NEW YORK UNIVERSITY Stern School of Business

advertisement

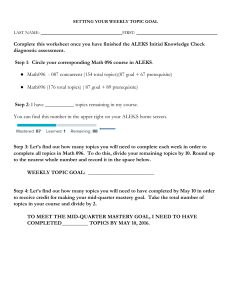

NEW YORK UNIVERSITY Stern School of Business SAMPLE B01.1306 Section 60: MW 6:00 – 9:00 Financial Accounting & Reporting Summer 2007 Professor Joshua Ronen 313 Tisch Hall 998-4144 -- Phone; 995-4230 -- Fax jronen@stern.nyu.edu -- E-mail Web Site: www.stern.nyu.edu/~jronen Teaching Assistant Anil Chinthakindi Email: akchinta@yahoo.com Course Description This course provides an introduction to the fundamental concepts of financial accounting. Its purpose is to help students become intelligent readers of the main financial accounting reports (balance sheet, income statement, and cash flow statement). The perspective taken is that these reports provide information that is useful for resource allocation decisions in a broad sense. The informativeness of these reports is determined both by the cash and accrual accounting methods used to generate the reports and by the market and institutional settings in which resource allocation decisions are made. Corporations generate data that are useful for internal decision making. These decisions include pricing, quantity of production, mix of products, advertising, distribution decisions and a myriad of other decisions that are necessary for the day to day operations of the firm as well as for long term strategic policy formulations. Not all of these data, however, are communicated externally to stakeholders in the organization. These stakeholders include stockholders, lenders, suppliers, consumers, government, and many other bodies for whom the external financial reports provided by organizations can be potentially important in making their own decisions on resource allocation. Financial accounting pertains to the content of those external financial communications, what governs these communications, how they are prepared, and what could they potentially mean to the reader. Clearly, the financial information externally communicated is a subset of the financial data internally generated. Decisions on what subset to select for external reporting are part of what is generally referred to as financial accounting theory. Thus, a theory of financial accounting specifies how standards for accounting choices are set and how managers may exercise discretion in the choice among such accounting methods when deciding on how to report an outcome of a given transaction and how to describe such a transaction. This course touches on the elementary features of the financial accounting system within the typical corporation and while the emphasis is primarily on understanding what the information contained in the financial reports means and how it could be used in making decisions, a prerequisite for this understanding is knowledge of the methods and the techniques used in generating the 1 information and in the selection of those subsets of events that are chosen for description, recording, and ultimate dissemination. Generally, the course will provide an overview of cash and accrual accounting measures, financial reports, and the market and institutional settings in which resource allocation decisions take place. Also, specific accounting methods and use of accounting information in valuing firms will be briefly discussed as well. A typical content outline of the course would cover the nature of financial statements, the balance sheet and the income statement, analysis of transactions, revenue and expense recognition, cash flow statement, concepts of present and future values, inventory and cost of goods sold, long lived assets and depreciation and amortization expense, marketable equity securities, debt financing and interest expense, stockholders equity, leases, taxes, and inter-corporate investments. The course has no prerequisites. A copy of the textbook is on reserve in the periodicals sections of Bobst Library. You may also purchase the student study guide to accompany the text at the bookstore or you may borrow my copy for limited time periods. Office Hours My office hours are by appointment (room 10-71in HKMC, 998-4144). My Teaching Assistant’s – Anil Chinthakindi -- office hours will be announced, and will be held in KMEC 10-181. Anil will be able to answer any questions related to the covered material including problems that may arise in connection with the homework. She can be reached via Email: akchinta@yahoo.com, Teaching Philosophy I believe the most efficient use of class time aims at reinforcing what the student has tried to achieve on an individual basis before entering the classroom. In the classroom learning is achieved by (a) whole-hearted and serious studying of the assigned readings and solving the assigned problems or cases; (b) discussions of the material by the students and teacher in class; and (c) my underscoring of important points via short lectures. I do not give lectures per se. In light of this, adequate preparation for the class and participation during class are essential. Assignments The readings and assignments for the course are attached. All homework assignments are included in ALEKS (see instructions below under “ALEKS”) and should be completed by the end of 3 days following the class sessions to which they are assigned. The assignments comprise exercises and problems contained in the ALEKS online system. Accordingly, they may be completed online and would not need to be handed in. 2 Exams There will be one midterm and a final. There will be no makeup for the exams. By the nature of accounting, the exams will be somewhat cumulative, but will emphasize the material since the prior exam. Also, there will be one quiz for each class session to be completed in ALEKS after the class session but before midnight on the dates indicated in the attached calendar. Both the Midterm Exam and Final Exam are open book and notes and will be taken outside the class through the ALEKS system. The Midterm and Final Exams will contain some essay-type questions. The answers to these questions are also to be submitted online, in two ways: by email directly to