Effectiveness of the Visual Analog Scale for Anna Stangl

advertisement

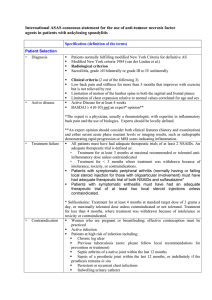

Effectiveness of the Visual Analog Scale for the Measurement of Business Expectations Anna Stangl Ifo Institute for Economic Research Brussels, 12. October 2009 Visual Analog Scale (VAS) in Web Surveys 3-Category Scale. Visual Analog Scale (VAS) 1. Present business situation 2. Business expectations Ifo Economic Climate Index 2 / 21 Motivation: Measurement of Expectations Qualitative measurement of economic expectations: category-rating scales • limited, coarse data • information loss in the neutral category • no information on dispersion • strong assumptions for modeling • easy to apply • reliable measurement Quantitative measurement of economic expectations: point forecasts • interval-scale measurement • information on dispersion and the shape of the distribution • costly and time-demanding • prone to inaccuracies • not available in business surveys Probabilistic expectations • theoretically appealing • information on dispersion and the shape of the distribution • information on uncertainty • applicable in surveys of professionals • general tendency of respondents to be optimistic / further drawbacks • not available in business surveys 3 / 21 Categorical Scale This country's overall economic situation at present? vs. Visual Analog Scale This country's overall economic situation at present? Economic confidence I. Economic confidence I. a b bad satisfactory good II. bad satisfactory good Score range: 1 to 100 Score range: 1 to 3 - Symmetric properties of the indifference interval are assumed - Information loss due to the central tendency of responses - Enables scores between categories - Shows direction of change and magnitude - Delivers dispersion and uncertainty measures 4 / 21 Categorical Scale vs. Visual Analog Scale 3-Category Scale bad Visual Analog Scale bad satisfactory good satisfactory good Economic Expectations 25 80 Economic Expectations 67.62 10 % 40 % 15 60 20 Uncertainty 20 5 21.96 0 10.42 0 -50 Present Economic Situation 0 Visual Analog Scale 50 15 60 Present Economic Situation % % 40 10 55.21 20 5 28.38 0 16.4 0 -50 0 Visual Analog Scale 50 5 / 21 Data Internet Business survey in manufacturing, Germany Number of responses Month 1 2 3 4 5 6 7 8 9 10 11 12 Total 2005 1,175 1,212 1,217 1,198 2006 1,393 1,384 1,447 1,430 1,434 1,345 1,374 1,296 1,369 1,359 1,386 1,422 2007 1,443 1,388 1,460 1,438 1,509 1,447 1,396 1,334 1,394 1,429 1,414 1,461 2008 1,476 1,519 1,498 1,521 1,512 1,516 1,562 1,543 1,542 1,571 1,541 1,541 2009 1,560 1,553 1,563 1,602 1,619 1,619 1,632 1,558 1,580 Total 5,872 5,844 5,968 5,991 6,074 5,927 5,964 5,731 7,060 5,571 5,558 5,622 4,802 16,639 17,113 18,342 14,286 71,182 6 / 21 Observation period 7 / 21 Scale Reliability Tests Scale reliability: VAS 3-Cat. Parallel-form reliability bad satisfactory good bad satisfactory good 1. Test-retest reliability Internal consistency Inter-rater reliability 2. 1. Step: Common factor of „econ. situation“ items extracted 2. Step: Correlation of the common factor with VAS / 3-Cat. 8 / 21 3-Category and VAS Business Expectations and Production Index 3-Category Business Climate VAS Business Climate 9 / 21 Measures of Uncertainty and Heterogeneity Direct survey-based measures: probability distribution of a point forecast • uncertainty of the individual forecaster • responses are comparable • internal consistency and accuracy • surveys of professionals • not available in business & consumer surveys Time-series based measure of uncertainty: forecast errors • proxy for uncertainty • readily available • accuracy • not available in business and consumer surveys Dispersion as a proxy for uncertainty (Zarnowith and Labros, 1987) • readily available • proxy for uncertainty • important in its own right as measure of heterogeneity • quantitative point-forecasts • not available in business and consumer surveys 10 / 21 Measuring Uncertainty and Heterogeneity with VAS 20 0 5 Bruine de Bruin et al., 2000 % 15 “Epistemic uncertainty” 10 1. 