EU-wide business survey in the financial service sector Consumer Opinion Surveys

advertisement

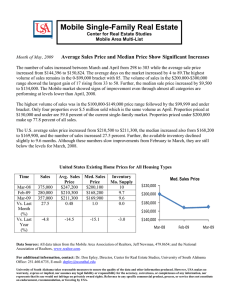

EU-wide business survey in the financial service sector Fourth Joint EU-OECD Workshop on Business and Consumer Opinion Surveys Brussels, 12th October 2009 Context & Objectives Extension of business surveys to the financial service sector • Importance of financial services sector for the development of the overall economy • EU-wide monthly survey among managers • 10 European countries covered Main Objectives • Provide useful information enabling to evaluate the development of the value-added and expectations of operators • Pilot phase: period of evaluation, between April 2006 and March 2007 • Main Phase: April 2007 – March 2011 Survey Design & Methodology Key Methodological Components A robust and homogeneous methodology across countries Guarantee representative results for the euro area and the EU as a whole Repeat the survey in the same way each month Obtain sufficient samples of completed interviews detailed analysis Ensure comparability of results over time Population Senior managers in sectors 65, 66 ,67 (NACE) Countries: DE, ES, FR, LUX, IT, NL, UK, PL, HU and CZ Sampling Recruitment of a panel of respondents: (initial panel, approx. 2,400 people) Telephone recruitment Source: business directory, updated regularly good approximation of the Universe Objective: 300-600 completed interviews each month during the whole year Questionnaire Content Standard questionnaire Repeated every month Topics: overall business situation, demand for services and employment Quarterly questions Asked in April, July, October, November Topics: operating income/expenses, profitability, capital expenditure, fees charged for the services and competitive position Scale questions : increase / remain unchanged / decrease Questionnaire translated into national languages Respondent can choose the language of the questionnaire Survey process CATI-Web technology STEP 1 Panel: telephone recruitment STEP 2 E-mail invitation + link to online questionnaire STEP 3 STEP 4 Reminder Questionnaire completion Sample sizes and response rate A response rate of 24% on average (min: 17% and max: 29%) is encouraging and in line with expectations 700 618 600 537 506 500 496 486 473 448 444 478 444 413 400 372 400 400 400 400 359 310 300 200 100 April 2008 - September 2009 Sep-09 Aug-09 Jul-09 Jun-09 May-09 Apr-09 Mar-09 Feb-09 Jan-09 Dec-08 Nov-08 Oct-08 Sep-08 Aug-08 Jul-08 Jun-08 May-08 Apr-08 0 Non-response Reasons From the moment of the recruitment and the actual invitation, people may have change their minds Some people may not have time to access the questionnaire during the fieldwork period Concerns about confidentiality and publication of the results Measures Letter signed by DG ECFIN explaining the scope of the survey Regular contacts by phone or e-mail, in order to: Some people were sent in advance the questionnaire in Word format, in order to: In some cases, invitation e-mails are blocked by the company’s firewall Reassure them about the content of questions Operators not motivated to respond to several waves Get agreement of their hierarchy Crisis: Increasing mobility of operators Reluctance to give out information about company Prospect of having access to the survey results Ask referral to panellist who wants to drop off Results: monthly questions Overall business situation TOTAL Q1 - How has your business situation developed over the past 3 months? It has ... 