Private Colleges & Universities Development of Accounting Standards Chapter 10

advertisement

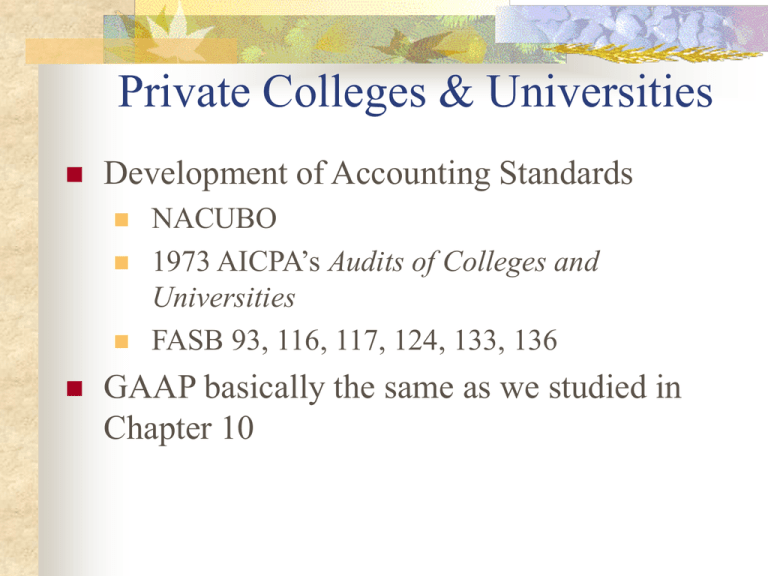

Private Colleges & Universities Development of Accounting Standards NACUBO 1973 AICPA’s Audits of Colleges and Universities FASB 93, 116, 117, 124, 133, 136 GAAP basically the same as we studied in Chapter 10 Specific Quirks: Private Institutions Financial Statements Considerable flexibility: Any of five formats are acceptable for S of FP (See page 335) Example of Corporate (aggregated) style of Financial Position Statement and Cash Flow Statement in text pp. 347-348 Statement of Unrestricted Revenue, Expenses and other Changes in Net Assets and Statement of Changes in Net Assets on pp. 345-346 Revenue Reduction vs Expenses Generally, revenue and expenses reported at gross Discounts reported as reduction of revenue Discounts do not require work by recipient Examples are academic and athletic scholarships Bad debt expenses also included as discounts Academic Term Revenue Academic terms that fall into parts of two fiscal years No guidance by AICPA or SFAS (FASB) 116 NACUBO recommends: Apportionment to two years using accrual accounting principles Miscellaneous Quirks When both unrestricted and restricted resources are available for restricted purposes, FASB requires use of restricted first Expenses are reported by function, either in financial statements or notes Collections reported as required by FASB 117 Fund Raising Expenses: Same as Chapter 10 Split-Interest Agreements AICPA Not-for-Profit Guide Charitable Lead Trust: SFAS 136 (p. 345-346) Perpetual Trust: Held by Third Party Contributions Revenue, permanently restricted Annual income depends Charitable Remainder Trust Charitable Gift Annuity Pooled (Life) Income Fund