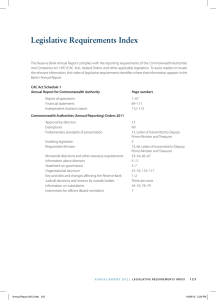

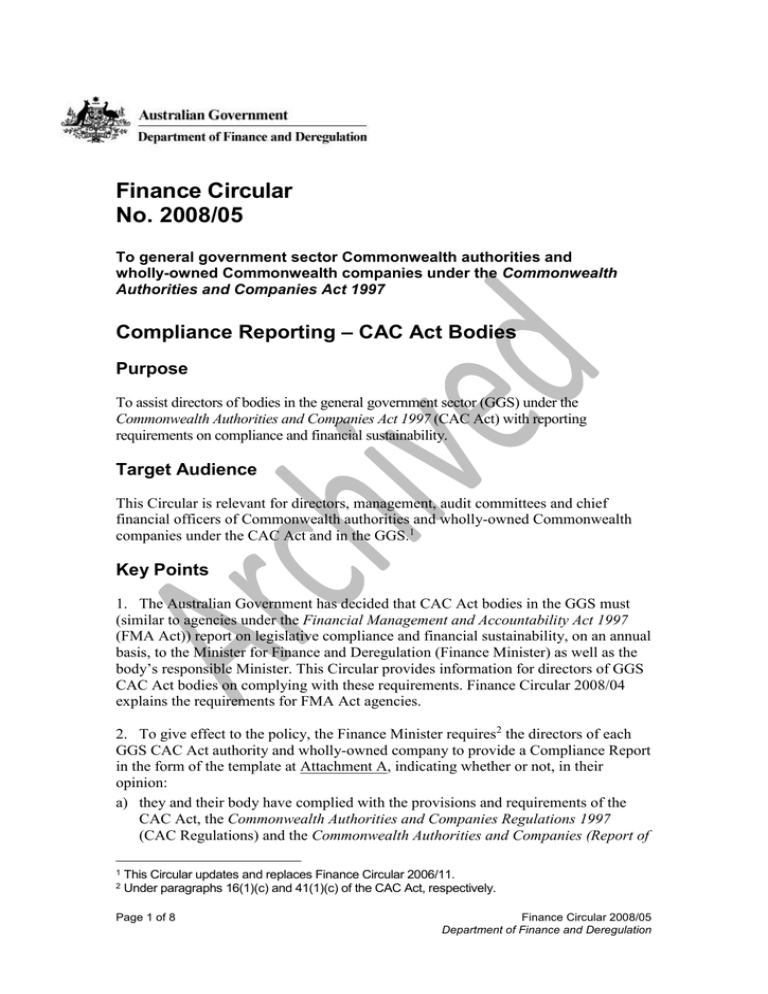

Finance Circular No. 2008/05 Compliance Reporting

advertisement

Finance Circular No. 2008/05 To general government sector Commonwealth authorities and wholly-owned Commonwealth companies under the Commonwealth Authorities and Companies Act 1997 Compliance Reporting – CAC Act Bodies Purpose To assist directors of bodies in the general government sector (GGS) under the Commonwealth Authorities and Companies Act 1997 (CAC Act) with reporting requirements on compliance and financial sustainability. Target Audience This Circular is relevant for directors, management, audit committees and chief financial officers of Commonwealth authorities and wholly-owned Commonwealth companies under the CAC Act and in the GGS.1 Key Points 1. The Australian Government has decided that CAC Act bodies in the GGS must (similar to agencies under the Financial Management and Accountability Act 1997 (FMA Act)) report on legislative compliance and financial sustainability, on an annual basis, to the Minister for Finance and Deregulation (Finance Minister) as well as the body’s responsible Minister. This Circular provides information for directors of GGS CAC Act bodies on complying with these requirements. Finance Circular 2008/04 explains the requirements for FMA Act agencies. 2. To give effect to the policy, the Finance Minister requires2 the directors of each GGS CAC Act authority and wholly-owned company to provide a Compliance Report in the form of the template at Attachment A, indicating whether or not, in their opinion: a) they and their body have complied with the provisions and requirements of the CAC Act, the Commonwealth Authorities and Companies Regulations 1997 (CAC Regulations) and the Commonwealth Authorities and Companies (Report of 1 2 This Circular updates and replaces Finance Circular 2006/11. Under paragraphs 16(1)(c) and 41(1)(c) of the CAC Act, respectively. Page 1 of 8 Finance Circular 2008/05 Department of Finance and Deregulation Operations) Orders 2005 (CAC Orders),3 collectively “the CAC Act legislation”; and b) the costs of the body are forecast to be within estimated sources of external receipts for the current financial year, including, where appropriate, estimates of external receipts in the Australian Government’s central budget system. 3. The compliance certification in Part 1 of the Compliance Report is retrospective. That is, it relates to the financial year ended prior to the completion of the Compliance Report (this will generally be the financial year ended 30 June). The financial sustainability certification in Part 2 of the Compliance Report is prospective. That is, it relates to the current financial year as at the date of the signing of the Compliance Report (for most bodies, this will be the financial year that began on 1 July). 4. The Compliance Report is to be provided to the Finance Minister, through the Secretary of the Department of Finance and Deregulation (Finance), and to a body’s responsible Minister, by the fifteenth day of the fourth month after the end of the financial year of the body,4 with the first report being provided for the 2006-07 financial year. 5. The Compliance Report is not part of a body’s annual report. The Compliance Report 6. As mentioned in paragraph 3, the Compliance Report consists of two Parts. These are to be completed in the format set out in Attachment A. Part 1 requires the directors to report whether the body and its directors have complied with the CAC Act legislation. Part 2 requires the directors to report whether the body’s costs are forecast to be within estimates of external receipts for the current financial year. 7. The sign-offs in Part 1 and Part 2 are made “in the opinion of directors”, consistent with existing certifications made by directors, such as the certification of the financial statements. 8. In providing their opinion, directors will be subject to existing provisions within their governance framework dealing with duties of officers (including directors’ duties), which will reflect relevant obligations and provide context for those obligations. In particular, directors of Commonwealth authorities, in completing the sign-offs, should have regard to: a) care and diligence requirements and the business judgement rule under section 22 of the CAC Act; and b) the reliance on information or advice provided by others under section 27D of the CAC Act. 9. Directors of wholly-owned Commonwealth companies are subject to equivalent provisions dealing with the conduct of officers under the Corporations Act 2001.5 3 As amended or replaced. The deadline will be 15 October if the financial year ends on 30 June. 5 Section 180 and Section 189. 