Ms. Yoon with a copy to me, and also to me via the ALEKS message system. The ALEKS message system is accessed through the Message button on the bar at the top of your ALEKS window (see below under Buttons, “Message”). PLEASE NOTE that it is very easy to lose information in any kind of computer message system. It would be the height of folly to type your essays directly into an email message or into the ALEKS system, where they could be lost due to a range of unpredictable technical glitches (power interruption, loss of Internet connection, etc.). Rather, type the essays initially into a Word document or other word-processor file on your computer, saving them frequently as you proceed. Not only will this protect you against data loss, but you will also be able to edit the answers more conveniently and achieve a better final result. Then, when you are satisfied with your essays, save the documents one more time and copy and paste the text into your email messages and ALEKS messages. Please use informative subject lines on your messages, indicating your name and the essay question that your message contains the answer to (e.g., “Smith, Jane – Final Exam Question #11”). Presence If you are absent, you are responsible for what you have missed. From past experience, here is my advice: do not plan on missing classes on a regular basis. Class material is often not covered in your textbook/reading materials. Moreover, as indicated below, 10% of the final grade is based on participation and attendance. Text (1) Libby, Libby, and Short, Financial Accounting (5th Edition, McGraw-Hill/Irwin, 2004, referenced as LLS in the syllabus). ALEKS In this course, you will be required to use ALEKS, an online system designed to help you master Financial Accounting concepts. Your work in ALEKS will constitute a significant part of your final grade in the course. 3 ALEKS is used over the World Wide Web. Each of you will have a password-protected account in ALEKS. Since all records of your work are kept on the ALEKS servers, you can access your account from any computer connected to the Internet. In ALEKS, you will be guided in your learning based on a profile of your current knowledge maintained by the system. At any given time during your use of ALEKS, you will be able to access a certain limited set of topics, based on your readiness. As you progress, new topics will continually become available to you. The topics in ALEKS are divided into units or "Chapters" corresponding to the chapters in LLS. Each chapter has a due date that corresponds to the class meeting on which the topic will be discussed. To receive the maximum benefit from class time, you should complete the material in ALEKS before each class. After each class, you have three days to complete the Quiz in ALEKS that corresponds to the unit discussed in class. If you don’t meet this deadline, you will receive a grade of 0 on that quiz. Quizzes can be found in your ALEKS account by clicking the "Quiz" button. Registration with ALEKS. In order to register with ALEKS, you need a 10-character Course Code. Here is your Course Code: Section 30: Section 35: DTTAV-VGTWD TVMFH-V9FGF When you have the Course Code, go to the following website: http://www.ALEKS.com To register, click on “Sign Up Now” in the upper left-hand corner of the home page. Follow the prompts to enter your Course Code, name, email address (optional), Student ID (optional), and Access Code. ALEKS will provide you with a Login Name and Password for subsequent access to your account. The first time that ALEKS is accessed from any computer, the ALEKS plug-in will be installed on that computer. This is a small (7 MB) software component that is needed by ALEKS and is provided free of charge to all ALEKS users. Normally, installation is fully automatic and requires only a minute or so. If there is any difficulty with installation, or any question at all about ALEKS, please contact ALEKS Customer Support: ALEKS Corporation Customer Support support@ALEKS.com (714) 245-7191 x201 (When you use ALEKS for later sessions, return to the same website as given previously and log in using your Login Name and Password.) 4 ALEKS Tutorial. After Registration you will take a brief "Tutorial," or introduction to the ALEKS interface. It shows you how to enter the various kinds of answers you may be called on to give in ALEKS. Please note that you can always return to particular parts of the Tutorial by using the “Help” button in ALEKS (see below). ALEKS Assessment. Following the Tutorial, you have the option of taking an assessment in ALEKS. If you have any knowledge of Accounting, taking this assessment may place you somewhat ahead in the material and save you time in completing the course. If you don’t take the assessment, ALEKS will consider that you have no prior knowledge of Accounting. ALEKS Pie chart. The results of your assessment are shown in a color-keyed pie chart. The pie chart itself represents the course curriculum and its various parts; each slice of the pie chart represents a part of the curriculum, and is filled in with solid color (from the center outward) to show the extent of your current mastery in that part of the curriculum. (If you do not take the assessment you still get the pie chart, but it will initially contain no solid color.) If you move your mouse pointer around the slices, they will pop out and display lists of items that you are currently ready to work on. Click on any one of these items to begin working in the Learning Mode. Your goal is to fill in the slices of the pie chart, thereby demonstrating your mastery of the course curriculum. Please note that the ALEKS system assumes that you are using it as a support to your learning in a continuous, consistent way throughout the time you are working in the course. It will guide you to work through the course materials in an efficient, progressive way, always building on your current knowledge in its approach to new concepts. You will not be able to skip ahead in ALEKS to topics for which your current knowledge does not prepare you. You