Potential Benefits of an RPS in Vermont Mark Bolinger Lawrence Berkeley National Laboratory

advertisement

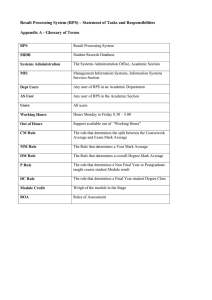

Potential Benefits of an RPS in Vermont Mark Bolinger Lawrence Berkeley National Laboratory MABolinger@lbl.gov (603.795.4937) VT RPS Collaborative Meeting Montpelier, VT October 1, 2003 Environmental Energy Technologies Division • Energy Analysis Department Potential Benefits of an RPS • Mitigates Fuel Price Risk • Reduces Natural Gas Prices (to all sectors) • Reduces Wholesale Power Prices (through “bid stack effect”) • Displaces Emissions & Mitigates Future Environmental Compliance Risk • Promotes Local Economic Development Environmental Energy Technologies Division • Energy Analysis Department Source: NYMEX Environmental Energy Technologies Division • Energy Analysis Department Feb-09 Mar-08 Mar-07 Mar-06 Mar-05 Apr-04 Apr-03 Apr-02 Apr-01 Apr-00 Apr-99 Apr-98 Apr-97 Apr-96 Apr-95 Apr-94 Apr-93 Apr-92 Apr-91 Apr-90 Natural Gas Futures Price ($/MMBtu) Gas Prices Have Increased 10 9 8 7 6 5 4 3 2 1 0 Gas Price Volatility Has Increased 90% 80% Annualized 90-Day Volatility 252-Day Moving Average 70% 60% 50% 40% 30% 20% 10% 0% Aug-90 Mar-91 Sep-91 Apr-92 Oct-92 May-93 Dec-93 Jul-94 Jan-95 Aug-95 Mar-96 Oct-96 Apr-97 Nov-97 Jun-98 Dec-98 Jul-99 Feb-00 Aug-00 Mar-01 Oct-01 May-02 Dec-02 Jun-03 Annualized Standard Deviation 100% Environmental Energy Technologies Division • Energy Analysis Department Gas Contributes to Electricity Price Volatility • The cost of natural gas accounts for more than half the levelized cost of new gas-fired generation, and more than 90% of operating costs • Gas-fired “peakers” often set the market clearing price in New England • VT currently not all that exposed to wholesale market…still true in 10 years? Environmental Energy Technologies Division • Energy Analysis Department LBNL’s Accounting for Fuel Price Risk… Question: How to compare fixed-price renewable to variable-price gas-fired generation? to Current Practice: • Cost of renewables is often compared to cost of gas-fired generation based on uncertain fuel price forecasts Best Practice: to • Cost of renewables should be compared to cost of gasfired generation based on a guaranteed fuel price How do guaranteed forward gas prices compare to uncertain gas price forecasts?? Environmental Energy Technologies Division • Energy Analysis Department Swap Prices Exceed Price Forecasts November 2000 Natural Gas Price ($/MMBtu) 4.1 3.9 3.7 Implied Forward Swap Curve (Enron) 3.5 EIA Forecast (AEO 2001) 3.3 3.1 2.9 2.7 2001 2002 2003 2004 2005 2006 2007 2008 2009 Source: Enron and EIA Environmental Energy Technologies Division • Energy Analysis Department 2010 Swap Prices Exceed Price Forecasts November 2001 Natural Gas Price ($/MMBtu) 4.7 4.2 3.7 3.2 Implied Forward Swap Curve (Enron) 2.7 EIA Forecast (AEO 2002) 2.2 2002 2003 2004 2005 2006 2007 2008 2009 2010 Source: Enron and EIA Environmental Energy Technologies Division • Energy Analysis Department 2011 Futures Prices Exceed Price Forecasts November 2002 Natural Gas Price ($/MMBtu) 4.0 3.8 3.6 NYMEX Futures Price (Annual Average) EIA Forecast (AEO 2003) 3.4 3.2 3.0 2003 2004 2005 2006 2007 Source: NYMEX and EIA Environmental Energy Technologies Division • Energy Analysis Department 2008 Physical Prices Exceed Price Forecasts November 2002 Natural Gas Price ($/MMBtu) 4.6 4.4 4.2 4.0 3.8 3.6 3.4 Williams/DWR Physical Supply Contract 3.2 3.0 2004 EIA Forecast (AEO 2003) 2005 2006 2007 2008 2009 Source: Williams and EIA