ProCard Program Procedure Manual GEORGETOWN UNIVERSITY DIVISION OF FINANCIAL AFFAIRS

advertisement

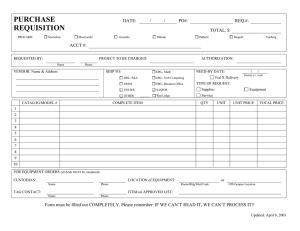

GEORGETOWN UNIVERSITY DIVISION OF FINANCIAL AFFAIRS ProCard Program Procedure Manual Note: The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS TABLE OF CONTENTS 1 2 3 4 5 PROCARD BASICS ................................................................................................................. 4 1.1 Corporate Liability for ProCard ................................................................................... 4 1.2 1.2.1 1.2.2 1.2.3 Eligibility for a ProCard Account ................................................................................. 4 Employment Status ..................................................................................................... 4 Maximum Number of ProCards per Employee ........................................................... 4 Changes in Employment Status.................................................................................. 4 1.3 ProCard Types ............................................................................................................ 5 1.4 Purchase Authorization Limits .................................................................................... 5 1.5 Performance Monitoring of the ProCard Program ...................................................... 6 PROCARD PRIVILEGES AND RESPONSIBILITIES ............................................................. 7 2.1 Adherence to ProCard Policies ................................................................................... 7 2.2 Document Maintenance .............................................................................................. 7 2.3 Account Reconciliation ................................................................................................ 7 2.4 Sponsored Accounts ................................................................................................... 7 2.5 Supervisor or Financial Administrator/Cost Center Manager Responsibilities ........... 8 2.6 Additional Disciplinary Actions .................................................................................... 8 PROCARD SECURITY ............................................................................................................ 9 3.1 Storage of the ProCard ............................................................................................... 9 3.2 Account Number ......................................................................................................... 9 3.3 Sharing (or Use by Someone Other Than the Cardholder) ........................................ 9 REPORTING A LOST OR STOLEN CARD .......................................................................... 10 4.1 Reporting a Lost or Stolen Card to JP Morgan ......................................................... 10 4.2 Reporting a Lost or Stolen Card to the ProCard Office ............................................ 10 4.3 Responsibility for Card-Present Fraudulent Transactions Prior to Bank Notification 10 TAX EXEMPTION .................................................................................................................. 11 5.1 Cardholder Responsibility for Ensuring Tax Exemption ........................................... 11 Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 2 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS 6 7 8 9 5.2 District of Columbia (DC) Tax Exemption Certificate ................................................ 11 5.3 Maryland or Virginia Tax Exemption Certificate ........................................................ 11 PROCARD PURCHASE PROCESS ..................................................................................... 12 6.1 Strategic Business Agreements (SBA) and Preferred Suppliers .............................. 12 6.2 Restricted Commodities for the Standard ProCard .................................................. 12 6.3 Allowable Commodities for the T&E and Unrestricted ProCards Only: .................... 13 6.4 Personal Purchases .................................................................................................. 13 6.5 ProCard Purchase Check List ................................................................................... 13 RECONCILING PROCARD TRANSACTIONS ..................................................................... 15 7.1 Business Purpose ..................................................................................................... 15 7.2 Billing Statement Period ............................................................................................ 15 7.3 Adequate Documentation ......................................................................................... 15 7.4 Frequency of Reconciliation ...................................................................................... 15 7.5 Reconciliation Process .............................................................................................. 15 7.6 Documenting ProCard Purchases ............................................................................ 16 PAYMENTNET ON-LINE SYSTEM ....................................................................................... 17 8.1 First Time Logon ....................................................................................................... 17 8.2 Accessing PaymentNet ............................................................................................. 18 DISPUTING A TRANSACTION ............................................................................................. 