COLLEGE OF BUSINESS AND GLOBAL AFFAIRS Course Data Sheet Fall 2015

advertisement

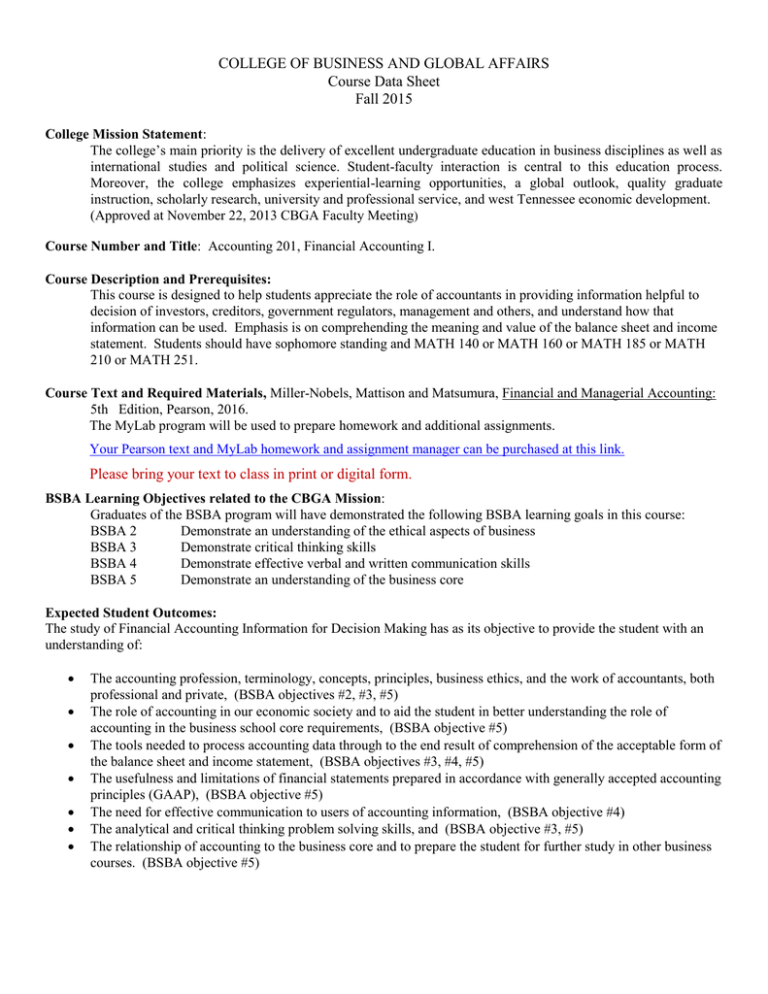

COLLEGE OF BUSINESS AND GLOBAL AFFAIRS

Course Data Sheet

Fall 2015

College Mission Statement:

The college’s main priority is the delivery of excellent undergraduate education in business disciplines as well as

international studies and political science. Student-faculty interaction is central to this education process.

Moreover, the college emphasizes experiential-learning opportunities, a global outlook, quality graduate

instruction, scholarly research, university and professional service, and west Tennessee economic development.

(Approved at November 22, 2013 CBGA Faculty Meeting)

Course Number and Title: Accounting 201, Financial Accounting I.

Course Description and Prerequisites:

This course is designed to help students appreciate the role of accountants in providing information helpful to

decision of investors, creditors, government regulators, management and others, and understand how that

information can be used. Emphasis is on comprehending the meaning and value of the balance sheet and income

statement. Students should have sophomore standing and MATH 140 or MATH 160 or MATH 185 or MATH

210 or MATH 251.

Course Text and Required Materials, Miller-Nobels, Mattison and Matsumura, Financial and Managerial Accounting:

5th Edition, Pearson, 2016.

The MyLab program will be used to prepare homework and additional assignments.

Your Pearson text and MyLab homework and assignment manager can be purchased at this link.

Please bring your text to class in print or digital form.

BSBA Learning Objectives related to the CBGA Mission:

Graduates of the BSBA program will have demonstrated the following BSBA learning goals in this course:

BSBA 2

Demonstrate an understanding of the ethical aspects of business

BSBA 3

Demonstrate critical thinking skills

BSBA 4

Demonstrate effective verbal and written communication skills

BSBA 5

Demonstrate an understanding of the business core

Expected Student Outcomes:

The study of Financial Accounting Information for Decision Making has as its objective to provide the student with an

understanding of:

The accounting profession, terminology, concepts, principles, business ethics, and the work of accountants, both

professional and private, (BSBA objectives #2, #3, #5)

The role of accounting in our economic society and to aid the student in better understanding the role of

accounting in the business school core requirements, (BSBA objective #5)

The tools needed to process accounting data through to the end result of comprehension of the acceptable form of

the balance sheet and income statement, (BSBA objectives #3, #4, #5)

The usefulness and limitations of financial statements prepared in accordance with generally accepted accounting

principles (GAAP), (BSBA objective #5)