can, of course, always review topics that you have learned, using the Review button in your ALEKS account. ALEKS Learning Mode. Most of your time in ALEKS will be spent in Learning Mode, working on practice problems. ALEKS can provide a nearly unlimited variety of practice problems, but in most cases you will do only a few problems per topic in order to establish your grasp of the concept. Every time you do a problem, ALEKS will give you immediate feedback on your answer and tell you how many more problems you need to do for that topic. Note that if you make mistakes, ALEKS requires a little extra practice, but it doesn't start you over; you always get credit for the problems that you have answered correctly. Timing Out. ALEKS will automatically terminate your session after 20 minutes with no activity, or after an hour with no question answered. There is no warning message before the session is terminated. If this occurs, simply log back on. ALEKS will bring you back exactly to where you left off. ALEKS Buttons. The following is a brief summary of the main buttons you will need in ALEKS, and what they do. 5 Practice. This button leads to a practice problem of the given topic, which you have the opportunity to answer. Explain. This button leads to an explanation and solution of the given practice problem. If you choose to view the solution, you will not get the same problem back again for practice, but rather a different problem of the same type. Next. This button submits your answer to the problem. Dictionary. This button leads to an online dictionary of Accounting terms. Accounting terms appearing in the Learning Mode are also hyperlinked to corresponding entries in the Dictionary. Review. This button enables you to practice topics previously mastered. Initially, a selection of recent topics will be proposed. Using the link, “more extensive review,” will provide a comprehensive list of topics for review. Message. This button gives access to the internal ALEKS Message Center. It can be used for exchanging messages with your instructor. You need to use this button to submit answers to essay questions appearing on your Midterm and Final Exams. Help. This button leads to a selection of Tutorial pages that you can access if you don’t know how to put in your answer. “All topics for Financial Accounting” gives a comprehensive directory of Tutorial pages. Browser Buttons. Do not use the “Back” and “Forward” buttons on your browser while logged on to ALEKS. They may produce undesired results, and all necessary navigation features are built into ALEKS itself. ALEKS Homework. 23 points toward your final grade will be based on your completion of work in ALEKS, either 2 or 4 points at the completion of each unit (some units contain one chapter, others two). The units are to be completed according to the schedule of assignments given below. 2 (or 4) points will be awarded if the unit is completed by the due date (the notation “Ready” appears in ALEKS), 1 (or 2) point(s) if it is almost completed (the notation “Almost Ready” appears in ALEKS). Your final homework grade will consist of the total points you received for all chapters. ALEKS Quizzes. 23 points toward your final grade will be based on your performance on quizzes in ALEKS. At the end of the course, the percentage scores you have received on all quizzes will be averaged. This average will be applied to the total of 23 points (e.g., an average quiz score of 79% will produce a Quiz grade of .79 x 23 = 18.17 points). ALEKS does not always give partial credit on quiz answers, some of which consist of more than one component. Thus, students will have to be particularly careful in their answers in order to show their true knowledge and receive high grades. The quizzes are short, and the students take them at times of their own choosing, so it is reasonable to expect that they will be very careful in answering the questions, and then check the answers they have given before submitting the quiz. 6 Grading Policy Midterm Exam1 20% Final Exam1 24% Quizzes 23% Homework 23% Participation and attendance 10% 1. Grading will be re-weighted to take into account improvement over the semester. If a student’s mean-adjusted score for the Final Exam improves relative to the mean-adjusted score for the Midterm Exam, then the weight on the Midterm Exam is reduced by 10 points, and the weight on the Final Exam is increased by 10 points. Final course grades will adhere to the school mandated core grade distribution. If you feel that an Exam has been incorrectly graded, submit a written analysis of why you believe you were improperly graded within one week of the announcement of the grades. Requests made after that will not be considered. The entire Exam will be re-graded. Schedule of Assignments Textbook: Libby, Financial Accounting Session Text Date of Session Date at Which Homework and Quiz are Due May 14, 2007 May 17, 2007 May 16, 2007 May 19, 2007 (questions also from Ch. 2) Chapter 1 Financial Statements and Business Decisions 1 Chapter 2 Investing and Financing Decisions and the Balance Sheet 2 Chapter 3 Operating Decisions and the Income Statement 3 Chapter 4 Adjustments, Financial Statements, and the Quality of Earnings 7 4 5 6 7 8 Chapter 5 Communicating and Interpreting Accounting Information Chapter 6 Reporting and Interpreting Sales Revenue, Receivables, and Cash Chapter 7 Reporting and Interpreting Cost of Goods Sold and Inventory MID-TERM EXAM Chapter 8 Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles Chapter 9 Reporting and Interpreting Liabilities; MBA Companion (pp. 33-53): Income Taxes Chapter 10 Reporting and Interpreting Bonds 9 10 11 Chapter 11 Reporting and Interpreting Owners' Equity Chapter 12 Reporting and Interpreting Investments in Other Corporations Chapter 13 Statement of Cash Flows May 21, 2007 May 24, 2007 May 23, 2007 May 26, 2007 May 30, 2007 June 2, 2007 June 4, 2007 June 6, 2007 June 9, 2007 June 11, 2007 June 14, 2007 June 13, 2007 June 16, 2007 June 18, 2007 June 21, 2007 June 20, 2007 June 23, 2007 8 12 FINAL EXAM June 25, 2007 9