52 46 33 46 24 22 22 22 17 45 47 45 47 47 41 35 34 28 20 28 20 18 18 12 10 7 23 18 12 11 8 2 -1 -15 -17 -19 -25 Remained unchanged Deteriorated -6 Jun-09 -29 -18 May-09 Mar-09 -32 Apr-09 Feb-09 Jan-09 Dec-08 -13 Nov-08 Oct-08 Sep-08 Aug-08 Jul-08 Jun-08 May-08 Apr-08 -2 Improved 26 19 17 15 16 29 26 27 22 20 53 4444 40 37 35 33 32 27 24 47 51 50 48 -3 Sep-09 53 51 Aug-09 54 Jul-09 54 Demand for the company’s services TOTAL Q2 - How has demand (turnover) for your company’s services changed over the past 3 months? It has ... 55 55 51 45 44 44 38 44 40 37 35 31 26 25 28 26 29 19 21 13 15 20 18 51 43 41 34 31 33 25 24 28 28 21 20 18 24 25 40 36 27 1117 51 46 45 23 19 55 51 16 15 18 10 17 15 5 Remained unchanged -25 Decreased Jul-09 -11 Jun-09 May-09 Apr-09 -19 -12 -16 -25 Increased Mar-09 Feb-09 -14 Jan-09 -13 Dec-08 -1 Nov-08 Sep-08 Aug-08 Jul-08 Jun-08 May-08 Apr-08 Oct-08 2 1 1 Sep-09 51 Aug-09 53 50 Expectations in terms of demand for company’s services TOTAL Q3 - How do you expect the demand (turnover) for your company’s services to change over the next 3 months? It will ... 49 49 48 50 48 45 39 59 55 50 49 47 39 36 36 26 15 10 28 28 25 22 21 13 36 34 33 31 30 22 21 18 39 36 31 21 13 57 53 48 31 58 57 55 19 15 22 27 29 27 24 15 11 17 14 16 3730 24 12 15 17 14 7 11 7 1 -19 Increase Remain unchanged Decrease Sep-09 Aug-09 Jul-09 Jun-09 May-09 Apr-09 -4 Mar-09 Feb-09 -12 Jan-09 -14 Dec-08 Nov-08 Oct-08 Sep-08 Aug-08 Jul-08 Jun-08 May-08 Apr-08 -3 Employment in the financial service sector TOTAL Q4 - How has your firm’s total employment changed over the past 3 months? It has ... 74 69 67 66 13 20 11 68 67 68 17 16 16 16 19 17 9 11 8 7 14 13 14 14 20 16 17 10 7 22 21 19 18 16 13 17 15 10 6 Remained unchanged Decreased 0 -5 Jul-09 Jun-09 Apr-09 -6 -4 -3 May-09 -11 Mar-09 -3 Feb-09 -1 Jan-09 -5 Dec-08 Nov-08 Oct-08 Sep-08 Aug-08 Jul-08 Jun-08 May-08 -4 Increased 18 13 1 Apr-08 69 64 26 16 7 70 68 62 25 17 18 8 69 67 66 24 21 73 Sep-09 69 Aug-09 71 Expectations in terms of employment TOTAL Q5 - How do you expect your firm’s total employment to change over the next 3 months? It will ... 77 72 72 73 71 67 70 71 16 15 15 15 73 11 12 -5 Increase Remain unchanged Mar-09 -11 -5 Feb-09 Jan-09 Dec-08 Nov-08 Oct-08 Sep-08 Aug-08 Jul-08 -1 Jun-08 12 -1 -7 16 17 12 -7 10 13 13 3 16 5 11 1 0 -3 Decrease Sep-09 12 19 17 Aug-09 6 11 13 14 Jul-09 9 22 19 15 16 Jun-09 11 17 7 May-08 71 May-09 18 9 12 10 Apr-08 71 69 23 12 7 69 66 26 19 22 21 14 67 70 Apr-09 68 73 Conclusions Coherence/stability of the survey results: Signs of quality of the sampling design The questionnaire do not seem to pose any problem of misinterpretation/misunderstanding Sensitive indicator Encouraging response rate in line with expectations For the next waves: continue the close monitoring of the fieldwork and anticipate any problem that might cause a decrease in response rate (e.g. lower motivation of respondents due to the participation to several survey waves) Thank you for your kind attention IPSOS Belgium Head Office: Kroonlaan 159-164 1050 Brussels – Belgium Operation Office: Waterloo Business Park Drève Richelle 161, bât. J 1410 Waterloo Phone 32-2-642.47.11 Fax 32-2-648.34.08 E-mail info@ipsos.be