19 Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 3 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS 1 PROCARD BASICS The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. The Procurement Card (ProCard) Program facilitates point of demand procurement giving authorized cardholders the ability to purchase specific goods and services directly from a supplier. The ProCard will eliminate the time and effort spent on processing requisitions and expense authorizations, filing of purchase order copies, and the reconciliation of invoices. It is designed to improve efficiency in processing low dollar value purchases from any vendor that accepts the MasterCard credit card. Many of our current suppliers, with whom you now use a purchase order, will accept the MasterCard credit card. 1.1 Corporate Liability for ProCard The ProCard has corporate liability for Georgetown University. Your personal credit is neither verified nor affected by ProCard activity. 1.2 Eligibility for a ProCard Account 1.2.1 Employment Status Only Georgetown University employees can be issued a procurement card. Students of Georgetown, temporary employees or volunteers of Georgetown are not eligible for ProCards. Exceptions may be granted with Campus CFO approval. 1.2.2 Maximum Number of ProCards per Employee Employees are entitled to a maximum of one regular Procard. In some cases, when approved, an employee may be issued an additional Declining Balance Card (DBC) ProCard. 1.2.3 Changes in Employment Status When a ProCard cardholder terminates employment with the University, transfers to another position within the same department or transfers to another University Department in which ProCard use is not a part of his/her job function, he/she or the Financial Administrator must contact the ProCard Office to close his/her account. The ProCard Office will close the account. The cardholder can also contact JP Morgan to close his/her account. The card must either be shredded or cut into several pieces. It is not necessary to return the card to the ProCard Office. If a ProCard cardholder transfers to another University department in which ProCard use is a part of his/her job function, he/she or the Financial Administrator must contact the Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 4 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS ProCard Office to suspend the account. An approved Update Application with a new ProCard Agreement must be forwarded to the ProCard Office for processing. The account’s hierarchy and default accounting will be updated. The card plastic and be reissued when it is convenient. NOTE: Any improper charges made to the card belonging to a terminated employee must be reimbursed to Georgetown by that original cardholder. 1.3 ProCard Types The ProCards is a “one card”; a single plastic that can be setup make different types of purchases: 1.4 Standard Procurement - Supply purchases Travel & Entertainment (T&E) - For travel and entertainment and for approved events or services Cash – Cash or Quasi-Cash Transactions Fines – Payment of fines, airport fees, parking (in some cases) iTunes – Downloadable media, such as music, e-book, e-periodicals Unrestricted – Combines all of the preceding types, it only excludes transactions at high-risk merchants, issued on a limited basis Declinine Balance (DBC) – the credit limit does not refresh, but declines to zero Purchase Authorization Limits Purchase Authorization Limits are initially setup during the application process. They can be revised, either permanently or temporarily, with approval from the Campus CBO/CFO. When a purchase authorization is requested by the supplier at the point-of-sale, the MasterCard ProCard system validates the transaction against pre-set limits. All transactions are approved or declined instantaneously based on the following ProCard authorization criteria: Monthly Credit Limit - (recommend spending limits based on position) Overall Single Amount Limit – Maximum across all types of purchases Cash Advance Limit – separate from Monthly Credit Limit, maximum $2,500 if Cash is authorized Single Amount Limit for Standard Procurement, usually $4,999 or less Single Amount Limit for Travel & Entertainment, usually $10,000 or less Splitting a transaction (including all delivery, shipping and/or special handling charges) into more than one charge to circumvent the approved Single Amount Limit, is a violation of ProCard Policy and can result in loss of the ProCard and additional penalties. Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 5 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS 1.5 Performance Monitoring of the ProCard Program Financial Affairs will monitor the performance of the Procurement Card program. All questions or concerns regarding this program should be directed to the ProCard Program Administrator. Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 6 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS 2 ProCard Privileges and Responsibilities 2.1 Adherence to ProCard Policies ProCard expenditures must be compliant with all existent avenues of procurement for goods and services. The privilege of ProCard use is always contingent on the full adherence to all relevant policies. 2.2 Document Maintenance ProCard users and departments must follow policy guidelines including maintaining proper documentation at the source of the transaction to ensure adequate internal control, sound financial accountability, and adherence to accounting and audit standards Per Policy 100-15, Record Retention and Destruction Policy, the Document Retention Steward, appointed by the University Office’s Dean or Vice President, is responsible for maintaining ProCard statements and supporting documents: ProCard Spending Type General/Other Sponsored Programs--Federal Grants 2.3 Retention Period 7 years from end of the reporting year 3 years from date of final expenditures report. Account Reconciliation ProCard expenditures must be reconciled on a monthly basis. The Cardholder or designee must reconcile all charges in conjunction with the monthly Center Status Report reconciliation. Cardholder should refer to their specific campus reconciliation deadlines. If allowed by the Cardholder’s campus, online reconciliation via PaymentNet is recommended. Cardholders are able to reconcile posted transactions—updating Worktags and the statement of business purpose. Normally, online reconciliation is available from the day after the cycle closes through the Second (2 nd) business day of the next calendar month. The online reconciliation period is shorter for the June, fiscal yearend period. ProCard charges should not remain in the S0193 – ProCard Expense, Spend Category after the financial period has closed unless the charge was offset by a credit or the transaction was a personal expense that was reimbursed to the University. 