PPPs and Affordability Philippe Burger University of the Free State

advertisement

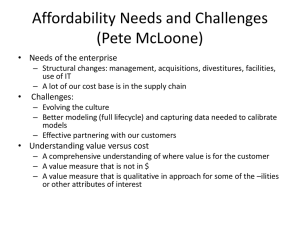

PPPs and Affordability Philippe Burger University of the Free State • • • • Affordability in principle terms Affordability in practical terms Affordability and VFM Affordability, limited budget allocations and legally imposed budgetary limits • Conclusion Affordability in principle terms • Affordability and VFM are the benchmarks for PPP viability. • Because of the off-balance sheet nature of PPPs, their use has led to some misconceptions regarding their impact on the affordability of projects. • Though PPPs may enable some projects to become affordable, this does not stem from their off-balance sheet nature. • The point is: Affordability not only relates to PPPs, but to gov expenditure items in general. • Confusion about affordability created by the off-budget nature of PPPs • Impression that because government not responsible for the acquisition of the asset, that PPPs are cheaper than traditional procurement – this is a fallacy • In principle affordability is about whether or not a project falls within the long-term (intertemporal) budget constraint of government. – If it does not, then the project is unaffordable. • However, because the cash flows and balance sheet treatment of PPPs differ significantly from that of traditional procurement, some confusion exists about the effect of PPPs on affordability. • In principle terms, a traditionally procured project is affordable if the present value of the future revenue stream of government: – equals or exceeds the sum of expected future interest payments and the present value of government’s expected capital and noninterest current expenditure, – while a portion of such future expenditure streams is allocated to such a traditionally procured project. • In principle terms, a PPP is affordable if the present value of the future revenue stream of government: – equals or exceeds the sum of expected future interest payments and the present value of government’s expected capital and noninterest current expenditure, – while a portion of such future expenditure streams is allocated to such a PPP. • In both cases the positive net worth of government depends on whether or not the present value of expected future primary surpluses (i.e. surpluses that exclude interest payments) equal or exceed the value of existing public debt. • The only essential difference between the two cases is between the timing of the flows Affordability in practical terms • Even though the above is technically correct, it has one shortcoming: – Although PPPs and the PSC used in PPPs involve detailed present value calculations over the whole life of a PPP contract, governments rarely use present value calculations for the rest of their activities. – Governments also rarely budget for a longer horizon than the upcoming year (although some use medium term fiscal forecast). • This raises the question: how should affordability of a PPP be assessed within an environment where the planning horizon is not very long? • As with other government activities in such an environment a PPP project is affordable if: – the expenditure it implies for government can be accommodated within current levels of government expenditure and revenue – and if it can also be assumed that such levels will be and can be sustained into the future. • This working definition of affordability allows for the use of present value calculations when estimating cost of a PPP vs that of traditional procurement (using a PSC), but to do so in an environment with a short planning horizon. Affordability and VFM • Relative affordability: affordability of PPP compared to that of traditional procurement – Interest rate and efficiency differentials main determinants (of relative affordability and VFM) • Absolute affordability: Can the project (delivered either trough a PPP or traditional procurement) be accommodated within the budget without violating the budget constraint • UK: – Procuring authorities must complete affordability model for any planned PFI (it includes sensitivity analysis) – The models based on agreed upon departmental figures for the years available and cautious assumptions about future dept spending envelopes • Victoria: – Decision about how a project is funded is separate from the decision about how it is to be delivered. – Potential PPP compete with other capital projects for limited budget funding to ensure that they fall within what is considered affordable – Funding is approved on the preliminary PSC • Brazil: – Project studies must include a fiscal analysis for the next ten years. In addition, the commitment of the federal budget to PPP projects is limited by law to 1% of the net current revenue of the government. • Hungary: – From 2007 a limit on the amount of expenditure on PPPs within the budget, so that each program has to fit within this limit. Affordability, limited budget allocations and legally imposed budgetary limits • Distinction between affordability, limited budget allocations and legally imposed budgetary limits • In many countries there are: – Limits on second- and third-tier government borrowing. – Fiscal rules that limit government expenditure, deficits or debt. • Thus, project might be affordable, but legally imposed budgetary limit prohibits borrowing. • Further example: budgetary allocations of government departments and authorities that are done from a central budget and within which expenditure plans must be fitted. • Even if a traditionally procured project would not violate the long-term budget constraint of government, a project may still exceed the future expected budgetary allocations of a specific government department. • Danger: less of a focus on VFM and create an incentive to get project off the books of government • Three specific cases when there is an incentive to get project of the books of government: • The first case is one where a project cannot be delivered through either traditional procurement or a PPP within budgetary limits. • Has 3 features, but a short-run focus on the 1st and a disregard for the 2nd and 3rd by government creates the incentive to go the PPP route 1. Should government use traditional procurement, the large initial capital outlay will cause a government entity to exceed its allocated budget. 2. Should entity then decide to go the PPP route, it may not be able to make future fee payments to private partners without exceeding its expected future allocated budgets. 3. In addition, the private partner also cannot impose a user charge on the direct consumers of the service. • Second case shares the same features with the first with the exception that instead of receiving a fee from gov, the priv partner can impose a user charge directly on the consumers of the service • As a result, the project might fit within the budget allocation of the government entity. • Additional question: Is the higher tax-plus-usercharge burden of those individuals benefiting from the good or services acceptable? • Third case occurs when gov operates under a fiscal rule that sets a limit on the overall fiscal balance of government (or a department operates under a budget allocation). • Traditional procurement: Capital outlays may contribute to breaking the budgetary limit in the year in which government undertakes outlays. • PPP: Private sector responsible for initial capital outlay and government might be able to fit future payment of fees to private partner into its budget without exceeding the budget limit. • In all three cases the budgetary limit may be main reason why government might want to get projects of its books. – However, main reason should be higher VFM. • This is not an argument against budgetary limits and rules – rather it is an argument in favour of emphasising VFM as the main rationale for going the PPP route Conclusion • Because of the off-balance sheet nature of PPPs, there has been some misconceptions regarding their impact on the affordability of projects • On the whole, these misconceptions may lead to a shift of focus away from VFM as the main rationale for doing PPPs • The analysis, though, indicates that affordability has little, if not nothing, to do with the set of books on which the project appears