Can Congress Make You Buy Broccoli? David Orentlicher, MD, JD

advertisement

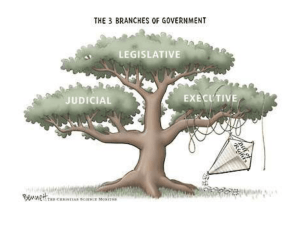

Can Congress Make You Buy Broccoli? David Orentlicher, MD, JD Samuel Rosen Professor and Co-Director, Hall Center for Law and Health Indiana University Robert H. McKinney School of Law Adjunct Professor, Indiana University School of Medicine 1 The constitutional question The national government is a government of limited powers—Congress must be able to invoke an enumerated power to enact any legislation What is the source of power for the individual mandate to purchase health care? Commerce Clause (Art. I, § 8, cl. 3)? Taxing and Spending Clause (Art. I, § 8, cl. 1)? 2 The challengers’ problem Congress can require everyone to buy health care coverage from the government—single payer (taxing power) Congress can require everyone to buy private health care coverage as a condition of obtaining medical care (commerce power) Why can’t Congress simply require everyone to buy health care coverage from private insurers? Why is it worse to require participation in a privately-operated health care system than in a government-run system? 3 Commerce Clause challenge According to critics, the individual mandate cannot be justified under the Commerce Clause The Commerce Clause allows Congress to regulate interstate economic activity or intrastate economic activity that has an interstate impact The individual mandate constitutes the regulation of inactivity Hudson, 728 F. Supp. 2d 768 (E.D. Va. 2010); Vinson, 780 F. Supp. 2d 1256 (N.D. Fla. 2011) 4 Commerce Clause response The critics have misframed the question The Commerce Clause allows Congress to regulate health insurance companies In the Affordable Care Act, Congress has prohibited health insurance companies from taking into account individual health status (i.e., no preexisting conditions clauses) Just as the Civil Rights Acts of 1964 prohibit discrimination on the basis of race or sex, the Affordable Care Act of 2010 prohibits discrimination on the basis of health status 5 Commerce Clause response Not fair to prohibit preexisting conditions clauses if people can pick and choose when to buy insurance—healthy people will just wait until they’re sick to purchase coverage States with community rating and no mandate saw non-group insurance markets collapse The anti-discrimination provision works in tandem with the individual mandate The individual mandate thus is an implied part of the Commerce Clause power (Thomas More Law Center v. Obama, 651 F.3d 529 (6th Cir. 2011)) The individual mandate is justified under the Necessary and Proper Clause (Art. I, § 8, cl. 16) 6 Commerce Clause response What would happen if the Affordable Care Act did not include the individual mandate? Congressional Budget Office estimated that the number of uninsured would increase by 16 million—eliminating half of the impact of the Act CBO, Effects of Eliminating the Individual Mandate to Obtain Health Insurance (June 16, 2010) Other estimates range from eliminating threefourths to one-fourth of the impact of the Act on access to health care coverage MIT economist Jonathan Gruber (24 million), RAND Corporation (22 million), Urban Institute (18 million), Lewin Group (8 million) 7 Commerce Clause response The individual mandate should not be seen as a regulation of inactivity Rather, it entails a regulation of the economic decision whether to purchase health care insurance or to self-insure Everyone uses the health care system at some point, so must either carry insurance or pay out of pocket Thomas More Law Center v. Obama, 651 F.3d 529 (6th Cir. 2011) 8 Commerce Clause challenge What about Lopez and Morrison? Hasn’t the Supreme Court narrowed the reach of the Commerce Clause? The Court was worried about Congress intruding into areas of local concern that should be regulated by states (K-12 education, community crime). Access to health care insurance is a matter of national concern. In Raich, Perez and other cases, the Court upheld provisions that, standing alone, would not be constitutional but were permissible as important parts of broad regulatory programs that were valid overall. Even if the application of doctrine is uncertain, application of underlying principle is not 9 Slippery slope? What about the implications of allowing Congress to regulate “inactivity?” Don’t we need the courts to protect us from an overreaching legislature? In 1824, Chief Justice Marshall wrote that the accountability of Congress to voters is generally an adequate safeguard We know from 70 years of history that Marshall was correct when it comes to purchase mandates Congress has had the power to force us to buy innumerable goods since the 1940’s and has not abused that power 10 Slippery slope? Virtually any other purchase mandate Congress might want to pass, it has been able to pass by regulating economic activity People could be required to buy broccoli when they buy food, or to cultivate broccoli when they grow their own crops People could be required to own a GM car as a condition of buying gasoline Congress sometimes requires the purchase of one product as a condition of buying another product (seat belts and cars, V-chips and TVs) The individual mandate simply reflects the distinctive nature of health care insurance Which answers the critics’ concern about the unprecedented nature of the mandate 11 Taxing power argument Congress has the power “to lay and collect taxes . . . to . . . provide for the . . . general welfare of the United States” (Art. I, § 8) As long as the tax serves the general welfare and has a non-exclusive, revenue-raising purpose, it is valid How is the individual mandate a tax? One could describe it as a duty to pay 2.5 percent of income (subject to minimum and maximum payments) to help fund health care for the indigent, with an exemption from the tax if you have your own insurance policy The individual mandate appears in the IRS part of the US Code 12 Taxing power argument But raising revenue is not the purpose of the tax—it’s designed to get people to buy insurance Congress long ago abandoned its distinction between regulatory taxes and revenue-raising taxes In Sanchez, 340 US 42 (1950), the Court upheld a marijuana tax As long as a tax is productive of some revenue, the Court will not “speculate as to the motives which moved Congress to impose it, or as to the extent to which it may operate to restrict the activities taxed” (Sonzinsky) The Court will ensure that the tax is not so severe as to be a criminal penalty in disguise 13 Taxing power argument But Congress called the 2.5 percent levy a “penalty” rather than a “tax” (Florida v. HHS, 648 F.3d 1235 (11th Cir. 2011)) Congress is not bound by its stated source of authority. If another source of authority exists, that is sufficient Fidelity to the statutory text is important when deciding the meaning of the statute (is it a 2.5 percent or 3.5 percent tax?), but not when deciding whether the statute is valid No reason to think Congress cares whether the mandate is upheld on basis of Commerce Clause or taxing power 14 Taxing power argument There is no accountability problem when Congress and the president change their justification Voters who don’t want to pay more to the government don’t care whether they pay a “penalty” or a “tax” Voters know whom to blame for the mandate (as the November 2010 election results indicated) This is not like New York or Printz Consider the separation of powers and first amendment concerns if the Court holds elected officials to their words—and few acts would be immune from challenge (Mitch Daniels estimated the cost of the Iraq War at $50-60 billion) 15 Medicare precedent If Medicare is constitutionally valid, so must be the individual mandate Medicare Part A entails a mandate to purchase hospital coverage for one’s senior years; the Affordable Care Act entails a mandate to purchase health care coverage for one’s current years Critics of the individual mandate recognize that Congress could have passed “Medicare-for-All” But Medicare-for-All constitutes a greater exercise of the national government’s power than does the Affordable Care Act—If the concern is to constrain governmental power, then the Affordable Care Act should be preferable to Medicare-for-All 16 Necessary and Proper Clause Congress has the power “to make all Laws which shall be necessary and proper for carrying into Execution” its other powers “Let the end be legitimate, let it be within the scope of the constitution, and all means which are appropriate, which are plainly adapted to that end, which are not prohibited, but consist with the letter and spirit of the constitution, are constitutional” (emphasis added) McCullough v. Maryland