2.4 Sponsored Accounts For budgets that involve a sponsored grant, it is the Principal Investigator’s, Cardholder’s or designee’s responsibility to (a) make sure all charges or reallocations adhere to, and are compliant with the conditions of the award and (b) that charges or reallocations are not charged to an expired account. Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 7 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS NOTE: ProCards may not default to a sponsored grant account without prior written approval from the Director of Sponsored Accounting. 2.5 Supervisor or Financial Administrator/Cost Center Manager Responsibilities Supervisors or Financial Administrators, signed and accept the terms and conditions of the Georgetown University ProCard Agreement along with each Cardholder for which they are responsible. These responsibilities include: 2.6 Ensuring that cardholders use the card in compliance with ProCard policies. Notifying the ProCard Office upon termination/resignation of a cardholder Notifying the ProCard Office when he/she leaves Georgetown University or changes departments and is no longer responsible for a cardholder or cardholders. Additional Disciplinary Actions Use of the ProCard for personal expenditures, or other violations of the ProCard policies and procedures, may also subject cardholders to disciplinary action under applicable University policies and procedures, up to and including termination of employment under Human Resources Policy #302. Please refer to the ProCard Policy FA161-07. Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 8 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS 3 PROCARD SECURITY The ProCard should always be treated with at least the same level of care that you treat your own personal credit cards. 3.1 Storage of the ProCard Keep your ProCard in an accessible but secure location. Since you, as the ProCard Cardholder, should be the only one using the card it needs to be accessible only to you. 3.2 Account Number Guard the account number carefully! Do not post it at your desk or write it in any other place that is easily accessible by others. 3.3 Sharing (or Use by Someone Other Than the Cardholder) The only person that may authorize the use of his/her card is the person whose name appears on the face of the card. If an individual is responsible for maintaining a departmental credit card, that person, along with the Cost Center Manager and the Department Chair, are responsible and accountable for the charges that post to that credit card. All purchase transactions processed against a ProCard should be made by the individual to whom the card is issued. Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 9 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS 4 4.1 REPORTING A LOST OR STOLEN CARD Reporting a Lost or Stolen Card to JP Morgan It is the responsibility of the Cardholder to report a lost or stolen ProCard immediately to the card issuer, JP Morgan--representatives are available 24 hours a day, seven days a week. When reporting a lost or stolen card, the cardholder must tell the representative the call is regarding a Georgetown University ProCard. J.P. Morgan 24-Hour Lost or Stolen Card Line: 4.2 (800) 316-6056 Reporting a Lost or Stolen Card to the ProCard Office After reporting a lost or stolen card to JP Morgan, and within 48 hours of the loss of theft, the cardholder must also report the following information to the ProCard Office with a carbon copy (cc:) to the ProCard Administrator: Cardholder Name Cardholder Account Number Card was Lost or Stolen (state which is the case) Date the Lost/Stolen Card Was Reported to JP Morgan The information must be provided in writing and may be delivered via service ticket, email or campus mail. 4.3 Responsibility for Card-Present Fraudulent Transactions Prior to Bank Notification It is the Cardholder's responsibility to report the loss of the card immediately to the issuing bank (JP Morgan Chase) and the University ProCard Office within 48 hours. Any charges incurred on a stolen or lost card where the actual card was being used to make purchases, are not disputable or reimbursable to the cardholder if the charges are incurred prior to bank notification that the card is lost or stolen. Thus, any fraudulent charges made with the actual credit card in hand prior to notifying the bank are the responsibility of the Cardholder. Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 10 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS 5 TAX EXEMPTION 5.1 Cardholder Responsibility for Ensuring Tax Exemption It is the Cardholder's responsibility as an agent of the University to ensure the proper use of the University's sales tax exempt registration numbers and to ensure the University is not charged sales tax whenever applicable. If sales tax was paid because an available exemption was not used or documentation of reasonable efforts undertaken to recover sales tax is not made then, the employee should reimburse the sales tax to the University. In no circumstance should funds from a Sponsored Program cost center be used to pay sales tax. A supplier may request a tax exemption certificate from the University as a result of a ProCard transaction. When this happens the cardholder should fax or email the supplier a copy of the proper tax exemption certificate. 5.2 District of Columbia (DC) Tax Exemption Certificate The District of Columbia (DC) tax certificate is used for all goods being delivered to DC or picked up in DC (regardless of where the vendor is located). 