Marina Ristic Prof Karen Anderson Career Paper

advertisement

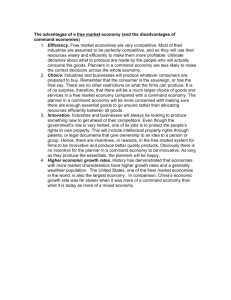

Marina Ristic CEP 121.2255 CAREER IN FINANCE Prof Karen Anderson Career Paper Financial planning is one of the careers in finance that I am very interested in. Since the financial planning sector is booming, it offers a variety of career options. Financial planners help individuals plan their financial futures. They help them with retirement planning, income tax, college savings, insurance and estate planning strategies. Career in finance is both personally and financially rewarding and requires excellent interpersonal skills. A good financial planner understands investments, taxes, estate planning issues and knows how to listen. This job can be done within a company or by yourself, as a sole proprietorship. Most financial planners are sole-proprietors or they work within smaller practice. According to the Wall Street Journal “despite the activity among the big names, there’s a feeling that many wealthy clients are more attracted to the personalized service offered by small businesses. Desire has driven the creation of smaller wealth management firms and multifamily offices, which focus on managing the investments of a small group of wealthy families”.(“Landscape Changing for Ultra-Wealth Management”, the Wall Street Journal.) In order to become successful in this field you have to have excellent people skills, communicational skills as well as creative, analytical and sales skills. Money managers either directly make investments or help others by providing investment advice. If they are in the first business they are usually called portfolio managers. If they are in the second, they are generally called financial planners. Financial planners can be compensated on a flat per-hour fee basis, a commission basis or both. One of the exciting things about investing is that you get rewarded for knowing how business works. People who understand and enjoy business are among the most likely to succeed in this arena. U. S. News and World Report listed the position of financial planner as one of the twenty hottest professions for the future. They stated that “the entry of baby-boomers into middle age with a bewildering array of investment choices will make financial planning a really hot profession in the future”.(U.S.News and World Report). Financial planners pointed out that getting a solo practice as a financial planner today can be difficult and highly competitive. In order to be successful in financial planning you need to know the details of various investments tax law, estate planning strategies and you need to be good at marketing yourself and listening to your customers. The field of financial planning is expected to experience substantial future growth, but it is a hard field to start in, because most financial planners work in entrepreneurial one or two person businesses and have difficulty affording new hires. Getting that crucial starting experience is the hardest part. According to the Consumer Federation of America there are over 250,000 financial planners. The largest company in the field is IDS Financial Services, a division of American Express. Financial planners are increasingly required to have the CFP (Certified Financial Planner) designation. “In order to become a Certified Financial Planner, you must pass an exam approved by the CFP Board of Standards which covers over 175 topics in investing and financial planning. Today, there are approximately 23,000 Certified Financial Planners”.(Certified Financial Planner Board of Standards,Inc). A growth area in financial planning and money management is targeting the high net worth individual. According to PSI, a financial services consultant, it is estimated that over 4 million US households have a net worth in excess of $1 million. According to Myra A. Thomas “The attraction of the U.S. consumers spending power and the American capital market is creating a wave of European company expansion here, presenting opportunities for finance professionals in a wide range of disciplines”.(Thomas 2). That means that skilled investment managers, accountants, analysts and CPAs with appropriate knowledge and an understanding of foreign markets can be an asset to firms considering establishing or expanding their stateside presence.” Being the point person for such a start up or expansion means a lot of work and wearing a lot of hats. However, it can also mean tremendous authority and opportunity for the right person. “"The banking and investment banking field is certainly looking stateside for expansion of its markets," emphasized Ken April of April International in New Rochelle, N.Y. His executive search firm specializes in international placement of professionals in the financial services industry. "The number of European financial institutions expanding their reach in the U.S. is growing at an ever-increasing rate,"(April qtd. In Thomas 2). One such expansion involves London-based HSBC, which is growing its American operations by adding branches in Washington, D.C., Maryland and Virginia. Joining professional organizations not only helps you meet other professionals, it often provides opportunities to assume a leadership role and build on your people skills.” Networking is the fundamental principle of getting ahead. You cannot do it yourself”"(Smith qtd in Thomas). According to Carl Turnipseed, executive vice president of the Federal Reserve Bank of New York, the people skills you develop through networking will be essential as you move into more senior positions. “As you move toward the top of the organization, what you've got to accomplish is going to be accomplished through people," While you're rising through the ranks, don't be afraid to have people around who are smarter than you. "Be sure to surround yourself with the best people you can find. In the dogeat-dog world of finance, there is no room for mediocrity in my tent."(Turnipseed qtd in Thomas). Duties of financial analyst involve determining financing needs, analyzing capital budgeting projects, long-range financial planning, analyzing possible acquisitions and asset sales, visiting credit agencies to explain firm's position, working on budgets, analyzing competitors, implementing financial plans, monitoring the market price of your firm's securities, analyzing leasing agreements and determining needs and methods of dealing with derivatives. Often you will be assigned to a specific area such as revenue, planning, and capital budgeting or project finance. As a senior financial analyst, you will be responsible for financial analyses in support of new business development opportunities and cross-portfolio financial initiatives. You will build financial models and provide key analyses for portfolio acquisitions, new partnerships, and strategic initiatives around regulatory changes, vendor management, capital allocation, and strategic planning. You will work with partners at all levels in risk, marketing, and finance to develop assumptions and validate findings. You will maintain and update financial models and create audit trail for your valuation scenarios. To be considered qualified for this position you must have two years of relevant work experience emphasizing financial analysis with an expertise in building, maintaining, and updating complex financial models. You have to possess strong communication and presentation skills and have an undergraduate degree in Finance or Economics. Financial services career is extremely rewarding, in terms of both financial compensation and personal satisfaction. This challenging job requires good analytical skills, computer skills and a broad understanding of finance. I believe that it is amazing to have an opportunity to make a difference in other people's lives, providing objective financial guidance and support. You'll become an advocate for your clients and prospects, helping to ensure that they and their families are protected, now and in the future. In conclusion, in order to be successful in this field you have to possess the desire to become a trusted financial professional, the ability to listen and empathize with someone’s hopes and dreams, the fire and the passion of an entrepreneur and the ability to develop and nurture long term relationship. .