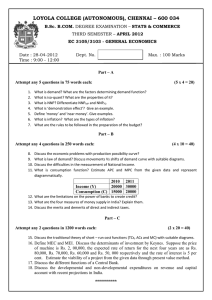

ECO220 MACROECONOMIC ANALYSIS

advertisement

FACULTY OF COMMERCE AUTUMN SESSION PRACTICE PROBLEMS 2005 ECO220 MACROECONOMIC ANALYSIS Hints Read the questions carefully. Answer the specific questions asked. Reread your answer at the end of your exam. Make sure you have correctly done Hints1 and 2. Think before you write. Use graphs and diagrams where they aid your analysis. Be sure to refer to your graphs/diagrams in your answer. Label axes and important points on your diagrams. Always relate your answers back to the models you have learned in the class. Essay form questions 1. Assume the economy is described by the following equations: C = c0 + c1 (Y – T) I = I0 But let’s add a wrinkle. Let’s say that taxes and government spending are dependent on GDP. Taxes and government spending are given by: G = g0 – g1 Y T = t0 + t 1 Y (a) Give an explanation for why G might be falling in Y and T might be rising in Y. (b) Derive the new IS curve. (Although really this is just an aggregate expenditure (AE) curve.) (c) What is the government expenditure multiplier in this case? (d) Compare the multiplier to the standard multiplier. Give some intuition as to why the multiplier is smaller or larger than in the standard case. (e) If an economy faces demand shocks (such as large random changes in c0), are the shocks to the economy greater or smaller than in the standard case? Explain. 2. (a) Explain carefully using the basic AD-AS and IS-LM model how equilibrating forces bring the economy back to the natural rate of output after there is a shock to the economy. (b) Assume labour unions refuse to allow a drop in nominal wages in Australia. How might this fact lead to recessions turning into depressions? 3. New stricter occupational health and safety rules drive up the mark-up that firms charge over wages when firms set prices. Show the impact of new workplace rules on the labour market and then on the economy as a whole. Pay particular attention to the impact on the natural rate of unemployment. 4. Suppose the Phillips Curve is given by: πt = πte + 0.18 – 3 ut and assume that expectations are based purely on last year’s inflation: πte = πt-1 (a) What is the natural rate of unemployment? Suppose that the economy is initially at the natural rate of unemployment, but a new government decides to lower unemployment to 4%. Let’s call this year 1. (b) What is the inflation rate that is required to lower unemployment to 4% in year 1? (c) What is the inflation that is required to keep unemployment at 4% in year 2, year 3, etc? 5. Given the medium-run model: ut – ut-1 = -β (gYt – g*Y) πt – πt-1 = - α (ut – un) gYt = g*Y – φ(πt – πT) (a) Explain the economic meaning of the terms g*Y, un and πT. (b) In this model, what are the long-run levels to which gYt, ut and πt return? Explain using the equations. (c) Explain what β, α and φ each represent. 6. BHP has $100m in cash this quarter, and the CEO of BHP is wondering what to do with the money. The interest rate/discount rate for investors is 5%. BHP can get a return of 8% on investment projects already planned for the next year. (a) Using the concept of share value as the discounted stream of net future profits, explain carefully and clearly whether BHP should return the money as dividends to shareholders or whether it should keep the money to invest in the company. (b) How would your answer change if the interest rate/discount rate were 10%? Explain carefully. 7. The government raises taxes which the government plans to spend updating Australia’s infrastructure- roads, bridges, ports and docks. The government claims these new taxes are warranted because the improved infrastructure will raise future growth in the economy. (a) Using the expectations-augmented IS-LM model, what are the impacts of these expected changes? Trace each change carefully through the model. (b) On a diagram, show the net impact of these changes. 8. Consider two open economies- the lands of Nod and GDI- with a fixed exchange rate between the two currencies. (a) GDI puts a tariff (a tax) on imported goods from Nod. This tax raises the price (and so lowers demand) for imports from Nod. What is the impact of the tariff on the GDI economy. Explain carefully using diagrams where appropriate. (b) What is the impact of the tariff on the Nod economy? Explain carefully using diagrams where appropriate. (c) How is your answer to (a) and (b) changed if Nod puts taxes on imports from GDI in retaliation for the GDI tax?