Environmental Energy Technologies Division • Energy Analysis Department 2010 Premiums Range from $0.4-0.8/MMBtu 0.7 0.9 0.6 0.8 0.7 0.5 0.6 0.4 0.5 0.4 0.3 0.2 0.1 0.3 Enron - AEO 2001 Enron - AEO 2002 NYMEX - AEO 2003 Williams - AEO 2003 Average (by contract term) Average (all contract terms) 0.2 0.1 0.0 0.0 2-Year 5-Year 6-Year Contract Term 7-Year 10-Year Environmental Energy Technologies Division • Energy Analysis Department Implicit Premium (¢/kWh) Implicit Premium ($/MMBtu) 1.0 Implications • Whether these premiums represent “hedge value” or something else (e.g., biased forecasts) is debatable, but does not change implications: Use forward prices, not forecasts, when comparing gas-fired to renewable generation • Synapse VT cost analysis captured some of this: – Used current NYMEX strip as the basis for the 2010 gas price input to the combined-cycle COE calculation – But did not account for fuel prices beyond 2010… – Ideally, would just use long-term wholesale electricity forwards (if they existed) Environmental Energy Technologies Division • Energy Analysis Department Potential Benefits of an RPS • Mitigates Fuel Price Risk • Reduces Natural Gas Prices (to all sectors) • Reduces Wholesale Power Prices (through “bid stack effect”) • Displaces Emissions & Mitigates Future Environmental Compliance Risk • Promotes Local Economic Development Environmental Energy Technologies Division • Energy Analysis Department Renewables Displace Natural Gas Theory: As renewables displace gas-fired generation, demand for natural gas declines, and the price of gas falls Author EIA EIA EIA EIA EIA EIA UCS Tellus Tellus Tellus ACEEE Reduction in US Gas Wellhead Implicit Date of Other Gas Consumption Price Reduction Inverse Supply Study Scope RPS Measures? Quads (%) $/Mcf (%) Elasticity 1998 National 10%-2010 No 1.1 (3.4%) 0.32 (12.9%) 3.8 2001 National 10%-2020 Yes 1.5 (4.0%) 0.27 (8.4%) 2.1 2001 National 20%-2020 Yes 3.9 (10.8%) 0.56 (17.4%) 1.6 2002 National 10%-2020 No 0.7 (2.1%) 0.12 (3.7%) 1.8 2002 National 20%-2020 No 1.3 (3.8%) 0.56 (6.7%) 1.8 2003 National 10%-2020 No 0.5 (1.5%) 0.00 (+0.05%) 0.0 2001 National 20%-2020 Yes 10.5 (29.7%) 1.57 (50.8%) 1.7 2002 RI 10%-2020 No 0.1 (0.4%) 0.00 (+0.04%) -0.1 2002 RI 15%-2020 No 0.2 (0.7%) 0.01 (0.4%) 0.6 2002 RI 20%-2020 No 0.3 (0.8%) 0.03 (0.8%) 1.0 2003 National 6.3%-2008 Yes 1.4 (5.5%) 0.77 (22.1%) 4.0 Inverse elasticities range from –0.1 to +4.0, averaging +1.7 (estimate from literature is +1.25) Environmental Energy Technologies Division • Energy Analysis Department Quantifying the Impact LBNL’s “Simplified Method” (for NEMS): • Survey implicit inverse price elasticity of supply from model output and economics literature • Study relationship between wellhead and delivered price changes, both nationally and regionally • Inject renewables in each NEMS region to determine what they displace With this basic information, we can get a rough idea of the impact of a state RPS on regional gas prices (without having to run the model!) Environmental Energy Technologies Division • Energy Analysis Department VT RPS May Reduce NE Gas Prices Impact of VT RPS (1%/yr to 10% in 2015) on Natural Gas Prices in New England 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 RPS-Induced Change in Avg Gas Price to All Sectors (2001 $/MMBtu) 0.00 VT Savings in 2015 (2001$): -$0.2 million (-$0.3/MWh) -0.01 -$0.4 million (-$0.6/MWh) -0.02 -0.03 -0.04 -0.05 -0.06 -0.07 -0.08 Inverse Supply Elasticity = 0.5 Inverse Supply Elasticity = 1.0 -$0.8 million (-$1.2/MWh) Inverse