5.3 Maryland or Virginia Tax Exemption Certificate The Maryland or Virginia certificates are used when an item is being picked up at a Maryland or Virginia location or the delivery is being made to a Maryland or Virginia location. The vendor may also request a copy of the DC certificate when the delivery is being made to Maryland or Virginia. (This is because the University has a billing address in DC and a delivery address to Maryland or Virginia.) Take note of the expiration date on these certificates. Some have a one year, two year, or life date. You must use a valid tax exemption certificate. If the one you are using has expired, contact the ProCard for a valid certificate. Laminated DC tax certificates are also available upon request. Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 11 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS 6 6.1 PROCARD PURCHASE PROCESS Strategic Business Agreements (SBA) and Preferred Suppliers All ProCard expenditures must be made in accordance with Strategic Business Agreements and Preferred Suppliers established by Purchasing and Contracts on behalf of the University. Using an alternate supplier requires prior written authorization from Purchasing and Contracts. If a particular product or service is not available through one of these, the user may choose a qualified supplier. The user should solicit support from the Purchasing Agent who has responsibility for that commodity. This program will enable you to purchase approved commodities directly from our vendors. The related charges will be debited directly to the University default budget number designated for each Procurement Card. Payment for all Procurement Card transactions is performed electronically by Financial Affairs, thus eliminating the need to process vendor invoices. 6.2 Restricted Commodities for the Standard ProCard The Standard ProCard cannot be used for the following transactions: Animal and Animal Related Purchases Annual Contract Maintenance Agreements Automotive Gasoline Capital Equipment (Over $4,999) Cash Advances (Includes GoCard funding. Gift Certificates allowed with recipient name, signature and purpose) Catering Services where a signed contract is required Construction and Renovations Consulting Services Controlled Substances (except for authorized research use) Donations Entertainment Fines Moving Relocations Office & Laboratory Furniture (orders over $4,999) Personal Items Prescription Drugs (except for authorized research use) Radioactive and Hazardous Materials (except for authorized research use and with approval from EH&S whenever applicable) Travel and Related Expenses (with the exception of small grocery purchases) Computers from Non-Preferred Computer Vendors (Designated employees from University Information Systems, McDonough School of Business Technology Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 12 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS 6.3 Allowable Commodities for the T&E and Unrestricted ProCards Only: 6.4 Services, Classroom Education Technology Services, Law Center Information Systems Technology and LAN Administrators employees are exempt) Monitors, Other Computing Hardware, Audio Visual Equipment such as televisions and projectors over $500. See Policy FA 165-08 for details. iTunes Music and E-book Downloads (Unless Approved By Campus CFO/CBO) Airfare Cabs/Metro/Parking/Buses/Tolls Cash advances, with a daily limit of $161 – (All advances must be reconciled with the trip receipts. The department has to request this feature and it must be approved by the Campus CFO.) Dinners with Potential or Active Donors and Guests – (Documentation must include all attendees and purpose of event) Events, Services and Deposits (after contract approval from Contracts Manager – See the Contracts Policy, FA 102-08) Gasoline for Rental Cars or University Vehicles Only Lodging (Hotels) Meals (while on travel for GU business) Rental Cars Trains Personal Purchases Purchases must be for the use and benefit of Georgetown University. No personal purchases are allowed. Accidental/incidental use of the ProCard for non-business must be reimbursed to the University by the cardholder and documented at the time of monthly reconciliation. The ProCard Administrator must also be notified of the correction in writing within 30 days of completion of the monthly reconciliation. 6.5 ProCard Purchase Check List Be sure to follow these procedures when using the ProCard: Make sure the purchase does not fall under a restricted commodity. Obtain necessary departmental approvals if applicable before ordering. Use a preferred supplier whenever applicable. Make sure the transaction total does not exceed the single purchase limit. Contact the supplier and state that you are calling from Georgetown University. Ensure the supplier knows of the University’s tax exempt status. Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 13 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS Order the supplies and give the supplier the ProCard number and the expiration date. Provide the complete shipping address including name, building and room number. Provide the billing address of the ProCard. Upon delivery, inspect the shipment for accuracy and maintain the receipt. Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 14 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS 7 RECONCILING PROCARD TRANSACTIONS 7.1 Business Purpose All purchases made with a Georgetown University Procurement Card must be for the use and benefit of the university. Monthly reconciliations of permissible charges must include a detailed business purpose. The card holder is responsible for supplying a description to reasonably help justify the expense as a university business expense. “..a description to reasonably help justify the expense...”. 7.2 Billing Statement Period The ProCard statement closing date is the 20th of each month (except for June 30th for the end of the fiscal year). Cardholder and Financial Administrators can reconcile their transactions from the day following the closing date through the first (1st) business day of the following month. PaymentNet transactions are uploaded to the accounting system on the second (2 nd) business day of the month following the statement closing date. Once transactions are uploaded into the accounting system, they can no longer be reconciled within PaymentNet and must be reconciled through a Journal Voucher. 