A Net Profit Approach to Productivity Carlo Milana by

advertisement

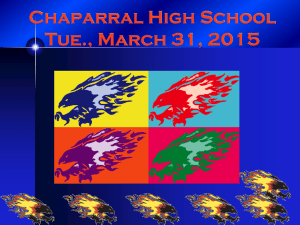

A Net Profit Approach to Productivity Measurement, with an Application to Italy by Carlo Milana Istituto di Studi e Analisi Economica, Rome, Italy This presentation has been prepared for the OECD Workshop on productivity measurement, 16-18 October, 2006, Bern, Switzerland. 1 Contents I. Measurement problems with non-invariant index numbers II. Empirical evidence in Italy III. Finding a better approach with the normalized profit function IV. An application to Italy V. Conclusion 2 Unit cost of production with constant returns to scale C(w,y) = c(w) · y Average cost C(w,y) y C(w1,y1) C(w1,y0) = C(w0,y1) = C(w0,y0) Invariant index number (with respect to y) c(w1) ___ c(w0) B D C(w1,y0) C(w1,y1) E A C(w0,y0) C(w0,y1) Inverse of MFP F y0 G y1 y Output 3 Unit costs of production with non-constant returns to scale C(w,y) = c(w) · g(y) Average cost C(w,y) y Non-invariant index number (with respect to y) C(w1,y0) C(w1,y1) > C(w0,y0) C(w0,y1) C(w1,y1) C(w1,y0) C(w0,y1) Effects on unit cost from diseconomies of scale C(w0,y0) Inverse of MFP y0 y1 Output y 4 “Superlative” index numbers The Translog-Törnqvist case with C(w,y) = c(w) · g(y) Diewert (1976) has shown that if the cost function has a Translog functional form, y affects only the first-order terms in w, then w CTr w , ( y y ) i 0 0 1 1/ 2 CTr w , ( y y ) w 1 0 1 1/ 2 1 i 0 i 1 0 1 ( s i si ) 2 Törnqvist index number Caves, Christensen, and Diewert (1982) have shown that 1 2 w CTr ( w , y ) CTr ( w , y ) i 0 0 0 1 CTr ( w , y ) CTr ( w , y ) w 1 0 1 1 1 i 0 i 1 0 1 ( s i si ) 2 In the case of homothetic separability in y, this price index is a pure price component of cost changes because, under the hypotheses made, the non-invariance elements of the Laspeyres- and Paasche5 type economic indexes are completely offset in the geometric average procedure. Unit cost of production with non-constant returns to scale C(w,y) Average cost C(w,y) y C(w1,y0) C(w1,y1) > C(w0,y0) C(w0,y1) Non-invariant index number C(w1,y1) C(w1,y0) C(w0,y1) Diseconomies of scale C(w0,y0) Inverse of MFP y0 y1 Output y 6 “Superlative” index numbers The Translog-Törnqvist case with the general case of C(w,y) Diewert (1976) has shown that if the cost function has a Translog functional form, y affects only the first-order terms in w, then w CTr w , ( y y ) i 0 0 1 1/ 2 CTr w , ( y y ) w 1 0 1 1/ 2 1 i 0 i 1 0 1 ( s i si ) 2 Caves, Christensen, and Diewert (1982) have shown that 1 2 w CTr ( w , y ) CTr ( w , y ) i 0 0 0 1 CTr ( w , y ) CTr ( w , y ) w 1 0 1 1 1 i 0 i 1 0 1 ( s i si ) 2 Törnqvist index number Moreover, if the Translog cost function has also the second-order terms in w affected by y, then (see, Milana, 2005): CTr ( w , y ) CTr ( w , y ) 0 0 0 1 C ( w , y ) C ( w , y ) Tr Tr 1 0 1 1 (1 ) w i w 1 i 0 i 1 0 1 ( si si ) 2 7 Homothetic case In the homothetic case we always have C ( w1 , y1 ) c( w1 ) Paasche " True" Paasche - type index C ( w0 , y1 ) c( w0 ) Paasche Ideal Fisher Laspeyres 1 " True" Laspeyres - type index 0 1 C ( w , y ) c( w ) Laspeyres 0 0 0 C ( w , y ) c( w ) The ratio c(w1)/c(w0) falls into the interval between Paasche and Laspeyres index numbers. The ideal Fisher is just one of the points belonging to this interval. The “true” index may be equal to c( w1 ) 1 ( L P ) with 0 1. 