Step 1: Request a PLUS Loan – Credit Check application – Requested Loan amount Step 2: Federal Loan Master Promissory Note (MPN) – You will be required to enter: • Your personal information • Your student’s information • Federal PIN to sign the MPN – Keep going until you receive a confirmation The Office of Financial Aid will access your completed MPN and counseling and set up dates for the transmission of loan funds. 51 Appealing your Financial Aid A completed FAFSA is not set in stone. If the student or parent has extenuating circumstances that can / will result in a change to the family’s ability to support the student, an appeal can be submitted. The appeal process may require additional time and documentation. 52 Things to Remember! Applying for Financial Aid is a separate process from Admissions and Housing. Students must complete the FAFSA application every year to be eligible to receive Federal Student Aid. Do not assume you are too poor to go to college or too rich to receive aid. Always apply to get your answer. Apply as early as possible! Some aid programs can run out of funding. 53 The changing landscape Having a College Plan: Graduation is closer than you think! After college: repayment and loan forgiveness. – Legal? – Teaching? – Public Service? 54 You & your student FERPA: Federal Education Rights and Privacy Act Importance of checking the mail (and email!) Personal fiscal responsibility Your adult student 55 Financial Aid Resources from the Government The US Department of Education www.studentaid.gov youtube.com/FederalStudentAid Illinois Student Assistance Commission www.isac.org Federal Trade Commission www.ftc.gov/scholarshipscams 56 www.StudentAid.gov 57 Financial Aid Workshops ISAC – Before college outreach isac.org/students/before-college/financial-aid-planning The primary goal of ISAC's outreach efforts is to help families navigate the steps of the college admission and financial aid processes. Check out the list of events in Illinois for the one nearest you on Outreach Activities Calendar. All events listed are open to the public. 58 Surf the Net! – Scholarships Schools will allow you to add outside scholarships to your existing financial aid package. The only stipulation is that you do not exceed the cost of attendance. Take some time and surf the Internet...it just might pay off! The College Board www.collegeboard.com FinAid.Org www.finaid.org College.Net Mach25 www.collegenet.com/mach25 Free Scholarship Search www.freschinfo.com College Quest www.collegequest.com College Answer www.collegeanswer.com College Connection www.collegescholarships.com Scholarships.com www.scholarships.com Fast Web www.fastweb.com Cappex College Search www.cappex.com/scholarships 59 Questions? Students and parents can contact us with questions during the week by visiting the office, email, or by phone. No appointments are necessary! 60 Contact Us Office of Financial Aid Lownik Hall, Main Floor 5700 College Road Lisle, IL 60532 (630) 829-6100 FinancialAid@ben.edu www.ben.edu/fa Monday – Friday: 8:30am – 5:00pm 61 Thank your for joining us! Financial Aid 101: Funding a College Education 62