7.3 Adequate Documentation Procurement Card holders are responsible for providing sufficient documentation for all transactions that occur on their card. For each charge on a monthly statement there must be supporting documentation. Original receipts are preferred; however, scanned copies of receipts may be accepted in the event that the originals are lost. Please note, summary receipts or statements are unacceptable. All receipts/documentation must be itemized. 7.4 Frequency of Reconciliation All charges on the ProCard must be reconciled monthly by the cardholder or department administrator within 30 days of the fiscal closing of the month. Individual campuses may impose shorter time frames for completing the reconciliation process. The Cardholder or designee is responsible for ensuring that the proper University Account Code and budget is charged for each purchase. Charges may not remain in the default ProCard account code 74833 more than 30 days. 7.5 Reconciliation Process The following actions should occur as part of the reconciliation process: Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 15 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS 7.6 All charges should be allocated to the appropriate cost centers and account codes Receipts and detailed description of activities should be attached to ProCard bank statement If necessary, the cardholder should reimburse the University for any personal, non-business charges, and such charges should be reported to the departmental administrator. Documenting ProCard Purchases ProCard users shall keep receipts (original or PDF scan). The register receipts or invoices must show the line item description and pricing of the individual items purchased and the total price for the transaction that correctly matches the charge on the bank statement. The receipts or invoices must illustrate the legitimate business purpose of all transactions made with the ProCard. Additional supporting documentation must include at least one of the following (to be determined by relevant divisional administrative unit by matter of internal policy): Confirmation and packing slip (as needed based upon commodity, dollar amount, or volume) Service report for any service performed by a supplier Reviews of compliance with ProCard policies (including reconciliation procedures) will be performed by departmental administrators, business managers, campus CFOs, Financial Affairs, and Internal Audit. Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 16 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS 8 PAYMENTNET ON-LINE SYSTEM PaymentNet, provided by JP Morgan, is the software used to manage the ProCard program. PaymentNet is updated every business day to reflect all posted transactions for all ProCards from the previous business day, allowing virtually real-time tracking. Cardholders, Supervisors and Financial Administrators have the ability to not only view, but also to reallocate transactions and printout various reports, such as the cardholder’s statement. 8.1 First Time Logon Go to: www.paymentnet.jpmorgan.com PaymentNet is most compatible with Internet Explorer, Mozilla Firefox, and Safari Browsers Help Resources are Circled in RED below JPMorgan will email directly… Org ID: GRGTOWN User ID: NetID – If NetID is less than 6 characters add “Pnet” Temporary Password • • • Prompted Immediately Regarding… Permanent Password Authentication Questions Machine Registration Usage Policy Daily View Transactions to avoid fraudulent activity Forgot your Password? This link allows you to reset your own password by clicking on it. You will no longer have to contact anyone else for a password reset. Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 17 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS 8.2 Accessing PaymentNet The website may be found by logging in to https://pwnet.procard.com/georgetownu/. It is important that only the Microsoft Explorer Browser is used to access Pathway. In addition, the “Pop-up Blockers” option located in the “Tools” tab must be turned off. The initial login will require the combination of the first 4 letters of the Cardholder’s last name combined with the last 6 numbers of their card. (See login screen below.) For example, John Smith may have a Username of “smit654321”. Use this combination for both the Username and the Password. (The Username and Password IS case-sensitive.) Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 18 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS 9 DISPUTING A TRANSACTION A Cardholder may dispute a charge that appears on their monthly ProCard statement. If there is a charge that is not recognized by the Cardholder, or if it appears to be incorrect, the Cardholder must first attempt to resolve the issue with the supplier. If a resolution with the supplier is not possible the Cardholder must submit a Statement of Questioned Item with supporting documentation to JP Morgan Chase. During the investigation, a credit will be issued to the cardholder's account for the amount questioned. When JP Morgan Chase has completed the investigation, the Cardholder will be notified of the resolution. If the dispute is not settled in the favor of the Cardholder, the account will be charged for disputed transaction amount. Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 19 GEORGETOWN UNIVERSITY – DIVISION OF FINANCIAL AFFAIRS 10 KEY CONTACTS AND RESOURCES 10.1 Contacting the ProCard Office The best way to contact the Procard Office is through Email at: procard@georgetown.edu The requestor will receive reference ticket number via email, created in the Kayako Customer Service Tracking System. or For questions concerning the administration of the ProCard, please contact the ProCard Administrator: mwp34@georgetown.edu (202) 687-3976 Effective 06/01/2009 Revised 11/25/2015 The Procurement Card (ProCard) must be used in accordance with the University’s ProCard Policy FA161-07. Page 20