Kauffman Firm Survey October 26, 2005 Zoltan Acs Kauffman Foundation Scholar-in-Residence

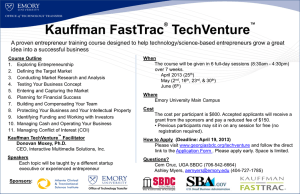

advertisement

October 26, 2005 Kauffman Firm Survey Zoltan Acs Kauffman Foundation Scholar-in-Residence zacs@kauffman.org zacs@ubalt.edu Kauffman Firm Survey (KFS) The Kauffman Firm Survey is a longitudinal survey of new firms that focuses on their financial development during the first four years of existence. The survey will have a sample size of approximately 5,000 firms started in 2004 and uses a list frame sample of new businesses selected from the Dun & Bradstreet (D&B) database. KFS Team • Principal Investigator: Scott Shane, Case Western Reserve University •Survey Firm: Mathematica Policy Research, Princeton, New Jersey Survey Objectives • Create a longitudinal dataset that tracks new businesses over four years • Focus on the financial development of the business • Oversample high-technology businesses • Create a public use data source • Inform policy decisions and academic analysis Definition of “new businesses” • Not a branch, subsidiary, or inherited business • Not a not-for-profit organization • No other legal status prior to 2004 • Did not apply for employer identification number (EIN) in 2003 or earlier • Did not file Schedule C before 2004 • Did not make UI payments before 2004 • Did not make federal social security (FICA) payments before 2004 Questionnaire Modules A - Introduction B - Eligibility Screening C - Business Characteristics D – Strategy and Innovation E - Business Organization and Human Resources Benefits F - Business Finances G - Work Behaviors and Demographics of Owner(s) Developmental Process • Pilot Test 1 in August 2004 • Pilot Test 2 in early 2005 • Full study began in Summer 2005 Pilot Test 1 August 2004, approximately 200 interviews with firms started in 2003 • To assess accuracy of the D&B women-owned firm indicator. The comparison indicated a high degree of correlation between D&B indicators and owner gender reporting. • To determine the incidence of businesses that were still operating. Approximately 7 percent of the 2003 firms reported being out of business. • To test the incidence of businesses that would meet potential eligibility criteria Pilot Test 2 Early 2005, 400 interviews with firms started in 2003 •To test instrument length and structure •To test use of incentives •Test web-survey data collection •To determine level of effort needed to achieve an acceptable cooperation and response rate Changes Resulting from Pilot Test 2 • Cut roughly one-third of questions • Determined that a $50 incentive would be effective • Decided to use both web and computer-assisted telephone interviewing (CATI) survey instruments Baseline Survey Currently in the field • Sample size of approximately 5,000 owners of businesses started in 2004. • 3,000 interviews will be allocated to two categories of high-technology businesses, and 2,000 interviews will be allocated to all other industrial classifications. •Three annual follow-up interviews are planned with businesses still in existence. KFS Data Availability Data from the baseline survey will begin to be available to researchers by the fall of 2006. Information regarding availability will be posted on the Kauffman Foundation’s Entrepreneurship Research Portal at www.kauffman.org/research. KFS Contacts Scott Shane Principal Investigator Case Western Reserve University sas46@weatherhead.cwru.edu David DesRoches Survey Researcher Mathematica Policy Research, Inc. DDesRoches@mathematica-mpr.com Alyse Freilich Ewing Marion Kauffman Foundation afreilich@kauffman.org