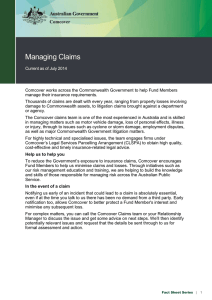

Comcover Information Bulletin Comcover 2013-14 Statement of Cover – Key changes

Comcover Information Bulletin

Comcover 2013-14 Statement of Cover

(Issue 42 – 1 July 2013)

Comcover 2013-14 Statement of Cover – Key changes

This bulletin provides a summary of the key changes to the terms and conditions of cover encompassed within the Comcover Statement of Cover for the 2013-14 year.

The Comcover 2013-14 Statement of Cover supersedes and updates the 2012-13 Comcover Insurance

Policy, with effect from 1 July 2013. It is important that you carefully read the Statement of Cover and understand changes that may affect your cover.

The document has been renamed as a Statement of Cover (from Insurance Policy) to reflect that the focus has moved away from a modified commercial insurance policy to a clearer statement of thepolicy for funding losses through the Comcover self-managed Fund. Comcover manages the Fund and settlement of claims in the interests of all Fund Members (and the Commonwealth). Comcover is not an insurer and the self-managed Fund is not technically an insurance fund, but rather it provides a program of financial protection for contributing Fund Members, and by doing so protects the Federal Budget and the Commonwealth.

There have been other (mostly cosmetic) changes to the structure and wording of the Statement of

Cover and it is important that you, as the Fund Member, familiarise yourself and understand the wording as it now stands. As always, CMS is available to provide guidance and advice in response to any queries you may have.

The Statement of Cover now includes a Preamble explaining the operation of Comcover and the self-managed Fund, and the roles and responsibilities of both Comcover and Fund Members

Page 1 of 3

Notable changes in the Comcover 2013-14 Statement of Cover from the 2012-13 Comcover Insurance

Policy include –

C HAPTER 2 – S TATEMENT OF C OVER

6. Defined Terms

A number of definitions have been deleted to reflect that the words have a commonly accepted meaning which is clear within the context of this document. Words or terms deleted from the Defined Terms include – amusement device; claim; emergency evacuation; employment practices; illness; injury; money; officer; outside directorship; person; pollutants; reasonable additional costs; revenue; terrorism.

For the sake of clarity, specifically defined words are highlighted in bold type throughout the document: some words have been given initial capitals to satisfy convention, but that does not affect their meaning or interpretation.

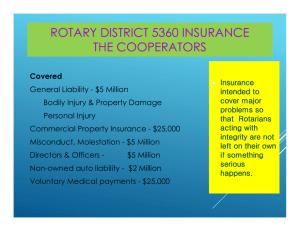

C HAPTER 3 – L IABILITY

7. General Liability and Professional Indemnity

7(3) The Statement of Cover now clarifies that directors and officers are covered for liability under both the General Liability and the Directors’ and Officers’ Liability (sections 7 and 8). This resolves the “gap” whereby directors and officers were not specifically covered under section 7.

8. Directors’ and Officers’ Liability

8(1) The Statement of Cover now clarifies that cover applies to directors appointed by or representing the Fund Member, but not for any other directorships they may hold.

C HAPTER 4 – P ROPERTY

9. Property

9(4) We have introduced the commonly understood term “competent authority” to indicate when decisions have been lawfully made by a properly constituted regulatory or public authority acting within its authority. This replaces various terms used previously, such as

“local government council” or “police service or official fire brigade or authority”.

C HAPTER 5 – M OTOR V EHICLE

13. Motor Vehicle

We have removed various sub-limits whilst retaining the requirement that costs claimed must be reasonable e.g. (4) (a) relating to accident clean up costs and (4) (b) relating to crash-attendance charges levied by competent authorities.

Comcover Member Services comcover@comcover.com.au www.comcover.gov.au

1800 651 540

Page 2 of 3

C HAPTER 6 – P ERSONAL A CCIDENT AND T RAVEL

15. Baggage and Personal Effects on Travel Outside Country

15(2) We have removed the sub-limits against various items (money, trip interruption, etc) on the basis that all losses must be adequately proven and justified.

16. Medical Expenses and Medical Emergencies Outside Country

16(3)(e) The Statement of Cover has been clarified to ensure that cover is provided for travel which has been legitimately approved in advance by the employing Fund Member in accordance with its internal procedures etc.

18. Personal Effects and Travel Inside Country

18(2) We have removed the sub-limits against these interrupted travel costs on the basis that all losses must be reasonable, adequately proven and justified.

C HAPTER 7 – O THER R EQUIREMENTS FOR C OVER

Terrorism

We have deleted the exclusion of any losses as a result of Terrorism on the basis that the

Fund is intended to spread the loss of unforeseen losses across the Commonwealth, so it is appropriate that terrorism attacks on Commonwealth property should be covered within this mechanism.

10.

Overseas Operations

We have removed the requirement that you must comply with all local law if you have operations in another foreign jurisdiction: this requirement exists quite independently of the cover provided under this Statement of Cover.

Dispute Resolution

This section has been modified to remove the referral to a mediator and instead all disputes must be dealt with between Comcover and the Fund Member, escalating to

Ministers if necessary for final determination.

Goods and Services Tax

The requirements relating to the application of Goods and Services Tax has been deleted: this is a statutory requirement that must be complied with.

N.B. This is only a summary of the changes between the 2012-13 Comcover Insurance Policy and the 2013-14 Comcover Statement of Cover. This summary is not, and is not intended to be, definitive: decisions relating to coverage in specific circumstances will be determined in accordance with the wording of the Statement of Cover.

If you require any further information, please contact your

Account Manager at Comcover Member Services on 1800 651 540

Comcover Member Services comcover@comcover.com.au www.comcover.gov.au

1800 651 540

Page 3 of 3