The need for effective communication to users of accounting information, (BSBA objective #4)

The analytical and critical thinking problem solving skills, and (BSBA objective #3, #5)

The relationship of accounting to the business core and to prepare the student for further study in other business

courses. (BSBA objective #5)

COLLEGE OF BUSINESS AND GLOBAL AFFAIRS

Class Data Sheet

Accounting 201, Sections 003 and 005, Fall 2015

Class time/place: Section 003, Monday, Wednesday and Friday; 11:00 p.m. – 11:50 p.m.; BA 135

Section 005, Monday, Wednesday and Friday; 12:00 p.m. – 12:50 p.m.; BA 135

Instructor:

Dr. Ronald Kilgore

Office:

Room 138, Business Administration

Office hours: Monday, Wednesday, and Friday: 1:00 p.m. – 2:00 p.m.

Tuesday and Thursday 11:00 pm – 3: 00 pm

Other times by appointment

Telephone:

731-881-7240

Email:

rkilgore@utm.edu

Required material:

Calculators (no cell phones) are permitted.

Calculators will be provided for examinations.

Pencils and erasers will be needed in completing all quizzes and exams.

Attendance Policy

Students are expected to attend all class meetings for the entire class period.

Students are responsible for all announcements made and material covered during an absence.

All assignments will be on the course syllabus with a due date.

No assignment can be made up or turned in after the due date

If one interim exam is not taken, the comprehensive final exam grade will be substituted for that interim exam.

If more than one interim exam is not taken, the comprehensive final exam grade will be substituted for ONE

AND ONLY ONE interim exam, AND a grade of zero (0) will be entered for each additional interim exam that is

not taken.

If all interim exams are taken AND the comprehensive final exam grade is higher than the grade on any interim

exam, the comprehensive final exam grade will be substituted for the interim exam with the lowest grade.

(Exception: An absence, if appropriately documented, resulting from participation in University-sponsored

activities.)

Other

Students are not only responsible for all material in the chapters assigned in the textbook but also for all

homework assignments which are to be completed.

Students are encouraged to ask for assistance as needed.

All transfers of junior and senior level courses normally taught in the College of Business and Global Affairs

must be approved in advance by the student’s department chair (or dean) upon recommendation by the student’s

advisor.

Evaluation

EXAM

1

2

3

MyLab

MASS FINAL

Grades:

DATE and CHAPTERS

SEE CLASS SCHEDULE

SEE CLASS SCHEDULE

SEE CLASS SCHEDULE

TIME

WEIGHT

100 POINTS

100 POINTS

100 POINTS

100 POINTS

100 POINTS

A:

B:

C:

D:

F:

Day

8/24

8/26

8/28

8/31

9/2

9/4

9/7

9/9

90.0-100% of total possible points

80.0-89% “

“

“ “

70.0-79% “

“

“ “

60.0-69% “

“

“ “

Below 60%

“ “

“ “

Topic Covered

What are the

organizations and rules

that govern accounting?

What is the accounting

equation?

How do you analyze a

transaction and how do

you prepare financial

statements?

How do you use financial

statement to evaluate

business performance?

What is an account and

what is double-entry

accounting?

How do you record

transactions and what is

the trial balance?

Labor Day

Using the debt ratio to

evaluate business

performance?

Difference between cash

basis accounting and

accrual basis accounting?

Reading

Assignments

Class

Problems

{A Only}

Extra Credit

Ch.1

Relationship

to BSBA Goals

BSBA 2

P41

BSBA 2

P42, P43

BSBA 3

P44, P45

Fraud 1-1

Ch.2

BSBA 2,3 4

BSBA 5

P29, P30

BSBA 2

P32, P33, P34

BSBA 3

Ch.3

BSBA 3

9/11

What concepts and

principles apply to

9/14 accrual basis accounting?

What are adjusting

entries and the adjusted

9/16 trial balance?

What is the impact of

adjusted entries on the

financial statements and

would a worksheet help in

preparing the adjusted

trial balance?

9/18

P33

BSBA 3

P34,P35

BSBA 3

P37,P38

BSBA 3

Fraud Case

1-1 Due

9/21 Test 1

9/23 How do we prepare

Ch.4

BSBA 2

9/25

9/28

9/30

10/2

10/5

10/7

10/9

10/12

10/14

financial statements and

would a worksheet help?

What is the closing

process and how do we

close the accounts?

How do we prepare a postclosing trial balance?

What merchandising

operations? Purchases of

merchandise inventory

recorded in a perpetual

inventory system?

Sales of merchandise

inventory recorded in a

perpetual inventory

system?

What are the adjusting

and closing entries for a

merchandiser?

How are the financial

statements prepared for a

merchandising firm?

What are the accounting

principle and controls

that relates to a

merchandising inventory?

How are the merchandising

cost determined under a

perpetual inventory

system?

How are financial

statements effected by

using different inventory

costing methods? LCM &

error effects on

inventory.