4 Page 2 of 8 Finance Circular 2008/05 Department of Finance and Deregulation 10. It is not intended that all actions and transactions of the body must be checked. It is, however, expected that directors will ensure that the CAC Act body has sufficient processes and controls in place to provide reasonable confidence about the accuracy of information contained in the Compliance Report. 11. The Compliance Report must be signed by a director (and made after a resolution of directors, where applicable). If, however, the body has only one director, then no resolution is, of course, necessary before that director signs the Compliance Report. 12. The statement by the director signing the Compliance Report that the above information is true and correct is a statement that the certifications accurately reflect the opinion of the directors as expressed by a resolution. Accordingly, the statement does not relate to the accuracy of the opinion on which the report is based. 13. Through being provided to the body’s responsible Minister as well as the Finance Minister, the Compliance Report is intended to build on existing reporting arrangements, including the monitoring of small agencies’ financial estimates and monthly reports by the relevant portfolio department. 14. Obligations may arise under the Freedom of Information Act 1982 (FOI Act) as a result of completing this report. The extent to which information, contained in or used in the preparation of the Compliance Report, may be subject to an FOI Act request, will depend on the individual circumstances of the request. Bodies with further issues regarding FOI Act implications should seek legal advice. Part 1 – Report on compliance with the CAC Act legislation 15. Part 1 of the Compliance Report requires directors to state whether, in their opinion, the body and its directors have complied with the requirements of the CAC Act legislation. 16. Directors of CAC Act bodies have a number of specific obligations under the CAC Act and are responsible for ensuring that the body complies with its legal obligations. Directors should, of course, be familiar with all requirements of the CAC Act legislation. Where the Compliance Report reflects that a provision of the CAC Act legislation has not been complied with, the directors need to provide details of: a) the provisions that have not been complied with; b) the circumstances surrounding any non-compliance; c) where relevant, the inadequacies of internal control systems; and d) any corrective action that has been taken or is proposed to be taken. Page 3 of 8 Finance Circular 2008/05 Department of Finance and Deregulation Basis of the Compliance sign-off 17. In completing Part 1 of the Compliance Report, directors will be able to make the sign-off based on the CAC Act body’s internal control systems, management and audit committee advice. 18. The processes, systems and controls that a body has in place to ensure compliance with its legal obligations will vary between CAC Act bodies based on their size, operations and structure. The specifics are up to the directors of each body to determine. In most cases it is likely that these processes, systems and controls would be an extension of those that currently give confidence to the directors associated with the operations of the body generally. 19. In completing the Compliance Report, directors will be able to draw on advice, materials and processes, which might include a program of internal audits, internal assessment of controls, senior management oversight and advice, and specialised assurance in relevant high risk areas. Additionally, it is expected that audit committees will have a role in reviewing and monitoring these internal control mechanisms. Under paragraphs 32(1)(a) and 44(1)(a) of the CAC Act, a function of the audit committee is to help the authority or company (respectively) and its directors to comply with obligations under the CAC Act.6 20. It is, of course, recognised that any internal control system, no matter how well operated, is unlikely to be able to prevent or detect every error or misstatement. Internal control systems are limited by realities that judgements in decision-making can sometimes prove to be incorrect, and that systems can fail. A reasoned judgement and balanced risk-based approach to the compliance monitoring process is therefore expected. 