[Carrier] HMO PLAN SMALL GROUP HEALTH MAINTENANCE ORGANIZATION (HMO)CONTRACT CONTRACTHOLDER

advertisement

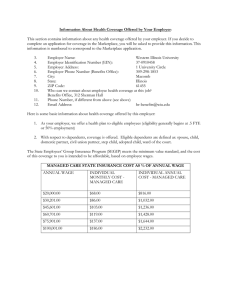

![[Carrier] HMO PLAN SMALL GROUP HEALTH MAINTENANCE ORGANIZATION (HMO)CONTRACT CONTRACTHOLDER](http://s2.studylib.net/store/data/017967018_1-5ea0927ec15c649675610806810ca571-768x994.png)