10/16 Test 2

10/19 Fall Break

What is internal control

and how does it protect

10/21 assets?

What are the inventory

control procedures with

respect to cash receipts

10/23 and cash payments?

How can a petty cash fund

and a bank account be

used for internal

10/26 controls?

10/28 Career Day

What are types of

receivables and how are

credit sales recorded?

10/30

BSBA 3,4

P28,P29

P30,P32,P33

Ethics Case

4-1

Ch.5

BSBA 2,4

BSBA 3

P31

BSBA 3

P33, P34

BSBA 3

P35, P36

BSBA 3

Ch.6

Fraud Case

6-1

BSBA 3

P28, P29,P30

BSBA 3

P31,P32

BSBA 3,5

Ethics case

4-1 and

Fraud case

6-1 Due

BS

Ch.7

Ch.8

BSBA 3

P21,P22

BSBA 3

P23,P25,

P26

BSBA 3

BSBA 2

11/2

11/4

11/6

11/9

11/11

How are uncollectible

accounted for using the

direct wright-off method

and the allowance

methods?

How are notes receivables

accounting for?

How does a business

measure of the cost of a

plant asset and what is

depreciation and how is

it computed?

How are disposals of a

plant asset recorded?

How are natural resources

and intangible assets

accounted for?

P27,P28

BSBA 2

P30,P32,

P33

BSBA 2

Ch.9

BSBA 3

P30,P31

P32,P33,

P34

Ethics case

9-1

BSBA 3

Ethics case

9-1 Due

11/13 Test 3

How are current

liabilities of known

11/16 amounts accounted for?

How are payroll recorded

and how are current

liabilities that must be

11/18 estimated accounted for?

Continued

11/20

How are long-term notes

and mortgages accounted

11/23 for?

11/25 Thanksgiving

11/27 Thanksgiving

What are bonds and how do

we calculate straight11/30 line amortization?

How is the retirement of

bonds accounted for? How

are liabilities reported

12/2 on the balance sheet

How do we use the debt to

equity ratio to evaluate

12/4 a business performance

BSBA 3

Ch.11

BSBA 2

P25,P26

P27,P28,

P29

BSBA 2

Ethics case

11-1

Ch.12

BSBA 2

BSBA 2

P31

BSBA 2,4

P32,P33

BSBA 2,4

P34,P35

Ethics case

11-1 Due

BSBA 2,4

Any student eligible for and requesting academic accommodation due to a disability is required to supply a letter

of accommodation from Disability Services (PACE Office), Clement 203 (Extension 7605 or 7744), within the first

two weeks of the semester

My WebPage:

http://www.utm.edu/~rkilgore/NewWPage/beta.html

Homework Instructions:

Your MyLab Homework Manager list those assignments which should be worked on MyLab to earn 100 of your total

points. These problems will be graded by MyLab and set to me automatically. MyLab will allow you Five (5) attempts

to work each problem and will record your highest attempt. The due dates for your MyLab homework are on your

syllabus and the test dates indicated and are in red.

Ethics Challenges:

The Ethics Challenges or Fraud Cases are located at the end of each chapter. They must be emailed to me at

rkilgore@utm.edu as an attachment in Word. Please also put the Case and Chapter number. For example,

Fraudcase1-1. Please contact me immediately if there is a discrepancy. Do not wait until the end of the semester to

reconcile any differences. The burden of proof concerning completed homework and other assignments falls upon the

student. Do not delete any “ETHICS or FRAUD CASES” until you are sure it has been graded and recorded.

The Ethics Challenges or Fraud Cases represent extra credit. They can count UP to 50 Points depending upon the

quality of your answers. They represent your only chance for extra credit. Therefore, they must be earned. There is NO

curve except a possible curve on the mass exam which is determined by the departmental after the tests are graded.

College of Business and Global Affairs Honor Code

WE STRIVE:

ETHICAL:

...

To be ethical in communications with others and our actions. We know that ethical

behavior contributes to and strengthens the learning environment. We support authorized

collaboration and refrain from corruption.

TRUSTWORTHY:

To be trustworthy and to fulfill responsibilities with integrity, timeliness, and honor. We

regard trustworthiness as a jewel that should be visible to all, that can be lost with one poor

decision, and that should never be compromised.

HONEST:

To be genuine in all transactions. We tell the truth with sincerity and respect in order to

maintain an honorable reputation.

...

IDEALISTIC: . . .

To set high, moral, and achievable goals and to establish a value system that assists us in

achieving goals. We endeavor to integrate professionalism into all aspects of the

educational experience.

COMPASSIONATE: To take a stand of compassionate concern for others and to acknowledge the value within

each human being. We encourage a rich learning environment demonstrating our belief

that all people have the right to be treated with dignity and respect.

SERVICE-MINDED: To cultivate a sense of community and a spirit of teamwork by supporting peers,

colleagues, and the UTM community. We acknowledge the investment made in UTM by

many individuals, our state, and our nation by sharing the resources of our knowledge and

time with the community.