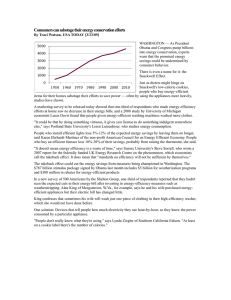

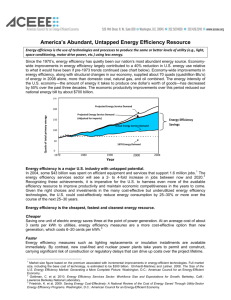

ENERGY-EFFICIENT HOMES

advertisement

ENERGY-EFFICIENT HOMES POLICY This presentation will analyze the potential effectiveness and benefits of EnergyEfficient Homes. ISSUES A 25% reduction of foreign oil imports would cause the price of oil to increase. This in turn would cause the cost of heating a home (that uses oil for its heat) to increase. Also, the price of gas at the pumps would increase, creating greater monthly expenses for all who drive. Energy efficient homes create other benefits not related to oil. CONCLUSIONS Energy efficient homes can dramatically decrease the cost of maintaining the average home. Energy efficient homes also have the benefit of using renewable energy sources, which conserves existing energy resources. BACKGROUND Industries aside, our homes are the chief consumers of many energy sources. The amount of energy wasted just through poorly insulated windows and doors is about as much energy as we get from the Alaskan Pipeline each year. The amount of electricity generated by fossil fuels for a single home puts more carbon dioxide into the air than two average cars. Almost every home in the United States could be powered by renewable energy of some kind to a greater or lesser extent. Converting existing homes to energyefficient homes, and building only new homes which are energy-efficient, would result in a myriad of benefits, both long term and short. EXISTING HOMES Improvements to an existing home, to make it an energy efficient home, focuses chiefly on ensuring that every aspect is properly installed, insulated, and all equipment is energy efficient. The major areas of concern are: Building Envelope Space Heating and Cooling Water heating and supply Waste water Appliances Garbage Lighting NEW HOMES Construction of a new home can take advantage of a concept known as “Whole Building Design.” “Whole Building Design” takes an integrative approach to building design so that all elements of the building help achieve an optimal energy performance. The building has to interact effectively with the outdoor environment — a concept known as climate-responsive architecture. “Whole Building Design” combines Energy-Efficiency with Solar Technologies to boost energy savings, and it reduces the amount of energy required to operate a home compared to conventional houses. NEW HOMES (CONT.) The “Energy Efficiency” aspect of “Whole Building Design” is concerned with the same areas as mentioned with Existing Homes. The “Solar Technologies” incorporated into the “Whole Building Design” involves the use of Passive Solar Design and Solar Thermal Technology. NEW HOMES (cont.) Passive Solar Design Is the technology of heating, cooling, and lighting a building naturally with sunlight rather than with mechanical systems. Some design features include large south-facing windows and building materials that absorb and slowly release the sun's heat. It can also involve the use of Photovoltaic (PV) technology. PV is basically "solar electricity" that results from converting sunlight into energy. PV systems help preserve the Earth's finite fossil-fuel resources such as coal, oil, and natural gas. It also helps reduce air and water pollution associated with these energy sources. Incorporating passive solar designs can reduce heating bills as much as 50%. NEW HOMES (cont.) Solar Thermal Technology Is the use of solar water-heating systems. Solar water-heating systems use collectors generally mounted on a south facing roof. These collectors heat water either Passively or Actively (Active being the most energy efficient). NEW HOMES (cont.) External “Whole Building Design” Features NEW HOMES (cont.) Internal “Whole Building Design” Features THE BIG QUESTION Relatively few homes (existing & new construction) across the U.S. are energy-efficient homes. Considering the environmental benefits that an energy-efficient home creates, why haven’t more people chosen to make their homes an energyefficient home? The Human Barrier Reluctance on the part of consumers to undertake the conversion of their homes to energy-efficient homes can be summed up in one word: MONEY The upfront costs that are required to make the conversion are often too great a barrier for the average consumer to overcome. Some energy efficiency improvements involve little or no implementation cost. However, there are also improvements that can cost a great deal of money. Replacing a heating system can cost up to $5,000 in a large house or even more if you are converting from electricity to another energy source. Installing new windows, while very beneficial to your home and the environment, can be a financial strain to implement. Overcoming Human Barriers I Knowledge of the long-term benefits and monthly utility savings that an Energy-Efficient Home can provide. Knowledge about Energy-Efficient Home financing programs (government backed & conventional loan programs). THE BOTTOM-LINE The average homeowner spends close to $1,300 a year on utility bills. But an energy-efficient home—with such features as proper insulation, high efficiency heating and cooling systems, and energy-efficient windows— can lower utility bills by 10 to 50 percent. This would all be reflected in a myriad of benefits, both long term and short. Where the Money Goes FINANCING AN ENERGY EFFICIENT HOME Because an energy-efficient home is costeffective, there are financing programs available from mortgages to home improvement loans, which allow more people the opportunity to live in such a home. Consumers can benefit from energy-efficient financing whether buying, selling, refinancing, or remodeling a home. People looking to buy an energy-efficient home, can qualify for a better, more comfortable home because with lower utility costs, they can afford a larger mortgage payment. Most Energy-Efficient financing programs will encourage you to have an ENERGY RATING for your new or existing home, which will tell you and the lender how energy efficient it is. A rating typically involves an inspection by a professional energy rater who is certified under a nationally or state accredited Home Energy Rating System (HERS). An energy rater will inspect the energy-related features of a home, such as: insulation levels window efficiency heating and cooling systems air leakage After inspection, the inspector will generate a report that includes the home's energy rating along with an estimation of annual energy use and costs. To help qualify for most energy-efficient financing, the report usually must show that the home is energy-efficient or that any recommended improvements are cost-effective and will save more money than would be needed to be borrowed to install them. While calculating whether a borrower qualifies for a mortgage, a lender can recognize these savings and add the cost of the improvements into the mortgage. Or, if the home is already energy-efficient, the lender can stretch the debt-to-income qualifying ratio (a borrower's monthly payment obligation on long-term debts divided by the borrower's net effective income or gross monthly income). An energy rater will inspect the energy-related features of a home, such as insulation levels, window efficiency, heating and cooling systems, and air leakage. Energy-Efficient financing is offered through either government-insured or conventional loan programs. There are 2 types of Energy-Efficient Mortgages: 1. For a New Home 2. For an Existing Home You can purchase or refinance a home that is already energy-efficient, or you can purchase or refinance a home that will become energyefficient after energy saving improvements are made. ENERGY EFFICIENT FINANCING PROGRAMS Government Insured U.S. Department of Housing and Urban Development FHA Energy-Efficient Mortgage FHA Section 203(k) Rehabilitation Mortgage Insurance FHA Energy-Efficient Home Mortgage FHA Mortgage Increase for Solar Thermal Systems FHA Title I Property Improvement Loan Insurance Government Insured (cont.) U.S. Department of Veterans Affairs The U.S. Department of Veterans Affairs (VA) guarantees mortgage loans for veterans. It can be used to purchase or refinance a home along with the cost of making energy-efficient improvements. Conventional Programs Most of the national lenders who offer energy-efficient financing operate through one of the following programs. ENERGY STAR® Mortgage Fannie Mae Freddie Mac E Seal DETAILS HOW AN EEM SAVES MONEY Standard Mortgage Energy Improvement Costs Appraisal Value New EEM $3,000 $100,000 $103,000 (add cost of improvement) Down Payment $10,000 $10,000 Mortgage Amount $90,000 $93,000 $614 $634 $0 $(50) $614 $584 P&I Energy Savings (Monthly) Total Monthly Payments HOW AN EEM INCREASES BUYING POWER For a standard home without energy improvements: Buyer's total monthly income Maximum allowable monthly payment 28% debt-to-income ratio: Maximum mortgage at 90% of appraised home value: $3,000 $5,000 $840 $1,400 $132,900 $221,500 $3,000 $5,000 $900 $1,500 $142,400 $237,300 $9,500 $15,800 For an energy-efficient home: Buyer's total monthly income Maximum allowable monthly payment 30% debt-to-income ratio: Maximum mortgage at 90% of appraised home value: Added Borrowing Power Due to the Energy Efficient Mortgage: THE ENERGY EFFICIENT MORTGAGE PROCESS SIMPLIFIED Overcoming Human Barriers II It has been suggested that the only way to “encourage” widespread use of EnergyEfficient Homes is through Governmental Legislation requiring energy-efficiency. Existing Legislation Most existing legislation is done at the state level. The Model Energy Code (MEC), published and maintained by the International Code Council (ICC), has influenced most legislation. While not all states have a requirement regarding the energy efficiency of homes, most states have, in some form, adopted provisions of the Model Energy Code (MEC). Other states have adopted the MEC as recommended practice but have no statewiderequirement that all new construction use it. The MEC contains energy efficiency criteria for new residential and commercial buildings and additions to existing buildings. The MEC covers the building’s ceilings, walls, and floors/foundations; and the mechanical, lighting, and power systems. While some states have adopted the MEC without modification, some states have adopted one of the MEC editions with state-developed amendments. In an effort to harmonize building codes across America, the MEC was revised to become the International Energy Conservation Code (IECC), first printed in 2000. ENERGY CODE STATUS BY STATE As presented at the NFRC Spring Membership Meeting, Regulatory Affairs Committee Snowbird, UT, April 2002 FEDERAL INVOLVEMENT Federal involvement in the effort to encourage energy efficient homes has chiefly come in the form of tax incentives. Example: The Omnibus Federal Energy Bill Passed by the House on August 2nd Awaiting approval by the Senate The Omnibus Federal Energy Bill This Bill contains several tax credit provisions aimed squarely at residential real estate. It provides federal tax credits for homeowners who install energy conservation items such as: New insulation Energy-efficient windows Doors Solar hot water Photovoltaic equipment For owners of existing homes the credit will be 20% of the amounts spent on “Qualified Energy Efficiency Improvements", up to a maximum credit of $2,000. Tax credits are more valuable to taxpayers than deductions because they are subtracted dollarfor-dollar off the bottom line of a taxpayer’s federal tax bill. There is a separate credit available for the installation of solar and photovoltaic energyproduction equipment. These tax credits are similar to the credits for conservation, with a maximum allowable credit of $2,000 during a tax year. Under this Bill, home builders and contractors also get a shot at tax relief. When they install energy-efficient heating and cooling systems in a new home they are constructing, they may be able to qualify for up to a $2,000 credit per home. These new federal tax credits are expected to be extremely popular. The congressional Joint Committee on Taxation estimates that the home improvement incentives alone will lead to $1.6 billion worth of tax credits to homeowners in the coming decade. The solar and photovoltaic credits are estimated to put $125 million back into home owners' pockets during the same period.