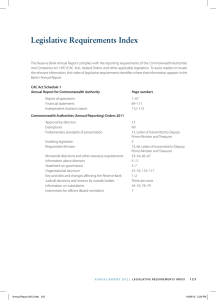

Certificate of Compliance – FMA Act Agencies Key points Finance Circular No. 2011/07

advertisement