0 c( w ) 8 General non-homothetic case • In the non-homothetic case economic index numbers are non-invariant (this is because it is not possible to disentangle univocally the mutual effects of variables) • If we deflate a nominal value by means of a non-invariant price index number the resulting implicit quantity index is not in general homogeneous of degree 1 (if, for example, the elementary quantities double, in general the quantity index does not double). • This undesirable behaviour is related to an anomalous position of the “true” index number with respect to the Laspeyres and Paasche index numbers. 9 General non-homothetic case •In the nonhomothetic case, we might have the following reverse position Geometric mean of the " True" Laspeyres - and Paasche - type 1 1 2 CTr ( w1 , y 0 ) CTr ( w1 , y1 ) 2 0 0 0 1 CTr ( w , y ) CTr ( w , y ) CTr ( w1 , y1 ) CTr ( w1 , y1 ) Tornqvist in the case of a translog CTr ) 0 1 0 1 C ( w , y ) C ( w , y ) Tr Tr CTr ( w1 , y1 ) " True" Paasche - type CTr ( w0 , y1 ) •Laspeyres Ideal Fisher Paasche• " True" Laspeyres type • CTr ( w1 , y 0 ) The Ideal Fisher is expected to be CTr ( w 0 , y 0 ) closer tha n Paasche (and Laspeyres) to the geometric mean of the two " true" index numbers! 10 General non-homothetic case Since a geometric average of two non-invariant economic index numbers is generally non-invariant with respect to reference variables, the “superlative” index numbers are also non-invariant in the non-homothetic case. While the price economic index number is linearly homogeneous by construction, in general the corresponding quantity index number fails to satisfy the linear homogeneity requirements in the non-homothetic case. (see, for example, Samuelson and Swamy, 1974, Diewert, 1983, p. 179). Samuelson and Swamy (1974, p. 576) observed that, in the general nonhomothetic case, the corresponding quantity index obtained implicitly by deflating the nominal cost by means of the economic price index fails to satisfy the requirements of the linear homogeneity test. Samuelson and Swamy (1974, p. 570) noted: “[t]he invariance of the price index is seen to imply and to be implied by the invariance of the quantity index from its reference price base”. 11 Empirical evidence (I) Table 1. Alternative Measures of TFP Changes Based on Different Cost Functions (in percentage) All industries in the Italian economy Implicit Generalized Leontief (3) Implicit Paasche (direct Laspeyres) (4) Direct Paasche/Direct Laspeyres ratio (5) = (1)/(4) Difference between direct Paasche and direct Laspeyres (6) = (1) - (4) 0.47 0.48 0.30 2.20 0.35 -1.33 -1.49 -1.8 -1.64 0.82 0.30 1973 2.93 2.86 2.86 2.78 1.05 0.15 1974 1.95 1.79 1.78 1.64 1.19 0.32 1975 -3.30 -3.45 -3.44 -3.61 0.91 0.31 1976 1.51 1.46 1.46 1.41 1.07 0.11 1977 -0.61 -0.65 -0.65 -0.68 0.89 0.07 1978 -0.06 -0.12 -0.12 -0.17 0.34 0.11 1979 -0.82 -0.93 -0.93 -1.05 0.78 0.23 1980 0.58 0.35 0.35 0.12 4.86 0.46 1981 -1.46 -1.50 -1.50 -1.54 0.94 0.09 1982 -0.70 -0.71 -0.71 -0.72 0.97 0.02 1983 0.17 0.14 0.14 0.12 1.35 0.04 1984 0.22 0.21 0.21 0.19 1.15 0.03 1985 1.68 1.66 1.66 1.63 1.03 0.05 1986 0.60 0.64 0.64 0.68 0.88 -0.08 1987 0.56 0.49 0.49 0.43 1.32 0.14 1988 1.00 0.98 0.98 0.95 1.05 0.05 Year Implicit Laspeyres (direct Paasche) (1) Implicit KonüsByushgens (ideal Fisher) (2) 1971 0.65 1972 Strong nonhomoth changes 12 