21. The nature of the confidence derives, in part, from the concept of selective testing of the body’s controls, which involves judgement regarding the areas to be tested and the nature, timing and extent of the tests to be performed. In addition, judgement is required in interpreting the results of the testing. Even with good faith and integrity, errors in judgement can be made. Directors are therefore relying on evidence that is persuasive rather than conclusive (ie, the level of confidence is not required to be absolute). In this regard, reasonable confidence would be associated with a remote chance of overlooking a significant compliance failing. Scope of the Compliance sign-off 22. The sign-off covers obligations relating to the relevant body contained in the CAC Act legislation,7 but does not include complying with the 6 Under section 32 (for Commonwealth authorities) and section 44 (for wholly-owned Commonwealth companies), directors must establish and maintain an audit committee. Accordingly, not establishing and maintaining an audit committee would involve non-compliance with the CAC Act and should be reported in the attachment to the report. 7 The sign-off only relates to obligations applicable to the body or its directors. For example, the CAC Orders relate to the preparation of the annual report of operations by Commonwealth authorities and do not contain requirements for Commonwealth companies. Page 4 of 8 Finance Circular 2008/05 Department of Finance and Deregulation Finance Minister’s Orders on the preparation of financial statements, as those statements are audited by the Auditor-General. 23. Where a body has been notified of a general policy of the government under section 28 (for Commonwealth authorities) or section 43 (for wholly-owned Commonwealth companies) of the CAC Act,8 directors must ensure the policy is carried out in relation to the body. Accordingly, non-compliance with a policy notified under these sections is non-compliance with the CAC Act and should be reported in the attachment to the report. A body should also advise the Department that administers the general policy of government where it considers it has failed to comply with a policy notified under sections 28 or 43. 24. Likewise, some bodies are prescribed in Schedule 1 to the CAC Regulations as being subject to procurement directions of the Finance Minister under section 47A of the CAC Act. For these bodies, any non-compliance with Finance Minister’s (CAC Act Procurement) Directions 2004 should be reported in the attachment to the report. Known breaches of the CAC Act legislation 25. The compliance monitoring process relied on by directors is not required to provide absolute confidence that compliance failings have not been overlooked. Where directors are aware that obligations under the CAC Act legislation have not been complied with, they must provide full details of the non-compliance, the circumstances surrounding this non-compliance and any corrective action that has been taken (or is proposed to be taken). Directors should also indicate whether further discussions with Finance are required to determine if the Finance Minister should consider commencing civil penalty proceedings under Schedule 2 of the CAC Act.9 26. This requirement does not, however, purport to require disclosure by directors that is contrary to any privilege that a person might claim, including the privilege against self-incrimination. 27. Requirements under the CAC Act legislation are statutory obligations and compliance is not assessed based on materiality of financial impact. Minor breaches of the CAC Act legislation that result in an immaterial loss, or no loss, must still be reported as non-compliance for the purposes of the Compliance Report. Where there is a large number of cases of non-compliance, such as caused by systemic issues of the same nature, it is sufficient to describe the problem in general terms and provide a reasonable estimate of the number of instances involving non-compliance. 8 Some Commonwealth authorities are exempt or partially exempt from section 28 of the CAC Act. Where a body is exempt from a general policy of government, there is no need to report non-compliance with the policy. 9 Directors have the ability to contact Finance, and their Department of State, at any time during the year if they consider non-compliance has occurred that may require commencement of proceedings under Schedule 2 of the CAC Act. Page 5 of 8 Finance Circular 2008/05 Department of Finance and Deregulation Part 2 – Report on financial sustainability 28. Consistent with statutory responsibilities, directors are expected to develop and implement risk management strategies associated with the conduct of their body’s operations,10 including measures to manage risks associated with financial sustainability.11 Directors should also have control systems in place to monitor the body’s performance against its budget. 