Supply Elasticity = 2.0 Inverse Supply Elasticity = 3.0 Assumptions: -$1.2 million (1) AEO2003 is the reference case (-$1.8/MWh) (2) Renewables displace gas-fired generation 1-to-0.66 (3) Gas-fired heat rate = 7,500 Btu/kWh (4) Range of 4 different inverse supply (wellhead) elasticities presented (5) A change in the avg wellhead price flows through 1-to-1 to a change in the avg national delivered price (6) NE delivered gas prices are impacted more than national delivered prices: by a multiple that drops from 2.5 to 1.25 (7) For VT Savings in 2015, assumes 15% of VT power needs met by gas (residential and C&I consumption data from EIA) Environmental Energy Technologies Division • Energy Analysis Department Potential Benefits of an RPS • Mitigates Fuel Price Risk • Reduces Natural Gas Prices (to all sectors) • Reduces Wholesale Power Prices (through “bid stack effect”) • Displaces Emissions & Mitigates Future Environmental Compliance Risk • Promotes Local Economic Development Environmental Energy Technologies Division • Energy Analysis Department Bid Stack Effect Theory: Renewables with low operating costs will bump higher-cost marginal resources out of the “bid stack,” leading to lower clearing prices • 2 studies of NY RPS measure this: Joint Utilities: -$1/MWh by 2013 NYSERDA: -$1.3/MWh by 2013 • Synapse VT cost analysis does not account for potential changes in bid stack Environmental Energy Technologies Division • Energy Analysis Department Environmental (Air Quality) State: MA RI NY NY Study: La Capra/SEA Tellus ICF/Joint Utilities NYSERDA RPS: +4% by 2009 +13.4% by 2020 +8% by 2013 +7.5% by 2013 CO2 (million tons/year) -2.6 -0.6 -1.5 to -1.8 -5.9 SO2 (thousand tons/year) -7.9 not measured +0.5 -14.0 NOX (thousand tons/year) -1.2 not measured +0.4 to -2.3 -8.0 Mercury (tons/year) not measured not measured 0 not measured “Cap and trade” programs for SO2 and NOX cloud the picture: • Emissions displaced by renewables may simply be “added” elsewhere (to get back to the cap) • While total emissions may therefore remain at the cap, the cost of compliance should be lower Also reduces risk of future envtl regs (e.g., carbon tax)! Environmental Energy Technologies Division • Energy Analysis Department Economic Development • Synapse NY study (for RETEC) provides a good survey of the literature; REV has its own VT-specific analysis • Note: Most economic development studies to date pertain to wind development, but Synapse VT RPS analysis shows biomass and hydro may dominate…applicability? Environmental Energy Technologies Division • Energy Analysis Department References • La Capra, Sustainable Energy Advantage (SEA). 2000. Massachusetts Renewable Portfolio Standard Cost Analysis Report. • ICF Consulting (for Joint Utilities). 2003. Report of Initial Analysis of Proposed New York RPS. • NYSDPS, NYSERDA, SEA, La Capra. 2003. New York Renewable Portfolio Standard Cost Study Report. • Synapse (for RETEC). 2003. Cleaner Air, Fuel Diversity, and High-Quality Jobs: Reviewing Selected Potential Benefits of an RPS in New York State. • ACEEE (with EEA). 2003. Impacts of Energy Efficiency and Renewable Energy on Natural Gas Markets. • LBNL. 2003. Accounting for Fuel Price Risk: Using Forward Natural Gas Prices Instead of Gas Price Forecasts to Compare Renewable to Natural Gas-Fired Generation • Tellus. 2002. Modeling Analysis: Renewable Portfolio Standards for the Rhode Island GHG Action Plan. • A number of national studies by EIA and UCS Environmental Energy Technologies Division • Energy Analysis Department