Piece of Mind

advertisement

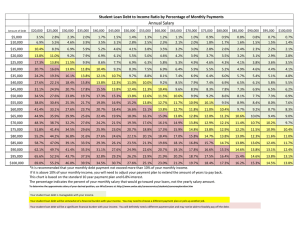

Piece of Mind Your money.....your future.....don’t blow it. Donna Gene Price, Director Student Financial Aid/Veterans Affairs January, 2013 Topics for Today • Student Loan Debt • Credit Card Debt • Student Financial Aid Student Loan Debt What’s the Big Deal? • Average Student Loan Debt at Graduation = $24,000 • Two out of five student loan borrowers fall behind on their student loan payment within the first five years • Defaulting on student loans may prevent your ability to borrow money in the future for a car or home. • Defaulting on student loans may result in garnishment of your wages. • If you borrow it.....you owe it! Student Loan Debt What’s the Big Deal? • Student loan debt is bad for you....bad for everybody – – – – Higher than credit card debt A drag on the housing economy Reduces your ability to qualify for a mortgage Age 25-35 first time home buyers make up 27% of the market. This is the lowest percentage in a decade. – Age 25-35 – 6 million are living with their parents compared to 4.7 million in 2007 – Victimization – pop up loan, quick cash and check cashing companies love to see you coming Student Loan Debt What’s the Big Deal? Struggling with student loans? 5 options http://money.msn.com/debt-management/student-debtis-stifling-home-salesbloomberg.aspx?videoId=0b9f0fe7-5695-4969-88532ff0a500f63a&from=email&src=v5:pause:email:uuids &from=mpl_en-us_iv2_en-us_money_VxParticle_debt-management-student-debt-is-stiflinghome-sales-bloomberg_Money_article Student Loan Debt • Would • you like to buy a house? Not so fast! http://money.msn.com/collegesavings/student-loan-calculator.aspx • Check your loan balance regularly....now and not just when you graduate at • www.studentloans.gov Credit Card Debt Credit Card Debt Let’s see how this credit card thing works...... http://www.bankrate.com/calculators/credit-cards/debtcalculator.aspx http://www.aie.org/managing-your-money/Creditcards/Credit-Card-Debt-A-Students-Story.cfm Credit Card Debt What if I’m in over my head? • Don’t ignore the bills! • Make at least the minimum payment • Negotiate with the credit card companies • Stop charging immediately ..destroy those cards • Adjust your wants vs. needs budget so you can make larger payments • Make a budget and stick to it Credit Card Debt • Avoid impulse buys and peer pressure • “Opt out” of new offers and mailing lists at www.optoutprescreen.com • Seek free counseling services in your community Student Financial Aid Office Student Financial Aid Office • You must be making academic progress to remain eligible to receive financial aid. – GPA – Pace (progression towards graduation) • Know our guidelines at www.apsu.edu/financialaid • Know the requirements for your degree • See your academic advisor regularly • Call, email or visit our office Student Financial Aid Office • Borrow only what you absolutely need – Need....not want • Use your refund wisely – Consider taking less of a refund by borrowing less • Don’t get billed! – If you enroll full time, then withdraw or have attendance grades, you may owe money back to the school. – Know our withdrawal policy at www.apsu.edu/financialaid Student Financial Aid Office Visit our website often at www.apsu.edu/financialaid • Important Dates • Financial Aid TV Videos • Withdrawal Policy • Academic Progress Policy • Step by Step Instructions • Financial Literacy Resources Resources • • • • www.money.msn.com www.aie.org www.dollarsensei.com www.apsu.edu/financialaid Example – Dependent Undergrad Tuition and Fees Housing Meal Plan Total Direct Costs Example 1– Grant Eligible Student Loans Pell Grant Lottery State Grant Total Financial Aid Refund = $3,472 $6,648 5,600 2,780 $15,028 $6,500 5,000 4,000 3,000 $18,500 Example – Independent Undergrad Example 2 Student Loans Pell Grant Lottery State Grant Total Financial Aid Refund = $7,472 $10,500 5,000 4,000 3,000 $22,500 Questions?? Email at sfao@apsu.edu Call at 931-221-7907 Visit at Ellington Building, Room 216