Document 17780354

advertisement

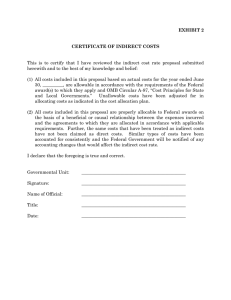

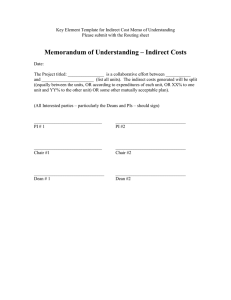

Cost Principles provide guidance for determining eligible costs and whether those costs are direct or indirect. • Outlined in detail in OMB Circular A-21 “Cost Principles for Educational Institutions”. • Ensure conformance to federal requirements and avoid costly audit findings. • Require sound management practices and accepted accounting systems to adequately document expenses. Direct Costs + Indirect Cost – Applicable Credits = Total Cost *Applicable credits are rarely encountered and difficult to anticipate during budget development. Additional information is included in Section C.5 of OMB Circular A-21. Costs must be: • Reasonable • Allocable • Consistent • Allowable Reasonable • Costs not exceeding those a prudent person would incur in a similar situation. • Costs necessary for performance of project. • Require practical purchase price, proper purchasing procedures, consistency with ethical business practice and institutional policy. Allocable • Costs that directly or indirectly benefit project. • Incurred specifically as a result of the project, benefit both the project and institution, or necessary for overall institution operation but also assignable to sponsored project. • Normally identify with a specific project objective. Consistent • Costs must be treated in a similar manner in other institutional business practices. • Costs cannot be both direct and indirect. • If a cost is considered indirect under one institutional project, it must be indirect under all. Allowable • Costs that are reasonable, allocable, and consistent. • Subject to limitations or exclusions of funder. • Cannot be used as matching for any other federallyfunded project. • Must be adequately documented. • Expenses that are always unallowable include alcoholic beverages, entertainment, promotional items, and general advertising/public relations. Expenses clearly assignable to project and identifiable with a high degree of accuracy. • Purpose, not nature, of goods and services must be considered. • Technical costs including salaries, wages, benefits, travel, and equipment. • A cost passing tests of reasonability, allocability, consistency, and allowability is normally direct. Expenses not readily identifiable or assignable to a specific project but necessary to ensure project completion. • Also known as “Facility and Administration” Costs (F&A). • Clerical support, office equipment and supplies, local phone service, facility space, and utilities. • Expenses assigned as indirect costs cannot also be charged as direct costs. Negotiated or specified rate applied to direct costs to determine indirect costs. • Percentage of eligible direct costs. • Based on “Modified Total Direct Cost” (MTDC). • Does not include cost of equipment, offsite facility rental, tuition remission, or cost of sub-awards in excess of $25,000 each. • Allowable when services are beyond grantee’s capabilities. • Must be specified and included in original project budget. • Indirect cost rate only applicable to first $25,000 of each sub-award. Salaries and Wages: Direct. • Provided individual is not included in indirect cost rate and total time assigned to all sponsored projects does not exceed 100% of paid work hours. Fringe Benefits: Direct. • Based on percentage of total salaries charged to project as calculated annually by institution. Equipment: Treatment varies based on item. •Items exceeding one year useful life and cost of $5,000 including modifications, accessories, taxes, and shipping. •Special Purpose: Direct. Used for research, technical activities, or purposes directly related to project. •General Purpose: Indirect. Can serve purposes other than those directly related to project. Travel: Direct. • Includes transportation, lodging, subsistence, and related costs based on per diem or actual costs. • Necessary for completion of project or reporting findings. • Air travel must be at coach rate and via a U.S.-owned carrier. Professional Services/Consultants: Direct. • Activities cannot be completed by institutional staff. • Specified in budget. • Total compensation not to exceed normal rate of consultant or limits set by funder. Publications, Documentation, Dissemination: Direct. • Expenses must be leveled impartially on all papers published by journal in question. • Documents for training purposes are allowable. Meetings and Conferences: Direct. • Must be included in project budget. • Facility rental, supplies, publications, services, food, and speaker fees are allowable. • Entertainment, social activities, and alcoholic beverages are unallowable. Participant Support Costs: Direct. • Trainees, study participants, etc. • Stipends, travel, registration fees, printed materials, etc. • Does not include Cooperative Extension employees. Materials and Supplies: Direct. • Useful life of less than one year and cost less than $5,000, including taxes and shipping. Sub-Awards: Direct. • Only first $25,000 of each award applicable to indirect cost rate. Advertising and Public Relations: Direct. • Only to extent they are involved in educational message dissemination. • General advertising, promotional items, and incentive items are excluded. All Direct Advisory Councils Bonding Communications directly related to project Insurance required for project Maintenance and Repairs Memberships directly related to project Rearrangement/Alteration of facilities as approved by sponsor • Pre-agreement costs as approved by sponsor • Rental necessary for completion of project • Scholarships/Aid • Tuition Remission • Specialized Services • Training • Freight/Postage necessary for project and exceeding normal operations • • • • • • • All Indirect • • • • • • • • • • • • • • • Administrative Expense Depreciation Employee Welfare Proposal Costs Taxes not on eligible items Clerical Support Office Equipment General Supplies Telecommunications Office Use Custodial Service Library Services General Insurance Memberships not directly related to project General freight/postage • • • • • • • • • • • Alcoholic Beverages Alumni Activities Debt Service Contingencies Donations* Entertainment Fund Raising Goods and Services for personal use Living Expenses Losses on sponsored projects Selling/Marketing *Value of Donations allowable in cost sharing situations.