29. Part 2 of the Compliance Report requires directors to state whether, as at the date of signing, in their opinion the costs of the body are forecast to be within estimated sources of external receipts for the current financial year, including, where appropriate, estimates of external receipts contained in the Australian Government’s central budget system. This Part of the Report is in addition to current reporting requirements, such as the operating loss approvals process and financial estimates and monthly reporting requirements. 30. For the purposes of this sign-off: a) External receipts are defined as a forecast of cash inflows from: the Australian Government (including all appropriations); cash inflow from operating activities; and proceeds from the sale of property, plant and equipment. For example, external receipts would include cash inflows from sources such as industry levies, sale of goods and services and interest earnings; and b) Costs are defined as a forecast of amounts to be paid out relating to: operating activities; the purchase of property, plant and equipment; and financing obligations. For example, costs would include cash outflows relating to employees, suppliers and debt payments representing principal and interest. 31. The intention of this Part of the Compliance Report is for the Government to receive an indication of the financial sustainability of a body (particularly where the body’s financial circumstances have deteriorated). For example, the Compliance Report will provide an opportunity for a CAC Act body to ‘flag’ to Government circumstances where a body may, potentially, seek additional budget funding in order to carry out its existing functions. Comments contained in this Part of the Compliance Report could also include updating Government on a situation where details of the financial circumstances of a body may have already been communicated to Government.12 10 For Commonwealth authorities, the annual report of operations must include a discussion of the risks and opportunities that it faces and the strategies adopted or proposed to be adopted to manage those risks and opportunities (refer paragraph10(1)(b) of Schedule 1 to the CAC Orders). 11 “Financial sustainability” in this context is the ability for the body to conduct existing operations without unexpected calls on the Budget, and includes the management of capital and long-term assets and liabilities. 12 The responsible Minister may have previously been notified of the body’s circumstances and/or an approval for an operating loss may have previously been obtained from the Finance Minister. Page 6 of 8 Finance Circular 2008/05 Department of Finance and Deregulation 32. Where external receipts are expected to be less than costs for the period, the directors must attach, to the Compliance Report, an explanation for this opinion. Where appropriate, the Compliance Report could reflect any actions the directors consider necessary to address the anticipated shortfall. The Compliance Report should also reflect, in these circumstances, whether an application for budgeting for an operating loss has been made to the Finance Minister, or whether an application will be made. 33. There may be a number of valid circumstances for a GGS CAC Act body to operate in conditions where, in the current financial year, costs are expected to be greater than its external receipts. This may include, for example, circumstances relating to using existing cash/investment reserves to cover costs or the purchase of property.13 Submitting the Compliance Report 34. The Compliance Report must be provided to the Finance Minister by the fifteenth day of the fourth month after the end of the financial year of the body (generally 15 October). The Finance Minister requires that the Compliance Report be provided directly to the Secretary of Finance, who will receive it on behalf of the Finance Minister. 35. Directors should also provide a copy of the Compliance Report to their responsible Minister, at the same time as it is provided to Finance on behalf of the Finance Minister. For most GGS CAC Act bodies, the report would typically be submitted to the responsible Minister along with the body’s annual report. Indeed. it is anticipated that it may be completed concurrently with the body’s annual report. However, the Compliance Report does not form part of the annual report and should not be included in the annual report. 36. Accordingly, the Compliance Report is separate from a body’s annual report for the purposes of the CAC Act or, if relevant, the Corporations Act 2001. However, for Commonwealth authorities, the Finance Minister’s requirement under paragraph 16(1)(c) of the CAC Act to provide the Compliance Report is a Ministerial Direction, if it is in the GGS, and this direction must be described in its annual report (for the purposes of paragraph 12(1)(a) of the CAC Orders). 