25 Economic Expectations -50 3. 25 20 % 15 10 Zarnowith and Labros, 1987, Bomberger, 1996, Batchelor and Dua, 1996, Giordani and Soderlind, 2003, Rich and Tracy, 2006, Mitchel et al., 2005, Lahiri and Liu, 2006, Doepke and Fritsche, 2006, Boero et al., 2007… Economic Expectations 5 Dispersion of business expectations (Heterogeneity) 50 0 2. 0 Visual Analog Scale -50 0 Visual Analog Scale 50 Kurtosis Doepke and Fritsche, 2006: A significant kurtosis above 3 indicates that the forecasters are very close to each other. 4. Skewness Doepke and Fritsche, 2006: If the distribution of economic expectations is significantly skewed, consensus among forecasters is rejected 11 / 21 Dispersion of VAS Business Expectations and the Production Index Growth fall / turning point Correlation: -0.84 12 / 21 Measuring Uncertainty with VAS 0 5 10 % 15 20 25 Economic Expectations -50 0 Visual Analog Scale 50 20 25 Economic Expectations 0 5 10 % 15 Correlation: 0.80 -50 0 Visual Analog Scale 50 20 25 Economic Expectations 0 5 10 % 15 Correlation: 0.72 -50 0 Visual Analog Scale 50 13 / 21 Skewness of the VAS Present Business Situation Skewness 14 / 21 Skewness of the VAS Business Expectations Skewness 15 / 21 Skewness of the VAS Business Expectations and Production Index 16 / 21 Correlation with Production Index in Manufacturing Correlation of the VAS Indicators with the Production Index in the German Manufacturing Sector Lead in months 0 1 2 3 VAS Climate 0.94 0.95 0.93 0.89 3-Cat. Climate 0.92 0.95 0.95 0.93 VAS Expectations 0.90 0.94 0.95 0.94 3-Cat. Expectations 0.74 0.84 0.90 0.93 VAS Situation 0.94 0.92 0.88 0.83 3-Cat. Situation 0.93 0.91 0.87 0.81 Skewness of VAS situation 0.93 0.93 0.91 0.88 Skewness of VAS expectations 0.65 0.72 0.77 0.82 Epistemic uncertainty 0.56 0.62 0.66 0.61 Standard deviation of VAS expectations 0.84 0.82 0.78 0.76 Kurtosis of VAS expectations 0.90 0.89 0.88 0.86 17 / 21 Summary: Effectiveness of the VAS 25 0 5 10 % 15 20 -50 % 15 20 25 Economic Expectations -50 3. Skewness of the VAS distribution - Cyclical - More pronounced in VAS business situation 0 Visual Analog Scale 50 10 “Epistemic uncertainty” (Bruine et al. definition) - Increases around turning points - Proxy for uncertainty Economic Expectations 5 2. Dispersion and Kurtosis of business expectations - Contra-cyclical - Proxy for uncertainty and heterogeneity 0 1. 0 Visual Analog Scale 50 18 / 21 The Present Study Adds to the Literature: • Dispersion as proxy of uncertainty was previously calculated only from point forecasts Presents a meaningful dispersion measure based on qualitative expectations • There was no direct uncertainty measure derived from qualitative responses Presents a meaningful measure of “epistemic” uncertainty without eliciting probabilistic forecasts • Business expectations were assumed to be normally distributed Demonstrates systematically variable skewness of business expectations over the business cycle 19 / 21 General Summary • VAS is easy to apply and does not require any quantitative information • VAS presents a direct, almost interval scale measure of economic expectations • VAS delivers reliable and valid information • VAS is highly efficient, delivering a variety of valid economic indicators - Dispersion measures - Uncertainty proxies - Distributional shape - Enables differentiation between uncertainty and heterogeneity • Assumptions of the three-category expectations are systematically violated VAS is an effective instrument for the measurement of business expectations 20 / 21 Research outlook • Gathering longer time-series • Improving the business cycle forecasts with the information on uncertainty and heterogeneity of expectations (out-of-sample forecasts) • VAS measurement of consumer expectations • Application of VAS batteries in surveys, analysis of drop-outs 21 / 21 Email: stangl@ifo.de 22 / 21