Empirical evidence (I) Table 1. (Continued) Alternative Measures of TFP Changes Based on Different Cost Functions (in percentage) All industries in the Italian economy Implicit Generalized Leontief (3) Implicit Paasche (direct Laspeyres) (4) Direct Paasche/Direct Laspeyres ratio (5) = (1)/(4) Difference between direct Paasche and direct Laspeyres (6) = (1) - (4) 0.26 0.26 0.24 1.23 0.05 -0.32 -0.35 -0.35 -0.38 0.83 0.06 1991 -0.34 -0.31 -0.31 -0.28 1.23 -0.06 1992 0.93 0.89 0.88 0.84 1.11 0.09 1993 0.94 0.94 0.94 0.94 1.00 0.00 1994 1.65 1.64 1.64 1.63 1.01 0.02 1995 1.20 1.20 1.20 1.21 0.99 -0.02 1996 -0.26 -0.26 -0.26 -0.26 1.00 0.00 1997 0.54 0.52 0.52 0.50 1.07 0.03 1998 -0.29 -0.30 -0.30 -0.30 0.97 0.01 1999 -0.08 -0.09 -0.09 -0.10 0.79 0.02 2000 0.73 0.63 0.62 0.53 1.36 0.19 2001 -0.31 -0.31 -0.31 -0.31 0.98 0.01 2002 -0.34 -0.34 -0.34 -0.35 0.96 0.01 2003 -0.42 -0.42 -0.42 -0.42 0.99 0.00 Year Implicit Laspeyres (direct Paasche) (1) Implicit KonüsByushgens (ideal Fisher) (2) 1989 0.29 1990 13 The Net Profit Approach (I) The basic idea is to find an unrestricted function where there are no reference variables. We build on the seminal research of Diewert and Morrison (1986) and Kohli (1990), who used the restricted revenue function to measure the terms-of-trade component of welfare change. We base our developments on the theory of profit functions. (See Lawrence J. Lau, “Profit Functions of Technologies with Multiple Inputs and Outputs”, Review of Economics and Statistics, August 1972, Vol. 54, no. 3, pp. 281-289.) 14 The Net Profit Approach (I) The function should exhibit some desirable properties, such as differentiability, homogeneity, and separability with respect to other variables. A possible candidate is the net profit function Πt(p,w) which can be considered as a transformation function in the space of output and input prices for a given profit value. It is dual to the transformation function Tt[y,(-x)] defined in the space of output and input quantities. 15 The Net Profit Approach (II) Let’s start with the simplest model of one output (y) and one input (x) of a price-taking firm producing under constant returns to scale and facing the output price (p) and the input price (w) in perfectly competitive markets. Productivity (TFP) is defined as y TFP x 16 The Net Profit Approach (III) The aim is to provide a measure of the relative rate of technical change (productivity net of scale effect). Under constant returns to scale (no scale effect) and perfect competition, in a one-output, one-input model of production, the relative rate of productivity or technical change (TFPG0) between t=0 and t=1, as seen from the perspective of situation t=0, is 1 0 0 1 0 0 1 y y y y x y x 0 TFPG 1 0 / 0 0 1 x x x y x Similarly, we could define the relative rate of change in TFP with respect to the comparison situation t=1. 17 The Net Profit Approach (IV) 1 0 0 1 0 0 1 1 0 0 1 1 1 y y y y x y x y x y x w y TFPG0 1 0 / 0 1/ 1 0 1 0 1 y x y x p x x x x y1 x 0 y 0 x1 w1 1 0 1 y y p x1 x 0 w1 1 1 1 1 1 1 0 1 1 1 ( p , w ) 1 0 0 ( p1 , w1 ) py py y y p ~ 1 ~ 1 ~ 0 ~1 [ (1, w ) (1, w )] Normalized net profit function In general, 1 w y k p x where k is the degree of RS. With CRS: k=1 k is generally unknwon * w y However, p x with w* = w / k if w* rather than w is observed. 