Note 28: Other borrowings Notes to the financial statements

advertisement

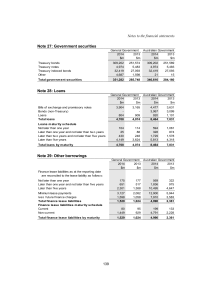

Notes to the financial statements Note 28: Other borrowings General Government 2012 2011 $m $m Finance lease liabilities as at the reporting date are reconciled to the lease liability as follows: Not later than one year Later than one year and not later than five years Later than five years Minimum lease payments less future finance charges Total finance lease liabilities Finance lease liabilities maturity schedule Current Non-current Total finance lease liabilities by maturity Australian Government 2012 2011 $m $m 227 408 904 1,539 691 848 151 446 867 1,464 708 756 251 490 1,486 2,227 1,138 1,089 151 447 867 1,465 708 757 272 576 848 99 657 756 277 812 1,089 98 659 757 Note 29: Other interest bearing liabilities Swap principal payable Amounts outstanding under repurchase agreements Special reserve - International Monetary Fund special drawing rights Finance lease incentives Other Total other interest bearing liabilities General Government 2012 2011 $m $m 510 431 4,570 117 23 5,220 4,585 35 29 5,080 Australian Government 2012 2011 $m $m 525 432 1,535 1,666 4,570 121 966 7,717 4,585 39 707 7,429 Note 30: Employee benefits General Government 2012 2011 $m $m 235,385 145,113 Total superannuation liability Other employee liabilities Leave and other entitlements Accrued salaries and wages Workers compensation claims Separations and redundancies Military compensation Other Total other employee liabilities Total employee and superannuation liabilities 7,323 633 2,622 97 3,510 406 14,591 249,976 6,482 455 1,889 64 2,267 406 11,563 156,676 Australian Government 2012 2011 $m $m 235,840 145,201 9,379 774 2,752 140 3,510 406 16,961 252,801 8,375 583 2,003 170 2,267 405 13,803 159,004 As at 30 June 2012, the number of full time equivalent employees was 313,825 (2011: 311,676). This comprises civilians and military personnel, including reserve forces. 107 Notes to the financial statements Note 31: Other provisions and payables Payables Suppliers payable Trade creditors Operating lease rental payable Other creditors Total suppliers payable Total personal benefits payable Total subsidies payable Grants payable State and Territory governments Private sector Overseas Local governments Other Total grants payable Other payables Unearned income Accrued expenses Other Total other payables Total payables Australian currency on issue Other provisions Grant provisions Provision for outstanding benefits and claims Provision for tax refunds Provision for restoration, decommissioning and makegood Other Total other provisions Total provisions Total payables and provisions 108 General Government 2012 2011 $m $m 2012 $m 2011 $m 4,485 193 748 5,426 5,386 2,392 3,388 191 2,338 5,917 6,461 1,823 5,252 193 919 6,364 5,386 2,392 4,120 191 2,474 6,785 6,461 1,823 515 745 1,190 7 555 3,012 962 616 1,303 18 447 3,346 515 745 1,190 7 555 3,012 962 616 1,303 18 447 3,346 1,974 862 1,135 3,971 20,187 - 2,752 826 1,204 4,782 22,329 - 3,022 1,289 1,136 5,447 22,601 53,595 3,471 1,150 1,232 5,853 24,268 50,059 11,806 10,191 11,806 10,191 10,520 3,376 8,411 2,236 10,897 3,376 8,791 2,236 1,923 1,802 29,427 29,427 49,614 1,785 1,504 24,127 24,127 46,456 2,009 2,060 30,148 83,743 106,344 1,857 1,792 24,867 74,926 99,194 Notes to the financial statements A: Reconciliation of movement in provisions General Government 2012 2011 $m $m Movement table: Balance of provisions at 1 July Provisions made during the year Provisions used during the year Provisions remeasured, reversed or unwound during the year Balance of provisions at 30 June Australian Government 2012 2011 $m $m 24,127 18,713 (12,109) 19,886 10,343 (6,838) 74,926 22,688 (12,571) 69,358 12,104 (7,242) (1,304) 29,427 736 24,127 (1,300) 83,743 706 74,926 Note 32: Net revaluation increases/(decreases) General Government 2012 2011 $m $m Financial assets Equity investments Non-financial assets Land Buildings Other infrastructure, plant and equipment Heritage and cultural assets Other non-financial assets Provision for restoration, decommissioning and makegood Intangibles Total non-financial assets Total revaluation increases/(decreases) 109 Australian Government 2012 2011 $m $m (918) (7,142) 363 (253) 32 200 223 694 (2) (8) 156 573 207 325 43 32 245 (71) 694 (2) (8) 163 655 739 325 43 1,139 221 1 1,305 (5,837) 890 1,253 1 1,926 1,673 Notes to the financial statements Note 33: Reconciliation of cash A: Reconciliation of net operating balance to net cash flows from operating activities General Government Net operating balance less Revenues not providing cash Other Total revenues not providing cash plus Expenses not requiring cash Increase in employee entitlements Depreciation/amortisation expense Mutually agreed writedowns Other non-cash expenses Total expenses not requiring cash plus Cash provided by working capital items (Increase)/Decrease in receivables (Increase)/Decrease in inventories (Increase)/Decrease in other financial assets (Increase)/Decrease in other non-financial assets Increase/(Decrease) in benefits, subsidies and grants payable Increase/(Decrease) in supplier payables Increase/(Decrease) in other provisions and payables Total cash provided/(used) by working capital items equals Net cash from/(used by) operating activities Australian Government 2012 2011 2012 2011 $m (39,151) $m (46,624) $m (39,430) $m (45,706) 837 837 789 789 837 837 789 789 7,942 5,840 2,034 1,229 17,045 5,470 5,876 2,442 889 14,677 8,055 6,478 2,034 1,233 17,800 5,575 6,384 2,442 891 15,292 (7,859) (746) 643 (616) (4,808) (781) 109 267 (7,181) (759) 589 (563) (5,713) (782) 231 323 (1,175) 1,652 3,009 1,429 (1,175) 1,719 3,009 1,522 (124) (1,126) 244 (1,078) (8,225) (1,901) (7,126) (2,488) (31,168) (34,637) (29,593) (33,691) B: Reconciliation of cash at the end of the reporting period as shown in the cash flow statement to the related items in the balance sheet General Government 2012 2011 $m $m Items in the balance sheet Financial assets - cash Financial liabilities - overdrafts Total items in the balance sheet Total as per cash flow statement 110 2,523 2,364 2,523 2,523 2,364 2,364 Australian Government 2012 2011 $m $m 4,641 (60) 4,581 4,581 5,427 5,427 5,427 Notes to the financial statements Note 33: Reconciliation of cash (continued) C: Cash flows associated with entities acquired during the year General Government 2012 2011 $m $m Australian Government 2012 2011 $m $m During the 2011-12 financial year, there were no material entity acquisitions. During the 2010-11 financial year, Medibank Private acquired 100% of Medibank Health Solutions Pty Ltd (formerly McKesson Asia-Pacific Pty Ltd) and 100% of Carepoint Holdings Pty Ltd During the 2010-11 financial year, Indigenous Land Corporation acquired Ayres Rock Resort and on-sold it to its wholly-owned subsidiary, Voyages Indigenous Tourism Australia Pty Ltd During the 2010-11 financial year, Australia Post acquired 100% of SecurePay Holdings Pty Ltd Consideration for acquisition Cash Total consideration Fair value of assets and liabilities of entities acquired were: Assets Total cash Financial assets Total non-financial assets Total assets Liablities Total debt Total payables Total provisions Total liabilities Net assets Goodwill / (discount) on acquisition and other adjustments Fair value of Australian Government's share of net assets acquired and goodwill 111 - - - 505 505 - - - 15 12 366 393 - - - 5 23 6 34 358 122 - - - 481