Budget review Croatia

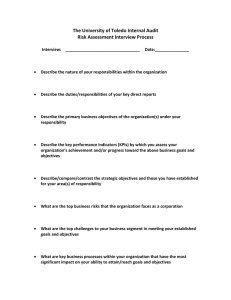

advertisement

Budget review Croatia Second meeting of Senior Budget Officials from Central, Eastern, and South-Eastern European Countries Ljubljana 16-17 February 2006 Daniel Bergvall Budgeting and Public Expenditures Division OECD 1 Introduction Small unitary country (4.5 million inhabitants) Two layers of sub-national government Focus on modernisation of public administration and budget process aiming at EU-membership 2 Compared to EU-15, relatively good growth in recent years EU 15 Croatia 1999 3.0 -0.9 2000 3.8 2.9 2001 1.9 4.4 2002 1.1 5.2 2003 1.1 4.3 2004 2.3 3.8 2005 1.4 3.9 2006 2.0 4.0 2007 2.2 4.4 2008 4.3 3 Large government sector, and high, but decreasing deficits 56 54 Revenues Expenditures 52 50 48 46 44 42 40 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 4 Government sector largely central government Plan 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 0% 20% 40% Central Government Budget 60% Extrabudgatary funds 80% 100% Budgets of LGU 5 Recent major structural reforms Overall aim… …both for institutional reform and fiscal policy are reforms aimed at EU-accession 6 Recent major structural reforms Budget act of 2003 Improving tax collection through establishment of the Financial Police Law on Civil Servants and Public Employees Introduction of Single Treasury Account 7 Major features of recent budgets Fiscal consolidation – reducing deficits and clearing arrears Bringing extrabudgetary funds on budget Control of contingent liabilities Privatization 8 Budget formulation - Timetable Due Dates Activities End April Medium term economic and fiscal outlook prepared by Ministry of Finance and presented to government. 15 May Government enacts budget guidelines End May On the basis of the guidelines, the Ministry of Finance issues instructions to budget users and extra-budgetary users of the state budget, and to local and regional self-government units, for the development of budget proposals. End June Budget users deliver their financial plan proposals to the responsible ministry. July - October The Ministry of Finance reviews the proposals, and reconciles them with the estimated revenues and receipts. Detailed negotiations between Ministry of Finance and the line ministries. 15 October The Ministry of Finance prepares the draft State budget and draft consolidated budget and delivers it to the government. End October Government deliberation and decision over final budget proposal, on the basis of proposals from the Ministry of Finance and line ministries. 15 November The government or the local executive authority delivers the budget proposal and the consolidated budget to the Sabor (parliament) or the local representative council for adoption. End December The Sabor or the representative council passes the budget. The approved budget is published in the Narodne Novine (National Official Gazette). 9 Budget formulation Fiscal year is the calendar year Budget on cash basis Yearly ‘Law on budget execution’ Detailed budget (approximately 7000 line items) Flexibility in spending – reallocation between expenditure items Large but decreasing number of extra budgetary funds Expenditure and revenue strategy – Keep deficit within acceptable boundaries (below 3 % of GDP) 10 Medium term fiscal framework No explicit fiscal rule Instead an expenditure and revenue strategy that aims at keeping the deficit within acceptable boundaries Reduce deficit in medium term (by 0.5 % of GDP per year) to below 3 % of GDP Year to year budget Multi year line item estimates from 2005 11 Parliaments role in the budget process According to the Budget act, amendments and supplements to the proposed budget may NOT alter the deficit in the budget proposed by the government Many proposals for amendments – few are ultimately included Late tabling of budget - little time for Parliament to discuss and act on the budget proposal Members of the Finance and budget committee include non-parliamentarians 12 Budget execution Basic principles for budget execution in the Budget Act and the annual Law on budget execution Single treasury account introduced in 2001 Preventive cash control main tool for keeping expenditures in line with the budget Service delivery centralized FINA 13 FINA – The Financial Agency Heritage from former Yugoslavia Formally a government agency Handles all transactions (expenditures and revenues) for the government Also used by the private sector (clearing house for banks, postal transfer system and general bank services) 14 Accounting and Auditing Supreme audit institution is the State Audit Office Annual audit plan has to be adopted by Parliament The definition of audit in the State Audit Act covers financial as well as performance audits Audit of government privatisation has taken a substantial part of SAO capacity in recent years About 600 audits per year are done The Finance and Budget committee of the Parliament spends little time on audit reports Internal audit has been introduced very recently and is not yet operational 15