18 The Net Profit Approach (V) TFPG 0 [ 1 1 1 1 1 0 1 1 ( p , w ) ( p , w )] 1 1 1 0 p y p y [ [ 1 1 1 1 1 0 0 0 ( p , w ) ( p , w )] 1 1 0 0 py p y 1 1 0 1 1 0 0 0 ( p , w ) ( p , w )] 1 0 0 0 py p y 0 x [( p1 y1 w1 x1 ) / p1 y1 ( p 0 y 0 w0 x 0 ) / p 0 y 0 ] 0 y Normalized net profit change w0 w1 0 1 p p Laspeyres-type relative price change component19 The Net Profit Approach (VI) If then 11 p 212 w 22 w t 1 2 2 and 1 1 ~t ~ t t ~ (1, w) (1, w) t ( p, w) t y py ~0 ~1 0 x x1 w0 w1 0,1 P ~ 0 ~1 0 ~ 0 ~1 1 0 1 p y y p Relative and technica l change [( p1 y1 w1x1 ) / p1 y1 ( p0 y 0 w0 x0 ) / p0 y 0 ] P0,1 Normalized net profit change Relative price change component 20 Some empirical results (I) Figure 4. Measures of effects of TFP growth on real factor prices, based on the GL and KB cost functions Cost-based measure of TFPG and its components All industries in the Italian economy 2.0% NK = Non-ICT fixed capital ICT = ICT fixed capital L = Labour 1.5% E = Energy inputs M = Materials E M = Relative changeinputs in real prices of non energy materials S = Service 1.0% TFP = Total factor productivity TFP L 0.5% L L M S L S NK IC E M S NK ICT TFP E ICT M NK ICT TFP E M S NK TFP 0.0% -0.5% -1.0% 2000 2001 2002 2003 Figure 5. Measures of effects of TFP growth on real factor prices, based on the GL and KB profit functions Profit-based measure of TFPG and its components All industries in the Italian Economy 2.0% NK = Non-ICT fixed capital E ICT = ICT fixed capital L = Labour 1.5% E = Energy inputs M = Materials S = Service inputs TFP 1.0% TFP = Total factor productivity M 0.5% M L L NK ICT 0.0% S L E M S NK ICT TFP E M S L NK ICT TFP E M S NK ICT TFP -0.5% -1.0% 2000 2001 2002 2003 21 Empirical results Main conclusions (I) Italy has had some special reasons to be concerned about productivity of the economy. The high public debt and the unresolved north-south regional divide require sustained growth in production. Many factors seem to constrain economic activities, including highly regulated markets and protective institutional setting in favour of incombents. While empirical studies have concluded that the US, for example, appear to have constant or slightly decreasing returns to scale thank to a relatively free capacity adjustment to the new opportunities of growth, decreasing returns to scale may be more dominant in Italy . 22 Empirical results Main conclusions (II) • One important element of productivity growth in Italy is technical change (TFP net of the scale economies or diseconomies). • Scale diseconomies seem to affect the internal structure of production. • Non-homotheticity appear to prevail over the whole period 1970- 2003, except three years. • Non-constant returns to scale are not neutral, thus bringing about rather strong asymmetric changes in the composition of production and in the use of factor inputs. 23 Empirical results Main conclusions(III) Towards “TFP growth accounting” • The negative trend in productivity noted recently in this country, almost disappear with the proposed measure. • Future steps in our nonparametric productivity measurement will be towards the completion of “TFP growth accounting” by correcting our proposed measure for other main components, as for example, market power, cyclical behaviour, externalities, adjustments, technical and organizational inefficiency. • Volunteers joining the company are welcome! • Critical comments are invited. 24