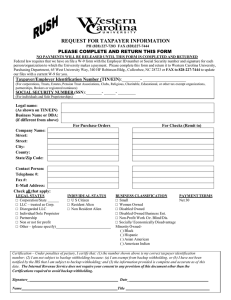

□ Substitute Form W-9 Request for Taxpayer

advertisement

Substitute Form W-9 Request for Taxpayer Identification Number and Certification Name (as shown on your income tax return) Print or Type Business name, if different from above □ Individual/Sole proprietor □ Corporation □ Partnership □ Limited Liability company. Enter tax classification (D=disregarded entity, C=corporation, P=partnership) ► -------- □ Exempt Payee □ Other (see instructions) ► Check appropriate box: Address (number, street, and apt. or suite no.) City, state, and ZIP code List account number(s) here (optional) Part I Taxpayer Identification Number (TIN) Social security number Enter your TIN in the appropriate box. The TIN provided must match the name given on Line 1 to avoid backup withholding. For individuals, this is your social security number (SSN). However, for a resident alien, sole proprietor, or disregarded entity, see the Part I instructions on page 3. For other entities, it is your employer identification number (EIN). If you do not have a number, see How to get a TIN on page 3. Note. If the account is in more than one name, see the chart on page 4 for guidelines on whose number to enter. (Instructions referred to above can be found at the IRS W9 website provided below.) Part II or Employer identification number Certification Under penalties of perjury, I certify that: 1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and 2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and 3. I am a U.S. citizen or other U.S. person (defined below). Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the Certification, but you must provide your correct TIN. See the instructions on page 4. Sign Here Signature of U.S. person ► Date ► General Instructions, and a fill-in W9 form, can be found at the following government website: http://www.irs.gov/pub/irspdf/fw9.pdf Section references are to the Internal Revenue Code unless otherwise noted. Note. If a requester gives you a form other than Form W-9 to request your TIN, you must use the requester’s form if it is substantially similar to the Form W-9. Please complete this Form W-9 and the Vendor Survey on the other side within 10 days of receipt to avoid delays in the purchasing and/or payment process. Return to the following address: University of Wisconsin-Platteville Pioneer Academic Center for Community Engagement (PACCE) 1 University Plaza Platteville, WI 53818-3099 UW-PLATTEVILLE Vendor Classification Survey Business Name____________________________________________________________ Address__________________________________________________________________ Address__________________________________________________________________ City_________________________________ St_______________ Zip Code__________ Vendor Classification: Please Check Appropriate Box Attorney Attorney or Corporation of Attorneys Corporation Corporation Or LLCs designated as a corporation United States Corporations only Employee Current active Employee of UW Institution Individual/Sole Proprietor Individual or Individual doing business by another name. Nonprofit An entity designated by the IRS as a non-profit entity Other Other is indicated to self-identify a vendor that does not fall into any other category. Partnership/LLC Only a United States registered LLC. LLC = Limited Liability Company Student A current enrolled student in a UW-Institution. Vendor Type: Please Check All That Apply Educational Institution All educational institutions. Foreign Vendor Business Entity with headquarters outside the United States Intergovernmental A local agency, board, commission, committee, council, department, or public body created by constitution, statute, ordinance, rule, or order. Wisconsin Certified Minority Vendor A Wisconsin Certified Minority Vendor Wisconsin Certified Woman Owned Minority Vendor Wisconsin Certified Woman Owned Minority Wisconsin Certified Woman Owned Vendor WI Certified Sheltered Workshop A Wisconsin Certified Woman Owned Vendor as indicated on the vendor survey or other documentation. An occupation-oriented facility operated by a not-for-profit corporation, which except for staff, employs only handicapped persons. Woman Owned Business A Woman Owned Business that is not WI Certified. HUBZone (Historically Underutilized Business Zone) A designation from the Small Business Administration that identifies disadvantaged geographical areas in which the federal government encourages commerce. Small Disadvantaged Business A firm that has registered with the federal government as an SDB Other Certified Minority Businesses Self-Certified Minority Business Other Veteran Owned Small Business Service Disabled Veteran Owned Small Business Minority vendors certified by other entities, i.e. other states, counties, cities or US federal government agency. A self certified minority business is an entity that has not formally registered for Small Disadvantaged Business as a Minority Business but wishes to claim their minority status. Veteran Owned Small Business. A designation from the Small Business Administration that identifies businesses principally owned by veterans, with whom the federal government encourages commerce. A designation from the Small Business Administration that identifies businesses principally owned by veterans disabled during their service, with which the federal government encourages commerce.