Administrative and clerical salaries

advertisement

Administrative and clerical

salaries

BACKGROUND, BEST PRACTICES, AND

THE FUTURE OF DIRECT CHARGING

ADMINISTRATIVE/CLERICAL SALARIES

TO GRANTS

MRAM

MARCH 2014

FISCAL COMPLIANCE

CORNER

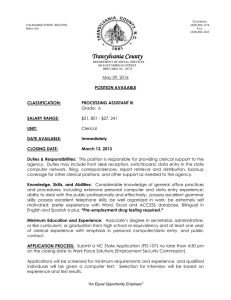

Breakdown of Facilities & Administrative rate

Incurred for common or joint objectives and cannot be identified readily and

specifically with a particular sponsored project:

Facilities* includes:

• Operation/maintenance of buildings

• Building Interest (cost of interest)

Administrative* includes:

• General administration

• College/School administration

• OSP/GCA (research administration)

*Based on OMB Circular A-21

Management Accounting and Analysis (MAA) website contains detailed information on the cost pools

Administrative portion is 26%

Established by Congress in 1991.

No change since that time despite efforts by Universities

and COGR requesting this be re-visited.

Administrative costs associated with sponsored projects

are charged to the project by virtue of sponsor paying the

F&A rate associated with the project.

Direct charging administrative or clerical costs is

generally disallowed for this reason. No doublecharging!

Are there exceptions?

No bright line exceptions, just general guidance via OMB

interpretation issued in 1994:

...direct charging of these costs may be appropriate where the nature

of the work performed under a particular project requires an

extensive amount of administrative or clerical support

which is significantly greater than the routine level of such

services provided by academic departments. The costs would need to

meet the general criteria for direct charging in section D.1. -- i.e., be

identified specifically with a particular sponsored project

relatively easily with a high degree of accuracy, and the special

circumstances requiring direct charging of the services would need to

be justified to the satisfaction of the awarding agency in the

grant application or contract proposal. {italics, bold added}.

Proposal stage: Key steps

CONSISTENT TREATMENT within your unit: Compare activity to

be undertaken by individual with other grants with similar activity or

other grants the individual is on doing same type of work.

CLEAR and THOROUGH JUSTIFICATION: Explain the activity

of the individual and why this project has “unlike”circumstances

warranting the direct charging of the salary cost.

RESPOND to OSP Review Comments: OSP has a “bird’s eye” view of

grants at the University and is looking to ensure consistent treatment of

costs in budget proposals across the University.

Know DEPT RESPONSIBILITY/RISK: Despite your best efforts to

justify and OSP approval of the proposal, the sponsor/auditor may see

it differently! See POST-AWARD key steps.

REMEMBER: OSP approval does not guarantee acceptability of costs as a direct cost!

When is it guaranteed the costs would be

allowable?

1)

Sponsor EXPLICITLY approves the line item cost in the

award terms and conditions (this rarely happens).

1)

University requests and receives direct sponsor approval to

add/charge such a cost to a budget. If post-award, this

would come through as a concurrence request.

Merely receiving an award in response to a proposal

that includes admin/clerical costs as a direct line item

with justification, is NOT explicit sponsor approval.

Spend at your risk and document, document,

document (see Post-Award key steps)

Key Post-Award Steps

Identify the individuals/positions involved.

Document activity directly related to achieving the

objectives of the sponsored program.

GCCRs processed and signed by the PI per university

policy.

If costs are questioned . . .

Have available:

Proposal with justification

Documentation in department file

Be prepared to explain individual’s activity and why

unlike/unusual

Be prepared to explain why individual’s activity on

THIS grant is different than on another grant, if such

individual’s time is NOT directly charged on another

grant.

Specific findings from recent years (at other

Universities)

Auditor’s findings included unallowable salary for

administrative and clerical type work such as

cleaning glassware, ordering supplies, and

supervising data collections.

The auditors determined that neither the nature of the work

performed on the projects nor any other circumstances

justified any unusual degree of administrative support or

showed that the employees were necessary for the

performance of the awards.

Disagreement over what constitutes a Major project

or program.

Uniform Administrative Requirements

(“OmniCircular”)

New provision:

(d) The salaries of administrative and clerical

staff should normally be treated as indirect

(F&A) costs. Direct charging of these costs

may be appropriate where all of the

following conditions are met:

Uniform Administrative Requirements

(“OmniCircular”)

Conditions:

(1) administrative or clerical services are integral

to a project or activity;

(2) individuals involved can be specifically

identified with the project or activity;

(3) such costs are explicitly included in the budget;

and

(4) the costs are not also recovered as indirect

costs.

Uniform Administrative Requirements

(“OmniCircular”)

Applies to new funding received after Dec 26, 2014

Current regulations will continue to apply to existing

funding.

The new language dropped the reference to “Major

Project or Activity” and the examples in Exhibit C.

Appears to provide some additional flexibility for

direct charging.

Not sure what specific sponsors or auditors will do.

Cautiously optimistic

Resources

OMB Circular A-21

GIM 23: (Includes list of job codes considered administrative/clerical

as determined by UW Management Accounting and Analysis, MAA)

OSP: osp@uw.edu

GCA: gcahelp@uw.edu

FAQs and additional process information:

http://www.washington.edu/research/guide/news.php?entry=795