37. In circumstances where a body is expected to cease to be covered by the CAC Act, either mid-reporting period or before the Compliance Report is submitted, Finance should be contacted to discuss appropriate arrangements. 13 Investment purchases and redemptions are excluded as a body is required to provide an explanation as part of its Compliance Report if it is using its reserves (investments) to fund costs. Page 7 of 8 Finance Circular 2008/05 Department of Finance and Deregulation Contacts 38. If you have any questions or comments about this Circular, please contact Legislative Review Branch at LRB@finance.gov.au or visit our website at http://www.finance.gov.au Tom Ioannou Acting Division Manager Financial Framework Division 13 June 2008 Page 8 of 8 Finance Circular 2008/05 Department of Finance and Deregulation Attachment A [Name of Commonwealth Authority / wholly-owned Commonwealth Company] Compliance Report for financial year ##/## 1) For the financial year ended dd/mm/yy, in the opinion of the directors, based on adequate internal control systems, including the advice of management and the audit committee, [name of entity] and its directors have: a) complied / not complied with the provisions and requirements of the Commonwealth Authorities and Companies Act 1997 (CAC Act); and b) complied / not complied with the provisions and requirements of the Commonwealth Authorities and Companies Regulations 1997 (CAC Regulations) and Commonwealth Authorities and Companies (Report of Operations) Orders 2008 (CAC Orders) (as amended or replaced). If there has not been full compliance, including due to inadequate internal control systems, please attach to this report a detailed description of all known instances, including: the provisions or requirements of the CAC Act, CAC Regulations or CAC Orders that have not been complied with; the circumstances surrounding any non-compliance; where relevant, the inadequacies of internal control systems; and any corrective action that has been taken or is proposed to be taken. 2) As at the date of this Report, in the opinion of the directors, the costs1 of [name of entity] are / are not forecast to be within its estimated sources of external receipts2 for the current financial year, including, where appropriate, estimates of revenue contained in the Australian Government’s central budget system. Where directors consider that the estimated external receipts is not sufficient to meet expected costs, please attach an explanation for this opinion. 1 For the purposes of the Compliance Report, costs are defined as a forecast of amounts to be paid out relating to: operating activities; the purchase of property, plant and equipment; and financing obligations. For example, costs would include cash outflows relating to employees, suppliers and debt payments representing principal and interest. 2 For the purposes of the Compliance Report, external receipts are defined as a forecast of cash inflows from: the Australian Government (including all appropriations); operating activities; and proceeds from the sale of property, plant and equipment. For example, external receipts would include cash inflows from sources such as industry levies, sale of goods and services and interest earnings. Attachment A I, _____________________________, as a director of [name of entity], certify that the above information: a) is true and correct; and b) has been made in accordance with a resolution of directors. [Remove if not applicable] Signed: ________________________________ Name: _______________________________ Date: ________________________________ Attachment A Signing Instructions This Compliance Report must: a) be signed by a director; and b) specify the date on which the Report is made; and c) if the authority or company has more than 1 director – be made in accordance with a resolution of the directors. This report has been requested by the Finance Minister under section 16 (Commonwealth authorities) or section 41 (wholly-owned Commonwealth companies) of the CAC Act, as applicable. Timing This report should be provided to the Finance Minister and the responsible Minister for the entity by the 15th day of the fourth month after the end of the financial year of the body.3 (For Commonwealth authorities, this is the same day that the authority’s annual report must be submitted to the responsible Minister.) 3 The deadline will be 15 October where the financial year ends on 30 June.